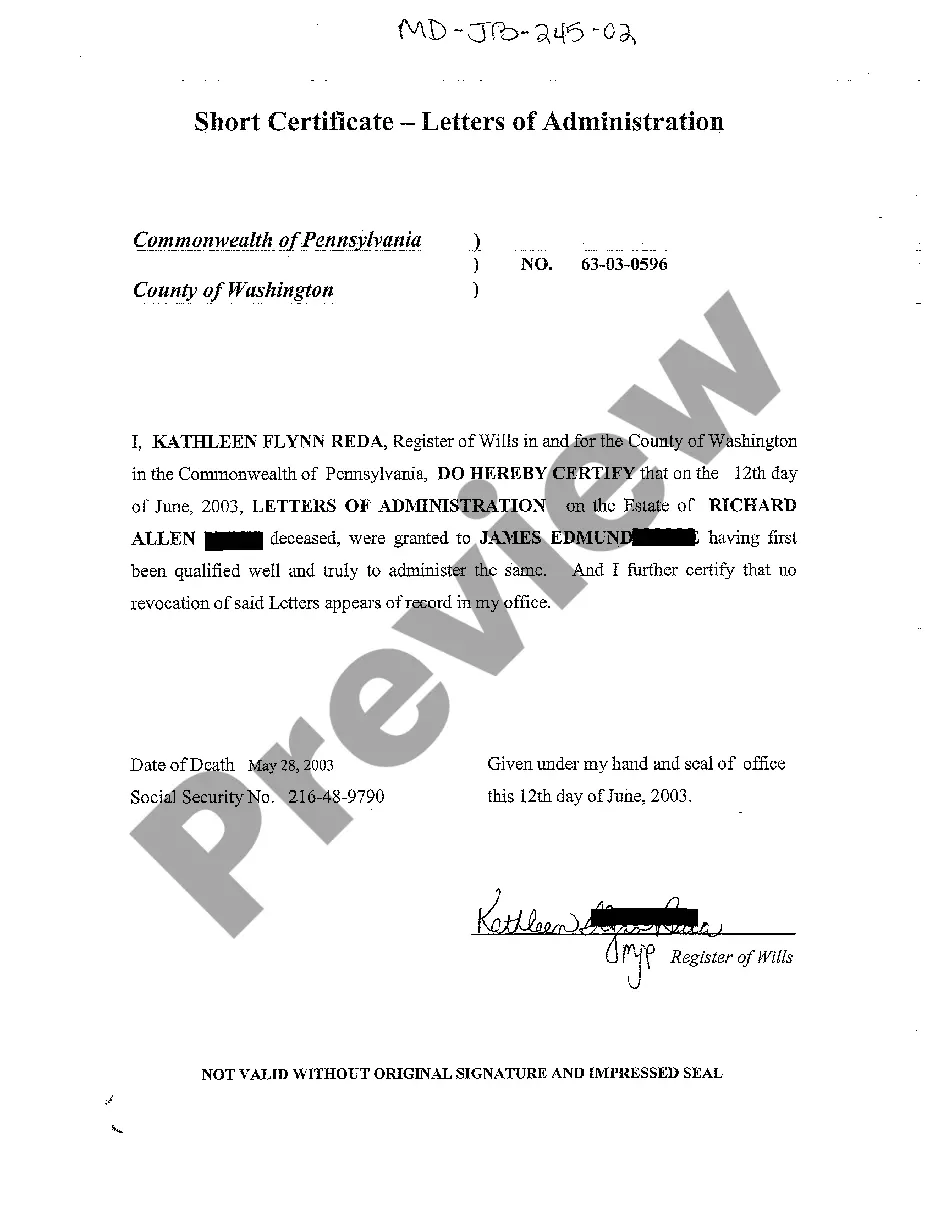

Maryland Short Certificate - Letters of Administration

Description

How to fill out Maryland Short Certificate - Letters Of Administration?

Greetings to the ultimate repository of legal paperwork, US Legal Forms. Here, you can obtain any template such as Maryland Short Certificate - Letters of Administration and download as many copies as you desire.

Prepare formal documents in just a few hours, rather than days or weeks, without incurring hefty fees for a lawyer. Acquire your state-specific template in a few clicks, assured that it was created by our skilled legal experts.

If you’re already a registered user, simply Log Into your account and then click Download next to the Maryland Short Certificate - Letters of Administration you require. Since US Legal Forms is online, you’ll always have access to your stored templates, no matter the device you are using. View them in the My documents section.

Print the document and fill it in with your or your company’s information. Once you’ve completed the Maryland Short Certificate - Letters of Administration, forward it to your attorney for verification. This additional step is essential for ensuring you’re fully protected. Join US Legal Forms today and gain access to countless reusable templates.

- If you don’t have an account yet, what are you waiting for? Follow our instructions below to get started.

- If this is a state-specific document, check its relevance for your state.

- Review the description (if available) to ensure it’s the correct template.

- Explore more information with the Preview feature.

- If the template meets all your needs, select Buy Now.

- To create an account, choose a subscription plan.

- Utilize a credit card or PayPal account to sign up.

- Download the template in your desired format (Word or PDF).

Form popularity

FAQ

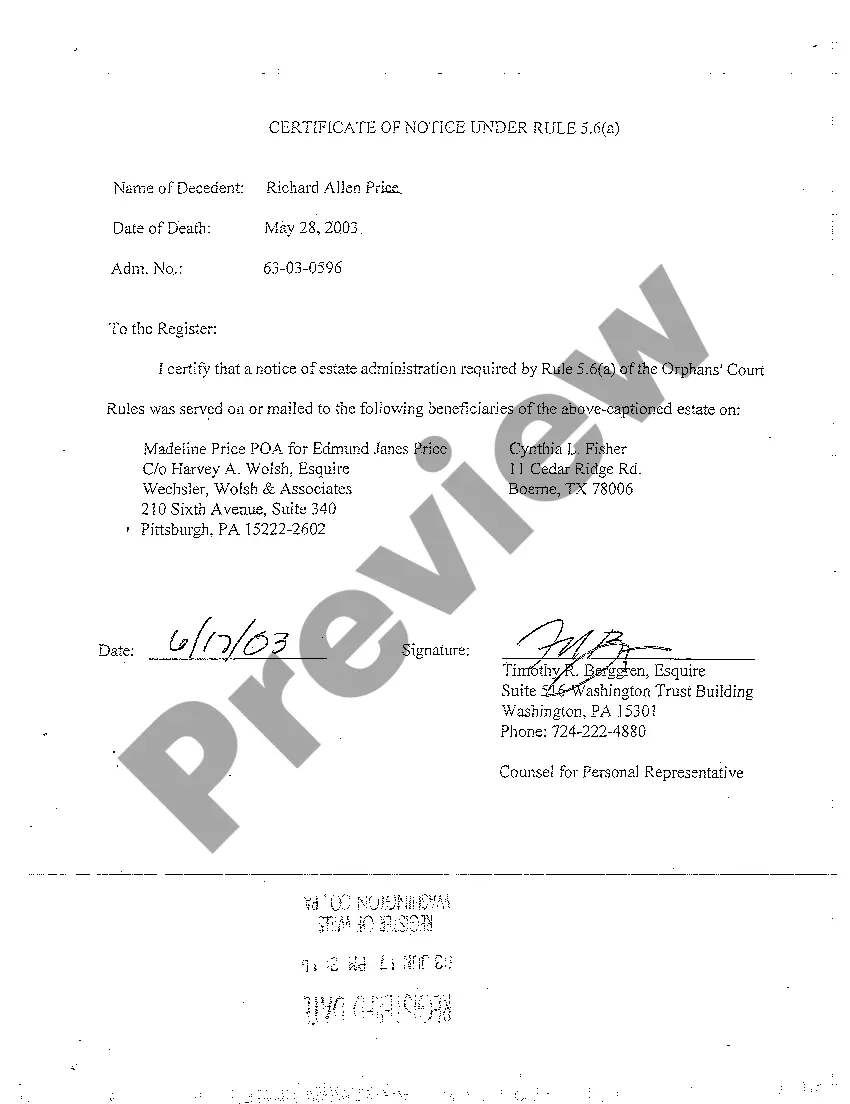

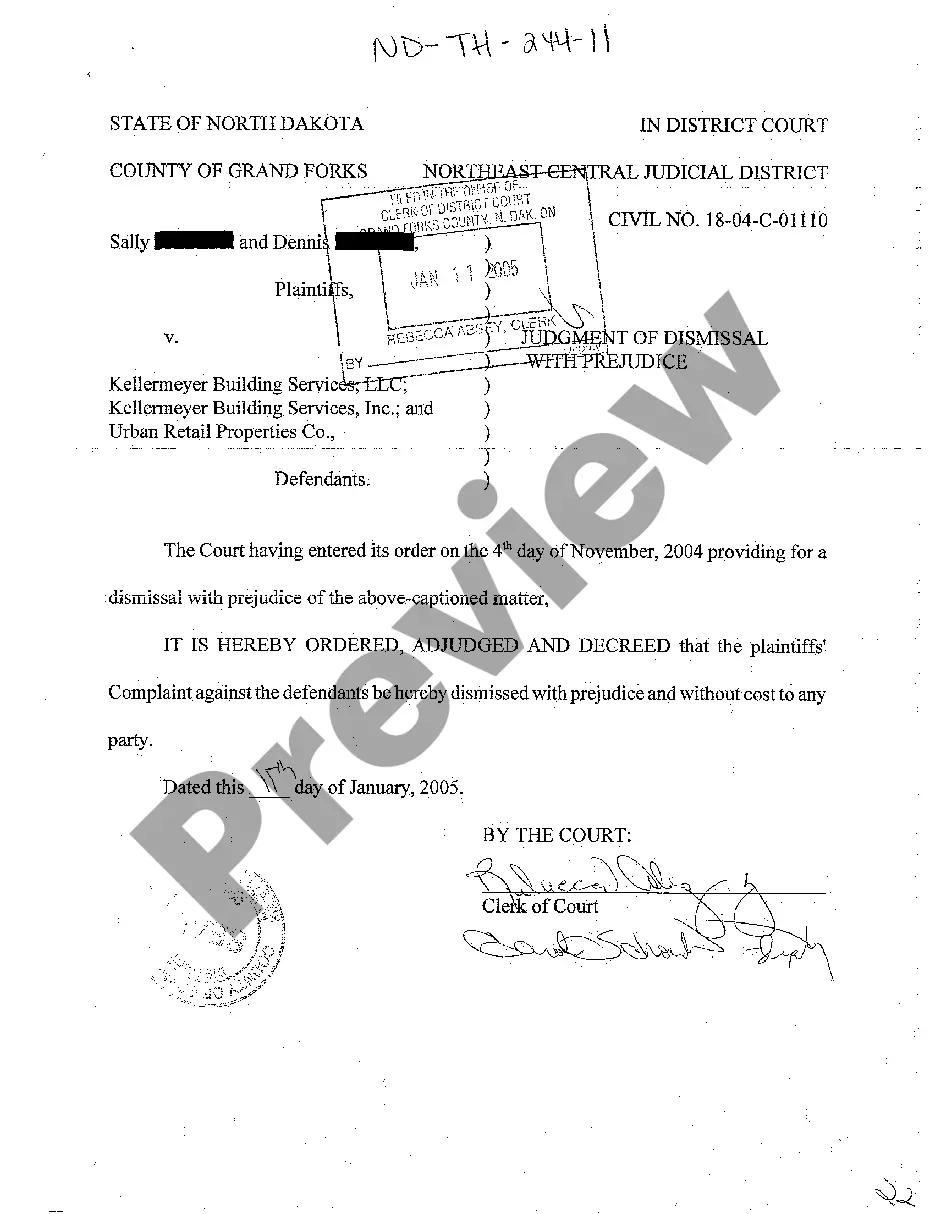

Letters of Administration are granted by a Surrogate Court or probate registry to appoint appropriate people to deal with a deceased person's estate where property will pass under Intestacy Rules or where there are no executors living (and willing and able to act) having been validly appointed under the deceased's will

Do you need a solicitor Many executors and administrators act without a solicitor. However, if the estate is complicated, it is best to get legal advice.

The simple answer is that once you have a grant of probate or letter of administration in hand, it usually takes between six and twelve months to transfer all the funds, assets and property in an estate.The Department for Work and Pensions needs to investigate the estate. The estate is bankrupt.

Children (or grandchildren if children have died) Parents. Siblings (or nieces and nephews over 18 if siblings have died) Half-siblings (or nieces and nephews over 18 if half-siblings have died) Grandparents. Aunts or uncles.

Speak to a probate specialist over the phone to discuss the value and details of your loved one's estate. Your probate application and tax forms are then prepared and sent to you to be signed. The application is then submitted to the probate registry for approval.

A grant of probate is issued to the executor/s named in the will, whereas a grant of letters of administration is issued to the next of kin of someone who died without a will.This document will allow whoever is dealing with the estate to close bank accounts, cash in investments and sell or transfer property.

Speak to a probate specialist over the phone to discuss the value and details of your loved one's estate. Your probate application and tax forms are then prepared and sent to you to be signed. The application is then submitted to the probate registry for approval.

Before applying for a grant you must publish an online notice of your intention to apply for Letters of Administration on the NSW Online Registry.

When the register of wills or orphan's court appoints a personal representative, it grants the representative letters of administration. Letters of administration empower the representative to distribute the assets in the estate.The court rules for estate administration are found in Title 6 of the Maryland Rules.