Car Title Lien Release Letter With Loan

Description

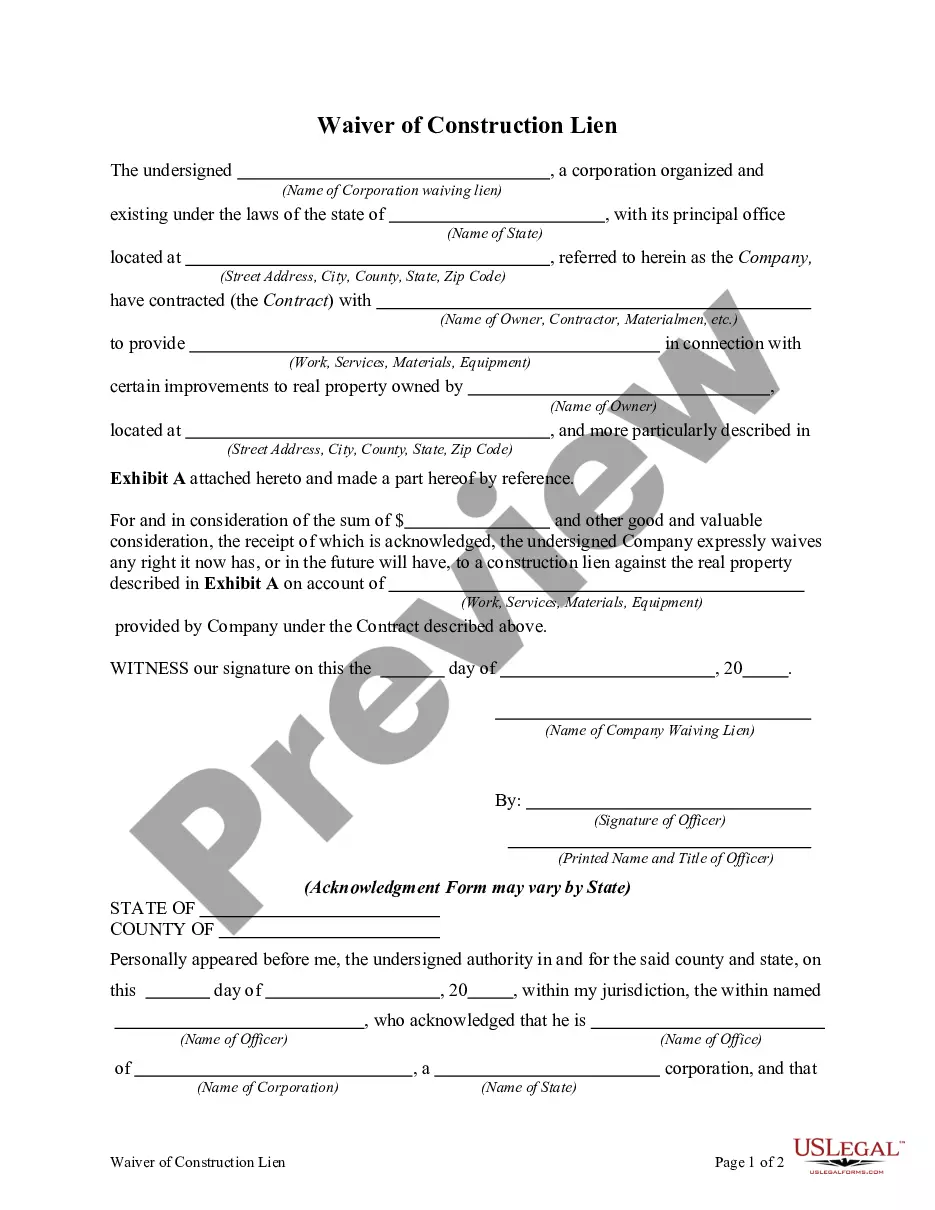

How to fill out Waiver And Release Of Lien By Contractor?

It’s clear that you cannot instantly become a legal expert, nor can you quickly learn how to prepare a Car Title Lien Release Letter With Loan without possessing a specialized skill set.

Drafting legal documents is a lengthy process that necessitates specific training and expertise. So why not entrust the creation of the Car Title Lien Release Letter With Loan to the professionals.

With US Legal Forms, one of the most extensive legal template collections, you can find anything from court documents to templates for internal corporate communication.

If you require any other form, begin your search again.

Sign up for a free account and select a subscription option to purchase the form. Click Buy now. Once the purchase is finalized, you can access the Car Title Lien Release Letter With Loan, complete it, print it, and send or mail it to the designated parties or organizations.

- We understand how vital compliance and adherence to federal and local laws and regulations are.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how to get started with our platform and obtain the form you need in just minutes.

- Find the form you need by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to determine if the Car Title Lien Release Letter With Loan is what you need.

Form popularity

FAQ

Yes, you can transfer car titles even if you have a loan on the vehicle. However, you will need the lender's approval and may require a car title lien release letter with loan to complete the transfer. It’s important to communicate with your lender to understand their specific requirements. Using platforms like USLegalForms can help simplify this process for you.

Transferring a financed car involves several steps. First, consult your lender about the possible transfer options they provide. You will need to secure a car title lien release letter with loan from the lender, confirming the lien’s removal. Once you have the necessary documentation, you can proceed with the title transfer at the DMV.

Yes, loan ownership can be transferred, but it often requires lender approval. You must inform your lender about the intention to transfer the loan, and they may require you to provide the new owner's information. Additionally, the new owner will need to meet the lender's credit and financial requirements. A car title lien release letter with loan may be required during this process.

To transfer a car title with a loan, first check your lender's requirements. You may need to obtain a car title lien release letter with loan from your lender, which confirms the lien's status. After receiving the release letter, you can visit your local DMV to complete the title transfer process. Ensure both parties have the necessary identification and paperwork ready.

If the lien is released manually, you should receive a paper title in the mail from your lender, showing that the lien was discharged. In order to remove the lien from the BMV records, you must take the title to any County Clerk of Courts Title Office and apply for a title.

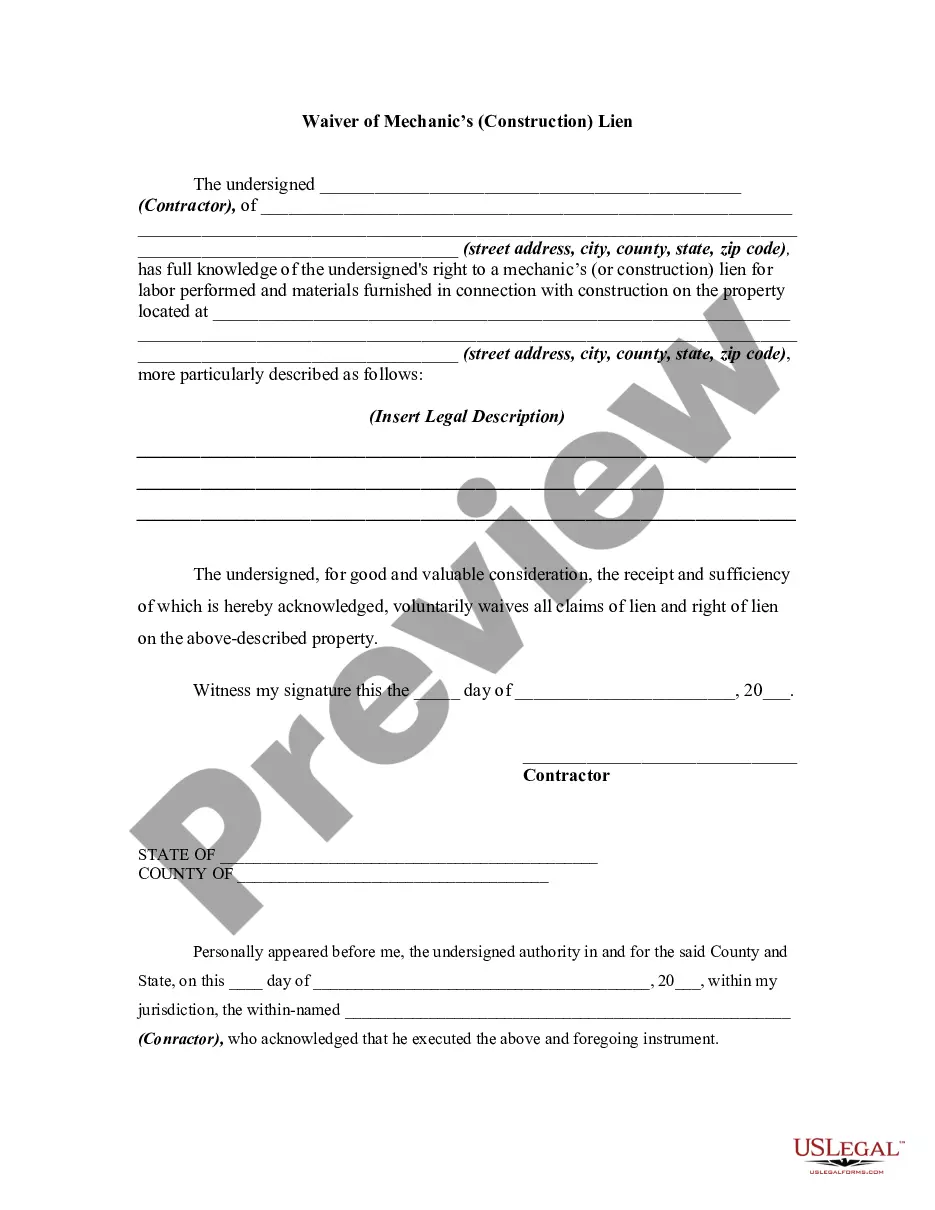

Protect Yourself With a Release of Lien (Lien Waiver) Fortunately, it's a simple process. A Lien Waiver is similar to a receipt. It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property.

When your loan is paid off, you will need to update the paperwork with the DMV or other state office. ing to Shinn, your lender will send you a lien release in states that require you to file to get your title. It should take no more than 30 days, so get in touch with your lender if it moves too slowly.

A lien release is a document that is filed in the public land records as the official notice that the lien is removed. Once payment has been received, a contractor has a duty to remove any lien that was filed against the property.

If your lender does not participate in Ohio's Electronic Lien and Title Program, the lender will mark that the lien was discharged and mail the paper title to you. To remove the lien from BMV records: Bring the title to any County Clerk of Courts Title Office. Apply for a title and pay for title fees.