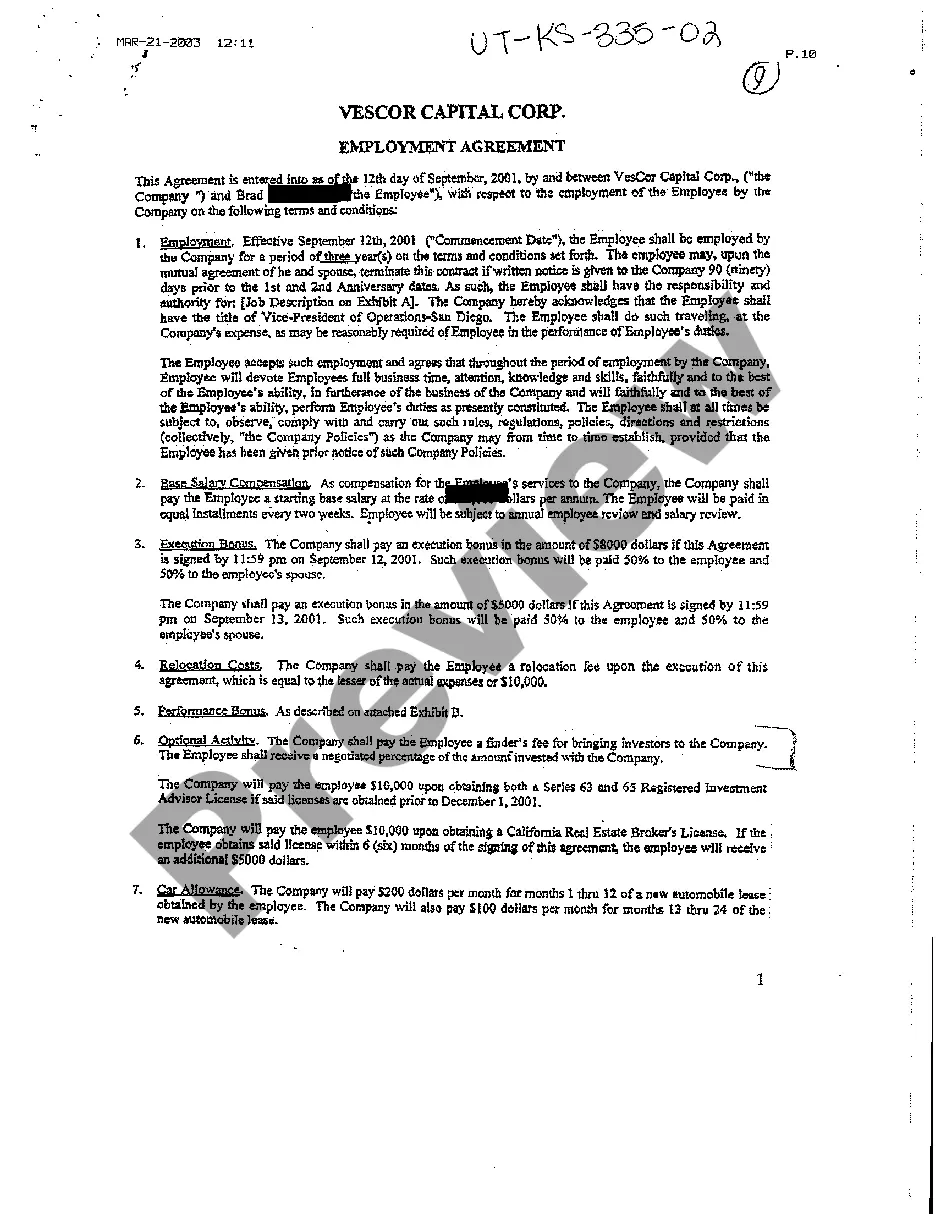

Under the Fair Credit Reporting Act, a person may not procure or cause to be prepared an investigative consumer report on any consumer unless: (1) it is clearly and accurately disclosed to the consumer that an investigative consumer report, including information as to character, general reputation, personal characteristics, and mode of living, whichever is or are applicable, may be made, and such disclosure: (a) is made in a writing mailed, or otherwise delivered, to the consumer not later than three days after the date on which the report was first requested; and (b) includes a statement informing the consumer of the right to request additional disclosures from the person requesting the report and the written summary of rights of the consumer prepared pursuant to ?§ 1681g(c) of the Act; and (2) the person certifies or has certified to the consumer reporting agency that the person has made the proper disclosures to the consumer as required under the Act.

Disclosure For Investigative Consumer Report

Description

How to fill out Disclosure For Investigative Consumer Report?

Well-crafted official documentation is one of the essential safeguards for preventing problems and legal disputes, yet acquiring it without the assistance of a legal professional may require time.

Whether you need to swiftly locate an updated Disclosure For Investigative Consumer Report or other templates for employment, family, or business purposes, US Legal Forms is always available to assist.

For existing users of the US Legal Forms library, the process is even more straightforward. If your subscription is active, you simply need to Log In to your account and click the Download button next to the desired document. Additionally, you can retrieve the Disclosure For Investigative Consumer Report at any time, as all documents ever obtained on the platform are accessible within the My documents tab of your account. Save time and resources on drafting official documents. Try US Legal Forms today!

- Ensure that the form is appropriate for your situation and jurisdiction by reviewing the description and preview.

- Search for another sample (if necessary) using the Search bar located in the page header.

- Select Buy Now once you identify the right template.

- Choose a pricing plan, Log Into your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose the PDF or DOCX file format for your Disclosure For Investigative Consumer Report.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

An investigative consumer report contains in-depth details, including your employment history, education, and any relevant criminal records. Additionally, it may incorporate personal references and interviews to enhance the clarity of your background. The disclosure for investigative consumer report ensures that you, as an individual, are aware of what information is being accessed and how it may impact your opportunities. It's vital to stay informed about the contents of these reports.

A consumer report provides a general overview of your credit and financial history, while an investigative report digs deeper into your background and personal character. The investigative report may involve interviews with people who know you, offering a more comprehensive view of your qualifications. Knowing the distinction and understanding the disclosure for investigative consumer report can help you prepare adequately for any background evaluations.

An investigative consumer report does not include opinions or personal assessments of character from the report provider. Rather, it focuses on factual information regarding your background and history. By clearly understanding the disclosure for investigative consumer report, you can better prepare for any checks that may arise in rental applications or job interviews. This knowledge empowers you to ensure your records are accurate.

A consumer report includes personal details such as your name, address, and Social Security number. It also summarizes your credit history, payment history, and any public records like bankruptcies. Importantly, the disclosure for investigative consumer report will highlight how the information was collected and what parties may access your report. This transparency helps build trust and accountability in the monitoring process.

An investigative consumer report typically reveals extensive information about an individual's background. This includes employment history, credit history, and any criminal records. Additionally, it may contain interviews with associates and references to provide more context. Understanding the disclosure for investigative consumer report is essential for both employers and individuals navigating the hiring process.

The purpose of a consumer report is to provide employers, creditors, and other entities with information used to assess your background. This assessment helps them make informed decisions regarding hiring, lending, or tenancy. Understanding the purpose and content of your consumer report is essential for managing your rights, particularly regarding disclosure for investigative consumer reports.

A consumer disclosure report provides individuals with a compilation of the information collected about them, often from various sources. This report can include data from credit agencies, criminal records, and other public databases. Utilizing a consumer disclosure report can assist you in ensuring that all data is accurate and trustworthy, particularly when reflecting on disclosure for investigative consumer reports.

No, a consumer report is not the same as a credit report. A consumer report can include a variety of information, such as rental history, employment verification, and background checks, while a credit report primarily details your credit-related activities. Recognizing this distinction is vital, especially when considering the implications of disclosure for investigative consumer reports.

Consumer disclosure includes a broader range of information about your identity, history, and any investigations conducted, while a credit report specifically focuses on your credit history and financial behaviors. Both documents are significant, but consumer disclosure offers a comprehensive overview of various aspects of your life. Understanding these differences helps you navigate issues related to disclosure for investigative consumer reports effectively.

A consumer disclosure report from LexisNexis provides a summary of your personal data as collected from various sources. This report enables you to review information used by lenders and employers in their decision-making processes. By obtaining and examining your report, you can ensure accuracy and transparency in matters related to disclosure for investigative consumer reports.