Partial Trust Distribution Letter Format

Description

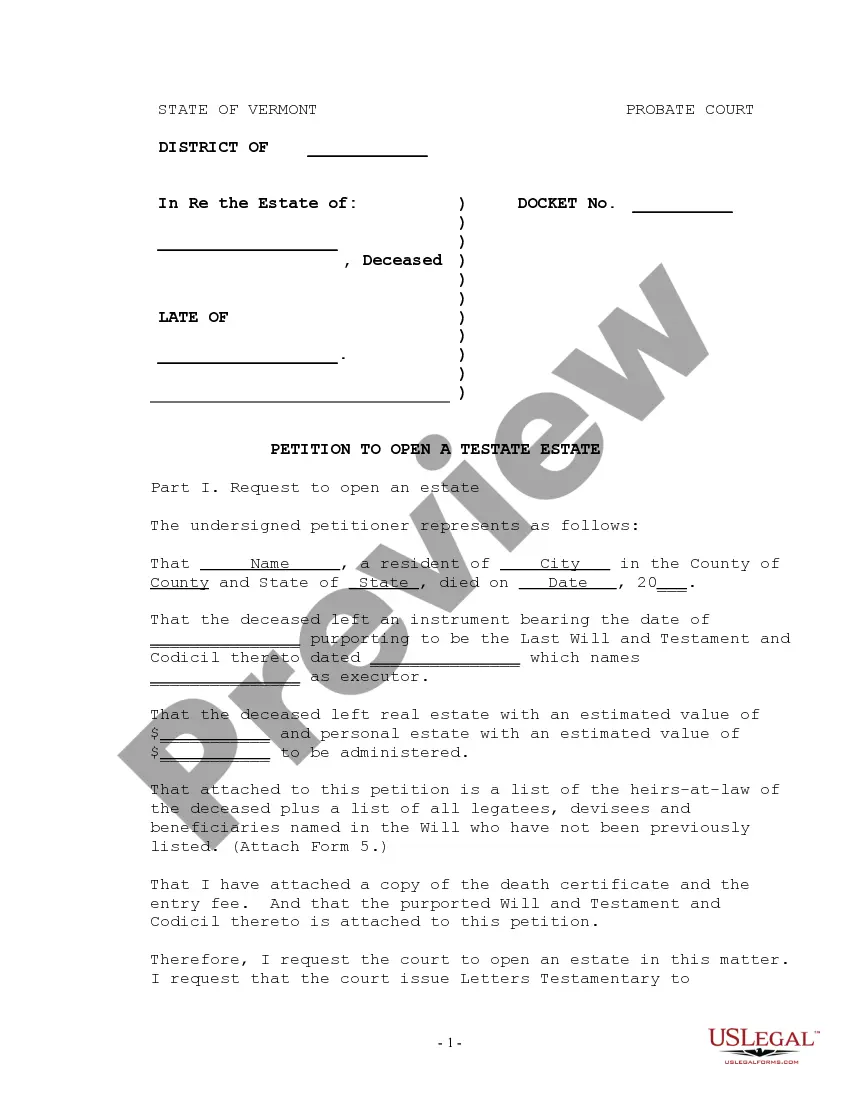

How to fill out Petition For Partial And Early Distribution Of Estate?

Getting a go-to place to access the most recent and appropriate legal samples is half the struggle of working with bureaucracy. Choosing the right legal files needs precision and attention to detail, which is why it is crucial to take samples of Partial Trust Distribution Letter Format only from reputable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to be concerned about. You may access and check all the information about the document’s use and relevance for the situation and in your state or region.

Consider the listed steps to finish your Partial Trust Distribution Letter Format:

- Make use of the catalog navigation or search field to find your template.

- Open the form’s information to see if it matches the requirements of your state and region.

- Open the form preview, if there is one, to make sure the form is the one you are interested in.

- Go back to the search and look for the right template if the Partial Trust Distribution Letter Format does not match your needs.

- If you are positive regarding the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Choose the pricing plan that suits your preferences.

- Proceed to the registration to complete your purchase.

- Complete your purchase by choosing a payment method (credit card or PayPal).

- Choose the document format for downloading Partial Trust Distribution Letter Format.

- Once you have the form on your gadget, you can modify it with the editor or print it and finish it manually.

Eliminate the headache that comes with your legal documentation. Explore the comprehensive US Legal Forms collection to find legal samples, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

For example, your trust could specify that a beneficiary should receive one-third of the trust at age 25, one-half at age 30, and the rest at age 35, when they will have a decade of financial management under their belt.

How to write a successful trust letter Information about the project for which you are applying for funding. Statistics and facts to support your application. Beneficiary case studies and/ or quotes. A budget. A copy of your accounts.

Generally, beneficiaries have to wait a certain amount of time, say at least six months. That time is used to allow creditors to come forward and to pay them off with the estate assets. (In some cases, an executor may make partial distributions to the heirs after he or she estimates the debts.

When writing your letter of instruction, include as much information about your estate and your assets as possible, and provide detailed instruction for how you want any assets not mentioned in your formal will to be dispersed among your heirs. Your letter of intent doesn't supersede the terms of your will.

What is a partial distribution? A partial distribution, sometimes called a preliminary distribution, is a distribution of some of the trust assets before the trust administration is complete and the trust assets are fully distributed. A trustee is required to complete trust distributions within a reasonable time.