Change In Venue Or Change Of Venue

Description

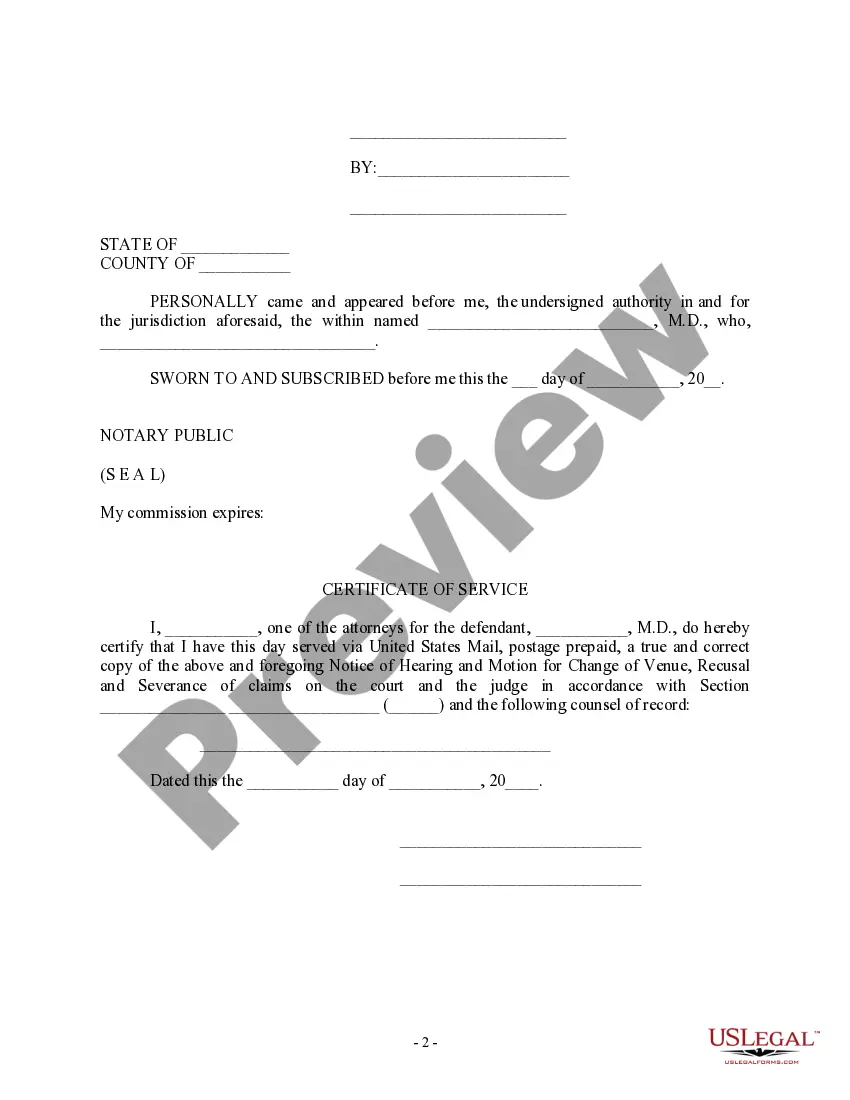

How to fill out Motion For Recusal And Change Of Venue Due To Co-Defendant's Prior Criminal Convictions?

Utilizing legal documents that comply with federal and local laws is essential, and the internet provides countless choices to select from.

However, what's the purpose of spending time searching for the proper Change In Venue Or Change Of Venue example online if the US Legal Forms digital library already has such documents assembled in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 editable documents created by attorneys for any business or personal situation.

Review the template using the Preview feature or through the text description to ensure it fulfills your requirements.

- They are straightforward to navigate, with all files categorized by state and intended use.

- Our experts stay informed about legal changes, so you can always trust that your form is current and compliant when you obtain a Change In Venue Or Change Of Venue from our platform.

- Acquiring a Change In Venue Or Change Of Venue is simple and fast for both existing and new users.

- If you have an account with a valid subscription, Log In and download the sample document you require in the correct format.

- If you are visiting our site for the first time, follow the instructions below.

Form popularity

FAQ

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...

An Oregon single-member LLC operating agreement is a legal document that is specifically designed for use by a sole owner or member. The document will guide the owner through the process of forming the policies and procedures of their company.

How much does an LLC in Oregon cost per year? All Oregon LLCs need to pay $100 per year for the Oregon Annual Report fee. These state fees are paid to the Secretary of State. And this is the only state-required annual fee.

Oregon doesn't require your LLC to have an operating agreement. However, having an operating agreement allows you to open a business bank account, override default laws, and better protect your limited liability.

To start an LLC in Oregon, you'll need to choose an Oregon registered agent, file business formation paperwork with the Oregon Secretary of State's Corporations Division, and pay a $100 state filing fee.

You'll need to choose a name to include in your articles before you can register your LLC. Names must comply with Oregon's naming requirements. The following are the most important requirements to keep in mind: Your business name must include the words Limited Liability Company, LLC, or L.L.C.

Starting an LLC costs $100 in Oregon. This is the state filing fee for a document called the Oregon Articles of Organization. The Articles of Organization are filed with the Oregon Secretary of State. And once approved, this is what creates your LLC.