Self Employed Contractor Agreement With Llc

Description

How to fill out Self-Employed Independent Contractor Agreement For The Sale Of Book?

Bureaucracy necessitates exactness and correctness.

If you do not engage with completing documents like Self Employed Contractor Agreement With Llc regularly, it may cause some misunderstanding.

Selecting the appropriate template from the start will guarantee that your document submission proceeds smoothly and avert any issues of resending a document or repeating the same process from the beginning.

If you are not a subscribed user, locating the needed template will involve a few additional steps: Find the template using the search box. Ensure the Self Employed Contractor Agreement With Llc you found is suitable for your state or area. Open the preview or read the description that includes details on the template's use. If the result fits your search, click the Buy Now button. Select the appropriate option from the available pricing plans. Log In to your account or sign up for a new one. Complete the purchase using a credit card or PayPal. Receive the form in your desired format. Acquiring the correct and updated samples for your paperwork takes just a few minutes with a US Legal Forms account. Eliminate the bureaucratic issues and streamline your paperwork.

- You can always discover the suitable template for your paperwork in US Legal Forms.

- US Legal Forms is the largest online forms repository that provides over 85 thousand templates for various fields.

- You can obtain the newest and most pertinent version of the Self Employed Contractor Agreement With Llc by simply searching it on the site.

- Find, store, and save templates in your profile or verify the description to ensure you possess the correct one.

- With an account at US Legal Forms, it is simple to gather, keep in one location, and navigate through the templates you save for quick access.

- When on the webpage, click the Log In button to authenticate.

- Then, proceed to the My documents page, where your form history is maintained.

- Review the descriptions of the forms and save those you need at any time.

Form popularity

FAQ

Therefore, independent contractors should consider forming their company as a separate business entity. Whether or not a 1099 contractor should form his company as an LLC will depend largely on his personal situation, but there are many benefits that come with forming a limited liability company.

You pay yourself from your single member LLC by making an owner's draw. Your single-member LLC is a disregarded entity. In this case, that means your company's profits and your own income are one and the same. At the end of the year, you report them with Schedule C of your personal tax return (IRS Form 1040).

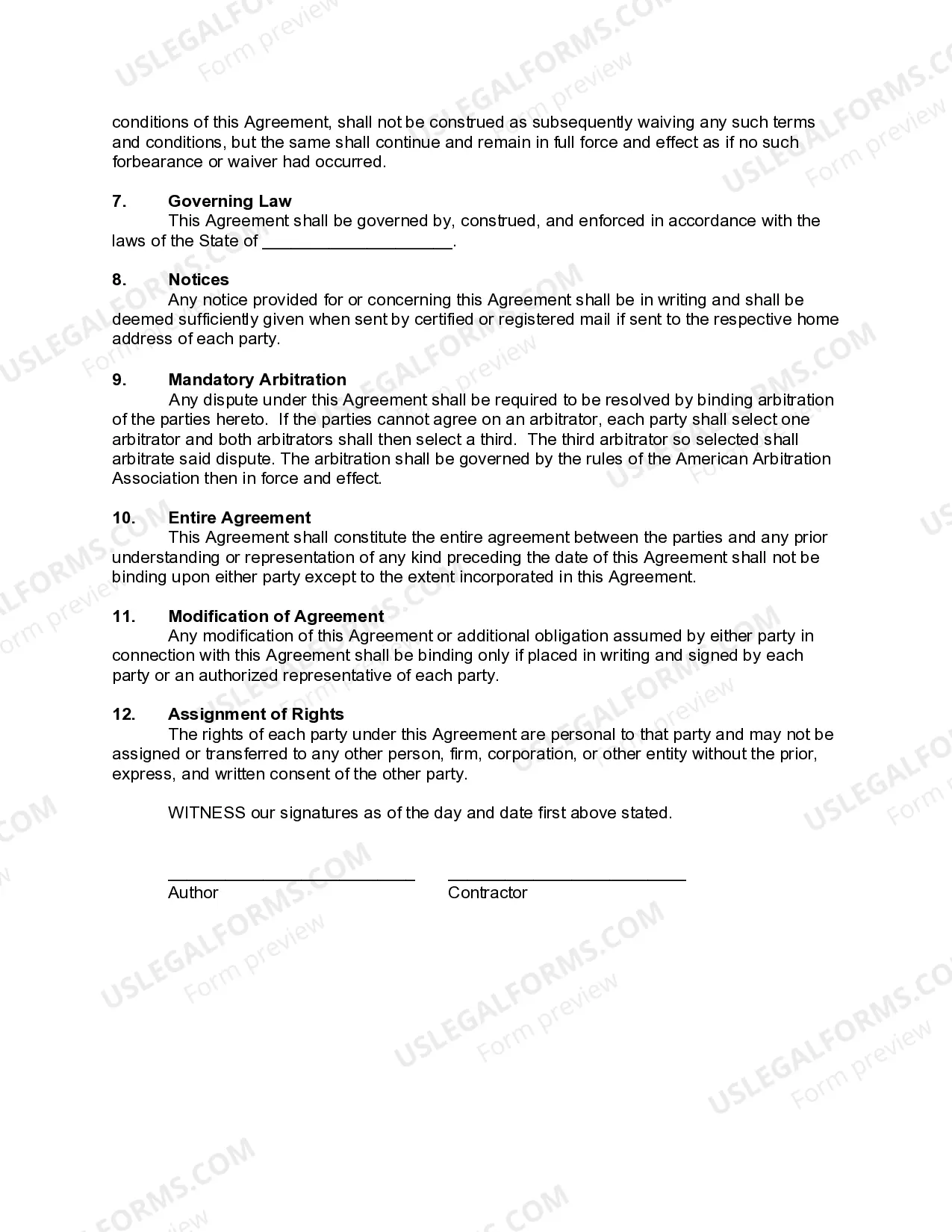

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Independent contractor vs LLC refers to the differences between an independent contractor and a limited liability company. Both are business types, but an independent contractor is comprised of one person, or member, while an LLC can have one or more members.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...