Agreement Bond With Surety

Description

How to fill out Bond Placement Agreement?

Individuals generally connect legal documentation with complexity that only a specialist can manage. In some respects, this is accurate, as crafting an Agreement Bond With Surety necessitates considerable knowledge of subject matter, encompassing state and county laws. Nevertheless, with US Legal Forms, the process has become more straightforward: ready-made legal templates for any personal and business needs specific to state legislation are compiled in a single online directory, now accessible to all.

US Legal Forms offers over 85,000 current forms categorized by state and purpose, so searching for an Agreement Bond With Surety or any other specific document takes mere minutes. Existing members with an active subscription must sign in to their account and click Download to retrieve the form. New users must first establish an account and subscribe before they can save any documents.

Here is a detailed guide on how to acquire the Agreement Bond With Surety.

All templates in our catalog are reusable: once acquired, they remain stored in your account. You can access them whenever necessary via the My documents section. Explore all the advantages of utilizing the US Legal Forms platform. Subscribe today!

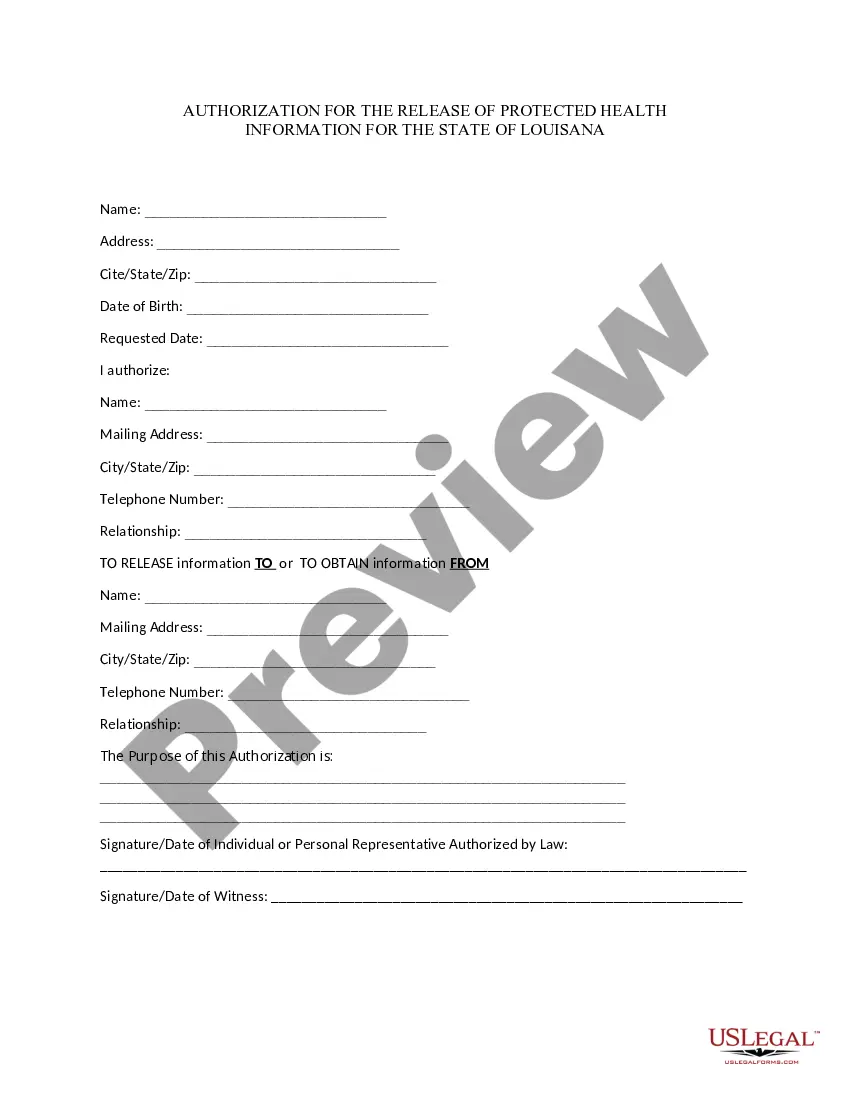

- Scrutinize the page content carefully to ensure it fulfills your requirements.

- Examine the form description or confirm it using the Preview feature.

- Find another template through the Search field above if the previous one does not meet your needs.

- Press Buy Now when you locate the suitable Agreement Bond With Surety.

- Choose a pricing plan that aligns with your preferences and financial plan.

- Create an account or Log In to proceed to the payment section.

- Remunerate for your subscription using PayPal or a credit card.

- Select the format for your document and hit Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

A: Surety bonds provide financial guarantees that contracts and other business deals will be completed according to mutual terms. Surety bonds protect consumers and government entities from fraud and malpractice. When a principal breaks a bond's terms, the harmed party can make a claim on the bond to recover losses.

A: Surety bonds provide financial guarantees that contracts and other business deals will be completed according to mutual terms. Surety bonds protect consumers and government entities from fraud and malpractice. When a principal breaks a bond's terms, the harmed party can make a claim on the bond to recover losses.

These bond types are also referred to as commercial bonds" or business bonds." Examples of license and permit surety bonds include auto dealer bonds, mortgage broker bonds, and collection agency bonds.

A contract surety bond is typically used to guarantee the performance of a contractor (who in this case is the principal) for a construction contract. If the contractor falls through, the surety company must secure another contractor to complete the project or reimburse the project owner for any financial loss.

A surety bond is a legally binding contract entered into by three partiesthe principal, the obligee, and the surety. The obligee, usually a government entity, requires the principal, typically a business owner or contractor, to obtain a surety bond as a guarantee against future work performance.