Repossession Order Form For Car

Description

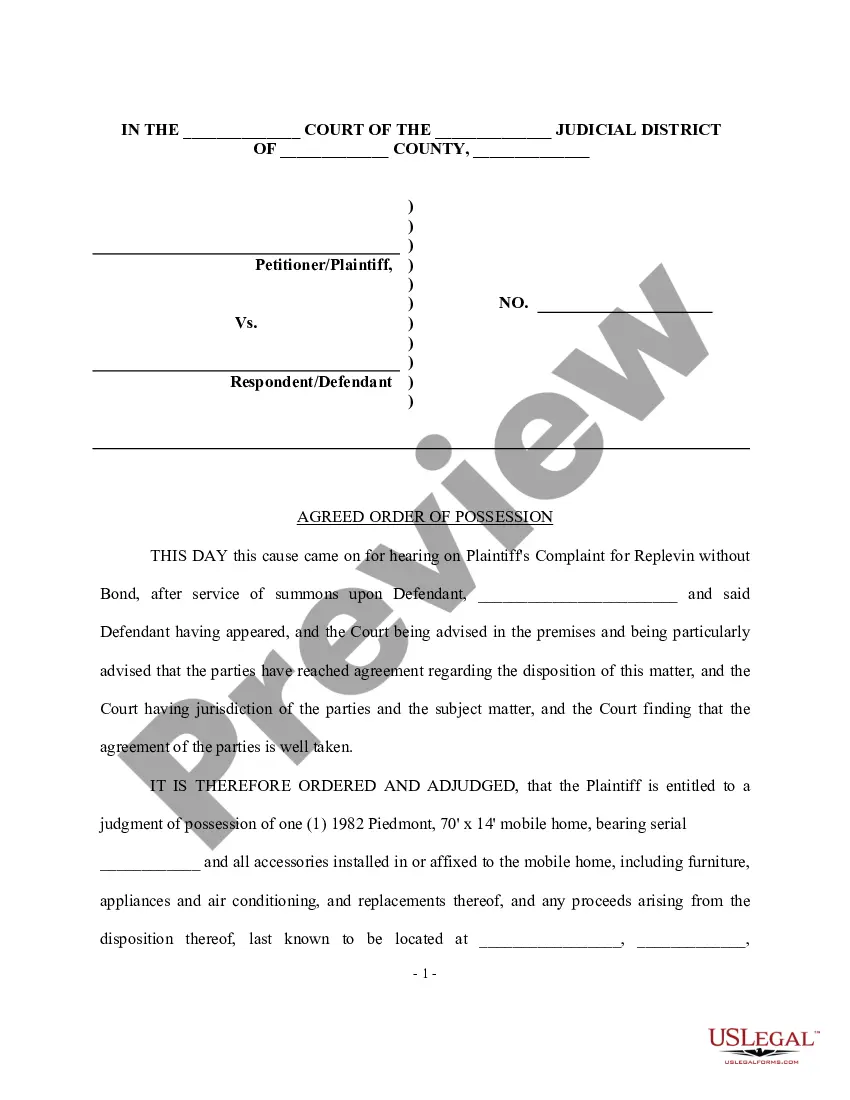

How to fill out Complaint For Replevin Or Repossession Without Bond And Agreed Order?

It's clear that you cannot instantly transform into a legal expert, nor can you swiftly learn how to prepare a Repossession Order Form For Car without a specialized education.

Drafting legal documents is an extensive undertaking that necessitates particular training and expertise.

So why not entrust the creation of the Repossession Order Form For Car to the experts.

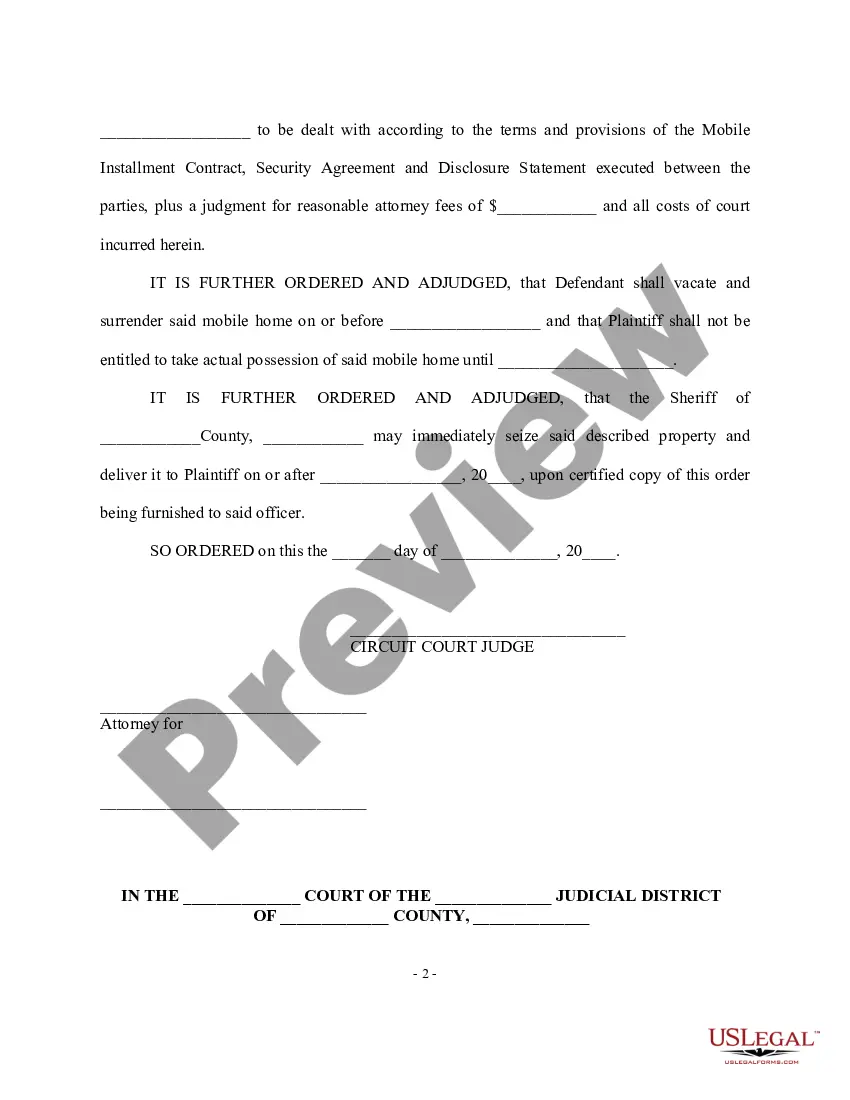

You can access your forms again through the My documents section at any time. If you are a current customer, you can simply Log In and find and download the template from the same section.

Regardless of the reasons for your forms—whether they are financial, legal, or personal—our platform is equipped to assist you. Check out US Legal Forms today!

- Explore the document you require using the search feature located at the top of the page.

- Preview it (if this functionality is available) and review the accompanying description to determine if the Repossession Order Form For Car meets your needs.

- Start your search anew if you require another template.

- Create a complimentary account and choose a subscription option to acquire the template.

- Click Buy now. Once the payment is completed, you can download the Repossession Order Form For Car, complete it, print it, and deliver or mail it to the relevant parties or organizations.

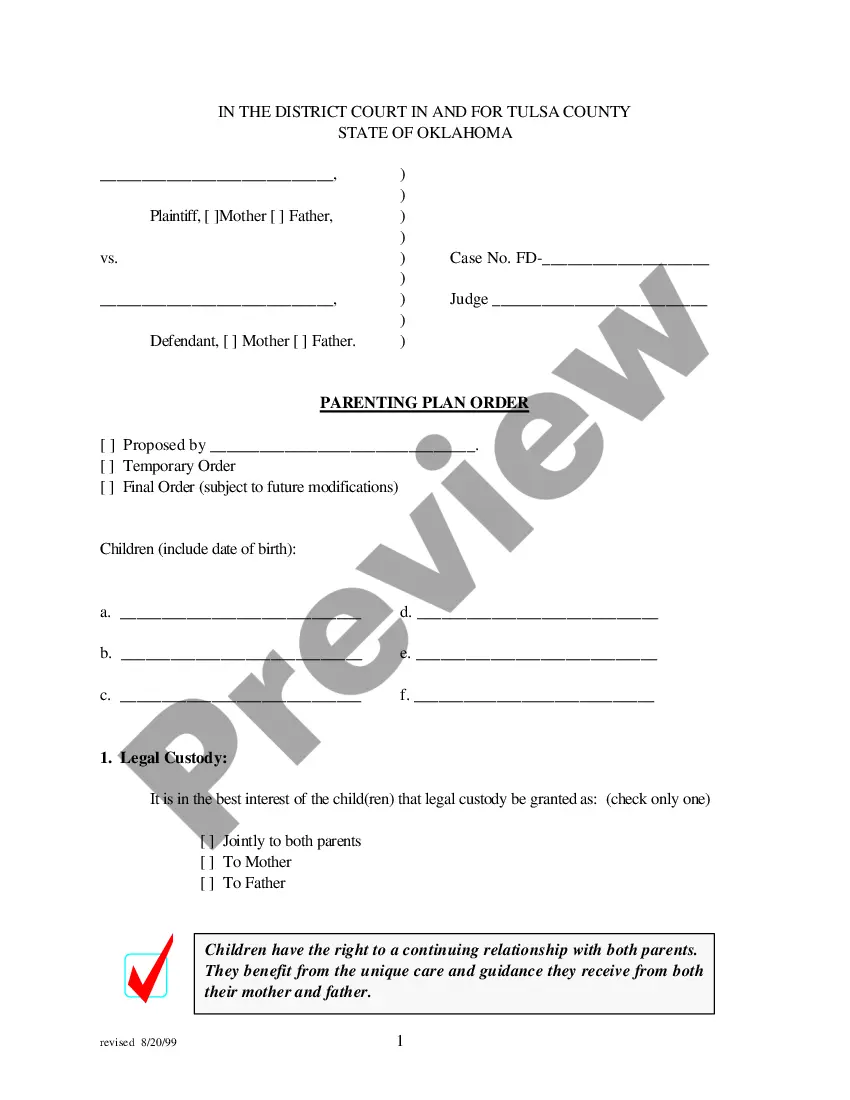

Form popularity

FAQ

However, if you fall behind with hire purchase payments, your car can be repossessed due to breaking the terms of the agreement.

The present rate of repossessions are said to be between 5000 and 7000 per month nationally, between all the banks. Multiply that by 12 months and it equates to the car and finance market losing 60,000 to 84000 clients per year. The problem with most defaulters is that they suffer from ?ostrich syndrome?.

Depending on how big the final payment is, you may find that you will not pay more than a third of the total amount payable before the end of the agreement. This means that if you miss payments, your creditor may be able to repossess the vehicle without getting a court order first.

If you default on your written loan agreement, a creditor can repossess a vehicle or personal property (but not a house or land) without advance notice to you and without filing a lawsuit. This is because your installment loan is secured by the property.

If your car is repossessed, the finance company will generally sell the car and the money goes towards the outstanding debt, but you will still have to make repayments until the entire debt is paid off.