Bond Investment

Description

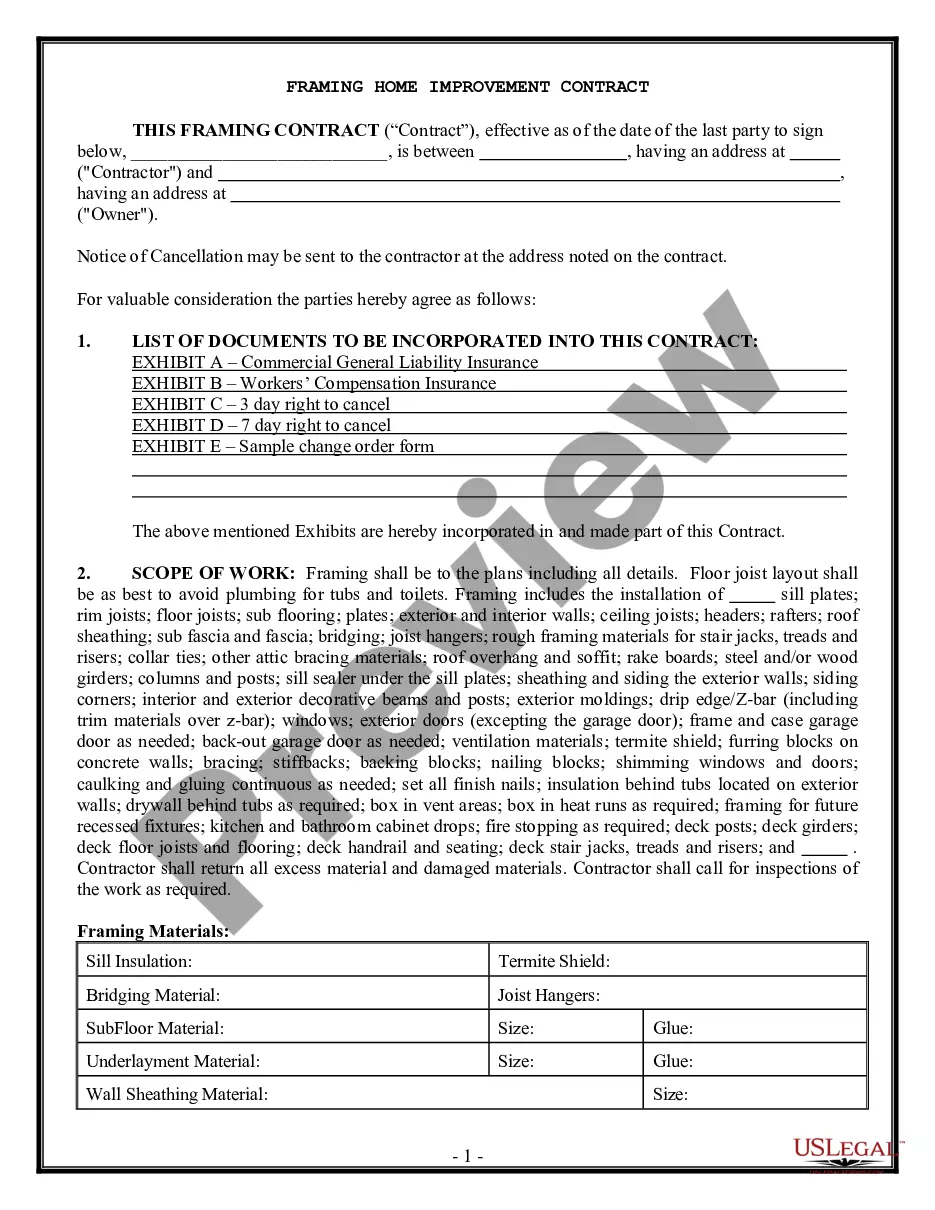

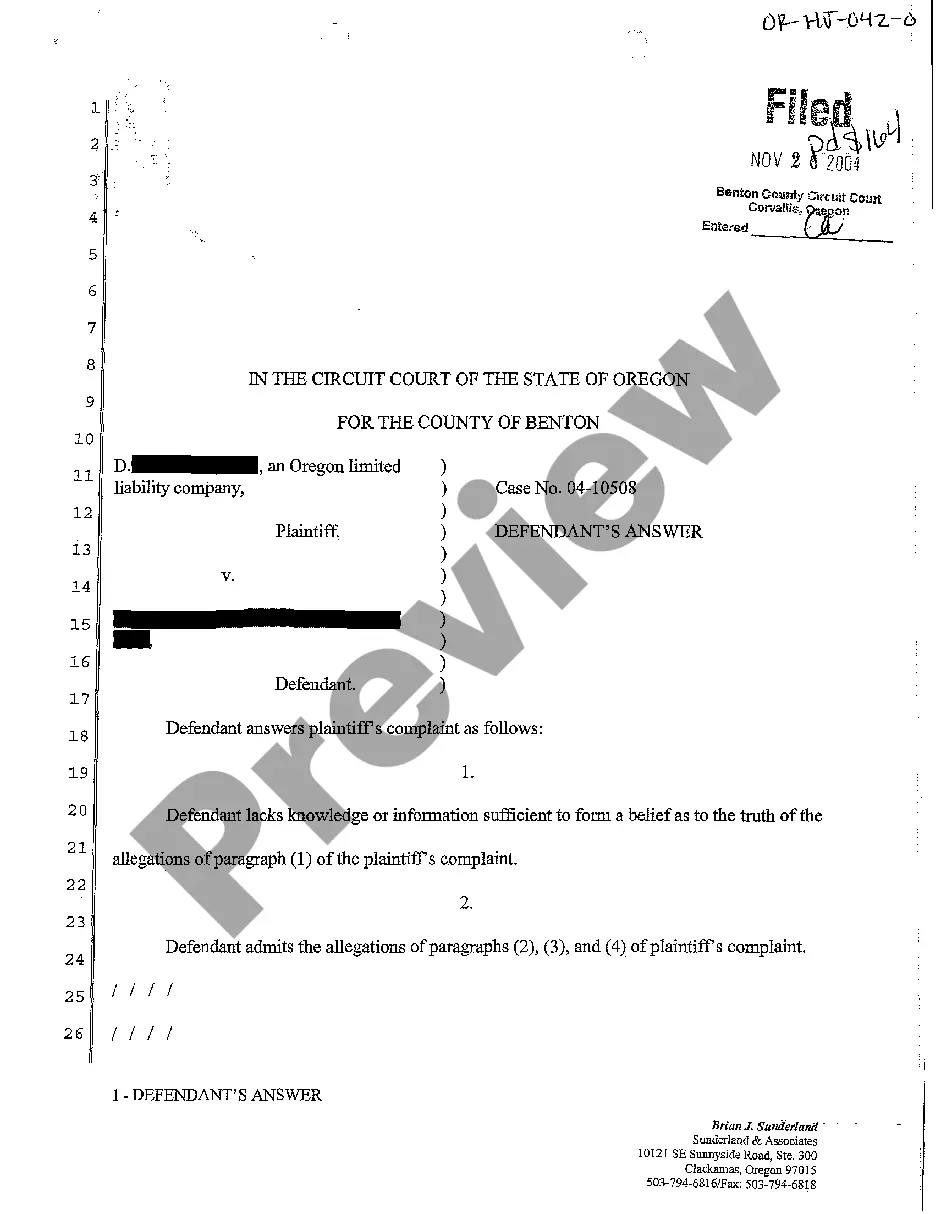

How to fill out Registered Investment Bond?

- Log in to your US Legal Forms account if you are a returning user. Ensure your subscription is up to date.

- If you're a new user, start by reviewing the form description and preview mode to confirm it meets your bond investment needs.

- Utilize the Search feature to find any additional templates if necessary.

- Click the 'Buy Now' button next to your selected document and choose your desired subscription plan.

- Complete your purchase by entering payment details, either through a credit card or PayPal.

- Download the form to your device for completion and future access through the 'My Forms' section on your profile.

By using US Legal Forms, you're ensuring that you have access to a robust collection of legal forms tailored for your requirements, making your bond investment process smooth and efficient.

Don't wait any longer; visit US Legal Forms today and streamline your legal documentation!

Form popularity

FAQ

To start investing in bonds, first, define your financial goals and risk tolerance. Next, explore different types of bonds and select an investment platform or broker that suits your needs. Uslegalforms can assist you with the necessary documents, aiding in a smooth entry into the bond investment market.

Bonds can be a good investment, especially for those seeking safety and steady income. They typically offer lower risk compared to stocks, making them an appealing option for conservative investors. Evaluating your financial goals and considering bond investment as part of a diversified portfolio can lead to balanced financial growth.

Your $100 savings bond may only be worth $50 if you have not held it long enough for it to accrue interest. Savings bonds, such as Series EE or I bonds, grow in value over time and can significantly increase after many years. You can check the bond’s current value online or consult with an expert to understand your bond investment's performance better.

Filling out a bond typically involves providing personal information, including your name and address, on the bond application. You must also select the bond type and determine the amount you wish to invest. If you are unsure how to proceed, using platforms like Uslegalforms can provide guidance and templates to help you complete your bond investment paperwork correctly.

Investing in bonds for beginners starts with understanding the basics. You can choose between government bonds, municipal bonds, and corporate bonds, depending on your risk tolerance. Begin by researching bond funds or online platforms that streamline the bond investment process. Uslegalforms can help simplify documentation and make your initial investment straightforward.

While bond investment offers stability, it is not without drawbacks. One major concern is that lower interest rates can lead to reduced returns compared to stocks. Additionally, if inflation rises significantly, it could erode the purchasing power of fixed income, making it essential to consider these factors when adding bonds to your portfolio.

Bonds often promise fixed returns over their lifespan, which many investors find appealing. However, the guarantee typically depends on the issuer’s creditworthiness. It’s essential to assess the quality of the bond before investing, as some bond investments may carry risks that could affect your returns.

While no investment is entirely without risk, bond investment generally offers a level of safety during market downturns. Bonds, especially government-issued ones, tend to hold their value better compared to stocks in turbulent times. This protective quality makes them a preferred option for those looking to mitigate risk during economic uncertainty.

Considering an investment bond can be a smart move for your financial portfolio. They typically yield lower returns than stocks but carry less risk—ideal for risk-averse investors. By diversifying your investments with bonds, you can enhance financial security without worrying about extreme market fluctuations.

Many investors wonder if bond investment remains a viable option in today’s financial landscape. Bonds offer stable income and are less volatile compared to stocks. While interest rates fluctuate, bonds can provide a predictable return if held to maturity, making them an attractive choice for those seeking stability.