Irrevocable Living Trusts With A Will

Description

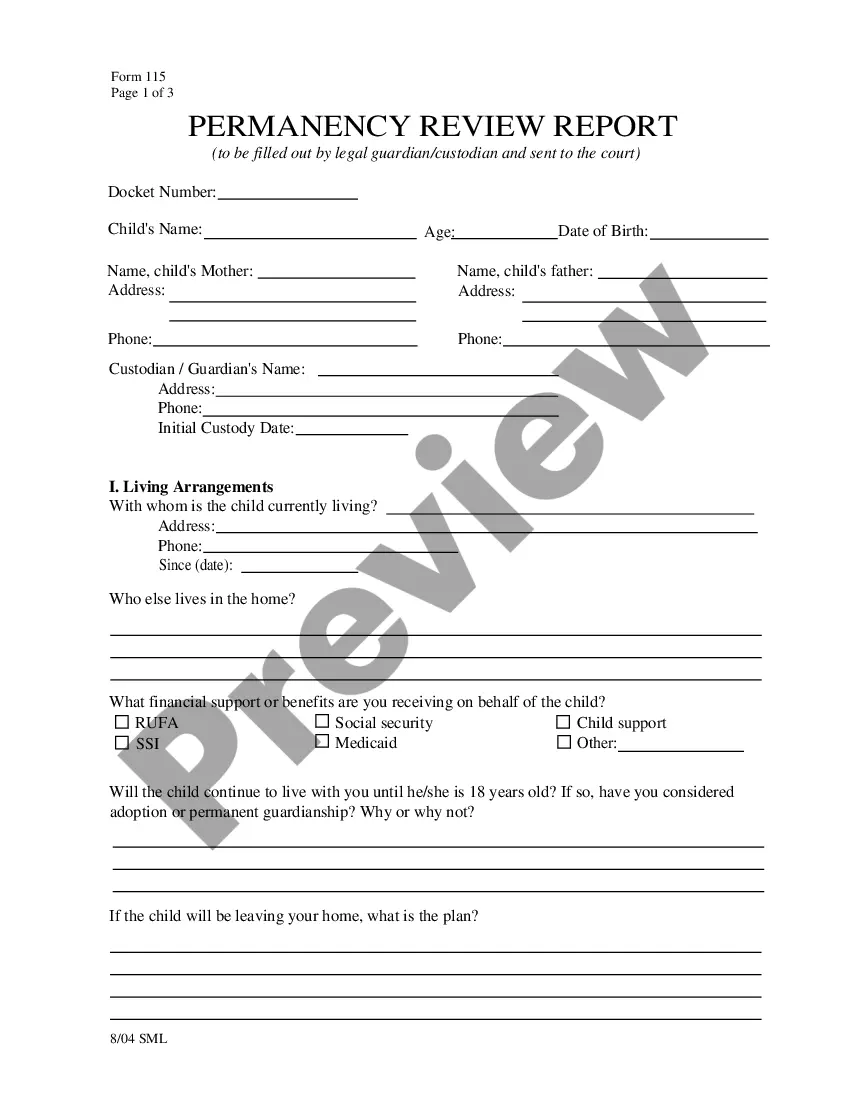

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren With Spendthrift Trust Provisions?

- If you're a returning user, log in to your account and download the required form templates to your device by clicking the Download button. Ensure your subscription is current; if not, please renew it as per your chosen payment plan.

- For new users, start by checking the Preview mode and form description to confirm you've selected the appropriate document that aligns with your needs and local requirements.

- Use the Search tab to find any alternate templates if the initial choice does not meet your requirements. Once the correct template is found, proceed to the next step.

- To purchase the document, click the Buy Now button and select your preferred subscription plan. Create an account to access the extensive library of resources.

- Complete your purchase by entering your credit card details or using your PayPal account to finalize the subscription.

- Download your form once the purchase is complete. Save the template on your device to complete it later and access it anytime from the My Forms section of your profile.

US Legal Forms not only offers a robust collection of over 85,000 legal forms but also ensures users can access premium experts for assistance. This guarantees that your documents are accurate and legally sound, providing peace of mind during the estate planning process.

In conclusion, using US Legal Forms simplifies the acquisition of irrevocable living trusts with a will. Enhance your legal planning today by visiting US Legal Forms to streamline your document preparation!

Form popularity

FAQ

Creating your own irrevocable living trust is possible, but legal guidance is often beneficial. While you can find templates online, using a platform like US Legal Forms can simplify the process and ensure all necessary legal requirements are met. An attorney can also help tailor the trust to your specific needs, ensuring that your assets are distributed according to your wishes. Ultimately, taking the right steps now helps secure your legacy for the future.

People choose irrevocable living trusts with a will primarily for asset protection and tax benefits. Once assets are transferred into these trusts, they generally cannot be removed without the consent of the beneficiaries. This arrangement ensures that your assets are safeguarded from creditors and legal judgments. Additionally, irrevocable trusts can help reduce estate taxes, allowing you to preserve more wealth for your heirs.

You should consider setting up irrevocable living trusts with a will if you want to protect your assets from creditors, assist in Medicaid planning, or reduce estate taxes. These trusts can provide significant benefits when structured correctly, allowing you to achieve specific financial goals without sacrificing your legacy. Using a platform like uslegalforms can help you navigate this complex process with ease.

One significant downside of irrevocable living trusts with a will is the potential for a loss of asset control. Once you place your assets in the trust, you cannot easily remove them or make changes without legal assistance. This can create challenges if your financial situation evolves or if you have unexpected needs in the future.

Irrevocable living trusts with a will can limit your control over assets once you transfer them into the trust. Additionally, any changes to the trust require a complex legal procedure, which can be time-consuming and costly. This means you may feel locked into decisions you made earlier without the flexibility to adapt to new circumstances.

Recent changes in tax laws may impact irrevocable trusts, particularly regarding how they are taxed and the treatment of trust income. Staying informed about these updates is crucial for effective trust management. If you are unsure how these changes affect irrevocable living trusts with a will, consider consulting with a professional for personalized guidance.

One common mistake parents make is failing to communicate their intentions clearly to their heirs. Transparency about the trust's purpose and how it operates can prevent misunderstandings and conflicts later. When establishing irrevocable living trusts with a will, make sure to discuss your plans with your family, ensuring everyone understands the benefits and responsibilities.

You usually do not need to file an irrevocable trust with any government agency. However, if you want to provide a copy to financial institutions or for tax purposes, keep a well-organized file. If court oversight becomes necessary, seek advice on how to navigate that process. For more information, consider exploring the resources at US Legal Forms.

A will does not typically override an irrevocable trust. When you establish irrevocable living trusts with a will, the trust's provisions take precedence over any conflicting terms in the will. It's essential to ensure that both documents align to avoid complications and provide clarity for your beneficiaries.

In general, an irrevocable trust does not need to be filed with the court. However, certain circumstances, such as disputes or tax matters, may require court involvement. It's wise to consult a legal professional for guidance tailored to your situation, especially when dealing with irrevocable living trusts with a will.