Judge Form Document Format

Description

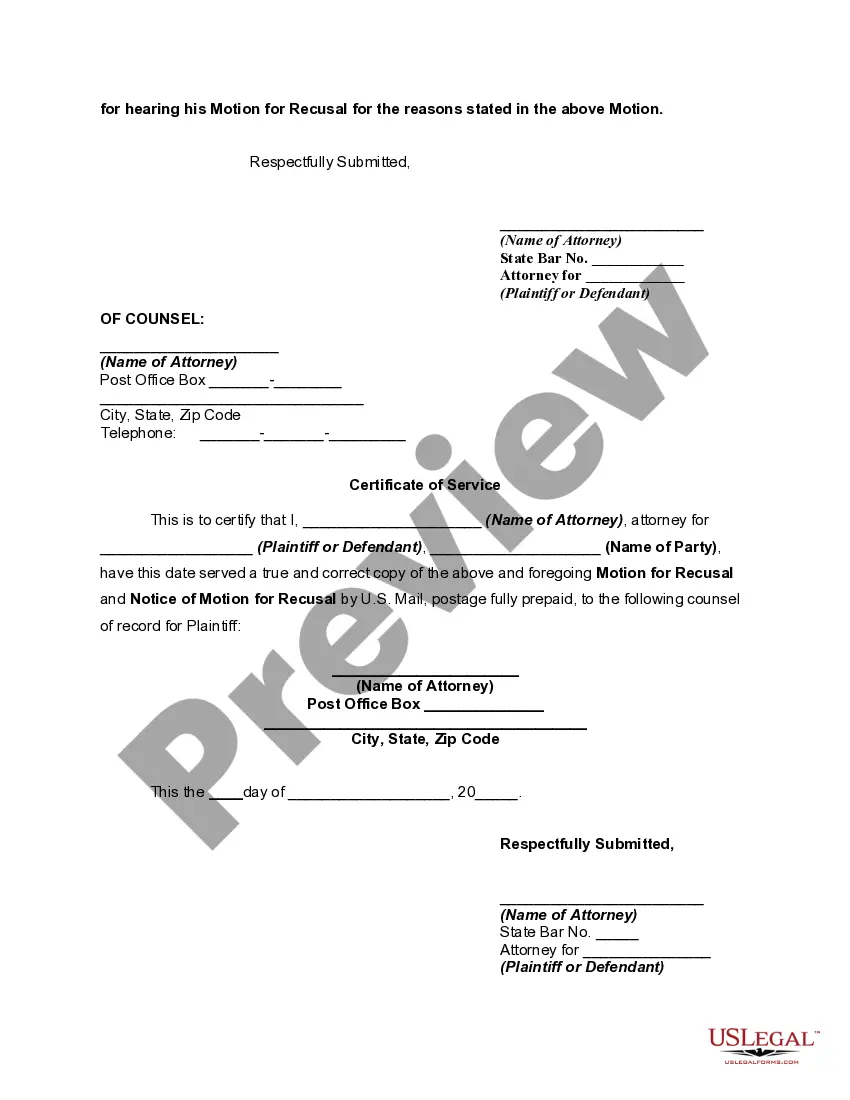

How to fill out Motion For Recusal Of Judge - Removal?

Obtaining legal document examples that adhere to national and local laws is essential, and the internet provides various options to choose from.

However, what's the purpose of spending time searching for the appropriate Judge Form Document Format example online when the US Legal Forms online library already compiles such templates in one location.

US Legal Forms is the largest internet legal repository with over 85,000 editable templates created by attorneys for various professional and personal situations. They are easy to navigate, as all documents are organized by state and intended use. Our specialists keep pace with legal updates, ensuring that your paperwork is always current and compliant when you obtain a Judge Form Document Format from our site.

Click Buy Now once you’ve located the suitable form and choose a subscription plan. Create an account or sign in and process payment via PayPal or a credit card. Choose the ideal format for your Judge Form Document Format and download it. All templates you find through US Legal Forms are reusable. To re-download and complete previously saved forms, access the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal document service!

- Acquiring a Judge Form Document Format is quick and straightforward for both existing and new users.

- If you already have an account with an active subscription, Log In and retrieve the document example you require in the appropriate format.

- If you are new to our platform, follow the steps outlined below.

- Review the template using the Preview function or through the text description to ensure it meets your requirements.

- Search for another example using the search option at the top of the page if necessary.

Form popularity

FAQ

A3: Form RP-5217-PDF is required whenever a deed is recorded with the county clerk's office. Form-RP-5217-PDF is required even if a property is not being sold and only the names are changing on the deed.

Schedule F To determine the consideration for the conveyance, multiply the fair market value of the real property at the time of conveyance by the percentage of interest not subject to the mere change exemption. Generally, the fair market value of the real property is to be determined by appraisal.

TP-584-I (Instructions) Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the Payment of Estimated Personal Income Tax; See notice about address change. See information about the STAR credit.

You can search for property records and property ownership information online, in person, or over the phone with a 311 representative. Property owners of all boroughs except Staten Island can visit ACRIS. To search documents for Staten Island property, visit the Richmond County Clerk's website.

(a) The following shall be exempt from payment of the real estate transfer tax: 1. The state of New York, or any of its agencies, instrumentalities, political subdivisions, or public corporations (including a public corporation created pursuant to agreement or compact with another state or the Dominion of Canada).

The capital gains tax rate for real estate sales in New York is between 15% and 20%.

This web page provides information about using the City Register Office. Please contact the Richmond County Clerk for properties on Staten Island. Property records are public. People may use these records to get background information on purchases, mortgages, asset searches and other legal and financial transactions.

Form TP-584 must be filed for each conveyance of real property from a grantor/transferor to a grantee/transferee. It may not be necessary to complete all the schedules on Form TP-584. The nature and condition of the conveyance will determine which of the schedules you must complete.