Agreement Borrower Contract Format

Description

How to fill out Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

Obtaining legal document samples that meet the federal and state laws is essential, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the correctly drafted Agreement Borrower Contract Format sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by attorneys for any professional and personal scenario. They are easy to browse with all files organized by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your form is up to date and compliant when acquiring a Agreement Borrower Contract Format from our website.

Obtaining a Agreement Borrower Contract Format is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, follow the steps below:

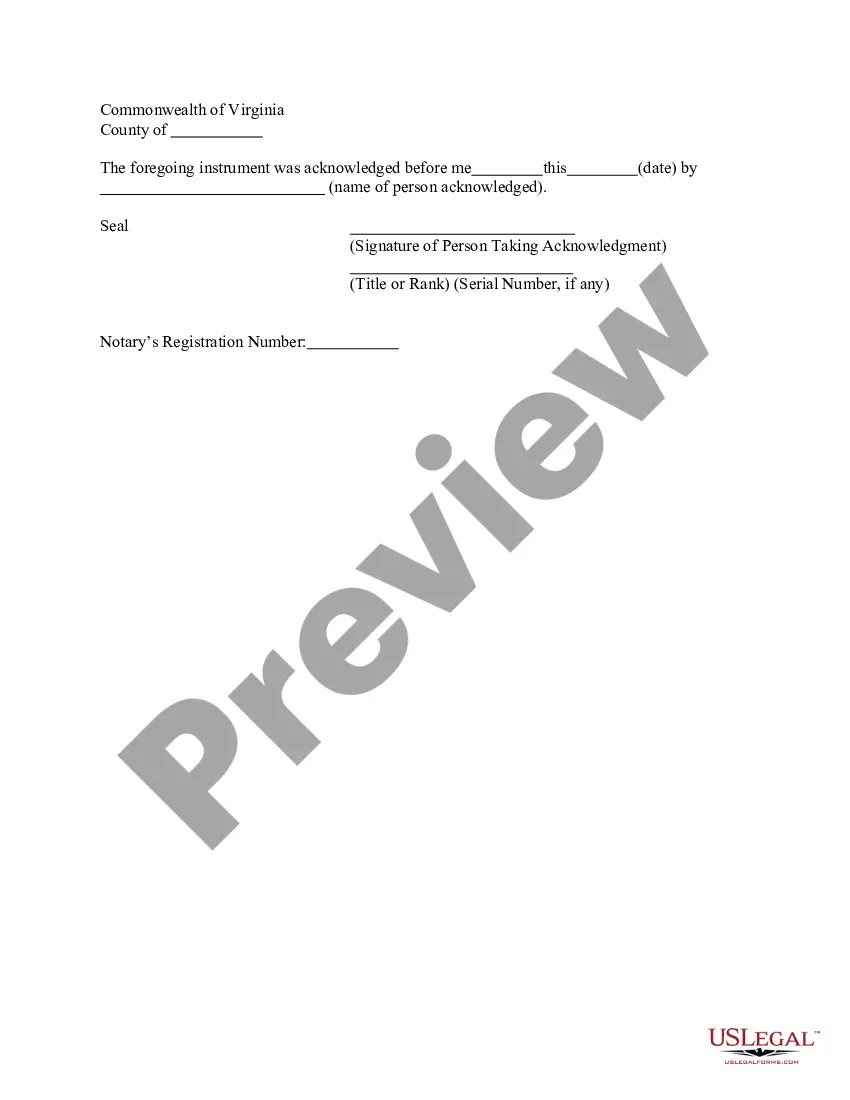

- Examine the template using the Preview feature or through the text outline to make certain it fits your needs.

- Browse for a different sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and choose a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Agreement Borrower Contract Format and download it.

All documents you find through US Legal Forms are reusable. To re-download and fill out previously saved forms, open the My Forms tab in your profile. Benefit from the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Credit is a contractual agreement in which a borrower receives something of value now and agrees to repay the lenderat a later date. It allows you to buy now with the promise of paying later. By understanding how each type of credit works, you will learn to manage credit successfully.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.