Sba Release Of Lien Form Texas

Description

How to fill out Waiver And Release Of Lien By Contractor?

Getting a go-to place to take the most current and appropriate legal templates is half the struggle of working with bureaucracy. Discovering the right legal files requirements precision and attention to detail, which is the reason it is important to take samples of Sba Release Of Lien Form Texas only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and see all the information regarding the document’s use and relevance for your situation and in your state or region.

Take the listed steps to complete your Sba Release Of Lien Form Texas:

- Make use of the catalog navigation or search field to find your template.

- Open the form’s description to ascertain if it fits the requirements of your state and county.

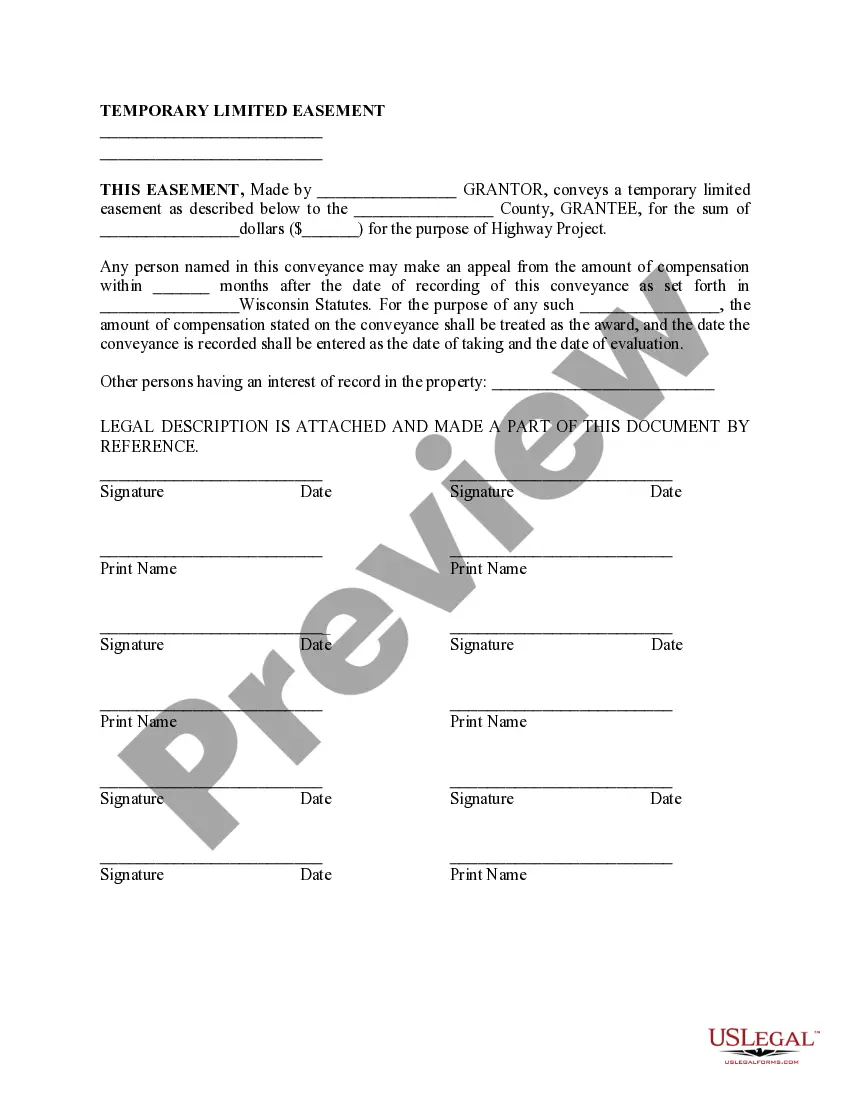

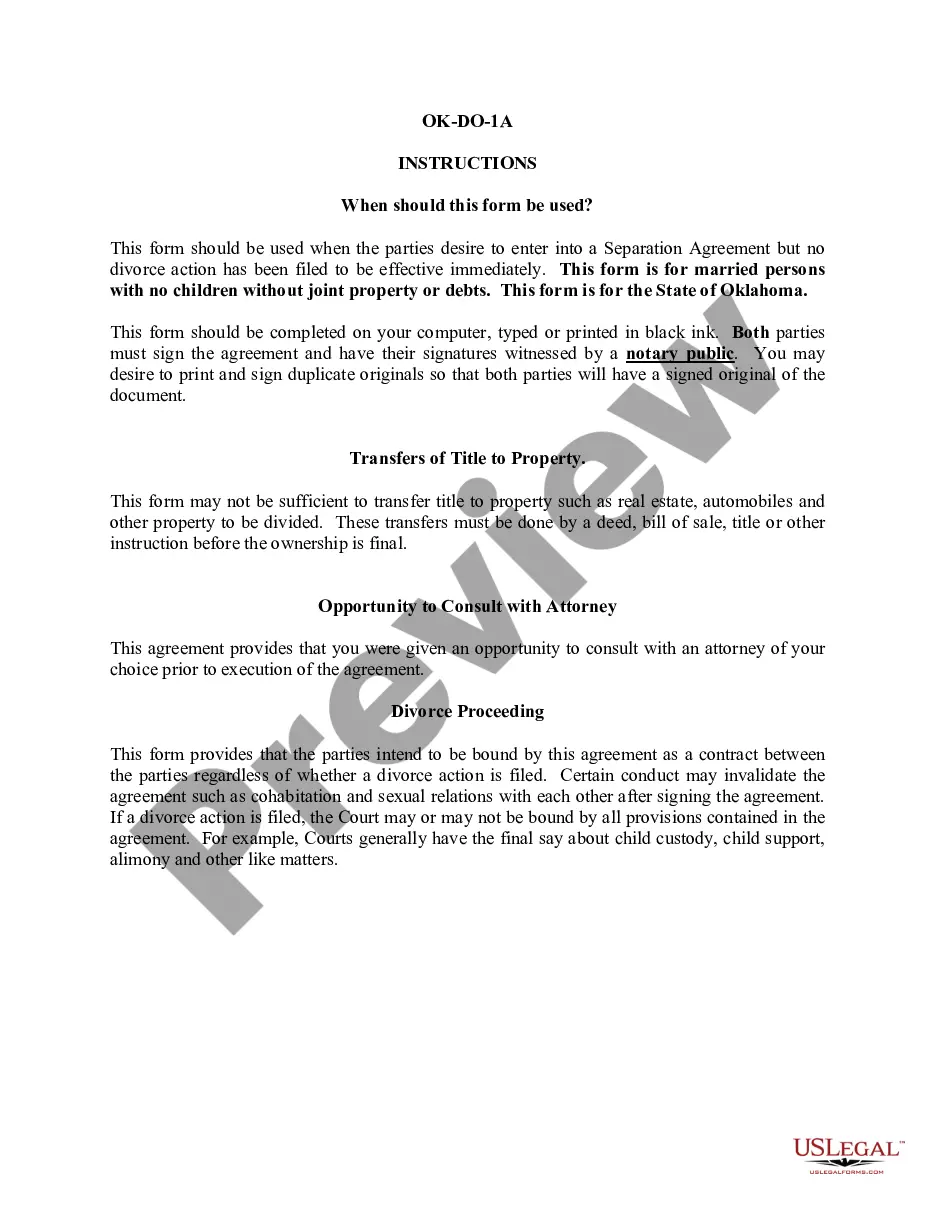

- Open the form preview, if there is one, to ensure the template is the one you are interested in.

- Resume the search and look for the proper template if the Sba Release Of Lien Form Texas does not suit your requirements.

- When you are positive regarding the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Pick the pricing plan that fits your preferences.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by picking a payment method (credit card or PayPal).

- Pick the file format for downloading Sba Release Of Lien Form Texas.

- Once you have the form on your gadget, you can change it with the editor or print it and complete it manually.

Get rid of the hassle that comes with your legal documentation. Discover the extensive US Legal Forms collection where you can find legal templates, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

The SBA requires the lender to liquidate any collateral with a recoverable value greater than $5,000 for business personal property and $10,000 for the real property unless there is a documented compelling reason not to.

If you have defaulted on an EIDL loan of more than $200,000, your personal assets can be seized. That includes real property you pledged for security, the money in your personal bank account, investments, cars, and other personal assets. The lender could sue you even if your loan was unsecured.

Pay your loan in full To request a payoff amount, contact COVID-19 EIDL Customer Service at 833-853-5638 (TTY:711) from a.m. to p.m. ET, Monday through Friday, email COVIDEIDLServicing@sba.gov , or send a message through the MySBA Loan Portal.

Loans under $200,000 do not require a personal guarantee, but there is an EIDL personal guarantee for loans above that amount. The guarantee is required of all individuals or entities that own 20% or more of the business.

View loan balance and make payments Create an account in the MySBA Loan Portal (lending.sba.gov) to monitor your loan status or to make payments. You are responsible for your COVID-19 EIDL monthly payment obligation beginning 30 months from the disbursement date shown on the top of the front page of your Original Note.