Transfer Trustee Trust Withdrawal

Description

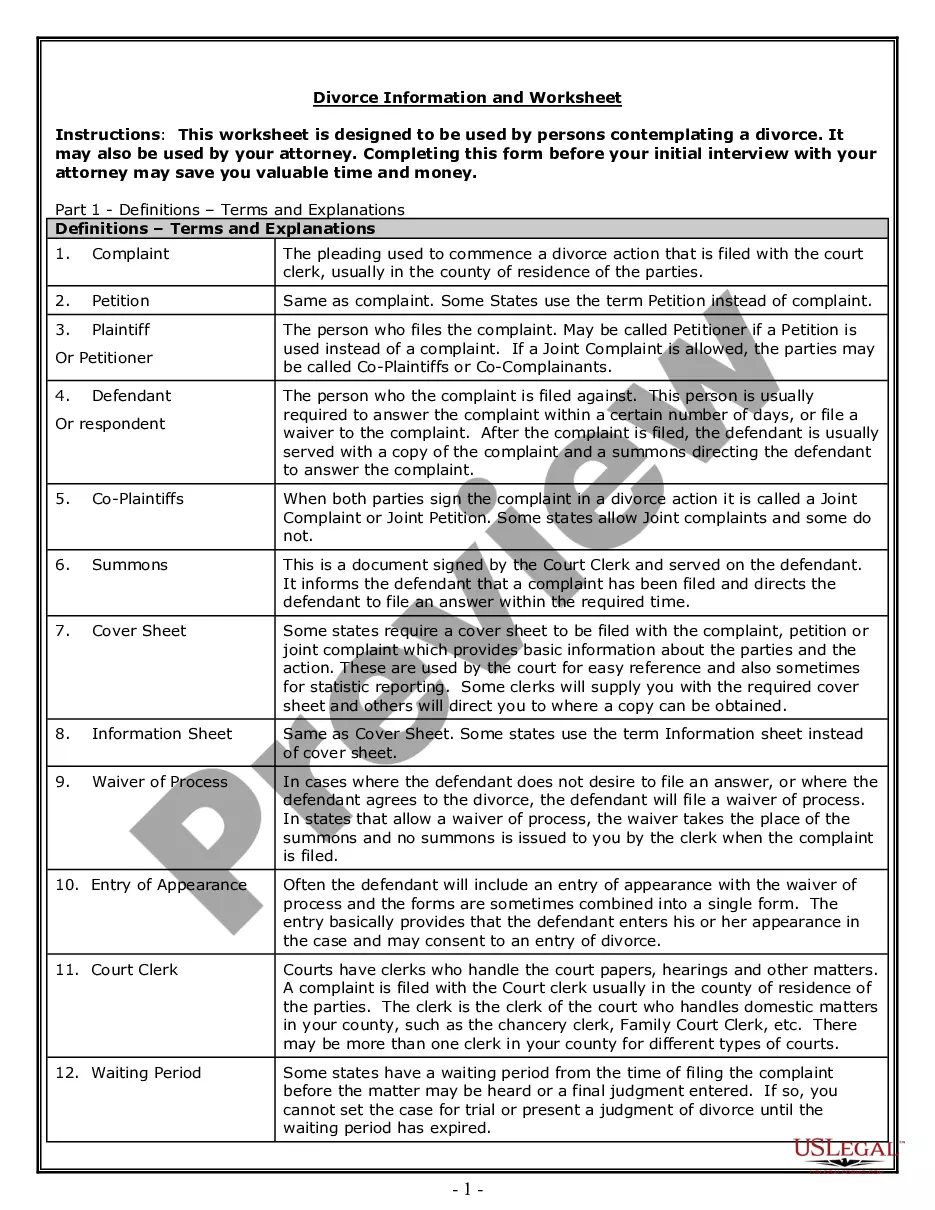

How to fill out Bill Of Transfer To A Trust?

It’s clear that you cannot instantly become a legal authority, nor can you quickly learn to draft a Transfer Trustee Trust Withdrawal without possessing a specific skill set. Compiling legal documents is a lengthy procedure that necessitates specialized training and abilities. Thus, why not entrust the creation of the Transfer Trustee Trust Withdrawal to the experts.

With US Legal Forms, one of the most comprehensive libraries of legal templates, you can access an array of resources ranging from court documents to templates for internal communication. We recognize how crucial compliance and adherence to federal and state laws and guidelines are. That’s why all templates on our site are location-specific and current.

Here’s how you can begin using our website and acquire the document you require in just a few minutes.

You can access your documents again from the My documents tab at any time. If you are a current customer, you can simply Log In and locate and download the template from the same tab.

Regardless of the intent behind your documents—whether it be financial, legal, or personal—our website has you covered. Try US Legal Forms now!

- Locate the document you require by utilizing the search bar at the top of the page.

- Preview it (if this feature is available) and read the accompanying description to determine if the Transfer Trustee Trust Withdrawal matches your needs.

- Initiate your search anew if you require a different template.

- Create a complimentary account and choose a subscription plan to purchase the template.

- Select Buy now. Once the transaction is finalized, you can retrieve the Transfer Trustee Trust Withdrawal, fill it out, print it, and deliver or mail it to the relevant individuals or entities.

Form popularity

FAQ

Yes, a trustee can withdraw funds from a trust, but this action must align with the terms set forth in the trust document. The trustee has a fiduciary duty to act in the best interest of the beneficiaries, ensuring that any transfer trustee trust withdrawal is justified and documented. If you are unsure about the process, using a platform like uslegalforms can provide you with the necessary forms and guidance to facilitate a compliant withdrawal. Always consult the trust agreement to understand the limitations and requirements for withdrawing funds.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust ing to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

With an irrevocable trust, the transfer of assets is permanent. So once the trust is created and assets are transferred, they generally can't be taken out again. You can still act as the trustee but you'd be limited to withdrawing money only on an as-needed basis to cover necessary expenses.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

The trust can pay out a lump sum or percentage of the funds, make incremental payments throughout the years, or even make distributions based on the trustee's assessments. Whatever the grantor decides, their distribution method must be included in the trust agreement drawn up when they first set up the trust.

When a trustee needs to withdraw money to fulfill their duties, they can use the bank account to write checks, withdraw cash, or complete wire transfers. It is imperative to note that trustees are responsible for managing all withdrawals of money from a trust account.