Trust Dtvm

Description

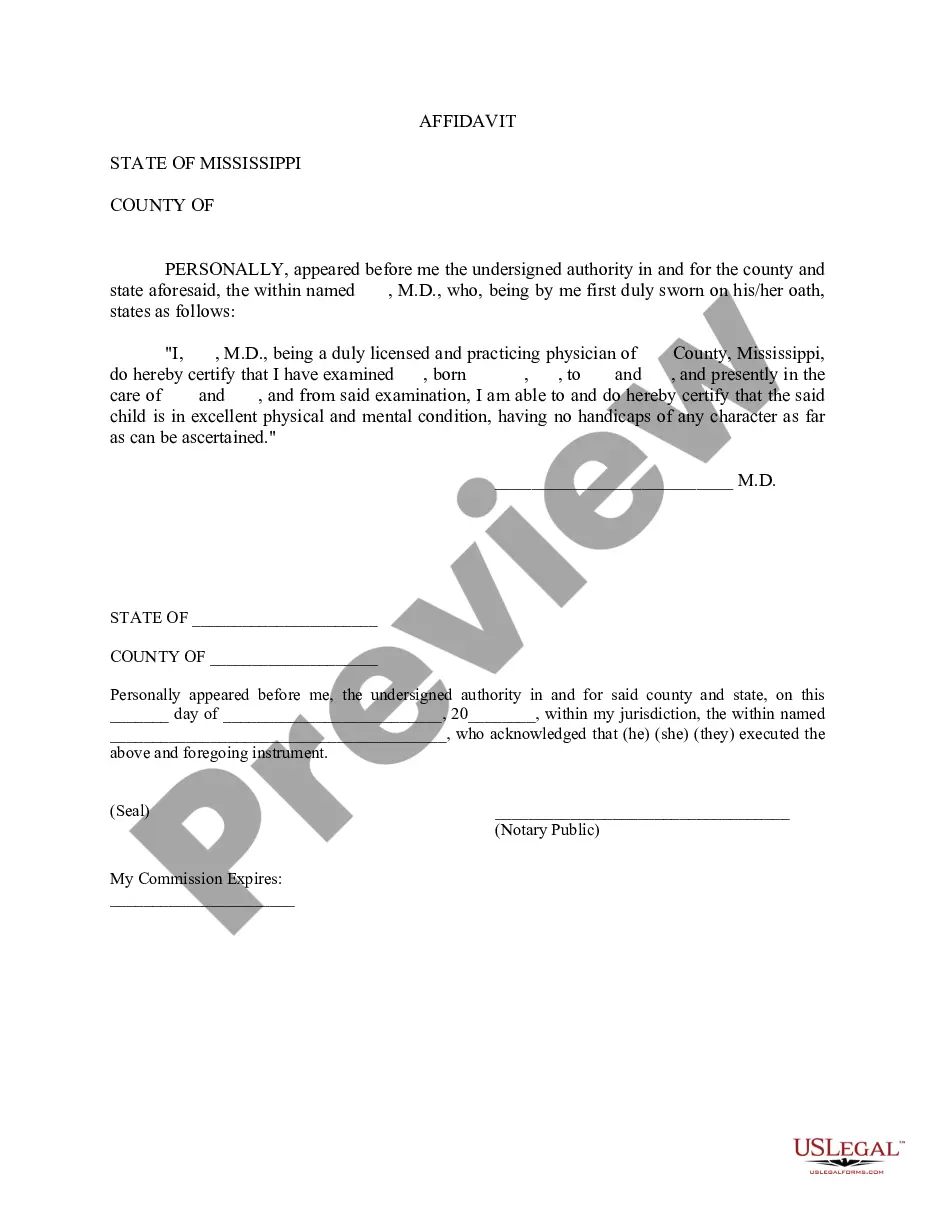

How to fill out Qualified Income Miller Trust?

- Log in to your existing US Legal Forms account or create a new one if you're a first-time user.

- Inspect the Preview mode and the description of the form. Ensure it aligns with your needs and complies with your local jurisdiction.

- If you need a different template, utilize the Search tab to locate the correct form that suits your requirements.

- Select the form and click on the 'Buy Now' button. Choose your desired subscription plan to gain access to the entire library.

- Complete your purchase by entering your payment details, either through a credit card or PayPal.

- Download the chosen form to your device, and access it anytime through the 'My Forms' section of your profile.

By utilizing US Legal Forms, you can quickly create legally sound documents with the guidance of premium experts who ensure accuracy.

Experience a hassle-free legal form process today! Start your journey with US Legal Forms by visiting their website.

Form popularity

FAQ

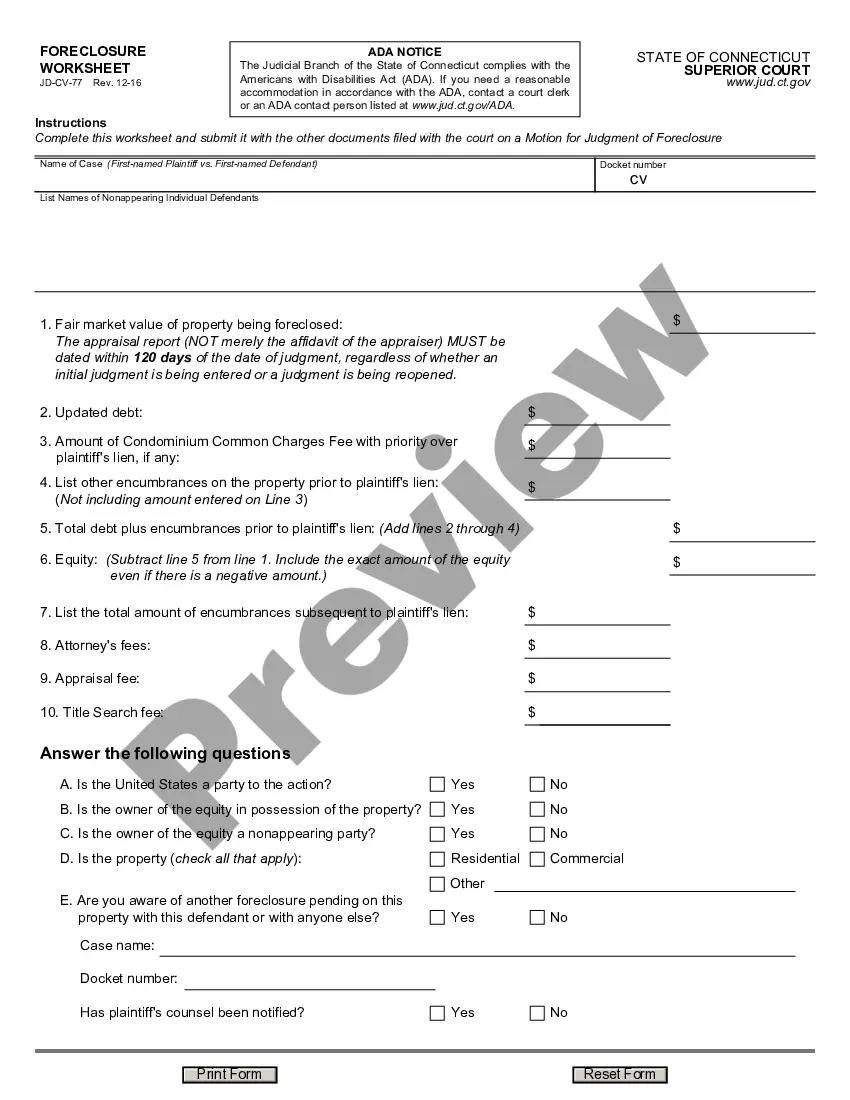

Generally, you will need Form 1041 to file a trust with the IRS. However, if the trust generates income, you may also require additional forms depending on the trust's structure. For detailed instructions and forms tailored to 'Trust dtvm', consider accessing the US Legal Forms platform, where you can find everything you need to file your trust correctly.

To file a trust fund, you need to prepare and submit the correct forms to the IRS, starting with Form 1041 if the trust is required to file an income tax return. Make sure to gather all necessary financial information about the trust. Utilizing the resources on the US Legal Forms platform can help you navigate the filing process seamlessly, especially concerning 'Trust dtvm'.

Reporting a trust involves completing the appropriate tax forms, such as Form 1041 for income tax purposes. You must determine if the trust is revocable or irrevocable, as this can affect how you report income and distributions. Using resources from US Legal Forms can provide clarity on these reporting requirements and help you file accurately regarding 'Trust dtvm'.

Yes, you can set up a trust fund by yourself, but understanding the requirements and paperwork involved is crucial. The US Legal Forms platform can simplify this process by providing step-by-step guidance and templates to assist you in creating your trust. While it's possible to do it independently, consulting an attorney might help ensure your trust complies with legal standards, especially regarding 'Trust dtvm'.

To mail your trust estimated tax payments, you should send your payment to the address specified by the IRS for your specific state. Ensure that you include the correct form and your trust's identifying information. If you have any doubts, consider using the US Legal Forms platform to find accurate mailing addresses and resources related to 'Trust dtvm'. This way, you can avoid any mistakes in your tax filing process.

Building your partner's trust begins with honest and ongoing communication. Show consistency in your words and actions, which demonstrates your reliability. Trust dtvm can assist you by offering practical steps to nurture and develop a stronger sense of trust within your relationship.

To gain more trust, prioritize open, honest interactions in your daily communications. Being consistent in your actions builds reliability over time, strengthening the bond. Resources like Trust dtvm provide insights and techniques to enhance relationship trust effectively.

If your partner struggles with trust, begin by addressing their concerns directly. Listening actively validates their feelings and can encourage open dialogue. Employing tools like Trust dtvm may offer strategies for enhancing trust and reaffirming your commitment to the relationship.

Fixing broken trust requires sincere effort and time. Start by acknowledging the breach and expressing remorse for your actions. Utilizing resources such as Trust dtvm can guide you through rebuilding trust effectively, allowing both partners to feel safe and valued again.

Gaining your partner's trust involves consistent communication and transparency. Begin by sharing your thoughts and feelings openly, which builds a foundation of honesty. Trust dtvm can help you understand the importance of reliability, as showing dependability reinforces your partner's confidence in you.