Final Estate Withdrawals

Description

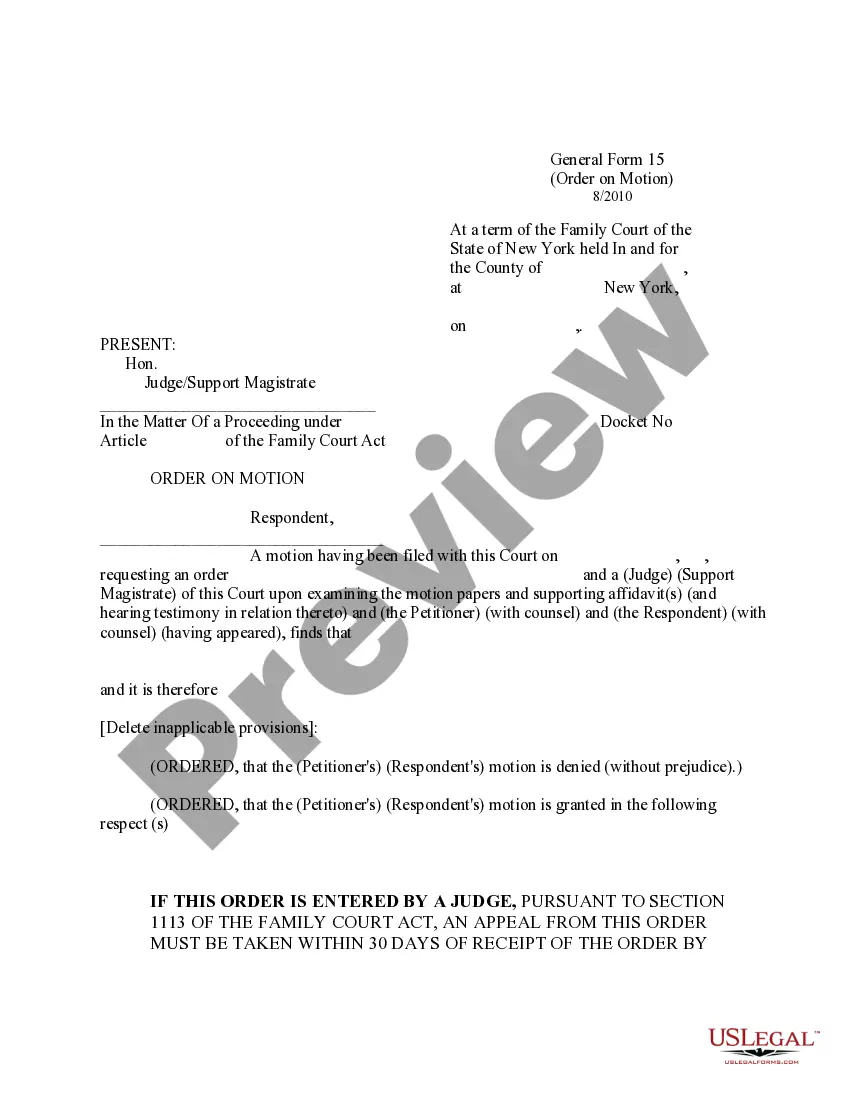

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

Creating legal documents from the ground up can frequently be somewhat daunting.

Certain situations might require extensive research and considerable financial investment.

If you’re searching for a simpler and more cost-effective method of producing Final Estate Withdrawals or other forms without unnecessary complications, US Legal Forms is always accessible.

Our digital collection of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal matters.

However, before proceeding to download Final Estate Withdrawals, consider these suggestions: Review the document preview and descriptions to ensure you have located the form you need. Verify whether the form you choose aligns with your state and county's regulations and laws. Select the appropriate subscription option to access the Final Estate Withdrawals. Download the file, then complete, certify, and print it. US Legal Forms holds a solid reputation with over 25 years of experience. Join us today and make document execution a simple and efficient process!

- With just a few clicks, you can swiftly obtain state- and county-specific forms carefully prepared for you by our legal experts.

- Utilize our website whenever you need dependable and trustworthy services to quickly locate and download the Final Estate Withdrawals.

- If you’re familiar with our services and previously created an account, simply Log In to your account, find the form and download it or re-download it anytime from the My documents section.

- Don't have an account? No worries. Registering takes hardly any time, allowing you to explore the library.

Form popularity

FAQ

(a) Motion for new trial, if filed, shall be filed prior to or within thirty days after the judgment or other order complained of is signed.

A response and brief to an opposed motion must be filed within 21 days from the date the motion is filed. Time for Reply Briefs. Unless otherwise directed by the presiding judge, a party who has filed an opposed motion may file a reply brief within 14 days from the date the response is filed.

FINDING TEXAS LEGISLATION The text of every bill filed since 1991 is available through the Texas Legislature Online Website, .capitol.state.tx.us.

3 Time for Motion and Ruling. A motion to dismiss must be: (a) filed within 60 days after the first pleading containing the challenged cause of action is served on the movant; (b) filed at least 21 days before the motion is heard; and (c) granted or denied within 45 days after the motion is filed.

Motions and requests are how you formally ask a judge to take an action during a case. Composed by TexasLawHelp.org ? Last Updated on December 23, 2022. Sometimes, parties need to ask the court for things before or during the trial.

Unless made orally during a hearing or trial, motions should be in writing, should state the action sought, and should set forth the facts. Motions are the primary way for litigants to ask the Court to take action in a case. They must be filed with the Clerk, and copies must be mailed to all opposing parties (L.R.