Modifying Amending Withholding

Description

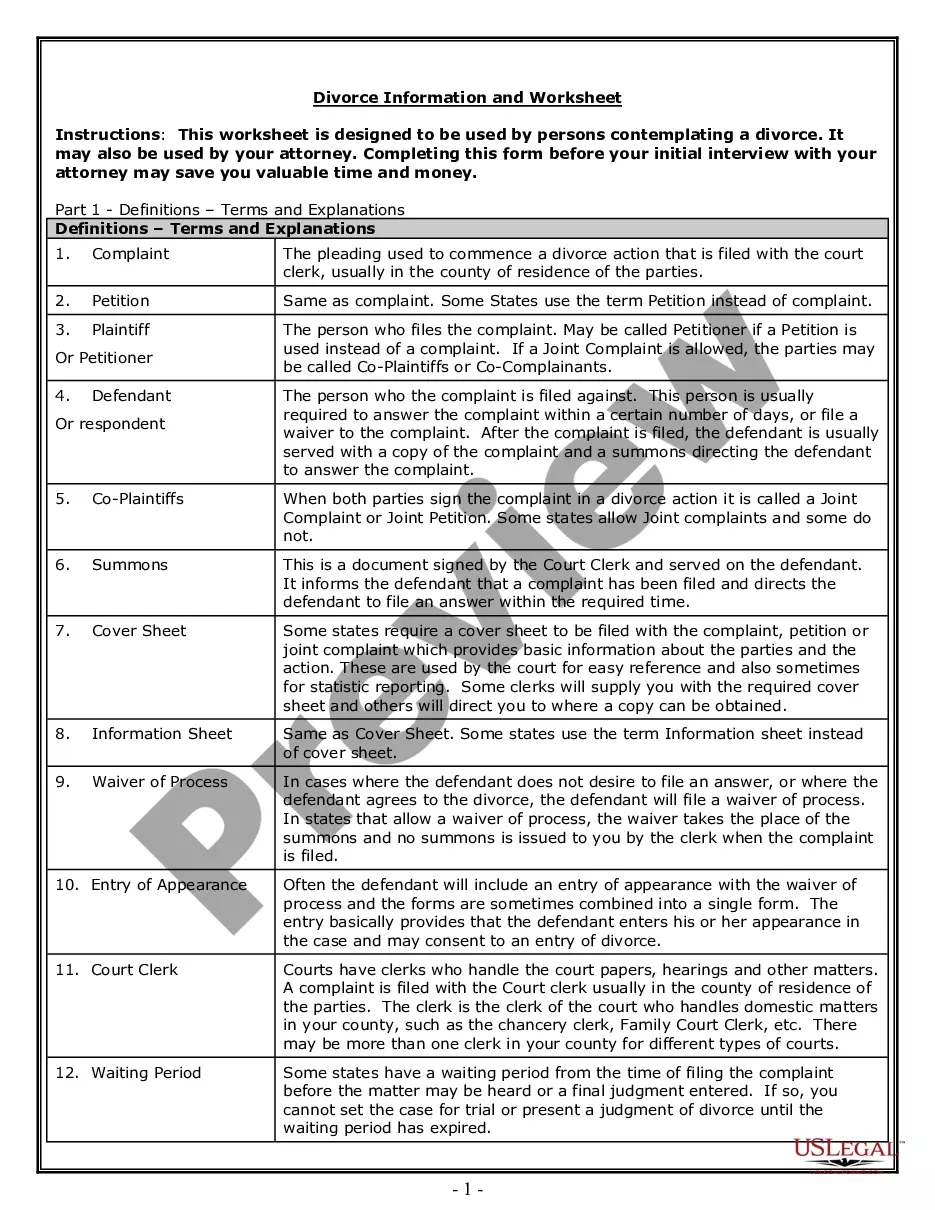

How to fill out Order Modifying Or Amending Divorce Decree To Change Name Back To Married Name?

Finding a reliable source for the latest and suitable legal samples is a significant part of navigating bureaucratic processes.

Selecting the appropriate legal documents requires accuracy and careful consideration, which is why it's crucial to obtain samples of Modifying Amending Withholding solely from trusted sources like US Legal Forms. An incorrect template could be a time-waster and could delay your current situation.

Remove the complications associated with your legal documentation. Browse the extensive US Legal Forms library to locate legal samples, evaluate their relevance to your situation, and download them instantly.

- Utilize the library search or navigation to find your sample.

- Examine the form’s description to determine if it meets the criteria of your state and county.

- View the form preview, if available, to ensure the template matches what you need.

- Continue searching for the correct template if the Modifying Amending Withholding does not meet your requirements.

- If you are confident about the form’s suitability, proceed to download it.

- If you are a registered user, click Log in to verify your identity and access your chosen forms in My documents.

- If you do not possess an account yet, click Buy now to acquire the template.

- Choose the pricing plan that best suits your needs.

- Go through the registration process to complete your purchase.

- Conclude your purchase by selecting a payment option (credit card or PayPal).

- Choose the document format for downloading Modifying Amending Withholding.

- After you have the form on your device, you can modify it with the editor or print it out to complete it by hand.

Form popularity

FAQ

To edit your tax withholdings, complete a new W-4 form and submit it to your employer. Take time to recalculate your needs based on your current circumstances, including income changes and family status. Keeping your withholding aligned with your financial situation can help avoid surprises at tax time. If you seek guidance, platforms like US Legal Forms can provide valuable resources tailored to your needs.

You can amend your tax returns, but there are specific time limitations. Generally, you need to file an amended return within three years of the original filing date. If you realize you made an error or left something out, it's important to act quickly. Utilizing platforms like US Legal Forms can simplify the process of modifying, amending, and withholding your tax documents.

Yes, you can adjust your tax withholding at any time throughout the year. Simply submit a new W-4 form to your employer with your updated preferences. This flexibility allows you to respond to life changes, unexpected income, or tax planning strategies. Regular modifications can support your financial health and help you stay aligned with your tax goals.

You should consider modifying your tax withholding when your financial situation changes. Common scenarios include getting a new job, receiving a raise, or having a child. Adjusting your withholding can help ensure that you neither owe a significant amount at tax time nor receive a large refund. Regular review of your status helps maintain accurate withholding.

To adjust your withholding amount, you need to complete a new W-4 and submit it to your employer. Carefully evaluate your financial situation and determine how much you should modify your amending withholding to meet your tax goals. You can use online calculators or resources like US Legal Forms for guidance. These tools can help you find the right balance and manage your withholdings effectively.

Amending a tax return is not necessarily a red flag; it’s a common practice when errors or changes occur. However, frequent amendments may draw attention from the IRS. It’s important to understand the implications of modifying amending withholding as it relates to your overall tax filings. US Legal Forms can assist you in navigating this process effectively and ensuring accuracy.

Yes, filling out a W-4 incorrectly can lead to underpaying or overpaying your taxes. If you report incorrect information, the IRS may flag your tax return, which could result in penalties. Therefore, it is crucial to be accurate when modifying amending withholding. Using resources like US Legal Forms can help you fill out your W-4 correctly.

You can fill out a new W-4 form at any time, allowing you to adjust your tax withholding according to your current financial situation. It is a straightforward process to update your information when your circumstances change. Modifying amending withholding via a new W-4 can help prevent surprises at tax time. This ensures that you withhold the right amount to match your expected tax liability.

Yes, you can change your tax withholding at any time throughout the year. It’s advisable to review your withholding regularly, especially when you experience significant life changes, such as getting married or having a child. Modifying amending withholding helps ensure that you are paying the correct amount of taxes. Utilizing tools like US Legal Forms can simplify the process.

To fill out an amended tax return, obtain the right form, such as Form 1040X for individual returns. Follow instructions carefully, reporting both original and corrected figures, while succinctly explaining any changes made. Utilizing USLegalForms can help streamline this process, ensuring that you navigate modifying amending withholding efficiently.