Estate Accounts For Probate

Description

How to fill out Petition For Partial And Early Distribution Of Estate?

Handling legal papers and procedures can be a time-consuming addition to your day. Estate Accounts For Probate and forms like it usually require that you look for them and understand the way to complete them correctly. Therefore, if you are taking care of financial, legal, or personal matters, having a thorough and hassle-free web catalogue of forms at your fingertips will significantly help.

US Legal Forms is the best web platform of legal templates, offering over 85,000 state-specific forms and a number of resources to help you complete your papers effortlessly. Explore the catalogue of pertinent papers open to you with just one click.

US Legal Forms offers you state- and county-specific forms offered at any time for downloading. Safeguard your papers management procedures having a high quality support that lets you put together any form within a few minutes without having additional or hidden charges. Simply log in in your account, identify Estate Accounts For Probate and acquire it straight away from the My Forms tab. You can also access previously saved forms.

Is it your first time using US Legal Forms? Register and set up up a free account in a few minutes and you’ll have access to the form catalogue and Estate Accounts For Probate. Then, adhere to the steps listed below to complete your form:

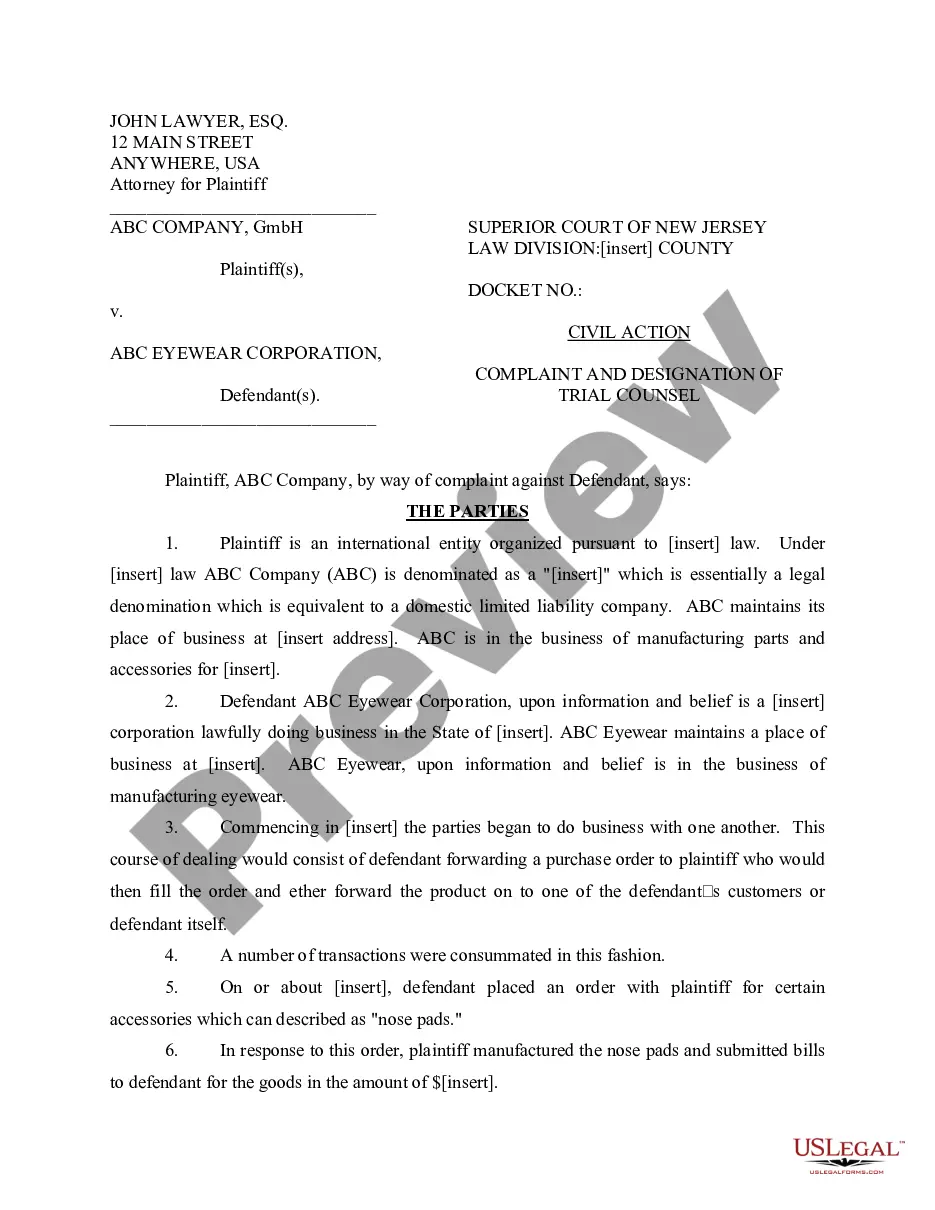

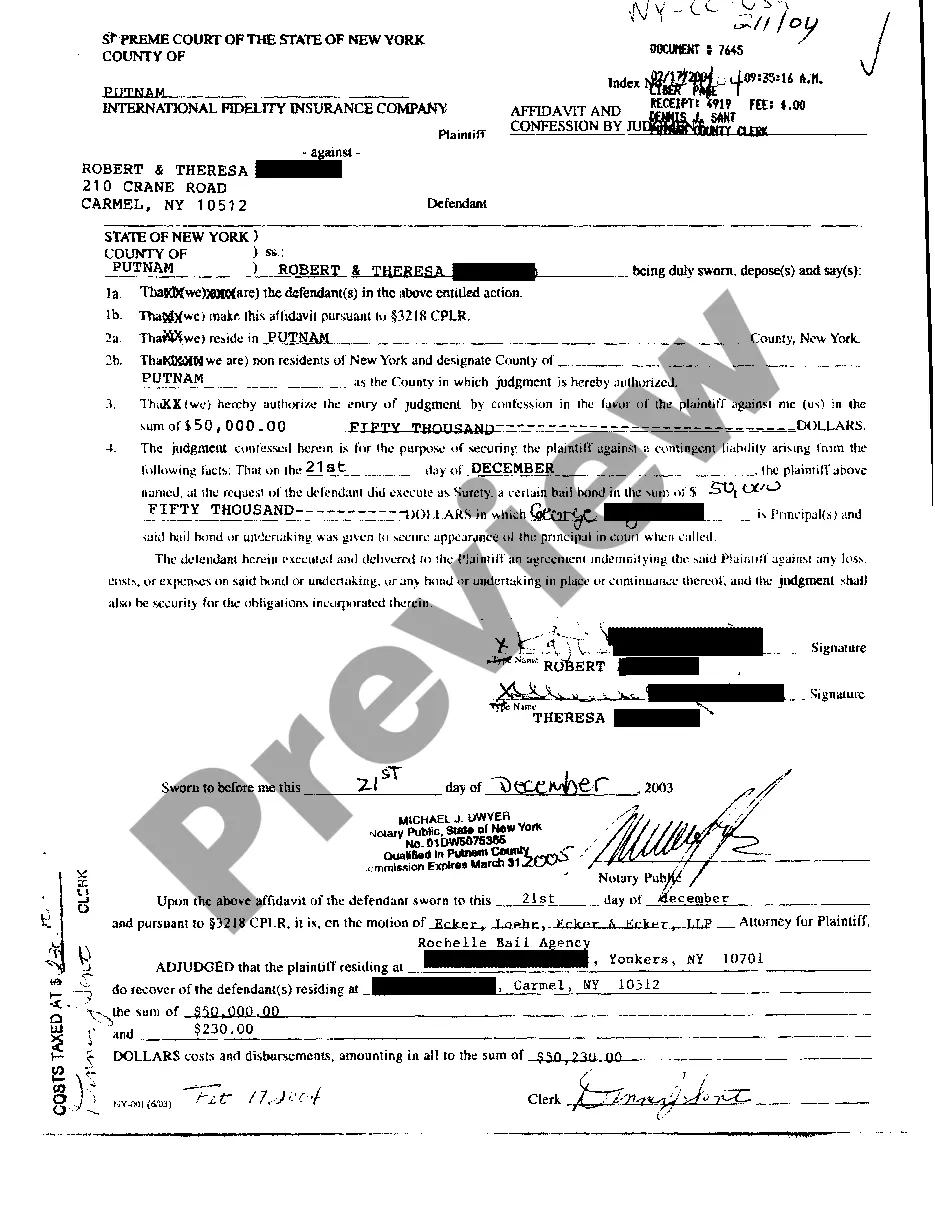

- Ensure you have the proper form using the Review feature and looking at the form information.

- Pick Buy Now once ready, and select the subscription plan that meets your needs.

- Select Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of experience assisting users control their legal papers. Get the form you want today and streamline any process without having to break a sweat.

Form popularity

FAQ

You can use the funds to pay any final bills, including court costs, lawyer fees and, eventually, the estate's beneficiaries. Keep track of your time and expenses. As executor, you are entitled to reasonable compensation for your time, so record how long you spend on estate-related tasks.

The executor is responsible for making sure all assets in the will are accounted for, along with transferring these assets to the correct party (parties). Assets can include financial holdings, such as stocks, bonds, or money market investments; real estate; direct investments; or even collectibles like art.

You should add together the totals for assets, changes, and income, then take away the totals for liabilities and expenses. This final figure should then be divided into the appropriate portions and then assigned to the list of beneficiaries.

All beneficiaries do not need to formally approve estate accounts; however, it is best practice for the Executor(s) and main beneficiaries to sign the estate accounts to show a legal agreement across all parties. Nevertheless, the beneficiaries are entitled to receive a copy of them and review the information.

The executor must give the accounting to all the residual beneficiaries and they must approve it before distribution takes place. (Note: the term ?personal representative? is the current legal term used to refer to an executor/executrix, administrator/administratix, and judicial trustee.)