Account Executor Estate With No Assets

Description

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

Whether for commercial reasons or for personal affairs, everyone must manage legal issues at some point in their lives.

Filling out legal documents entails thorough attention, beginning with choosing the appropriate form template.

Having a comprehensive US Legal Forms library at your disposal allows you to avoid wasting time searching for the right template online. Utilize the library’s user-friendly navigation to discover the appropriate form for any situation.

- Locate the template you require using the search bar or catalog navigation.

- Review the form’s description to verify it fits your circumstances, state, and locality.

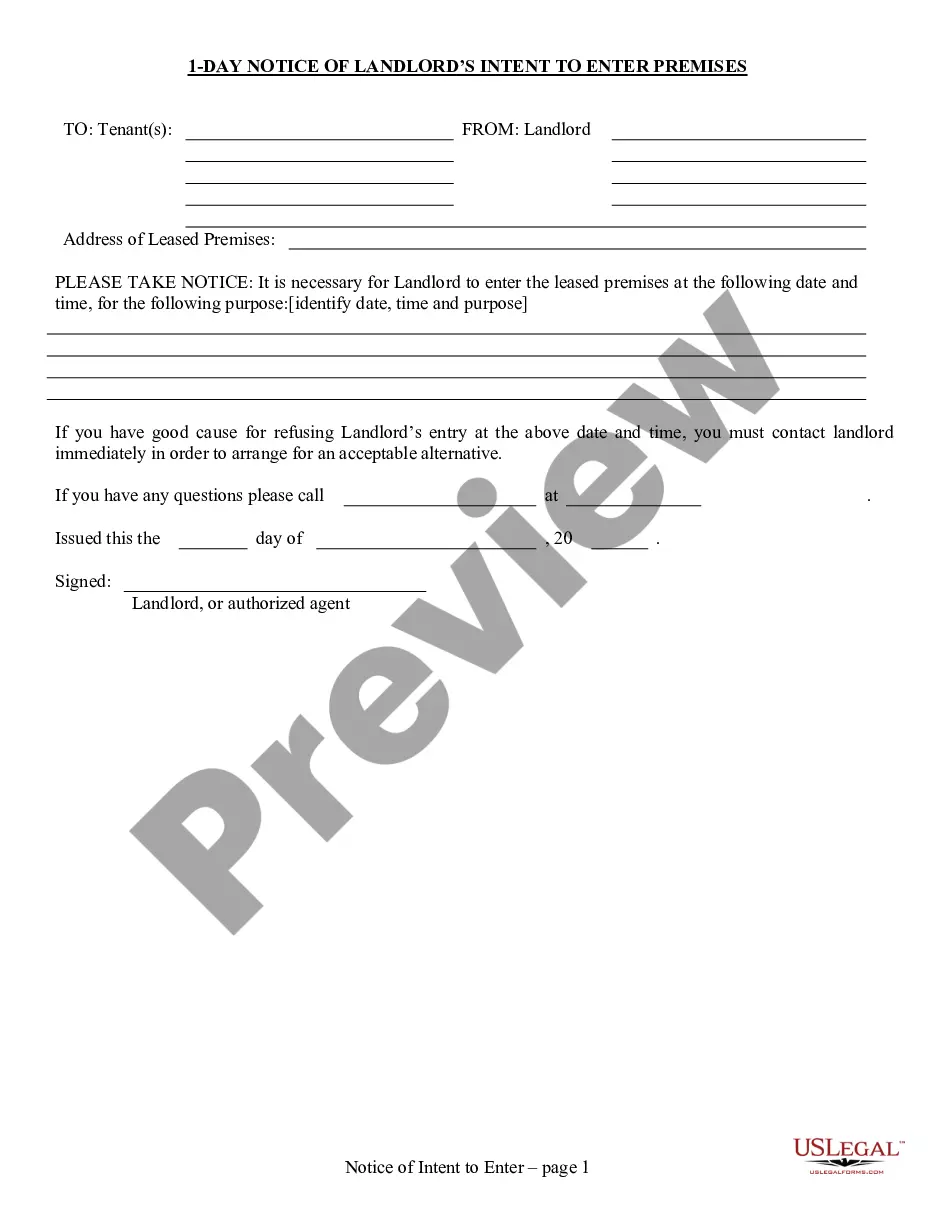

- Click on the form’s preview to view it.

- If it is not the correct form, return to the search function to find the Account Executor Estate With No Assets template you seek.

- Obtain the template if it aligns with your needs.

- If you have a US Legal Forms account already, simply click Log in to access previously saved documents in My documents.

- If you do not possess an account yet, you can download the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the account registration form.

- Choose your payment method: you may use a credit card or PayPal account.

- Select the document format you prefer and download the Account Executor Estate With No Assets.

- After downloading, you can complete the form using editing software or print it and finish it manually.

Form popularity

FAQ

If an executor fails to follow the will, they may face legal action from beneficiaries seeking to enforce the directives outlined in the will. This can lead to complications and potentially delay the distribution of the estate. Using resources such as USLegalForms can help ensure that all obligations are met and reduce the chances of mismanagement.

An executor can hold funds until all debts and taxes are settled. This period can vary, especially if the estate is complex, but they should generally distribute assets promptly once financial obligations are cleared. Remember, if you have an account executor estate with no assets, the timeline might be shorter due to fewer complications in managing the estate.

If no one is named as an executor in the will, the probate court will assign a suitable person to fill the role. This might be a family member, friend, or an attorney, focusing on the duties necessary for the account executor estate with no assets. Engaging with a legal platform like uslegalforms can help you establish clear lines of management for such situations.

Kentucky House Bill 528 (abbreviated H.B. 528) is a 2018 family law that created a rebuttable presumption that both parents' equal shared parenting time and equal parental decision-making are in the child's best interest.

FAMILY FAMILYAdoption$198.00Divorce/Annulment/Custody and Medical Support (in Circuit Division)$198.00Paternity (no filing fee if filed by Division of Child Support)$75.50

How to File for Custody in Kentucky Agree on a Parenting Plan. It is highly recommended that parents try to reach an agreement on the terms of custody prior to filing. ... Calculate Child Support. ... Complete Required Forms. ... File Forms with Local County Clerk. ... Notarize and Serve Summons on Second Parent.

A truly unfit parent is a danger to their children. They are abusive and neglectful. They may have substance abuse problems. Removing their parental rights is in the child's best interests.

For parents who want to file for child custody but who cannot afford a lawyer, filing pro se is a viable alternative.... File a Petition for Custody Proof of paternity or legal parentage7. Child's birth certificate. Any existing orders related to the child.