Estate Letter With For You

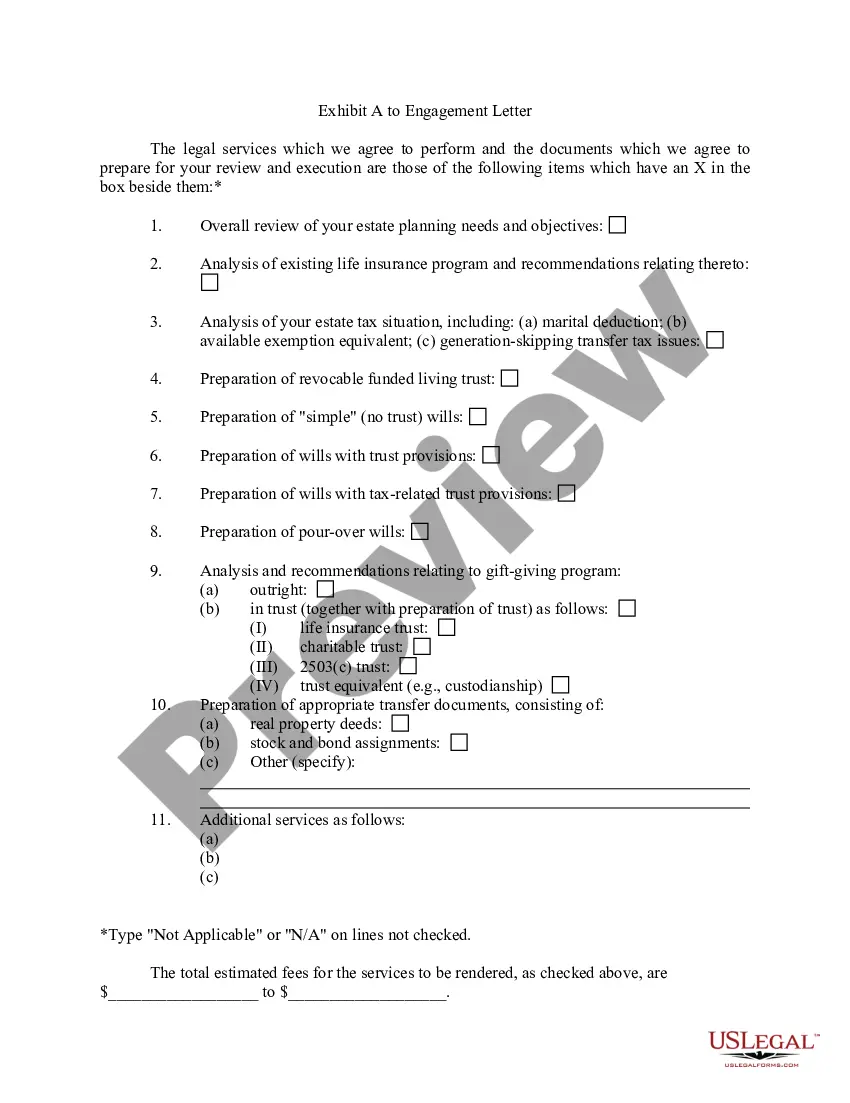

Description

How to fill out Estate Planning Data Letter And Employment Agreement With Client?

Properly composed official documentation is one of the key assurances for preventing complications and legal disputes, but acquiring it without an attorney's support may require time.

Whether you need to promptly locate a current Estate Letter With For You or other forms for employment, family, or business matters, US Legal Forms is consistently available to assist.

The procedure is even simpler for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and hit the Download button beside the desired file. Additionally, you can access the Estate Letter With For You at any time, as all documentation obtained on the platform is stored within the My documents section of your profile. Save time and money on drafting formal documents. Explore US Legal Forms today!

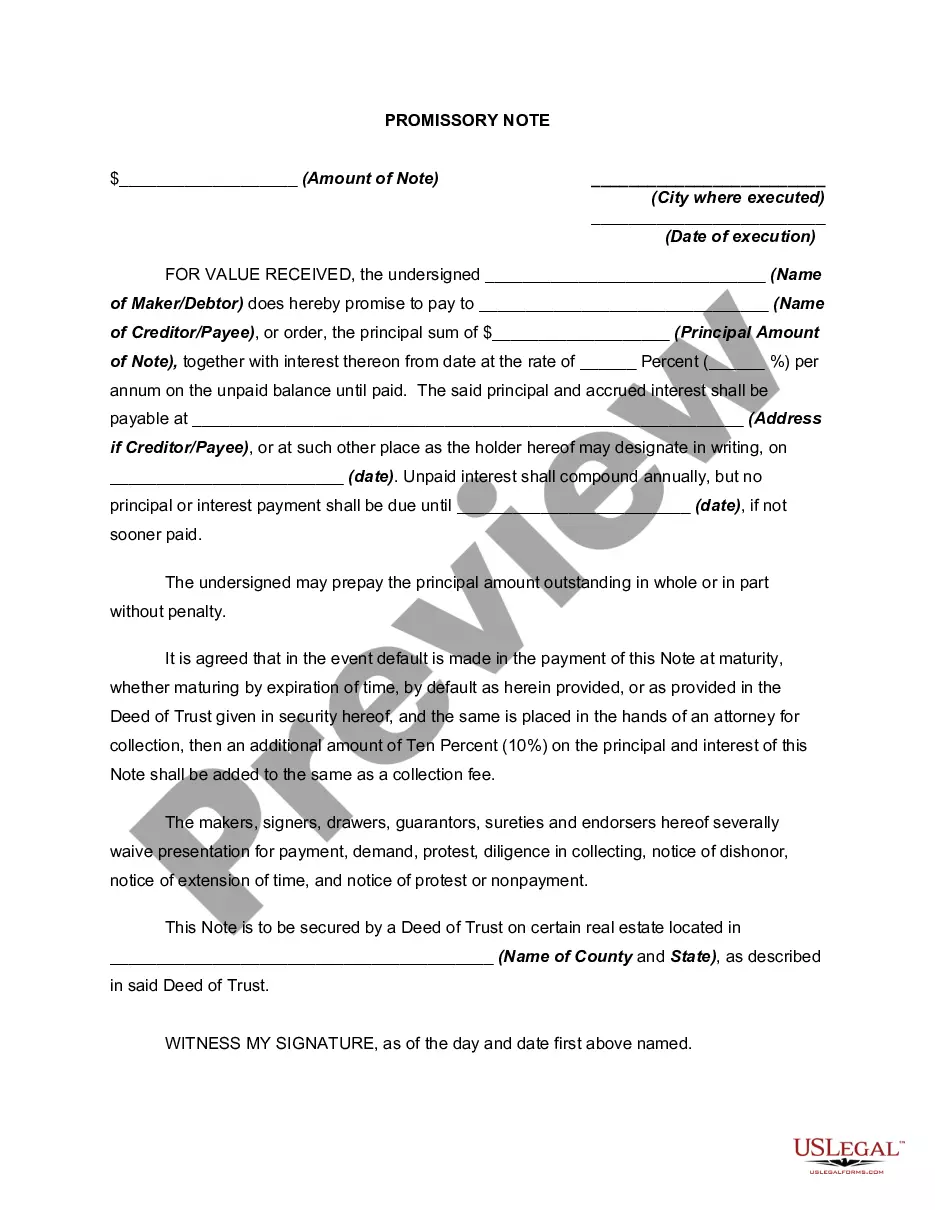

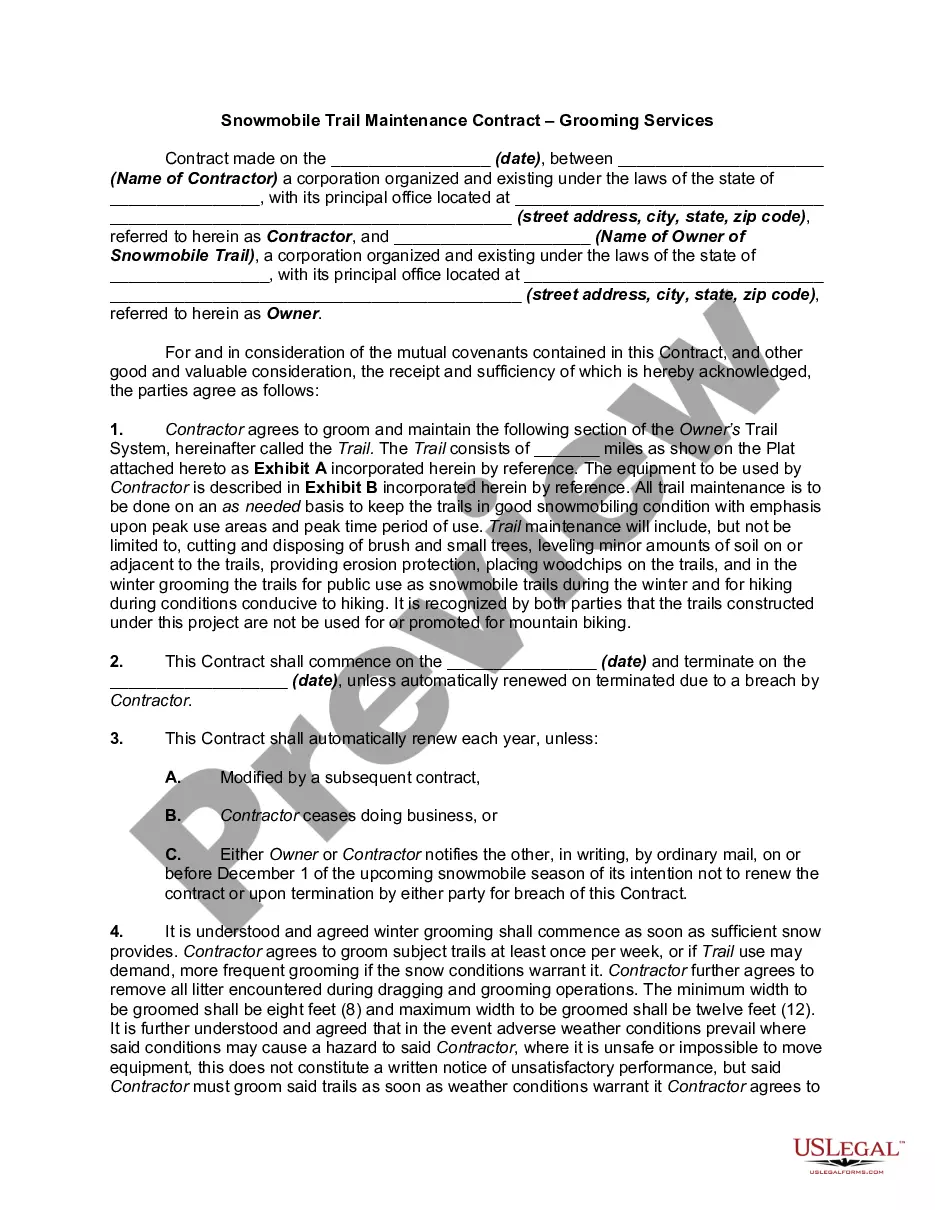

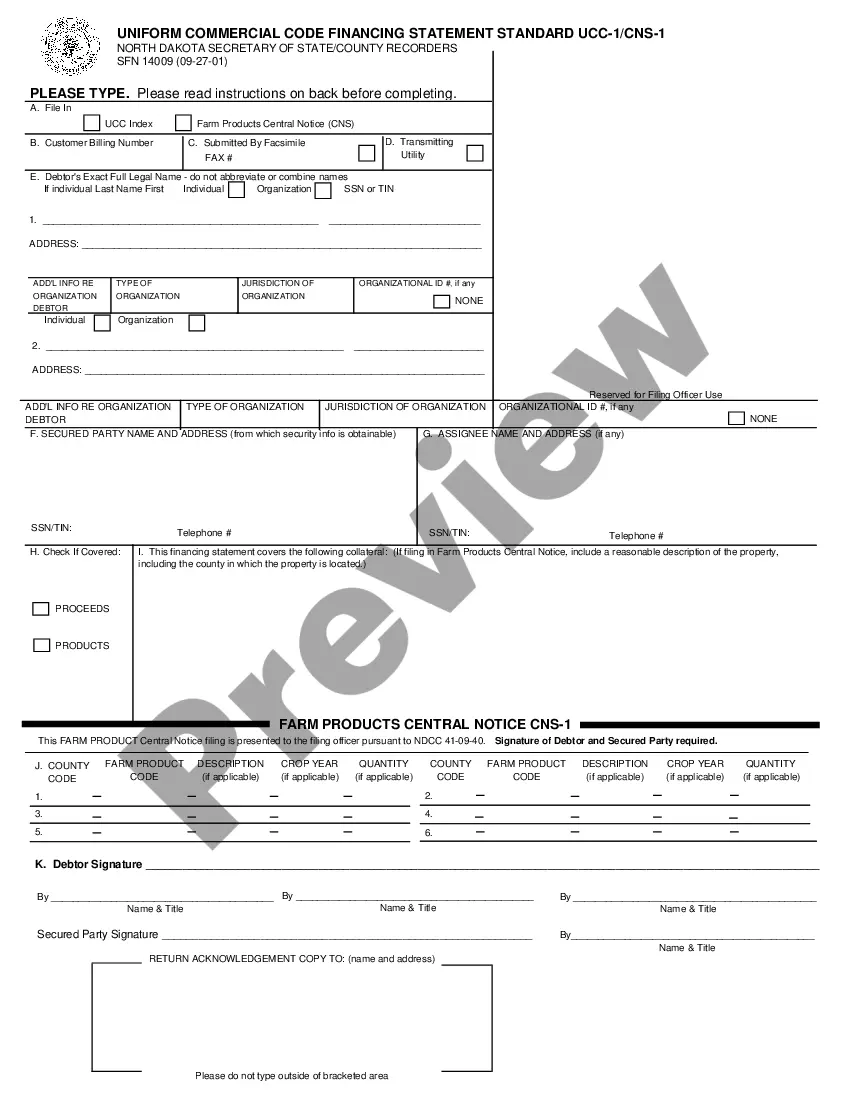

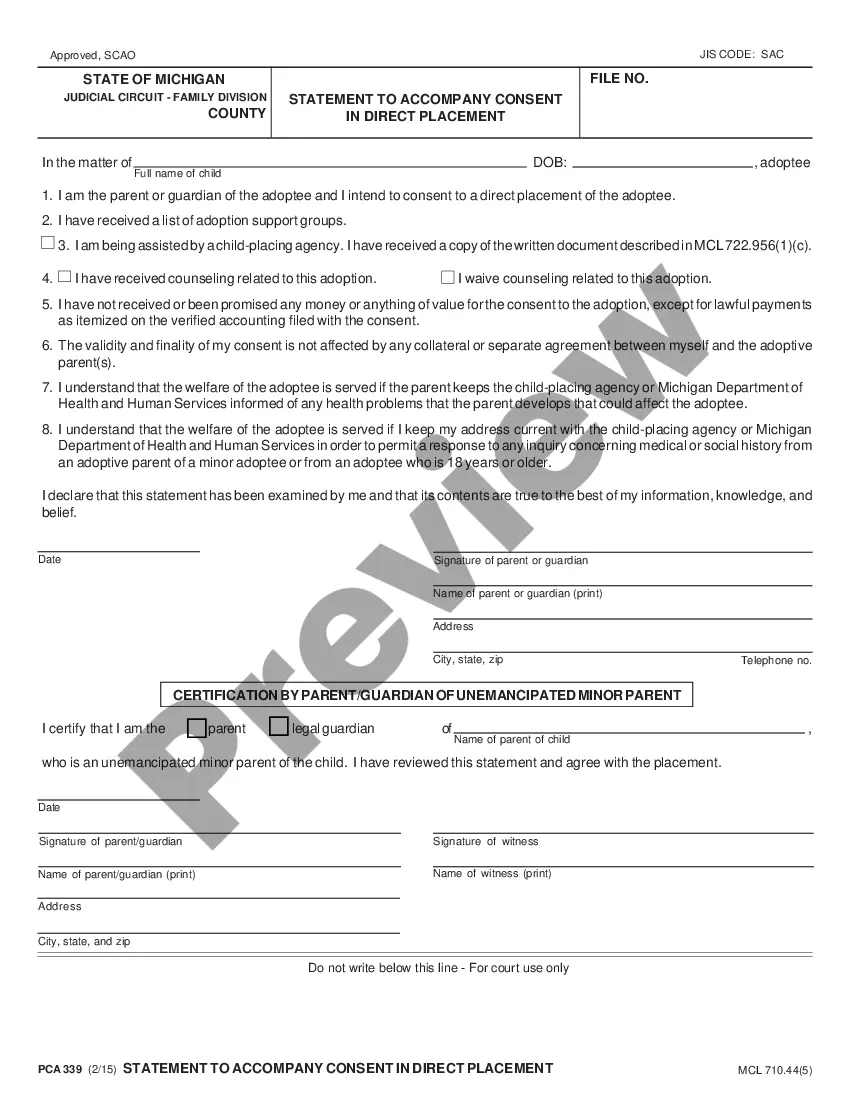

- Confirm that the form is appropriate for your situation and area by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar located in the page header.

- Press Buy Now after you find the suitable template.

- Choose the pricing option, Log In to your account or create a new one.

- Select your preferred payment method to acquire the subscription plan (using a credit card or PayPal).

- Pick PDF or DOCX file format for your Estate Letter With For You.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Filling out estate paperwork requires careful attention to detail and an understanding of the required documents. Start by gathering necessary information, such as asset lists, debts, and beneficiaries. Using an estate letter with for you can help streamline this process, as it provides templates and guidance, making the completion of paperwork more straightforward. This approach not only simplifies your tasks but also enhances accuracy, helping you navigate estate administration with confidence.

An estate letter is a formal document typically used to communicate important information regarding someone's estate after they pass away. For instance, a letter may inform heirs of their rights, outline the distribution of assets, or provide instructions on settling debts. By utilizing an estate letter with for you, individuals can clarify their wishes and avoid potential disputes among family members, ensuring a smoother process during a difficult time.

To settle an estate without a lawyer, start by gathering all necessary documents, including the will, death certificate, and any estate letter with for you. Familiarize yourself with the probate process in your state, as procedures can vary. Organizing documentation and carefully following state laws will help you navigate through the settlement without legal assistance.

The steps to settling an estate typically include initiating probate, notifying beneficiaries, inventorying the estate's assets, paying debts and taxes, and distributing the remaining assets. Using an estate letter with for you can provide a clear framework for these steps, ensuring nothing is overlooked. Each step requires attention to detail to ensure a smooth transition of assets to the rightful heirs.

While a lawyer is not always necessary to close out an estate, having legal assistance can simplify the process and ensure compliance with legal requirements. If the estate is straightforward and you have an estate letter with for you that outlines everything clearly, you may be able to handle it on your own. However, consider seeking legal advice for more complex situations to protect your interests.

Settling an estate without an attorney is possible by following specific steps, including filing necessary paperwork with the probate court and managing the estate's assets. You will benefit from using resources like an estate letter with for you to guide you through the legal processes. However, you must ensure compliance with state laws to avoid complications down the line.

Most estates take anywhere from several months to a couple of years to settle, depending on the complexity of the estate and any disputes that may arise. The process can be expedited by having a clear estate letter with for you, detailing the deceased's wishes and assets. Factors such as tax requirements and creditor claims can also influence the timeline for settling an estate.

The estate tax closing letter can be requested by the executor or administrator of the estate. They will need to submit the relevant tax forms and provide proof of their authority to manage the estate. In some cases, beneficiaries may also be able to request this letter if they demonstrate a valid interest in the estate's tax obligations, providing clarity on the estate letter with for you.

To claim the estate of a deceased, you must first identify the executor or administrator named in the will or appointed by the court. Next, gather all necessary documents, including the death certificate and the estate letter with for you, which outlines your rights to the estate. Once you have this information, file a petition with the probate court to begin the process of claiming the estate.

A handwritten note might be legally binding if it meets specific legal criteria set by your state. While some jurisdictions recognize holographic wills—wills entirely in the maker's handwriting—others do not. To ensure your wishes are respected, consider using uslegalforms to create a legally sound document.