Transfer Trustee Trust For Irrevocable

Description

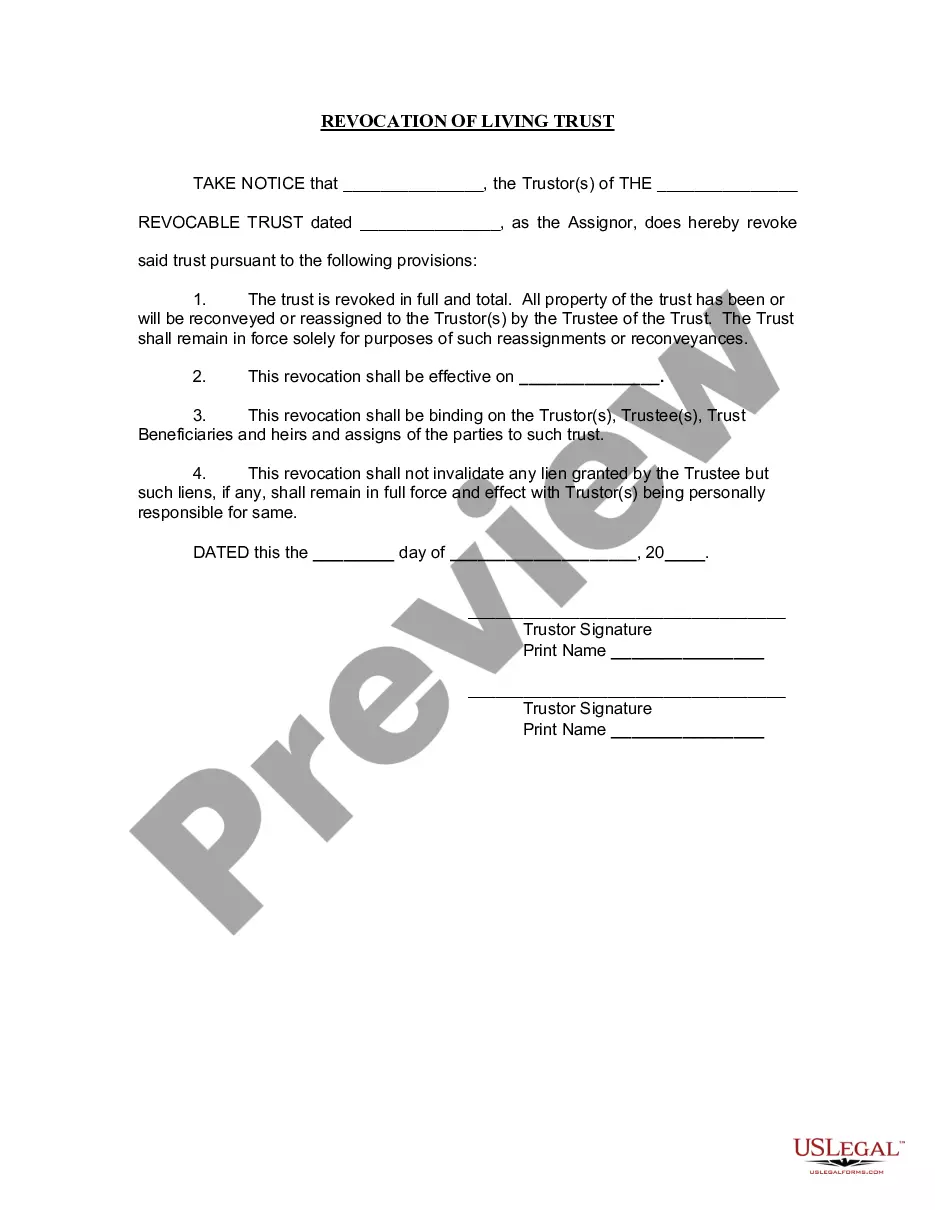

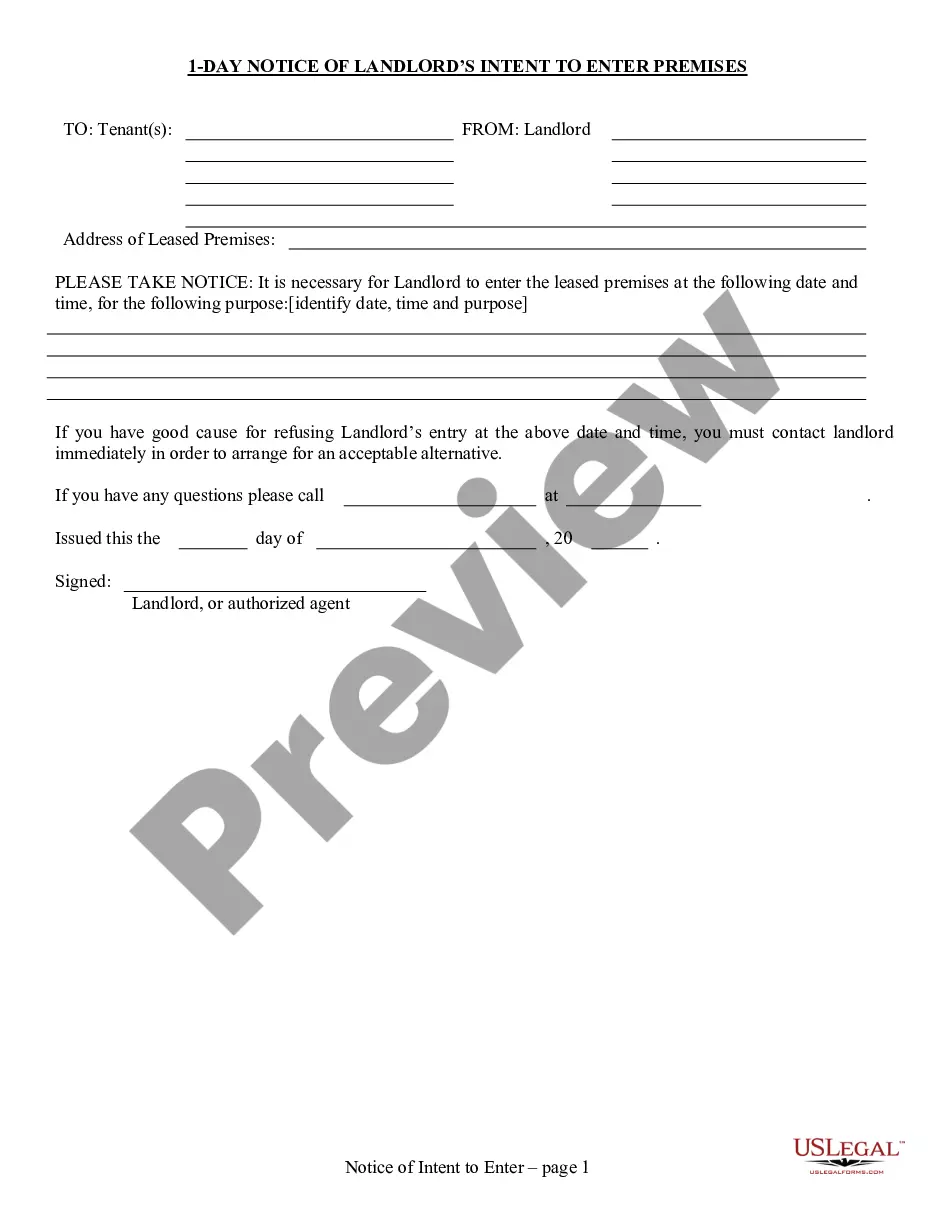

How to fill out Bill Of Transfer To A Trust?

The Transfer Trustee Trust For Irrevocable you observe on this page is a reusable legal framework crafted by expert attorneys in compliance with federal and state statutes and regulations.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal practitioners more than 85,000 validated, state-specific documents for any commercial and personal event. It is the fastest, simplest, and most reliable method to acquire the necessary paperwork, as the service ensures bank-level data protection and anti-malware safeguards.

Use the same document again whenever necessary. Open the My documents tab in your profile to redownload any previously obtained forms. Register for US Legal Forms to have verified legal templates for all of life’s circumstances at your fingertips.

- Explore the document you require and assess it.

- Navigate through the sample you searched for and view it or check the document description to ensure it meets your needs. If it doesn’t, use the search feature to find the right one. Click Buy Now when you pinpoint the template you want.

- Select a pricing plan that fits your needs and create an account. Use PayPal or a credit card for immediate payment. If you already hold an account, Log In and check your subscription to continue.

- Select the format you prefer for your Transfer Trustee Trust For Irrevocable (PDF, DOCX, RTF) and save the document on your device.

- Print out the template to fill it out manually. Alternatively, use an online multifunction PDF editor to quickly and accurately complete and sign your form with an eSignature.

Form popularity

FAQ

Yes, an irrevocable trust can be transferred under certain conditions. While the trust itself cannot be revoked or amended once established, you can transfer the role of the trustee or the assets within the trust. To facilitate this process, you may want to consult with a legal expert to ensure compliance with state laws and the trust's terms. At US Legal Forms, we provide resources and guidance to help you successfully transfer a trustee trust for irrevocable situations.

Yes, a beneficiary can borrow money from an irrevocable trust, but only if the trust document allows for it. Unlike revocable trusts which can be amended or terminated, irrevocable trusts cannot be changed once established or once the original trustee(s) has passed.

Disadvantages of Irrevocable Trusts Fairly Rigid terms: They are not very flexible. Once the terms are established, they can be difficult to change. The Three-Year Rule: If you include life insurance in an irrevocable trust and pass away within three years, the proceeds return to your estate and become taxable.

As the Trustor of a trust, once your trust has become irrevocable, you cannot transfer assets into and out of your trust as you wish. Instead, you will need the permission of each of the beneficiaries in the trust to transfer an asset out of the trust.

The grantor forfeits ownership and authority over the trust and is unable to make any changes or amendments to the terms of the trust without permission from the beneficiary or a court order. A third-party member called a trustee is responsible for managing and overseeing an irrevocable trust.

Irrevocable trust: If a trust is not a grantor trust, it is considered a separate taxpayer. Taxable income retained by the trust is taxed to the trust. Distributed income is taxed to the beneficiary who receives it.