Report Information Insurance Without Card

Description

How to fill out Notice Of Increase In Charge For Credit Or Insurance Based On Information Received From Consumer Reporting Agency?

Whether for business purposes or for individual affairs, everybody has to deal with legal situations at some point in their life. Completing legal paperwork needs careful attention, starting with choosing the right form sample. For instance, when you pick a wrong edition of the Report Information Insurance Without Card, it will be declined when you submit it. It is therefore crucial to get a dependable source of legal files like US Legal Forms.

If you have to obtain a Report Information Insurance Without Card sample, stick to these easy steps:

- Get the sample you need using the search field or catalog navigation.

- Examine the form’s description to make sure it matches your case, state, and county.

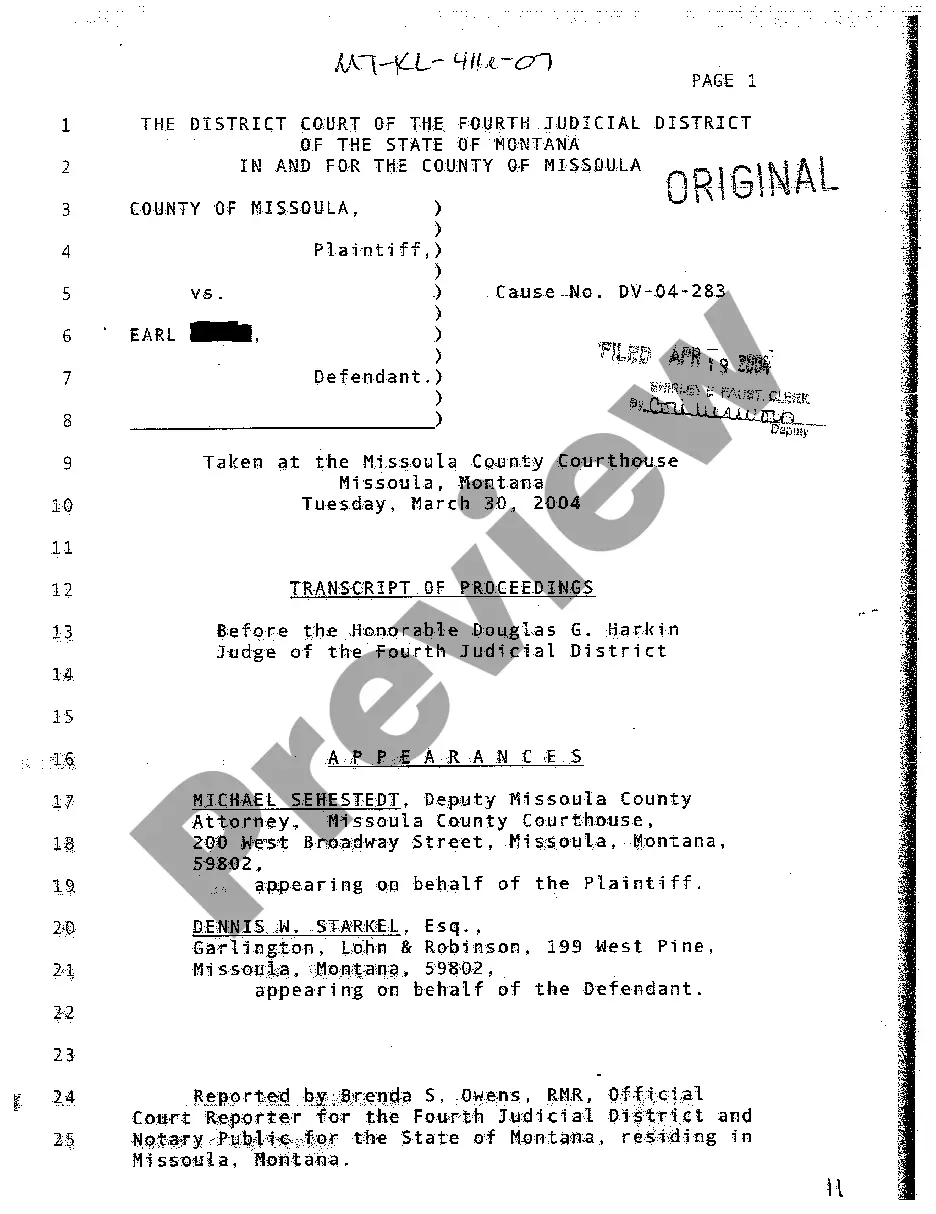

- Click on the form’s preview to see it.

- If it is the wrong document, get back to the search function to locate the Report Information Insurance Without Card sample you need.

- Get the template if it matches your needs.

- If you have a US Legal Forms account, simply click Log in to access previously saved files in My Forms.

- In the event you do not have an account yet, you may download the form by clicking Buy now.

- Choose the proper pricing option.

- Finish the account registration form.

- Pick your transaction method: you can use a credit card or PayPal account.

- Choose the file format you want and download the Report Information Insurance Without Card.

- After it is downloaded, you can complete the form with the help of editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you don’t have to spend time seeking for the right sample across the internet. Take advantage of the library’s easy navigation to find the proper template for any occasion.

Form popularity

FAQ

How to Fill the Car Insurance Claim Form? Basic Details. ... Claim Intimation Number. ... Driver Details at the Time of Accident. ... Accident details. ... Vehicle Details. ... Declaration.

How To Write A Car Accident Report For Insurance? Personal Information. Date and time of the accident. Location. Description of the Accident. Damage to vehicles. Injuries. Witness information. Police involvement.

Insurance claims are often denied if there is a dispute as to fault or liability. Companies will only agree to pay you if there's clear evidence to show that their policyholder is to blame for your injuries. If there is any indication that their policyholder isn't responsible the insurer will deny your claim.

Hear this out loud PauseCustomers are also required to submit a PAN card if the insurance premium is Rs 50,000 or greater than that in a financial year. Existing policyholders whose insurance premium does not exceed Rs 50,000 in a financial year are mandated to submit a PAN card or Form 60 within the specified date by the IRDAI.

Hear this out loud PauseFill in your name, relation with the insured person (in case of primary dependents like children etc.) Write your address and other relevant details (the details should match the information given in original policy documents). Enter the amount/tax ID etc.