Convertible Promissory Note With Collateral Sample

Description

How to fill out Convertible Promissory Note By Corporation - One Of Series Of Notes Issued Pursuant To Convertible Note Purchase Agreement?

Red tape requires meticulousness and exactness.

If you aren’t accustomed to completing paperwork like the Convertible Promissory Note With Collateral Example on a daily basis, it may cause some confusion.

Choosing the appropriate example from the outset will ensure that your document submission proceeds smoothly and avert any hassles of needing to resubmit a file or redo the same task from the beginning.

If you are not a registered user, finding the necessary example will require a few additional steps: Locate the template using the search box. Ensure the Convertible Promissory Note With Collateral Example you found is suitable for your state or area. Access the preview or read the description that details the use of the sample. When the result aligns with your search, click the Buy Now button. Choose the appropriate option from the available pricing plans. Log In to your account or create a new one. Complete the transaction using a credit card or PayPal account. Download the document in the preferred format. Acquiring the correct and current samples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate bureaucratic uncertainties and enhance your form handling efficiency.

- You can always acquire the correct template for your documentation at US Legal Forms.

- US Legal Forms is the largest online repository of forms that provides over 85 thousand templates for various domains.

- You can access the most recent and pertinent edition of the Convertible Promissory Note With Collateral Example by simply searching it on the website.

- Find, save, and download templates within your account, or verify the description to confirm you have the correct one ready.

- With an account at US Legal Forms, you can conveniently gather, organize in one location, and scan through the templates you maintain to retrieve them with just a few clicks.

- When on the webpage, click the Log In button to authenticate.

- Then, navigate to the My documents section, where your forms are stored.

- Review the descriptions of the forms and download those you need whenever necessary.

Form popularity

FAQ

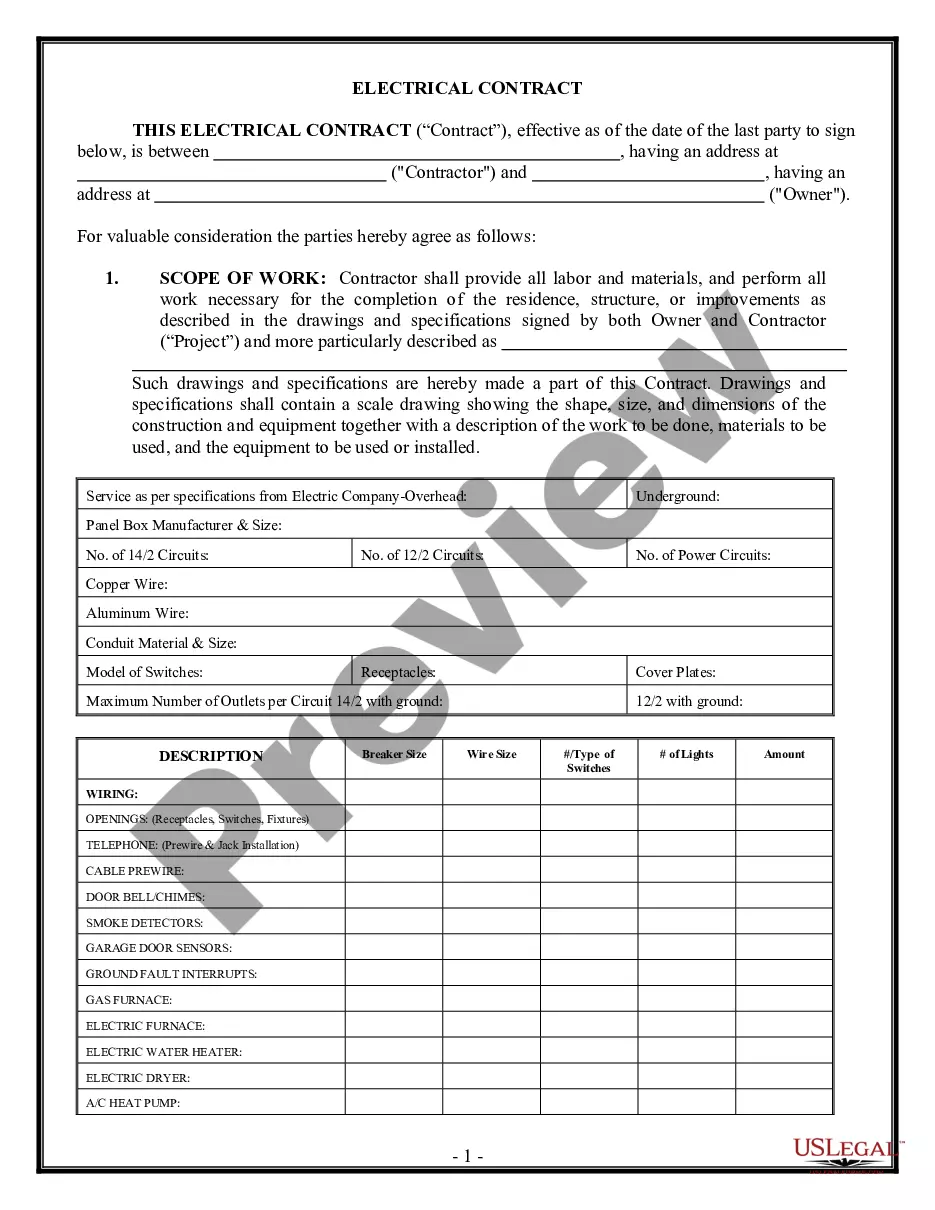

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

Convertible debentures are usually unsecured bonds or loans, often with no underlying collateral backing up the debt. These long-term debt securities pay interest returns to the bondholder like any other bond. The unique feature of convertible debentures is that they are exchangeable for stock at specified times.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Secured Promissory NotesThe property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Secured Promissory NotesThe property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.