A Miller Trust With The Irs

Description

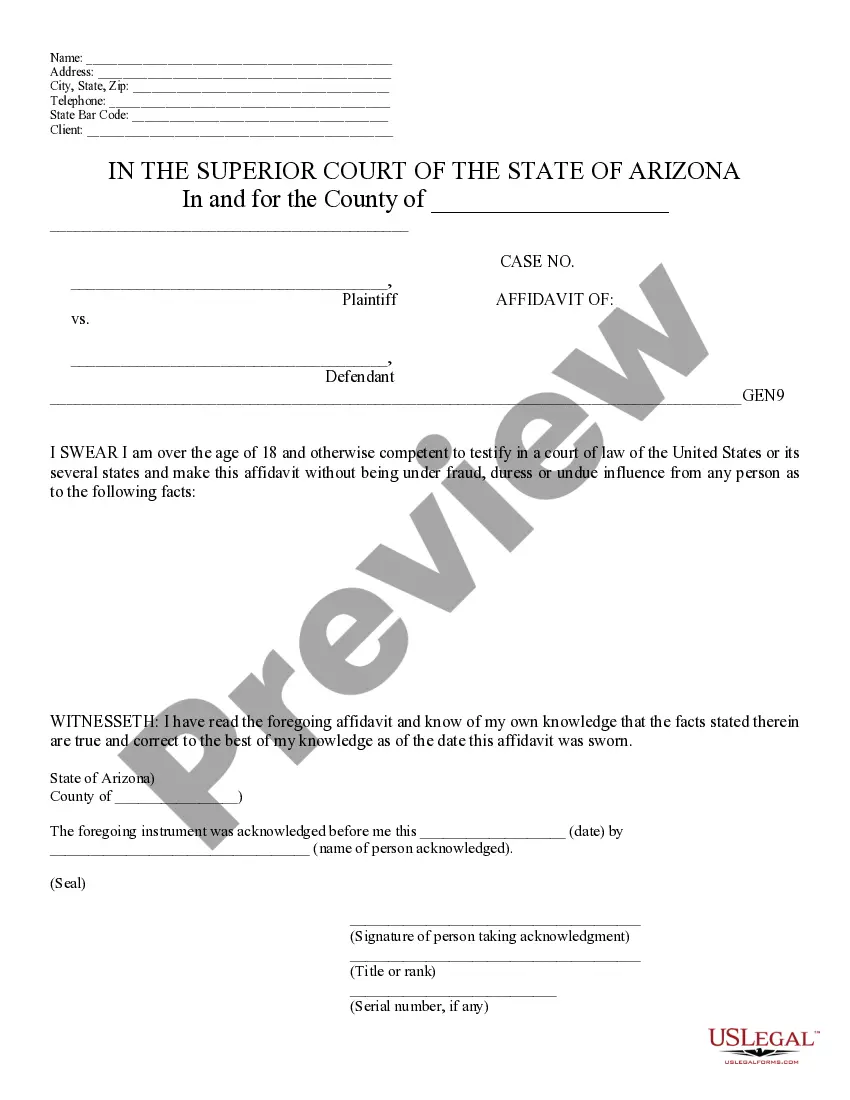

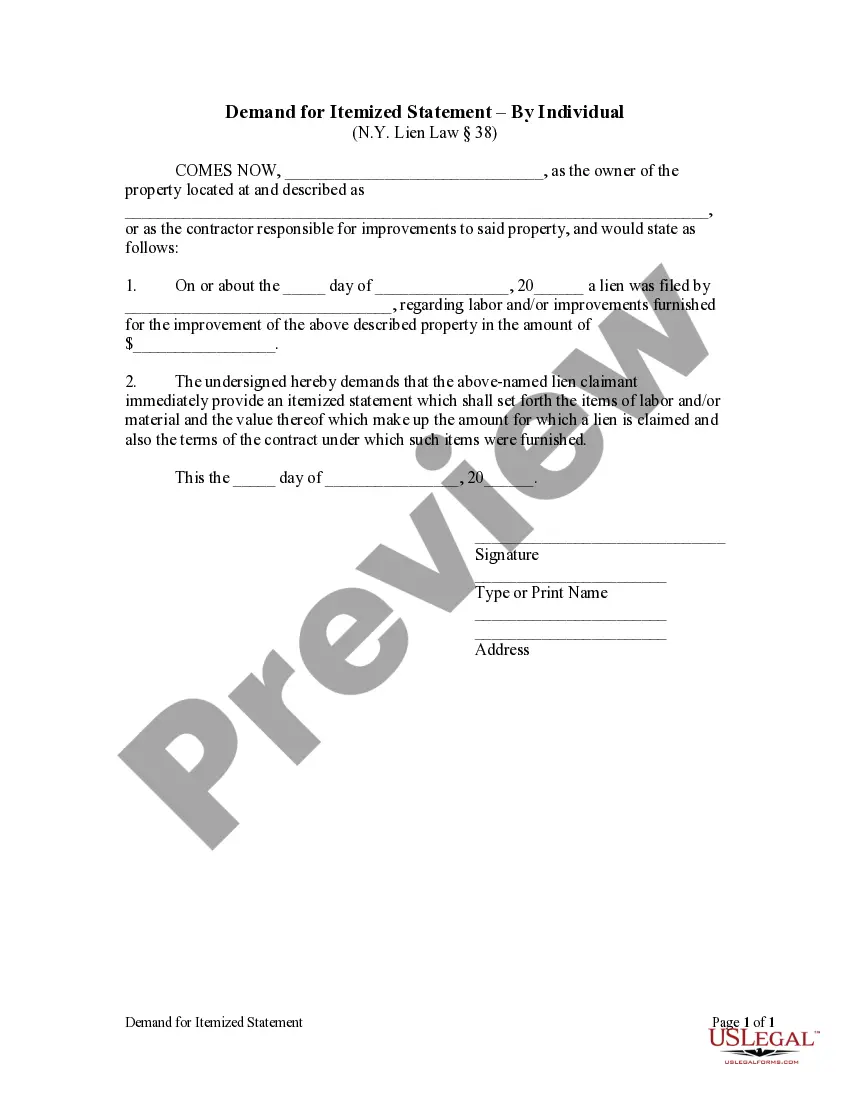

How to fill out Qualified Income Miller Trust?

Dealing with legal documents and operations can be a lengthy addition to the day.

A Miller Trust With The IRS and similar forms typically require you to locate them and understand how to fill them out accurately.

Therefore, if you are managing financial, legal, or personal matters, utilizing a comprehensive and effective online directory of forms when needed will be beneficial.

US Legal Forms is the leading online platform for legal templates, showcasing over 85,000 state-specific documents and various tools to help you complete your paperwork effortlessly.

Is this your first experience using US Legal Forms? Register and set up an account within a few minutes, and you will gain access to the form directory and A Miller Trust With The IRS. Then, follow the steps below to complete your document.

- Explore the directory of relevant documents available to you with just one click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Safeguard your document management processes by using a reliable service that enables you to prepare any form within minutes without extra or hidden charges.

- Simply Log In to your account, search for A Miller Trust With The IRS, and download it directly in the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

You might need a Miller trust if you are facing high medical costs and wish to qualify for Medicaid without sacrificing your assets. This trust allows you to legally redirect excess income, making you eligible for essential healthcare benefits. It provides peace of mind by protecting your financial resources while complying with IRS regulations. Consulting tools available through US Legal Forms can streamline your journey in setting up a Miller trust with the IRS.

Benefits of starting a Michigan LLC: Separates and limits your personal and business liabilities and debts to protect your assets. Quick and simple filing, management, compliance, regulation and administration. Easy tax filing and potential advantages for tax treatment. Low cost to file (just $50)

Steps to Create a Michigan General Partnership Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN) Get Michigan state tax identification numbers.

An LLP insulates your personal assets from others' actions and the actions of the partnership's employees. That said, limited liability has limits. Each partner in an LLP remains personally liable for his or her own professional activities.

LLC: Core Differences. In basic terms, the owners of an LLP are considered partners in an organization, while the owners of an LLC are members. As a result, there are key differences between how the limited liability protection is recognized, how an LLC and LLP are managed and how each structure is taxed.

A Limited Liability Partnership (LLP) is a type of business structure which provides limited liability to the partners, or members as well as the same structural and tax flexibility of a partnership. An LLP is a business structure which is commonly chosen by licensed professionals.

A Guide for Starting a Business in Michigan Fine-Tune Your Business Idea and Create a Plan. ... Name Your Business. ... Choose the Right Business Entity. ... Appoint a Registered Agent in Michigan. ... Register Your Business Entity. ... Obtain an Employer Identification Number. ... Open a Business Bank Account. ... Understand Michigan's Business Taxes.

You can complete the Certificate of Limited Partnership here as a pdf and submit it either by mail to the Michigan Department of Licensing and Regulatory Affairs or through the Corporations Online Filing System. Cost to Form an LP: The state of Michigan charges a filing fee of $10 to form a limited partnership.

On the downside, LPs require that the general partner have unlimited liability. They are responsible for 100% of management control but also are on the hook for any debts or mishandling of business dealings. As well, limited partners are only allowed limited involvement in operations.