Sample Return Authorization With Special Power Of Attorney

Description

How to fill out Sample Letter For Return Authorization?

Individuals often link legal documents with something intricate that only an expert can handle.

In some respects, this is accurate, as creating a Sample Return Authorization With Special Power Of Attorney requires considerable knowledge in relevant fields, including state and local laws.

However, with US Legal Forms, matters have become simpler: ready-made legal documents for every life and business scenario tailored to state regulations are compiled in a single online directory and are now accessible to everyone.

Print your document or transfer it to an online editor for quicker completion. All templates in our catalog are reusable: once purchased, they remain stored in your account. You can access them anytime you need via the My documents section. Explore all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85k current documents categorized by state and application area, making the search for Sample Return Authorization With Special Power Of Attorney or any other specific template just a matter of minutes.

- Existing users with an active subscription need to sign in to their account and select Download to acquire the form.

- New users of the service must first set up an account and subscribe before downloading any documents.

- Here's a detailed guide on how to secure the Sample Return Authorization With Special Power Of Attorney.

- Carefully review the page content to confirm it meets your requirements.

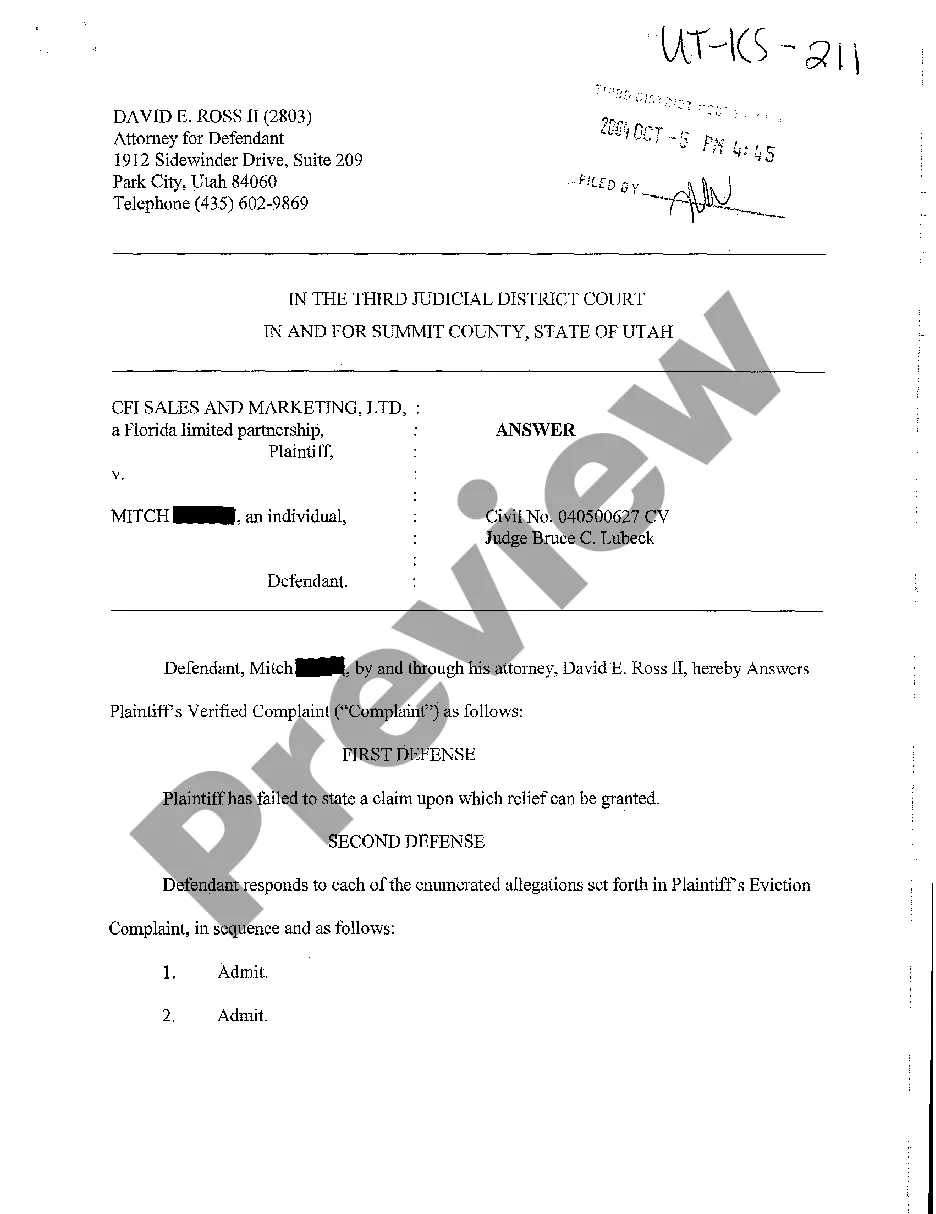

- Examine the form description or view it using the Preview feature.

- If the previous form does not meet your needs, find another sample using the Search bar above.

- Once you identify the appropriate Sample Return Authorization With Special Power Of Attorney, click Buy Now.

- Choose a subscription plan that aligns with your goals and budget.

- Create an account or Log In to continue to the payment page.

- Complete your subscription payment through PayPal or your credit card.

- Pick the format for your document and click Download.

Form popularity

FAQ

As per the provisions stated in Section 288 of the Income Tax Act, 1961, more specifically Clause (i) of Sub-section (2), any family member, relative or employee of the income tax assessee in question can act as an authorised representative on his or her behalf.

The representative named in a POA cannot sign an income tax return unless: The signature is permitted under the Internal Revenue Code and the related regulations (see Regs. Sec.

You can allow the IRS to discuss your tax return information with a third party by completing the Third Party Designee section of your tax return, often referred to as "Checkbox Authority." This will allow the IRS to discuss the processing of your current tax return, including the status of tax refunds, with the person

The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization. There are different types of third party authorizations: Power of Attorney - Allow someone to represent you in tax matters before the IRS.

You can legally file a tax return for someone else The IRS says you can file a tax return for someone else as long you have their permission to do so. Here are a few important things to know before you begin offering your services to others: You can file tax returns electronically for up to five people.