What Is Garnished

Description

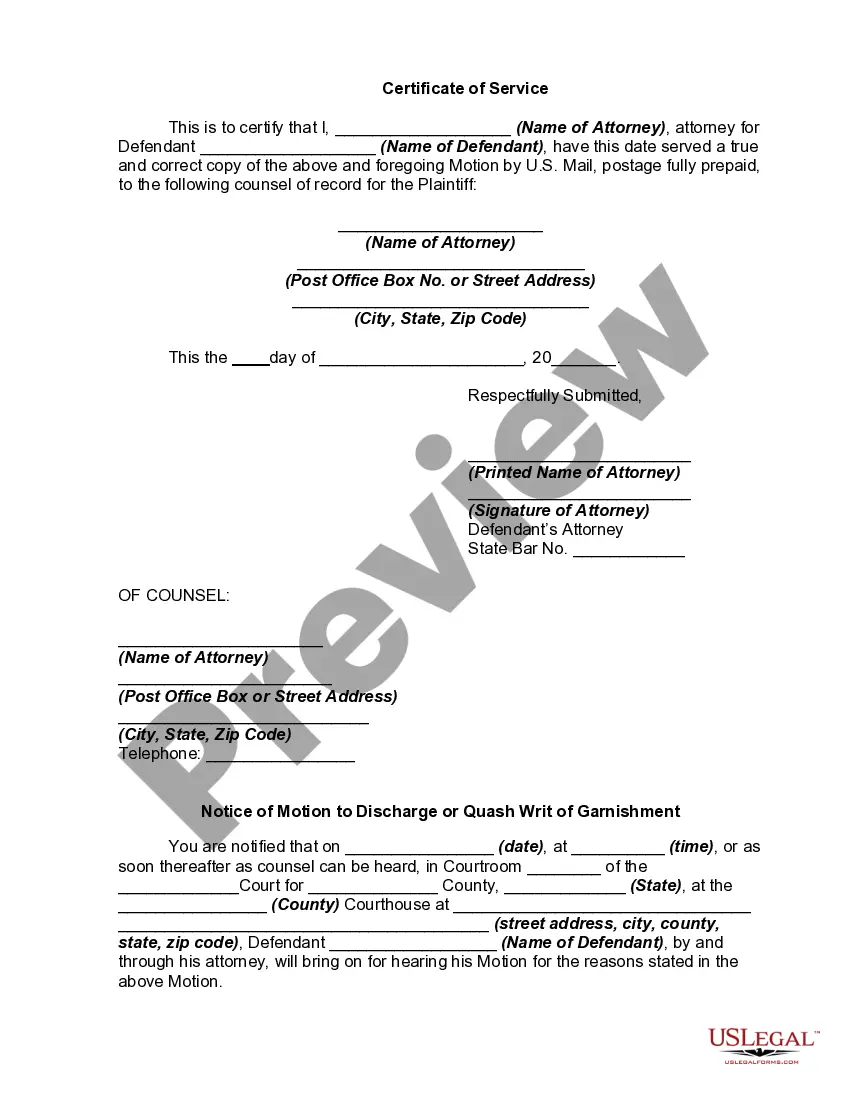

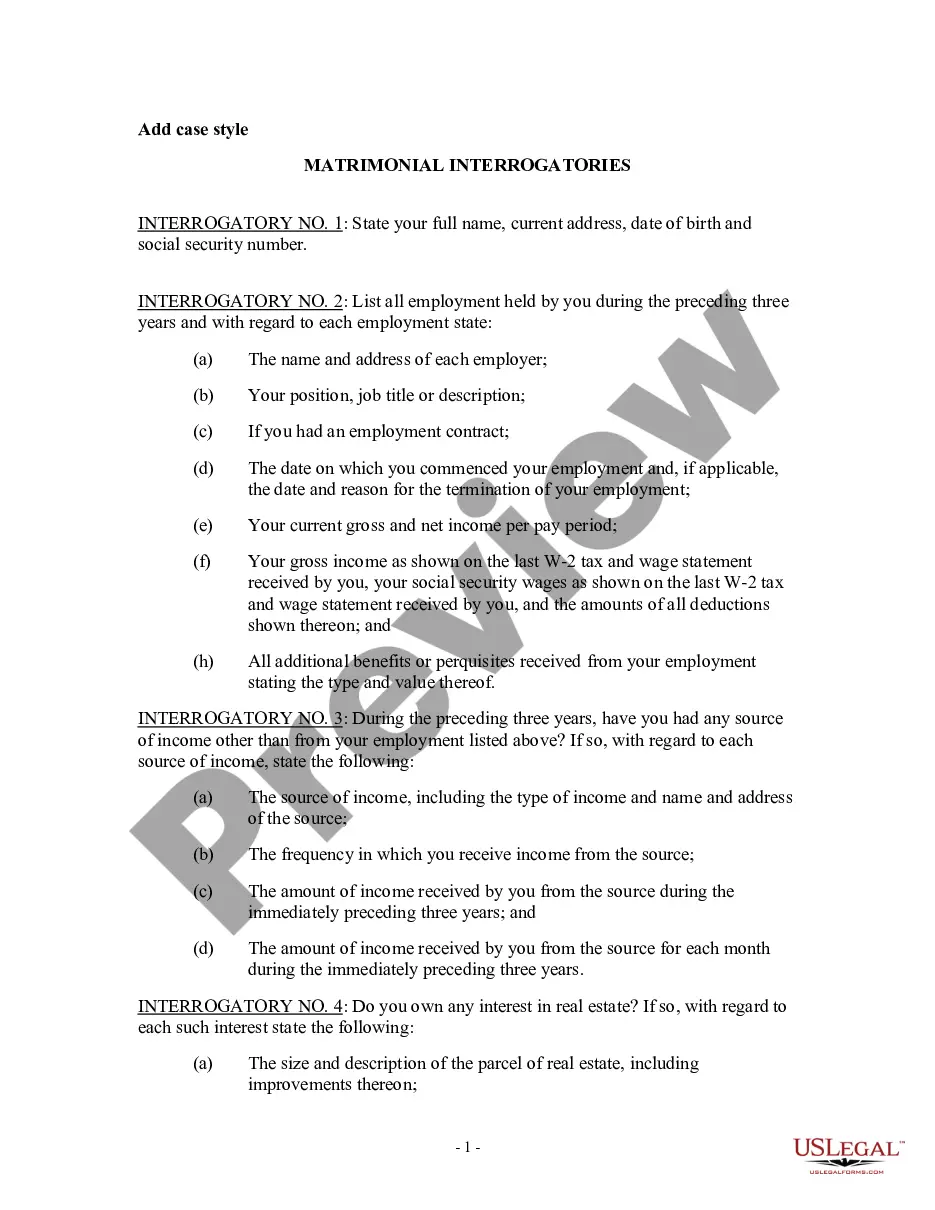

How to fill out Motion To Discharge Or Quash Writ Of Garnishment?

- If you have previously signed up with US Legal Forms, start by logging into your account. Make sure your subscription is active to download your needed template by hitting the Download button.

- For first-time users, begin by exploring the Preview mode of our documents. This ensures you choose accurately according to your local requirements.

- If you need a different form, utilize the Search function above to find a template that aligns better with your needs.

- Once you’ve selected a suitable document, click on the Buy Now button and opt for your preferred subscription plan. You'll need to create an account to dive into our extensive library.

- Finalize your purchase by entering your payment details or utilizing your PayPal account to complete your subscription.

- Download the form onto your device for immediate access, and find it again easily under the My Forms section of your profile.

US Legal Forms stands out with its expansive collection of over 85,000 legal documents. Not only can users easily fill and edit forms, but they also gain access to premium expert guidance for meticulous form completion, ensuring documents are legally sound.

In conclusion, accessing legal forms doesn't have to be overwhelming. US Legal Forms provides a streamlined approach to obtaining necessary documents, making legal processes manageable. Start your journey today and experience the benefits!

Form popularity

FAQ

Surviving a wage garnishment involves understanding your rights and exploring options to manage the situation. Creating a strict budget can help you adapt to the loss of income, while also considering strategies to negotiate with creditors. Additionally, seeking professional advice or exploring services like USLegalForms can provide resources to help you navigate the complexities of a garnishment. Knowing what is garnished allows you to regain control over your finances.

In most cases, a creditor cannot garnish your wages without your knowledge. The law requires that you be notified of the court proceedings and that you have the opportunity to contest the garnishment. However, if you do not respond, the court may proceed without your input. To stay informed about what is garnished, consider monitoring your financial situation regularly.

Garnishment works by allowing creditors to deduct a specific amount from your earnings or bank assets to satisfy a debt. Once a court approves a garnishment, your employer receives instructions on how much to withhold from your paycheck. Generally, the withheld funds are sent directly to the creditor until the debt is fully satisfied. Knowing what is garnished can help you plan your budget around the reduced income.

The garnishment process begins when a creditor obtains a court order to collect a debt directly from your wages or bank account. This order allows your employer or bank to withhold a portion of your income or funds. Typically, you will receive notice before any garnishment occurs, providing you with an opportunity to address the situation. By understanding what is garnished, you can take steps to manage your finances effectively.

To find out what you are being garnished for, review any court documentation you received regarding the garnishment. You can contact your employer’s payroll department for specifics, or reach out to the court that issued the garnishment. Systems like USLegalForms can help you understand your rights and the implications of the garnishment.

You can look up garnishments through court records, online databases, or by contacting the appropriate local court. Many jurisdictions provide online access to certain legal documents, including garnishment records. If you are unsure where to start, consider using resources such as USLegalForms to assist you in navigating the public records system.

Yes, garnishments are generally considered public information, which means they can be accessed by the public. This includes details about the creditor, the amount garnished, and your information. Being aware of this fact helps you understand how garnishments can affect your financial record and reputation.

When filling out a challenge to garnishment form, begin by checking your local court's requirements. Include your personal details, the specifics of the garnishment, and a clear statement of the reasons for your challenge. Providing evidence to support your position is crucial. Using platforms like USLegalForms can simplify this process and ensure that you include all necessary information.

The formula for garnishment typically hinges on your disposable income, which is your net earnings after mandatory deductions. Generally, the maximum amount that can be garnished from each paycheck is 25% of your disposable earnings or the amount that exceeds 30 times the federal minimum wage, whichever is lower. Understanding this formula can help you determine how much of your wages may ultimately be garnished.

To fill out a wage garnishment exemption, start by downloading the appropriate form for your state. Review the requirements for exemptions to see if you qualify. Clearly indicate your income details and provide any necessary documentation that supports your claim. If you need assistance, services like USLegalForms can guide you through the process and ensure your form is completed accurately.