This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Foreclosure Worksheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Foreclosure Worksheet?

The greater the number of documents you need to prepare, the more stressed you become.

There are numerous Connecticut Foreclosure Worksheet templates available online, but you may be unsure which ones to trust.

Eliminate the difficulty and simplify obtaining samples by utilizing US Legal Forms. Obtain professionally prepared documents that are designed to comply with state standards.

Enter the necessary information to set up your account and complete the payment using your PayPal or credit card. Choose a convenient file format and obtain your sample. Access each template you acquire in the My documents section. Just navigate there to fill out a new version of the Connecticut Foreclosure Worksheet. Even when preparing well-structured templates, it remains important to consider consulting your local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- If you already hold a US Legal Forms membership, Log In to your account, and you will find the Download button on the Connecticut Foreclosure Worksheet’s page.

- If you haven’t used our platform before, complete the registration process with the following steps.

- Ensure that the Connecticut Foreclosure Worksheet is acceptable in your residing state.

- Verify your selection by reviewing the description or utilizing the Preview mode if available for the chosen document.

- Click on Buy Now to initiate the registration process and choose a pricing plan that fits your requirements.

Form popularity

FAQ

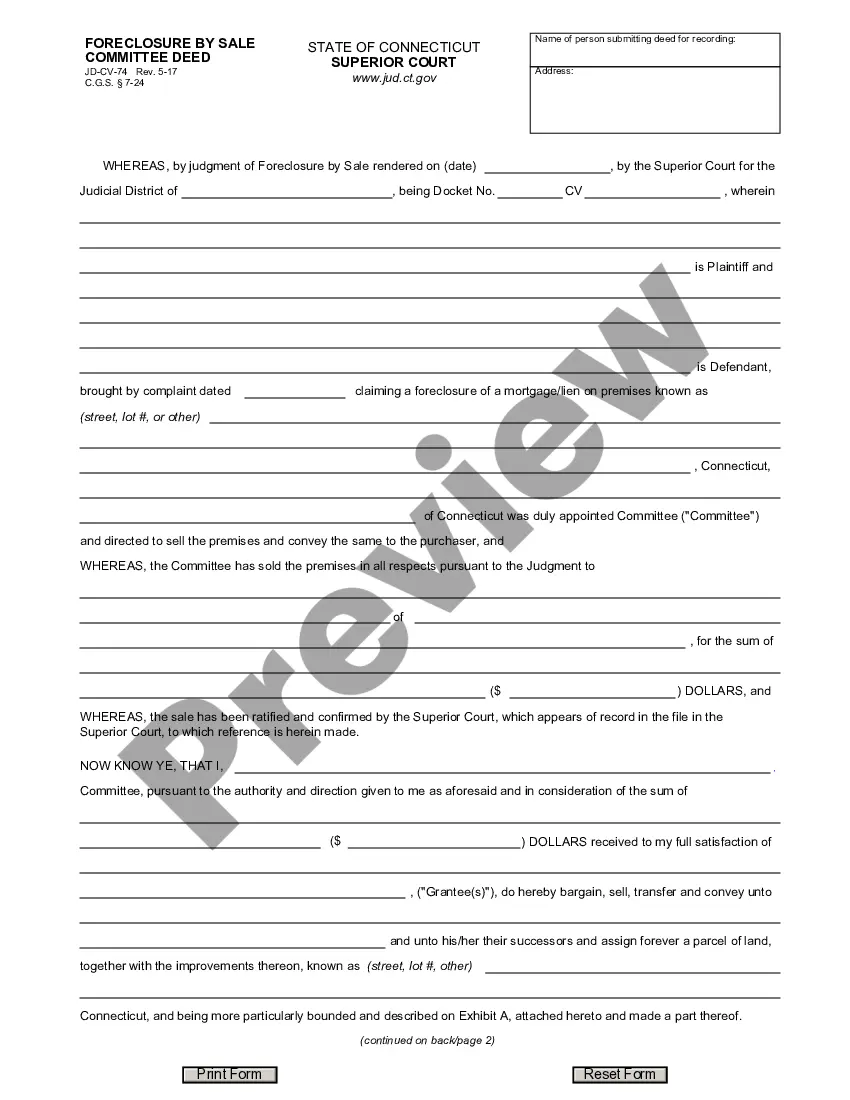

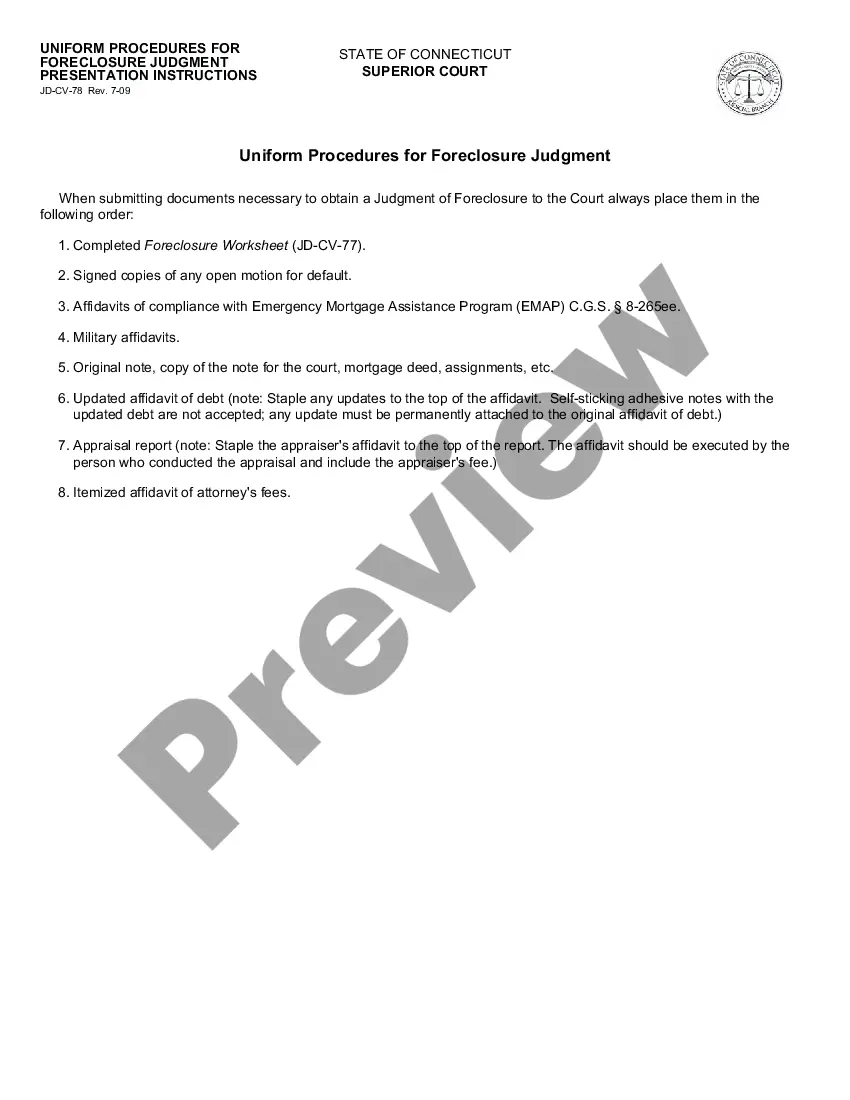

The foreclosure process in Connecticut begins when a lender files a complaint in court after a homeowner defaults on the mortgage. Once the court validates the complaint, a judgment is issued, and the property may be auctioned. Understanding this process is crucial, and the Connecticut Foreclosure Worksheet serves as an essential resource, guiding you through each phase and advocating for your rights.

Generally, homeowners in Connecticut can miss about three to four mortgage payments before the foreclosure process begins. However, it is essential to communicate with your lender and seek guidance immediately if you anticipate difficulty making payments. The Connecticut Foreclosure Worksheet provides valuable information to help you navigate these challenges effectively.

The timeline for foreclosing on a house in Connecticut can vary, but it usually takes several months to over a year. Factors influencing the duration include the court's schedule and whether the borrower contests the foreclosure. Utilizing the Connecticut Foreclosure Worksheet offers insights into the timeline and steps you might encounter, helping you to prepare for what lies ahead.

In Connecticut, you typically can fall behind on mortgage payments for several months before facing foreclosure. Lenders often start the foreclosure process after a homeowner misses three consecutive payments. It's crucial to address payment issues early on using tools like the Connecticut Foreclosure Worksheet to explore your options and avoid reaching this point.

A judgment of foreclosure by sale in Connecticut allows a lender to sell a property to recover the unpaid mortgage balance. This process comes after the lender files a foreclosure action and obtains a court judgment. The Connecticut Foreclosure Worksheet can help property owners understand their rights and obligations during this process, ensuring they are informed about each step involved.

In Connecticut, the redemption period lasts for six months after the foreclosure sale. During this time, you can reclaim your property by paying the full amount owed. Completing a Connecticut Foreclosure Worksheet can provide valuable insight into your outstanding debts and help you make informed decisions within this redemption window.

After foreclosure in Connecticut, the homeowner typically has a short period to vacate the property, generally 5 to 7 days following the court's judgment. Once the court grants the lender possession, they may initiate an eviction process if necessary. Being informed with the Connecticut Foreclosure Worksheet can help you understand your timeline and plan your next steps.

In Connecticut, redemption allows property owners to reclaim their homes after foreclosure by paying the total debt owed, including costs and fees. The process provides homeowners with a chance to recover their property before it is sold at auction. Using the Connecticut Foreclosure Worksheet can help you understand your financial obligations, making it easier to navigate this critical period.

You can find pre-foreclosure information through public records, online listings, or even local real estate agents. Many platforms provide detailed data about properties before they go to foreclosure. By using a Connecticut Foreclosure Worksheet, you can effectively organize this information, helping you identify potential opportunities.

In Connecticut, a lender usually initiates foreclosure proceedings after the homeowner misses three consecutive mortgage payments. However, this can vary based on the lender's policies. To avoid foreclosure, it's essential to act quickly, and a Connecticut Foreclosure Worksheet can guide you through your options and help you take proactive steps.