Connecticut PLLC Notices and Resolutions

Overview of this form

The PLLC Notices and Resolutions package consists of essential legal documents designed for the efficient operation of a Limited Liability Company (LLC) in Connecticut. This collection includes multiple notices and resolutions that facilitate crucial company activities, such as meetings, member admissions, amendments, and dissolutions. Unlike generic forms, these templates are specifically crafted by licensed attorneys to ensure compliance with Connecticut laws and regulations governing LLCs.

Form components explained

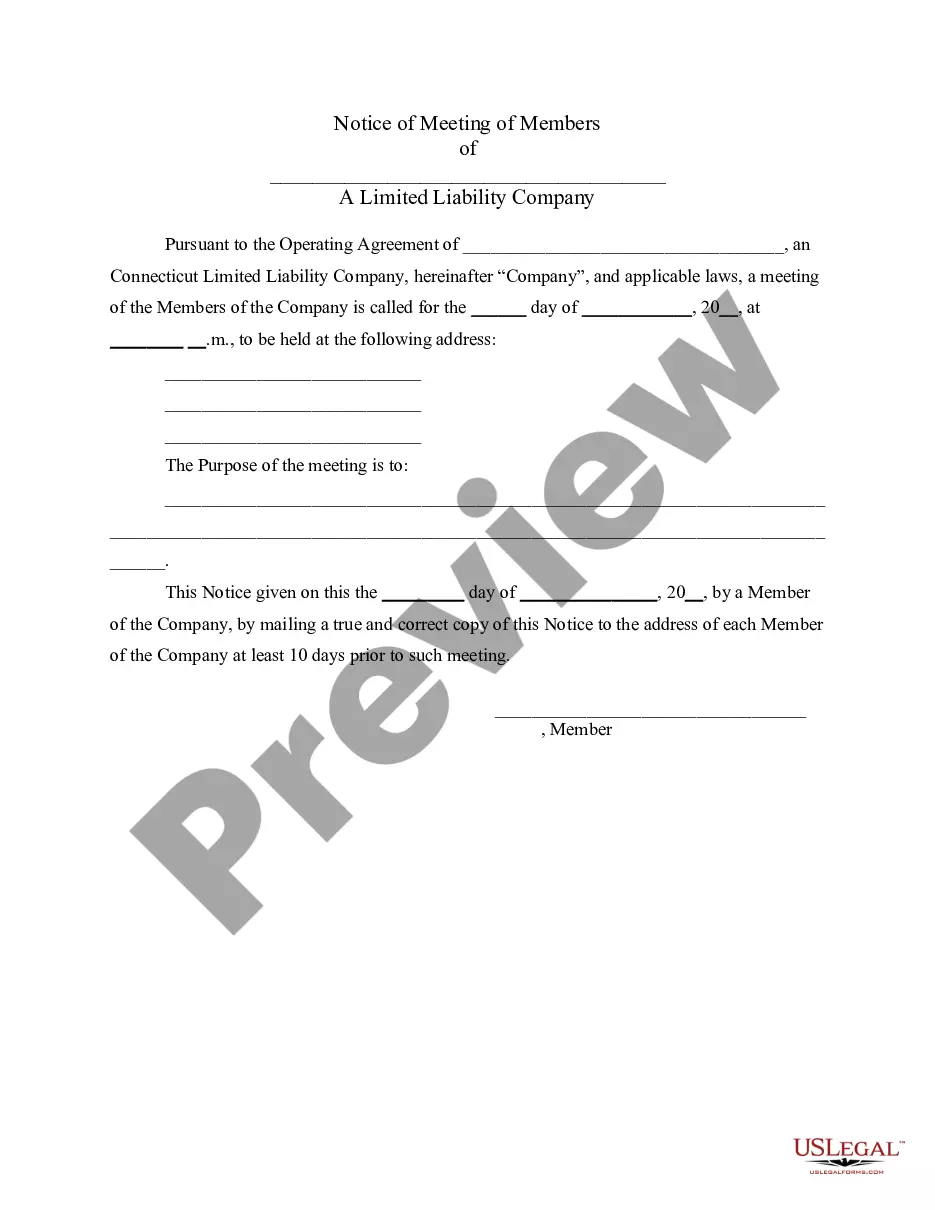

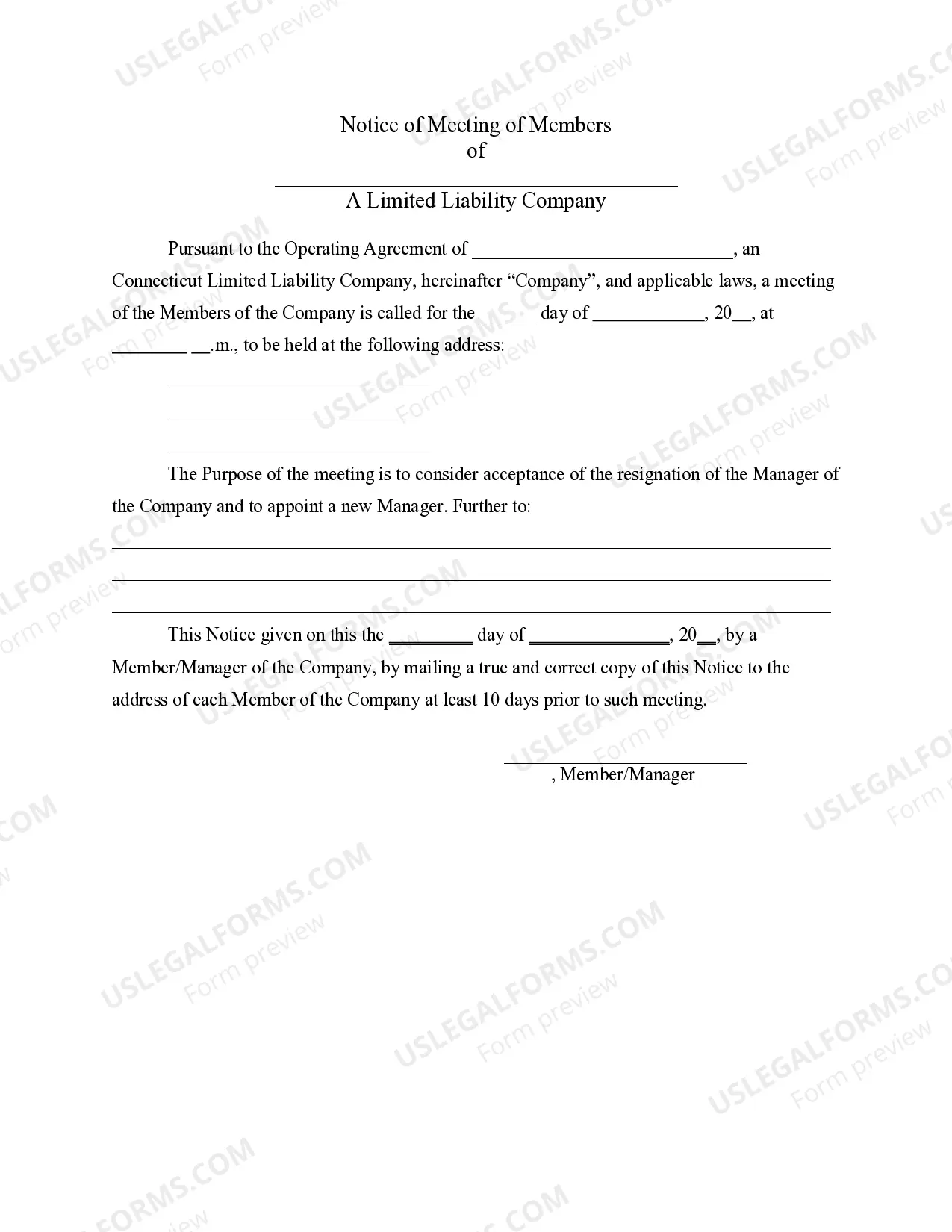

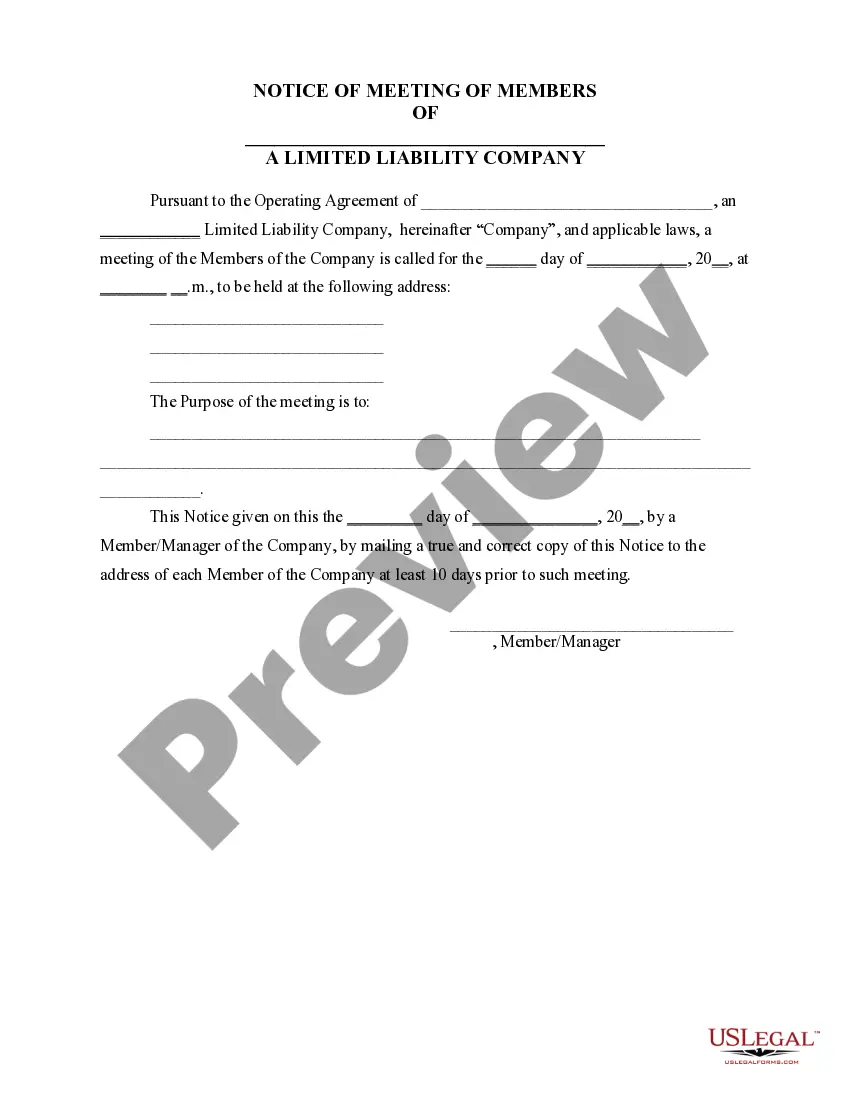

- Notice of Meeting for General Purpose

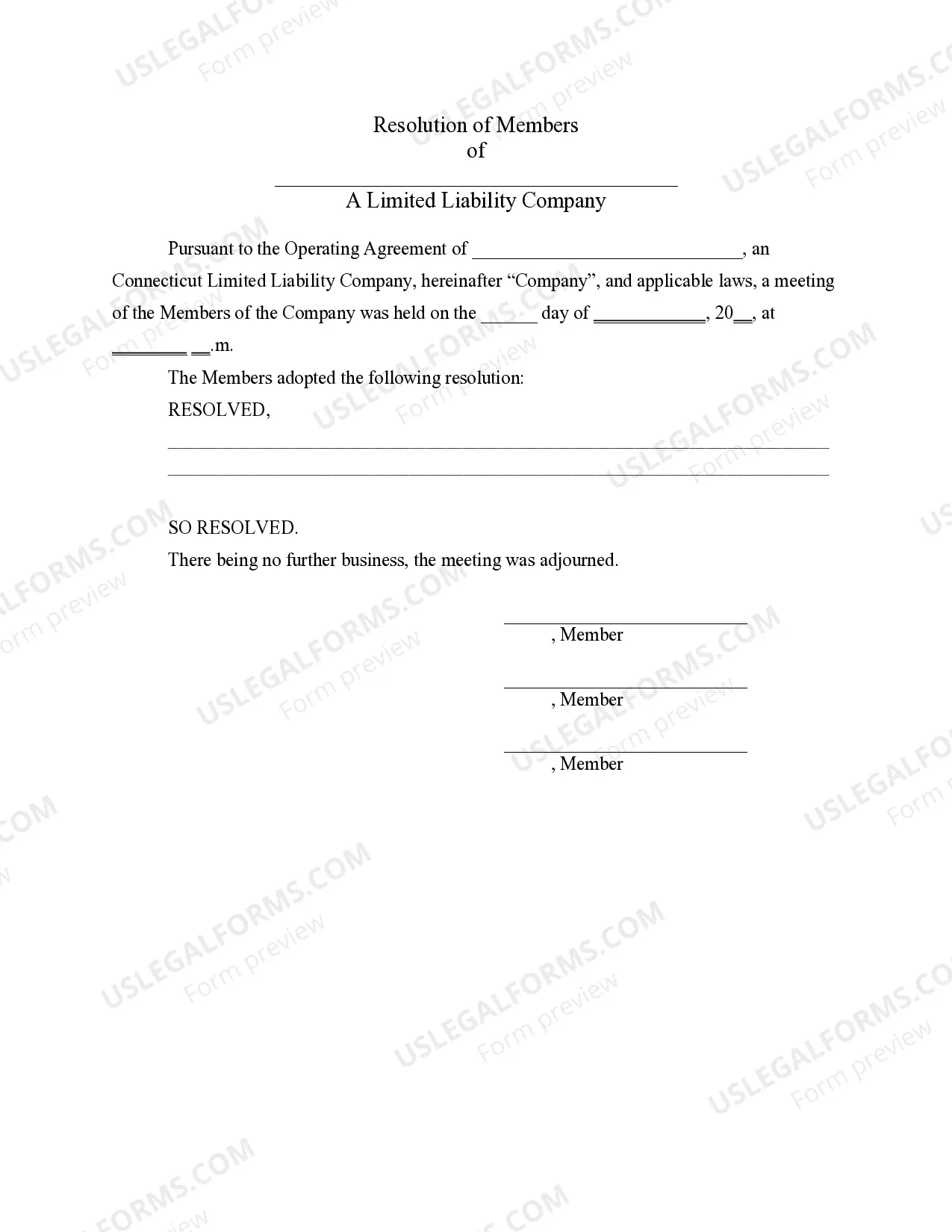

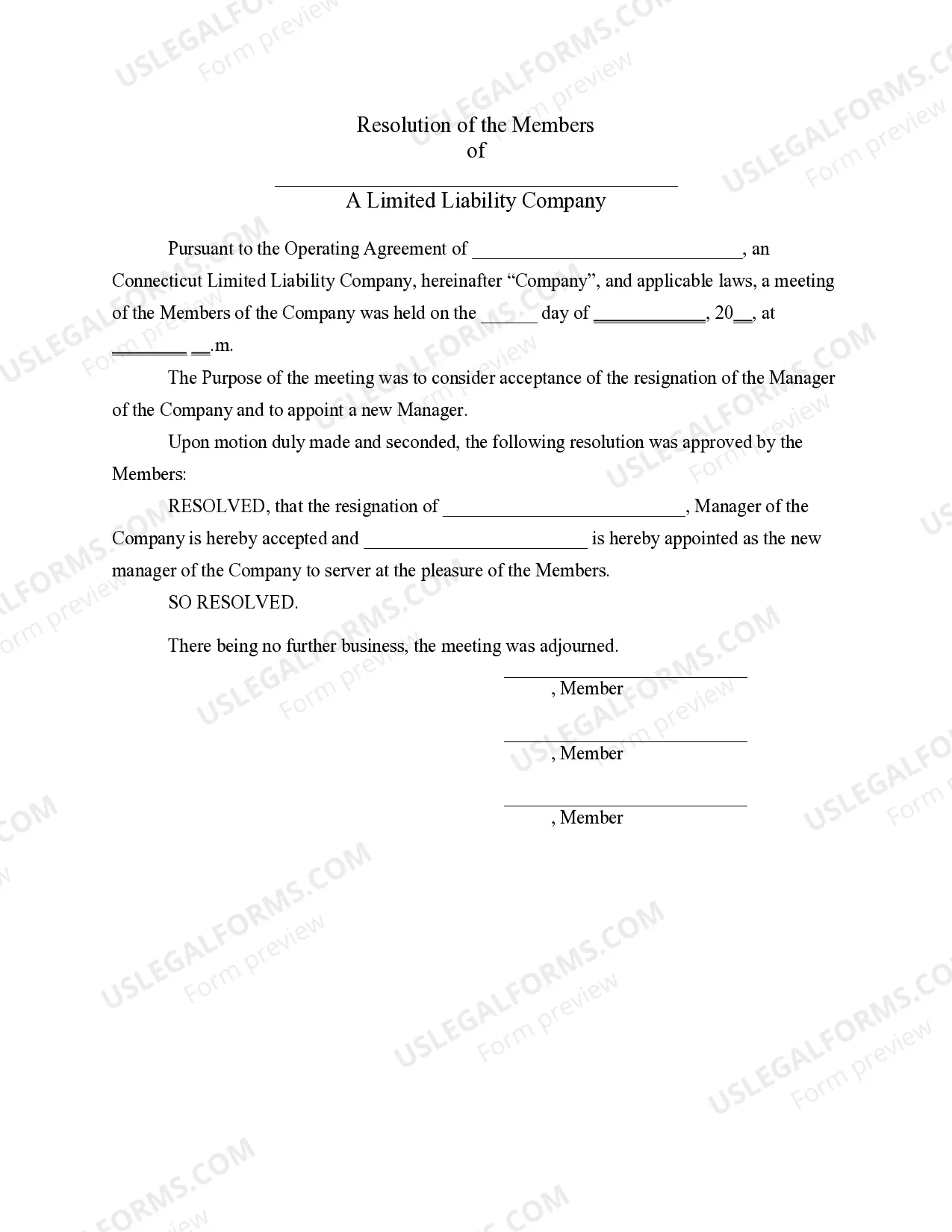

- Resolution of Meeting for General Purpose

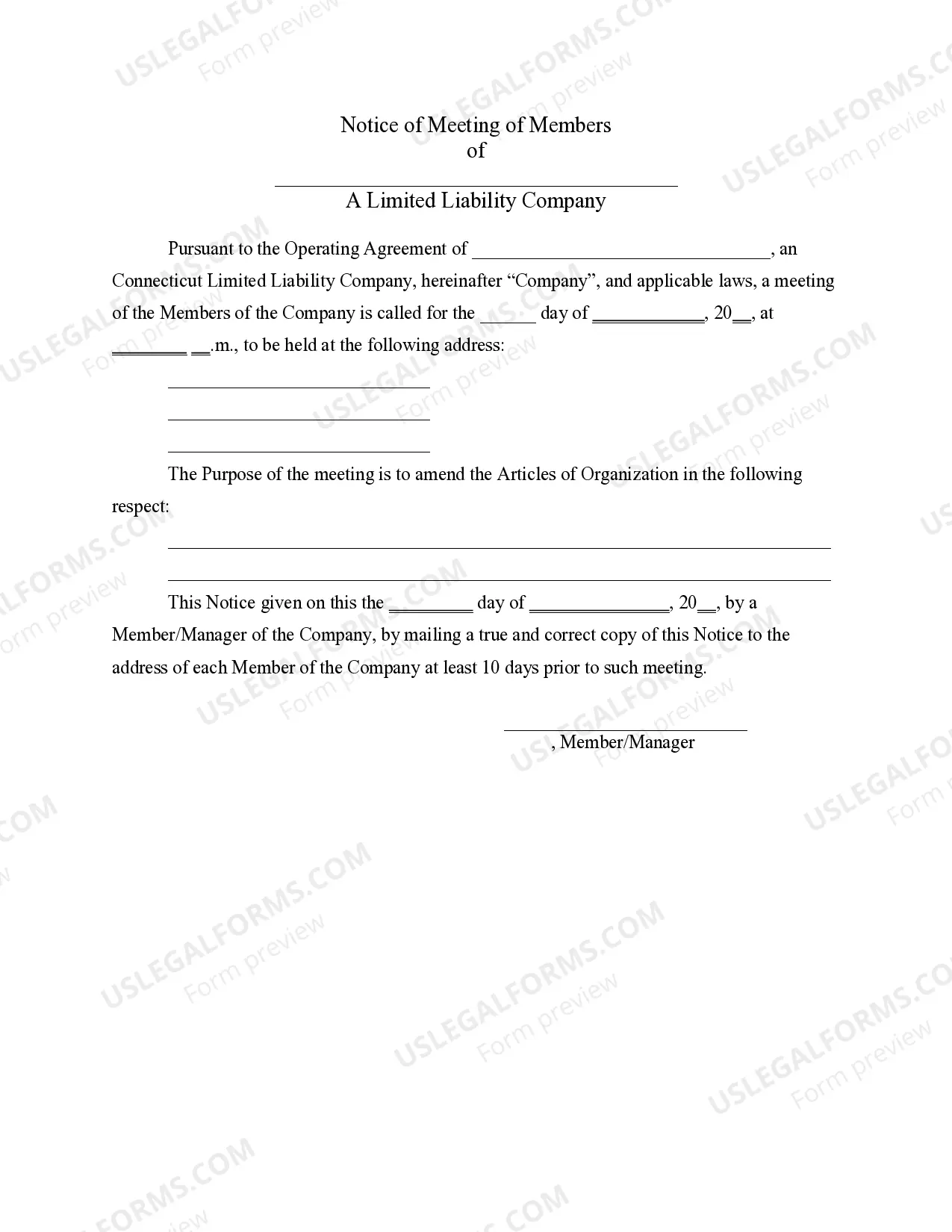

- Notice of Meeting to Amend Articles of Organization

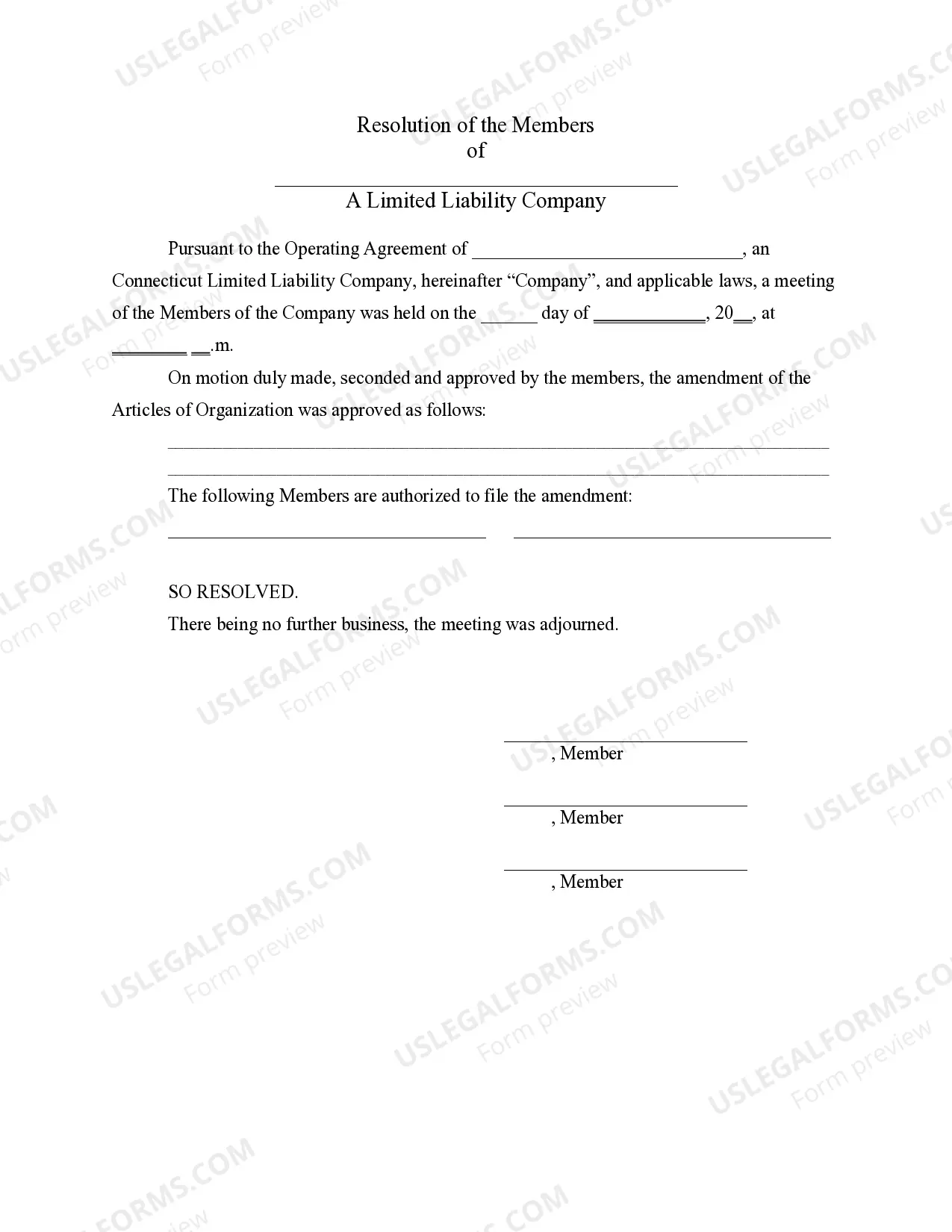

- Resolution to Amend Articles of Organization

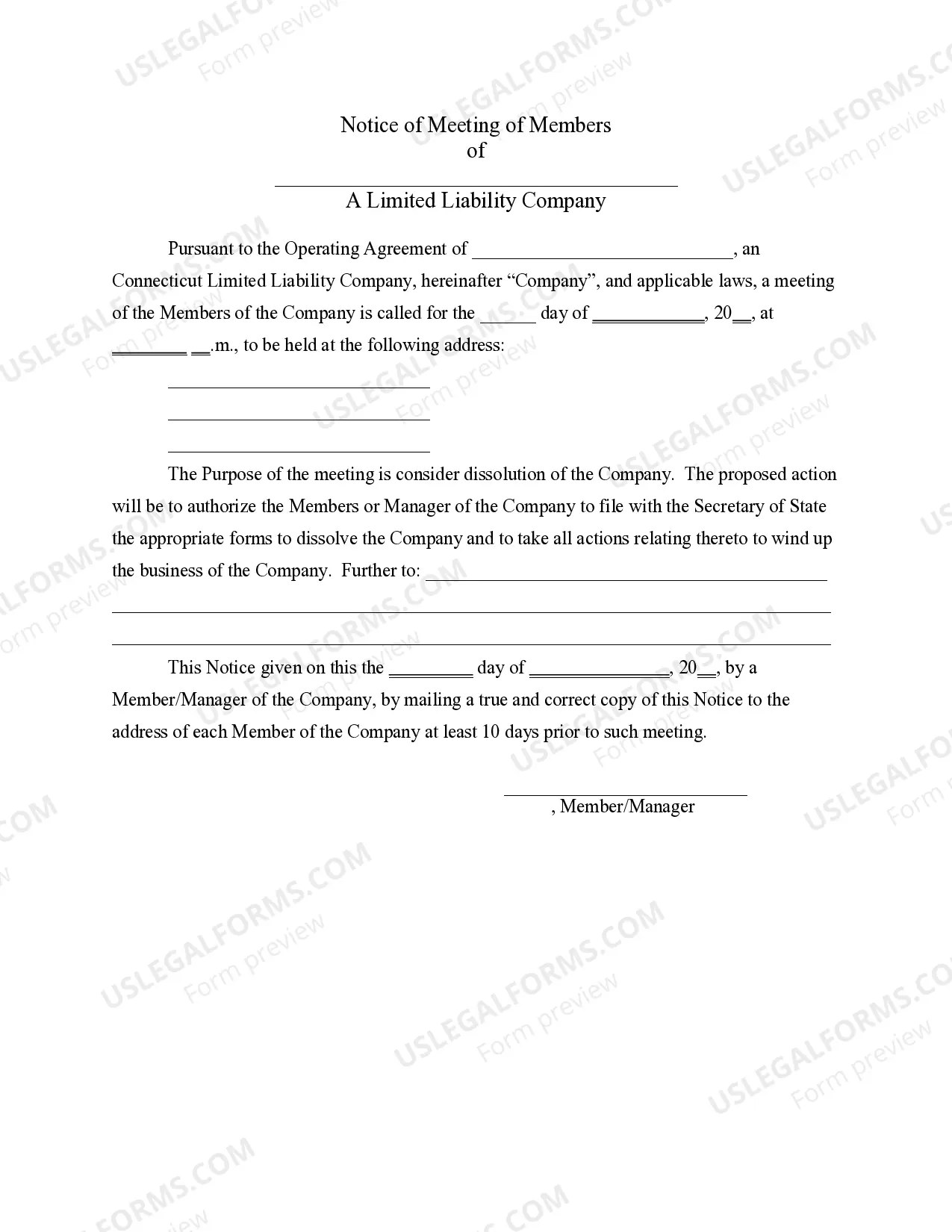

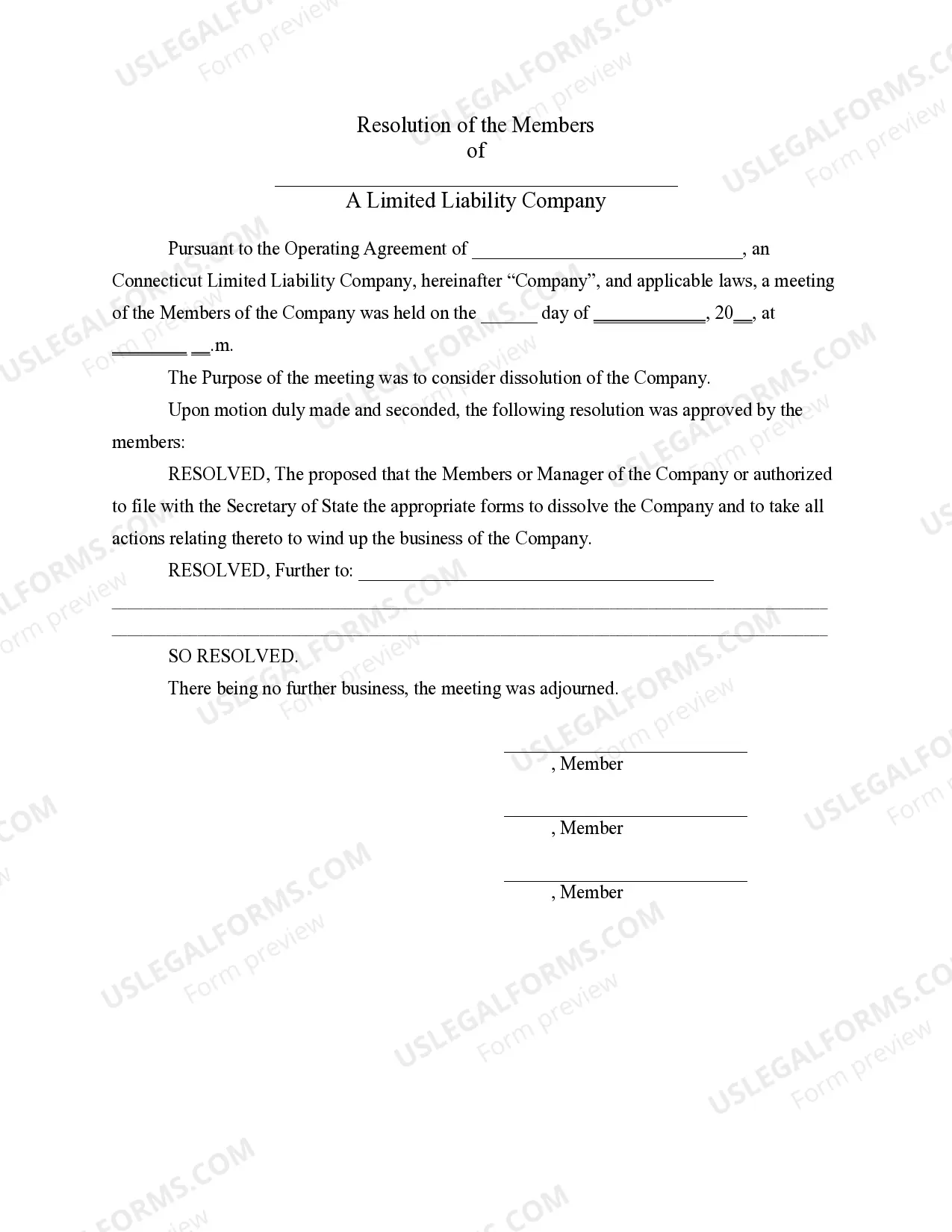

- Notice of Meeting to Dissolve the Company

- Resolution Concerning Company Dissolution

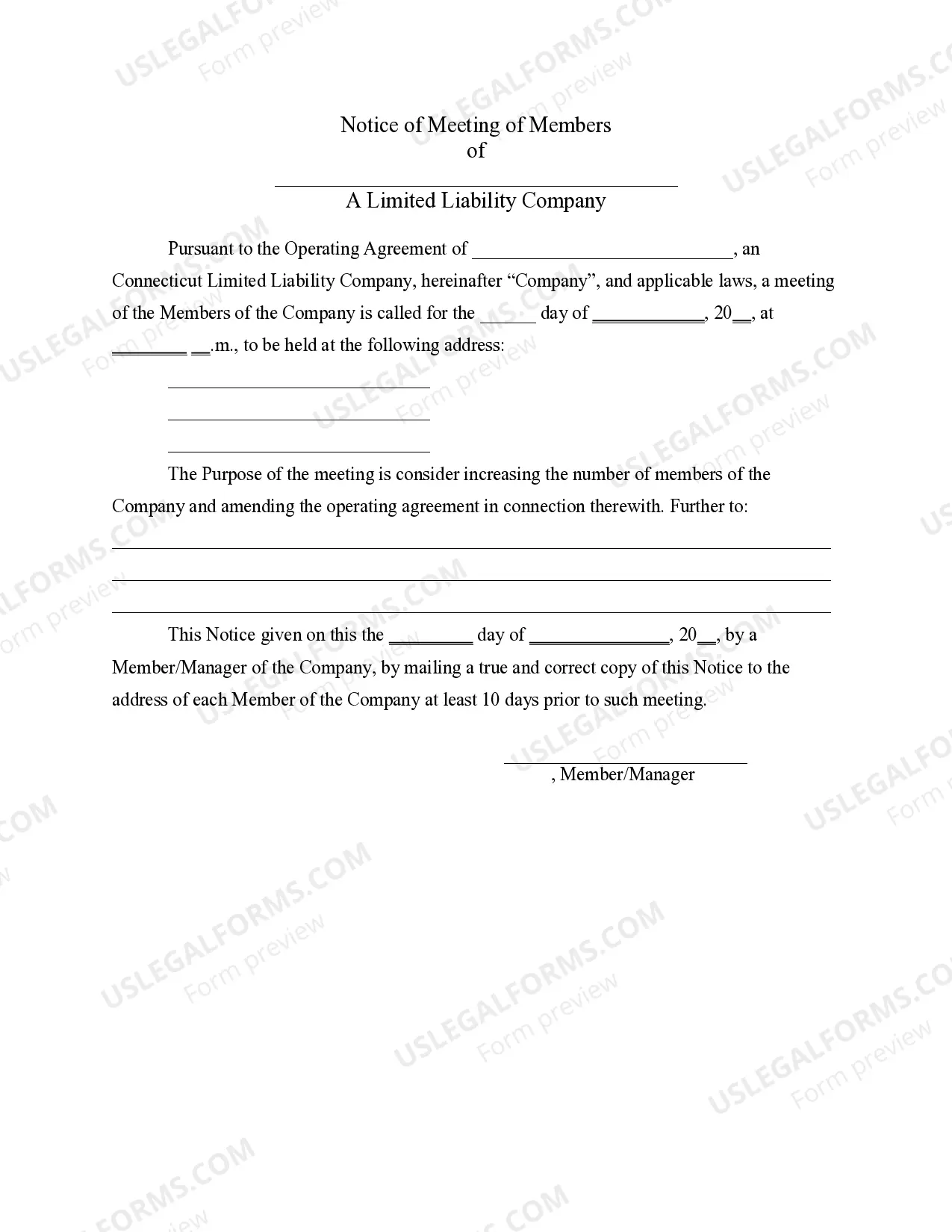

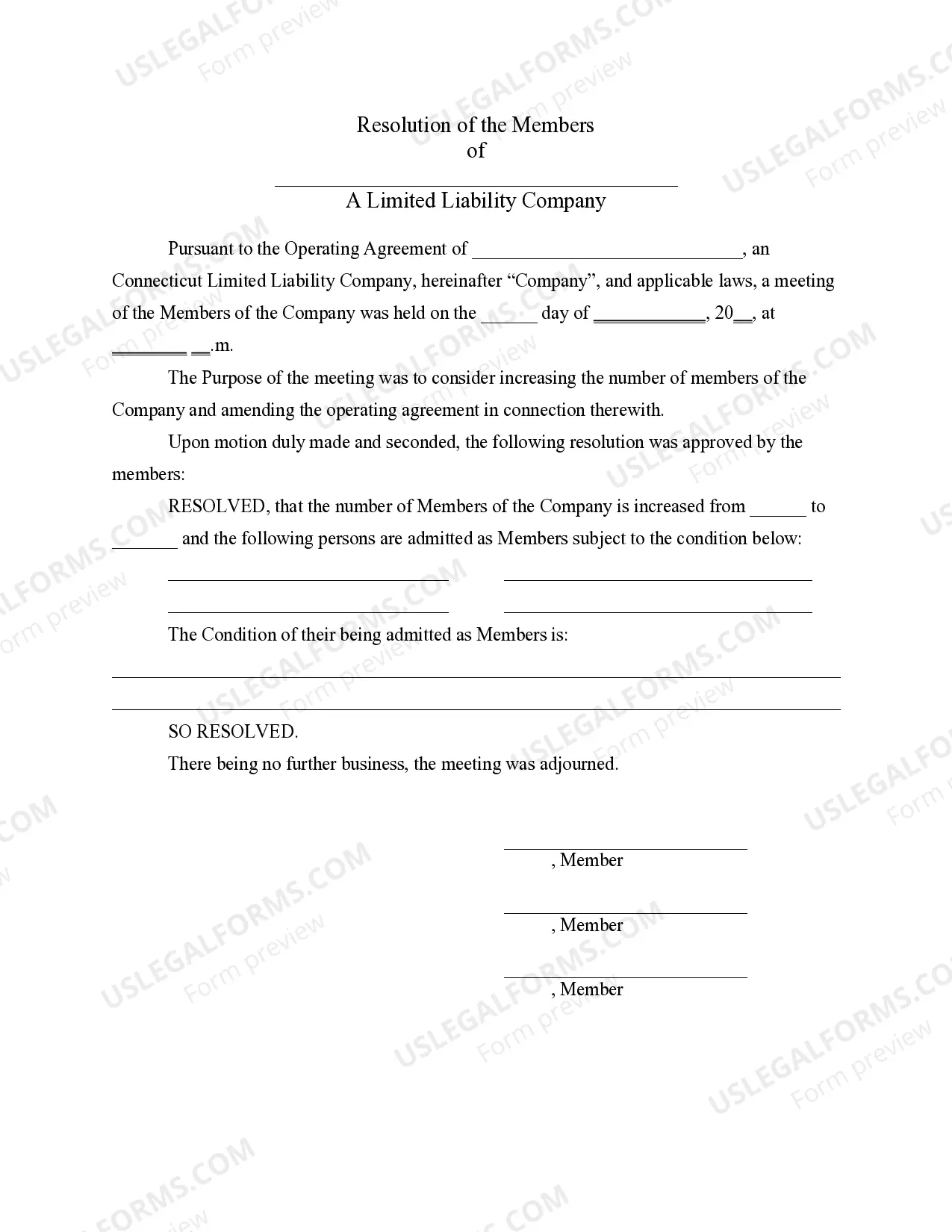

- Notice to Admit New Members

- Resolution Concerning Admitting New Members

- Notice of Meeting to Remove Manager

- Resolution Concerning Removal of Manager

- Demand for Indemnity by Member/Manager

- Assignment of Member Interest

Situations where this form applies

Use the PLLC Notices and Resolutions when your company's members need to formalize decisions through meetings or resolutions. Common scenarios include amending the articles of organization, admitting new members, accepting resignations, and proposing dissolution of the company. Having these forms prepared ensures that your LLC operates smoothly and complies with legal requirements.

Who this form is for

- Members of a Limited Liability Company (LLC) in Connecticut.

- Managers responsible for overseeing company operations.

- Anyone involved in the governance of an LLC, including new and existing members.

Steps to complete this form

- Identify the name of the Limited Liability Company and the date of the meeting.

- Specify the purpose of the meeting and the resolutions to be adopted.

- Include the names of members present and any necessary votes related to the resolutions.

- Ensure that all sections are correctly filled out by obtaining signatures from the members involved.

- Mail the notices to all members at least ten days before the meeting.

Does this document require notarization?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to notify all members of the meeting in a timely manner.

- Inadequately specifying the purpose of the meeting in the notice.

- Omitting necessary signatures from members on the resolutions.

- Using outdated templates that do not comply with current laws.

Why use this form online

- Convenience of accessing and completing forms from any location.

- Editability allows for quick customization to meet specific company needs.

- Reliability with templates drafted by licensed attorneys.

Main things to remember

- The PLLC Notices and Resolutions are essential for documenting major decisions in an LLC.

- Use the forms to facilitate transparent communication among members.

- Ensure compliance with Connecticut laws by using correctly drafted templates.

Looking for another form?

Form popularity

FAQ

Many states across the U.S. recognize Professional Limited Liability Companies (PLLCs), but regulations vary from state to state. States such as New York, Texas, and Florida have established provisions for PLLCs, allowing licensed professionals to take advantage of this business structure. If you're considering forming a PLLC, make sure to consult your state's laws and consider using resources like US Legal Forms for guidance on Connecticut PLLC Notices and Resolutions.

While Connecticut does not legally require an operating agreement for LLCs, having one is highly recommended for clarity and legal protection. An operating agreement outlines the management structure and operating procedures of the LLC, including aspects relevant to Connecticut PLLC Notices and Resolutions. By establishing a clear agreement, you can avoid potential disputes and ensure all professionals are aligned with business goals.

Yes, Connecticut allows the formation and operation of PLLCs. The state provides specific regulations that govern professional entities, ensuring compliance with relevant professional standards. By structuring your business as a PLLC, you can manage Connecticut PLLC Notices and Resolutions efficiently while focusing on your core professional services.

Connecticut does recognize Professional Limited Liability Companies (PLLCs). This recognition means that licensed professionals in Connecticut can form a PLLC and benefit from the protections and flexibility offered by this structure. When you manage your Connecticut PLLC Notices and Resolutions, you can confidently operate within the legal framework established by the state.

Yes, a Professional Limited Liability Company (PLLC) is a specific type of Limited Liability Company (LLC) designed for licensed professionals. In the context of Connecticut PLLC Notices and Resolutions, PLLCs provide the same liability protection as standard LLCs while accommodating the regulatory requirements for certain professions. This distinction is essential for professionals who seek to limit personal liability while adhering to state laws.

The minimum tax for corporations in Connecticut is $250, regardless of your company's income. This tax applies annually and is due even if your corporation is not profitable. Staying informed about Connecticut PLLC Notices and Resolutions can help you manage tax responsibilities effectively and ensure your corporation meets all financial obligations.

To look up a business in Connecticut, you can visit the Secretary of State’s website, where you can access the Business Entity Search tool. This tool allows you to find any registered business by name or business identification number. Additionally, reviewing Connecticut PLLC Notices and Resolutions can help you understand the status and compliance of the business you are investigating.

Connecticut does not require an S Corp election if you choose to incorporate. However, if you want your corporation to be taxed under Subchapter S, you need to file Form 2553 with the IRS. Understanding this process is vital, as it relates to Connecticut PLLC Notices and Resolutions that provide detailed insights into tax obligations and benefits.

Yes, you can start a corporation by yourself in Connecticut. As a sole incorporator, you can file the necessary documents solely in your name. While it's possible, consider consulting resources like Connecticut PLLC Notices and Resolutions for crucial information on structure, governance, and compliance to support your new business.

Incorporating in Connecticut involves several key steps. Start by selecting a unique name for your corporation and then submit your Certificate of Incorporation to the Secretary of State. Don't forget to familiarize yourself with Connecticut PLLC Notices and Resolutions to ensure your incorporation meets state requirements and governance.