Pre Foreclosure Notice Without

Description

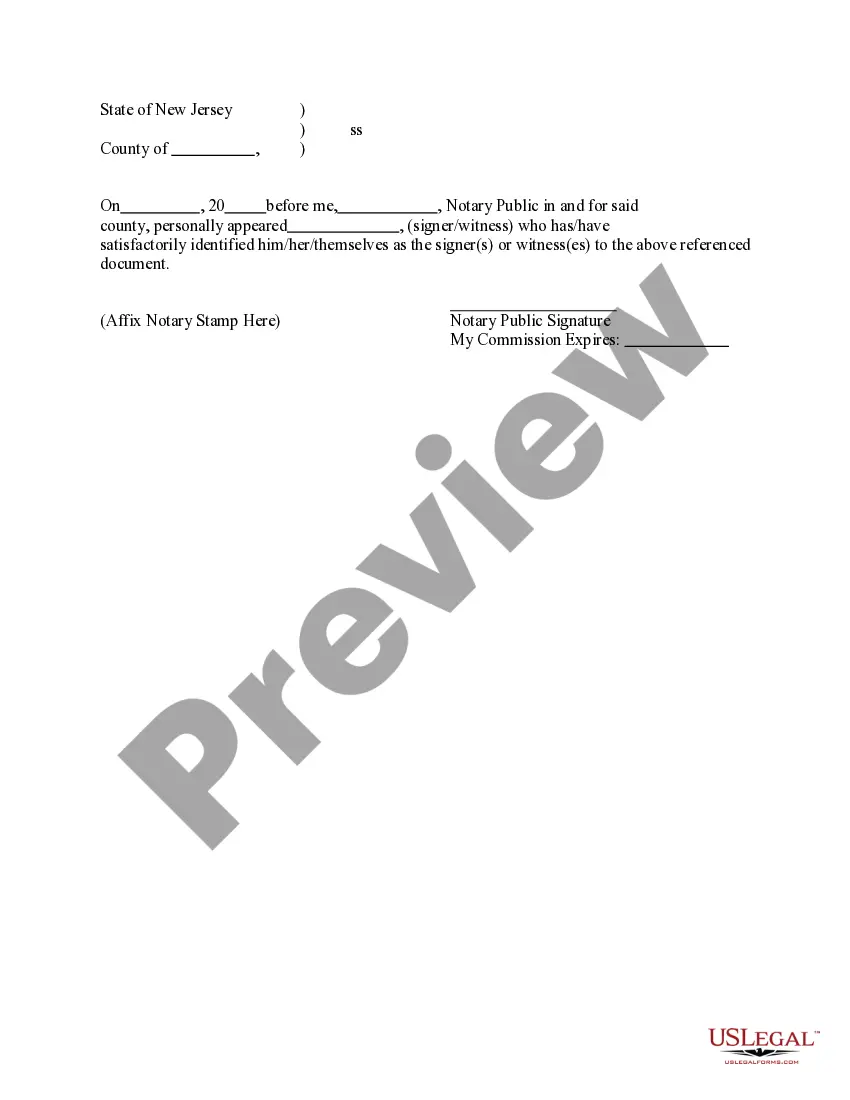

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

The Pre Foreclosure Notification Without you view on this page is a reusable formal template formulated by expert lawyers in accordance with federal and state statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal professionals with over 85,000 confirmed, state-specific documents for any business and personal event. It’s the fastest, easiest, and most reliable method to obtain the documents you require, as the service assures the utmost level of data protection and anti-malware security.

Register for US Legal Forms to have verified legal templates for every life's situation readily available.

- Search for the document you require and verify it.

- Select the pricing plan that works for you and create an account.

- Opt for the format you desire for your Pre Foreclosure Notification Without (PDF, Word, RTF) and save the template to your device.

- Complete and sign the document.

- Utilize the same document again whenever necessary.

Form popularity

FAQ

A house generally remains in pre-foreclosure for approximately three months. However, the timeline can differ significantly based on location and individual circumstances. During this period, homeowners receive a pre foreclosure notice without immediate pressure to vacate. Understanding this timeframe allows potential buyers to gauge their options effectively.

To obtain pre-foreclosure listings, you can utilize online platforms that specialize in real estate, including uslegalforms. These resources often provide access to current pre foreclosure notice without requiring extensive searches. Local public records and county courthouses also provide valuable information. Engaging real estate professionals can further enhance your search for the right opportunities.

Buying a pre-foreclosure home can be an excellent investment opportunity if approached carefully. Investors often find homes at discounted prices, and they can negotiate directly with the homeowner before the property enters foreclosure. However, buyers must perform thorough due diligence. Understanding the risks can lead to successful transactions and solid returns.

You can identify a house in pre-foreclosure by checking public records, which often list properties facing foreclosure actions. Listings may also display a pre foreclosure notice without indicating if the house has already entered the foreclosure phase. Furthermore, real estate websites sometimes feature pre-foreclosure listings. Staying informed is crucial to spotting these opportunities quickly.

A house typically stays in pre-foreclosure for about 90 days, but this period can vary based on local laws and the homeowner's situation. During this time, the homeowner receives a pre foreclosure notice without immediate legal action. It presents an opportunity for distressed homeowners to settle debts or work on a remedy. If unresolved, the property could move to foreclosure, leading to potential loss.

A house can remain in preforeclosure for varying lengths of time, generally lasting several months up to a year. It largely depends on the lender's policies and the specifics outlined in the pre foreclosure notice without formal legal action. Homeowners should actively seek resolutions during this period by consulting legal aid or financial advisors to understand their options. The sooner you act, the better your chances of protecting your property.

If your house is in pre-foreclosure, you have options to avoid losing your property. You may receive a pre foreclosure notice without being in immediate danger of foreclosure. At this stage, you can consider selling the property or negotiating with your lender for better payment terms. Taking action early can often lead to favorable outcomes, preventing further escalation of the situation.

Preforeclosure is the stage where a homeowner is behind on payments but has not yet lost the property legally. In contrast, foreclosure occurs when a lender takes legal action to reclaim the property after failing to receive payments for a certain period. A pre foreclosure notice without formal foreclosure offers more options for the homeowner to remedy the situation. Being aware of this distinction can assist you in taking action sooner.

The duration of preforeclosure can vary, typically lasting from a few months to over a year, depending on state laws and lender policies. During this time, homeowners can explore several options to resolve their debt. Staying in preforeclosure too long can increase the risk of home loss, so it's vital to act quickly. A pre foreclosure notice without timely intervention may lead to serious consequences.

You can identify a home in pre-foreclosure through various public records. Look for notices of default or similar announcements that lenders file when a homeowner misses payments. Additionally, online platforms and local real estate listings can provide insights about properties that are in pre-foreclosure. A pre foreclosure notice without awareness can lead to missed opportunities, so stay informed.