Note Mortgage Sample With Interest

Description

How to fill out Agreement To Modify Promissory Note And Mortgage To Extend Maturity Date?

Regardless of whether it is for commercial objectives or private matters, everyone must handle legal issues at some point during their life.

Completing legal documents requires meticulous care, starting from selecting the appropriate form template.

Once it is downloaded, you can fill out the form using editing software or print it to complete it by hand. With a comprehensive US Legal Forms catalog available, you won't have to waste time searching for the suitable template across the internet. Leverage the library’s easy navigation to locate the right form for any event.

- Obtain the template you require through the search box or catalog navigation.

- Review the form’s details to confirm it suits your situation, state, and locality.

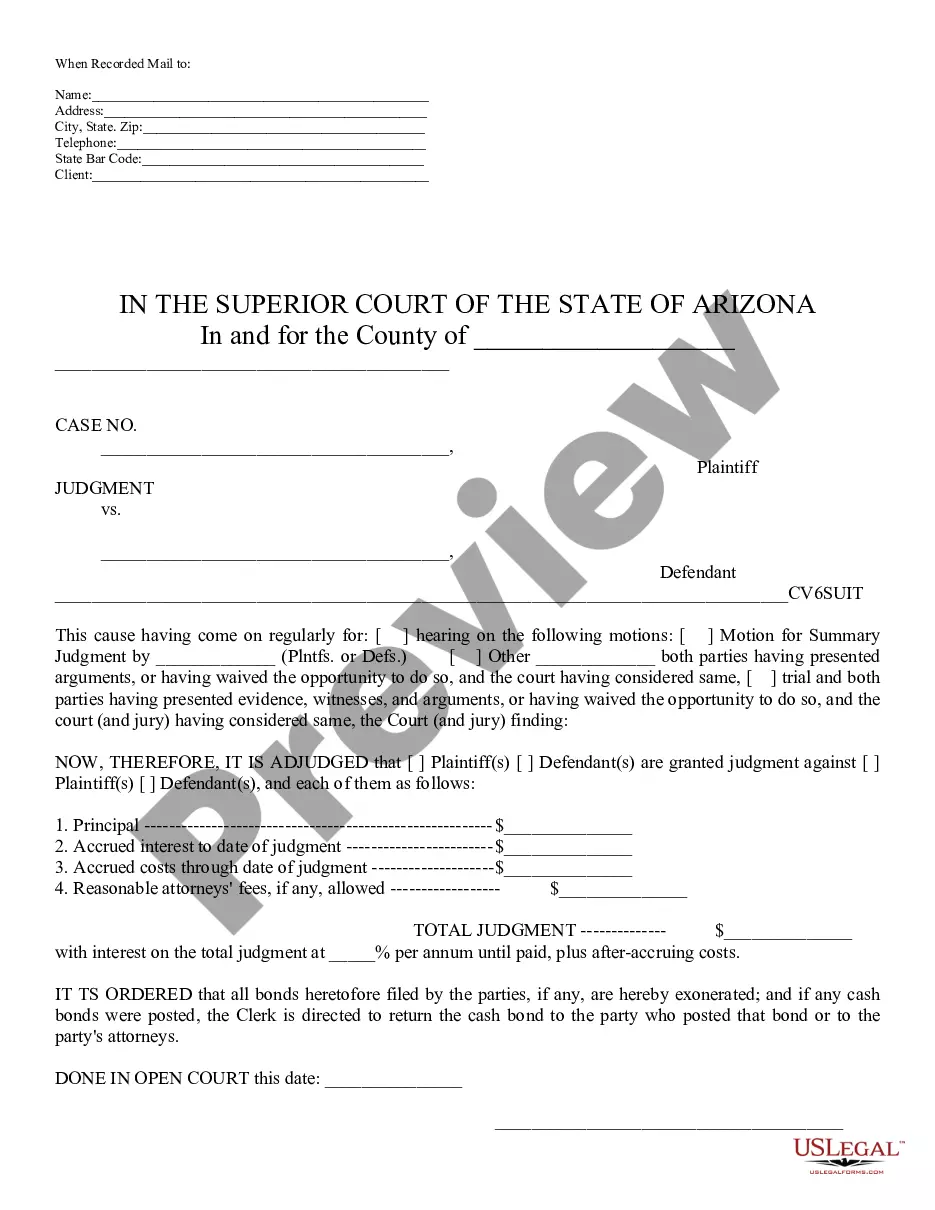

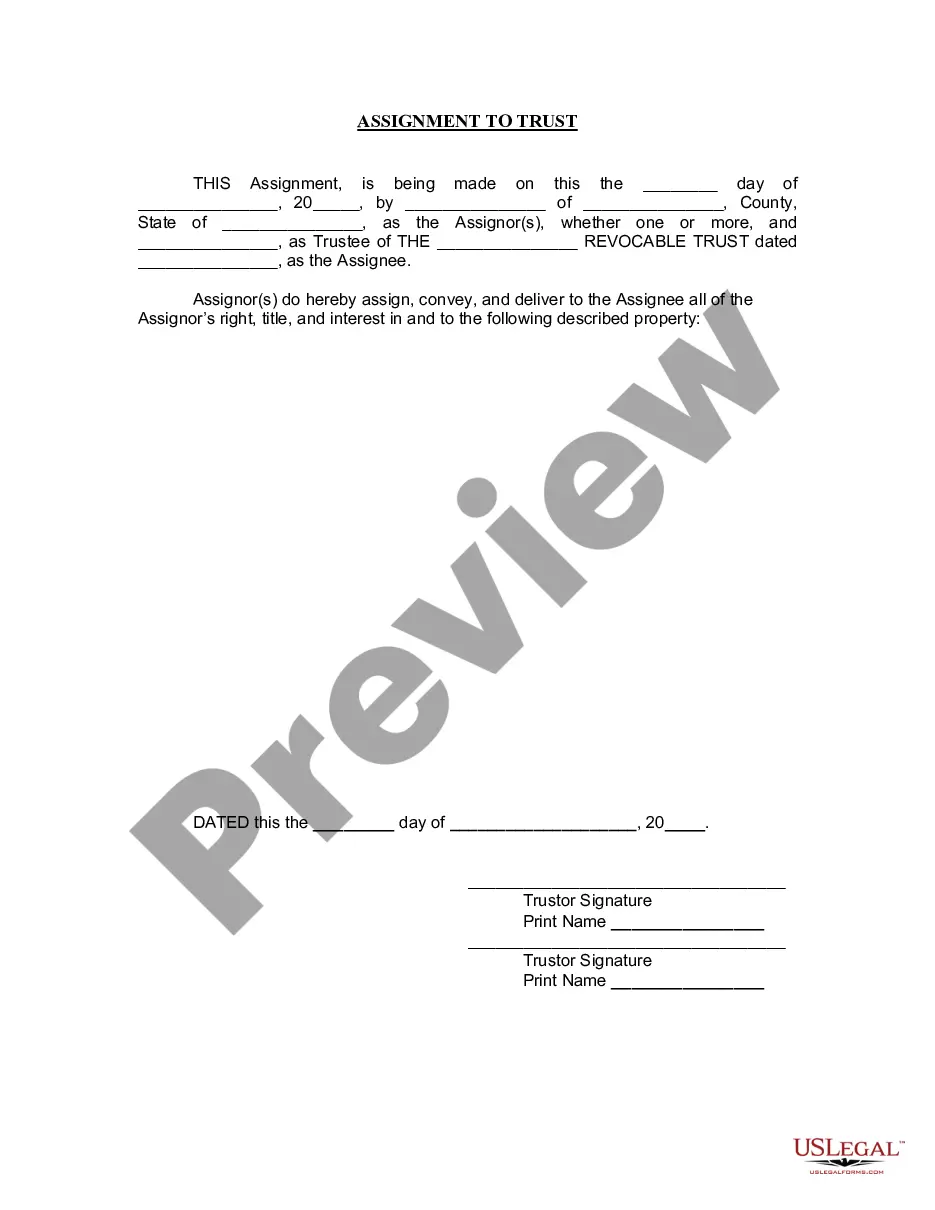

- Select the form’s preview to check it.

- If it is the wrong document, return to the search option to locate the Note Mortgage Sample With Interest template you need.

- Download the file if it aligns with your specifications.

- If you already possess a US Legal Forms account, simply click Log in to retrieve previously saved templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: credit card or PayPal account.

- Select the desired file format and download the Note Mortgage Sample With Interest.

Form popularity

FAQ

To calculate 5% interest on $5,000, you multiply $5,000 by 0.05, resulting in $250. This means that after one year, you would owe $5,250 if no payments were made. Understanding interest calculations like this is essential when dealing with loans or mortgages. For a comprehensive understanding, consider looking at a note mortgage sample with interest that includes similar calculations.

Once you receive your 1098 mortgage interest statement, you should keep it for your records. You will need this document when filing your tax return to claim any mortgage interest deductions. If you're unsure about how to use it, consider consulting a tax professional or using platforms like US Legal Forms for guidance on managing your mortgage documents and understanding your note mortgage sample with interest.

You report a mortgage interest statement on your tax return under the itemized deductions section. This is where you include the information from your 1098 form. Utilizing a note mortgage sample with interest makes it easier to compile this information accurately. Ensure you maintain records of all related documents for a smooth filing process.

You can enter your 1098 mortgage interest statement in the section dedicated to deductions for mortgage interest. TurboTax will guide you through the process, ensuring you provide all necessary details. By using a note mortgage sample with interest, you can prepare your information accurately and avoid potential mistakes. This will help you maximize your tax benefits.

The mortgage promissory note includes the borrower's ?promise to pay? the loan and the consequences should the borrower pay late or miss a payment altogether. It also includes: Amount you're borrowing. Interest rate (if an adjustable-rate mortgage, this is the introductory rate)

Mortgage Note Details The dollar amount of the mortgage loan. The interest rate that borrowers will pay. ... The down payment amount. Whether monthly or bimonthly payments are required. Whether a prepayment penalty is imposed. The penalties for late payments.

The promissory note portion includes: The dollar amount of the mortgage loan. The interest rate that borrowers will pay. ... The down payment amount. Whether monthly or bimonthly payments are required. Whether a prepayment penalty is imposed. The penalties for late payments.1.

The mortgage note is signed by borrowers at the end of the home buying process stating your promise to repay the money you're borrowing from your mortgage lender. This document will list how much you'll pay each month, when you'll make these payments and your mortgage's interest rate.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.