Revocable Trust For Asset Protection

Description

How to fill out Consent To Revocation Of Trust By Beneficiary?

Legal administration can be daunting, even for adept professionals.

If you are looking for a Revocable Trust For Asset Protection and lack the time to dedicate to finding the appropriate and current version, the procedures may be challenging.

Benefit from a valuable resource library of articles, guides, and materials pertinent to your circumstances and needs.

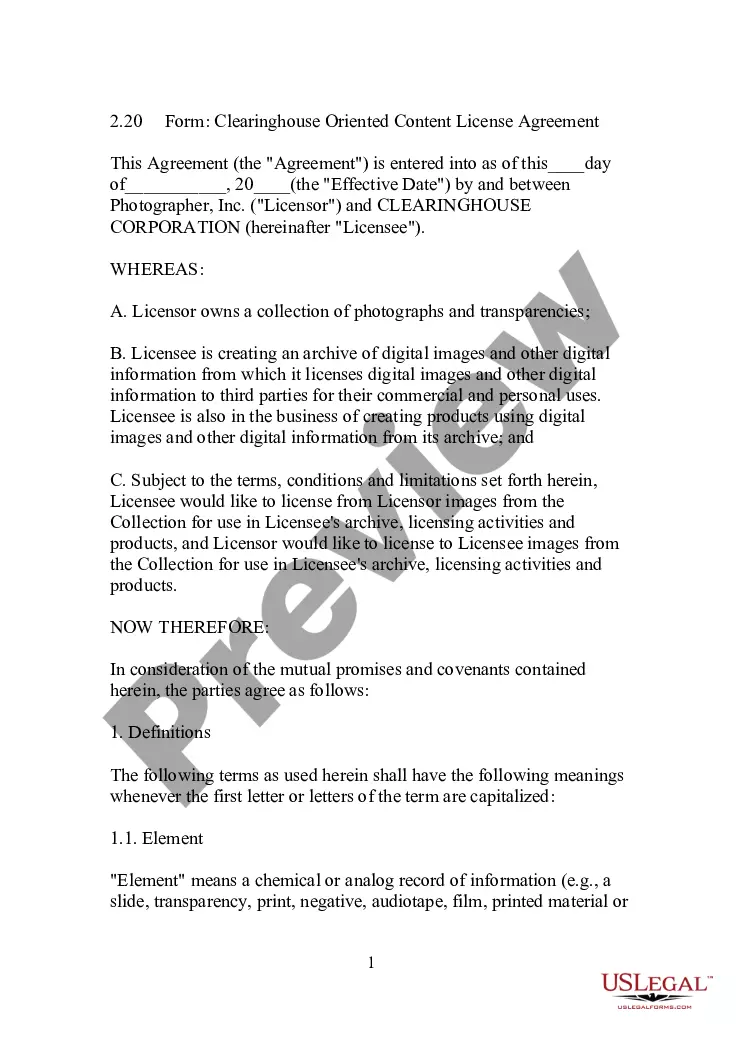

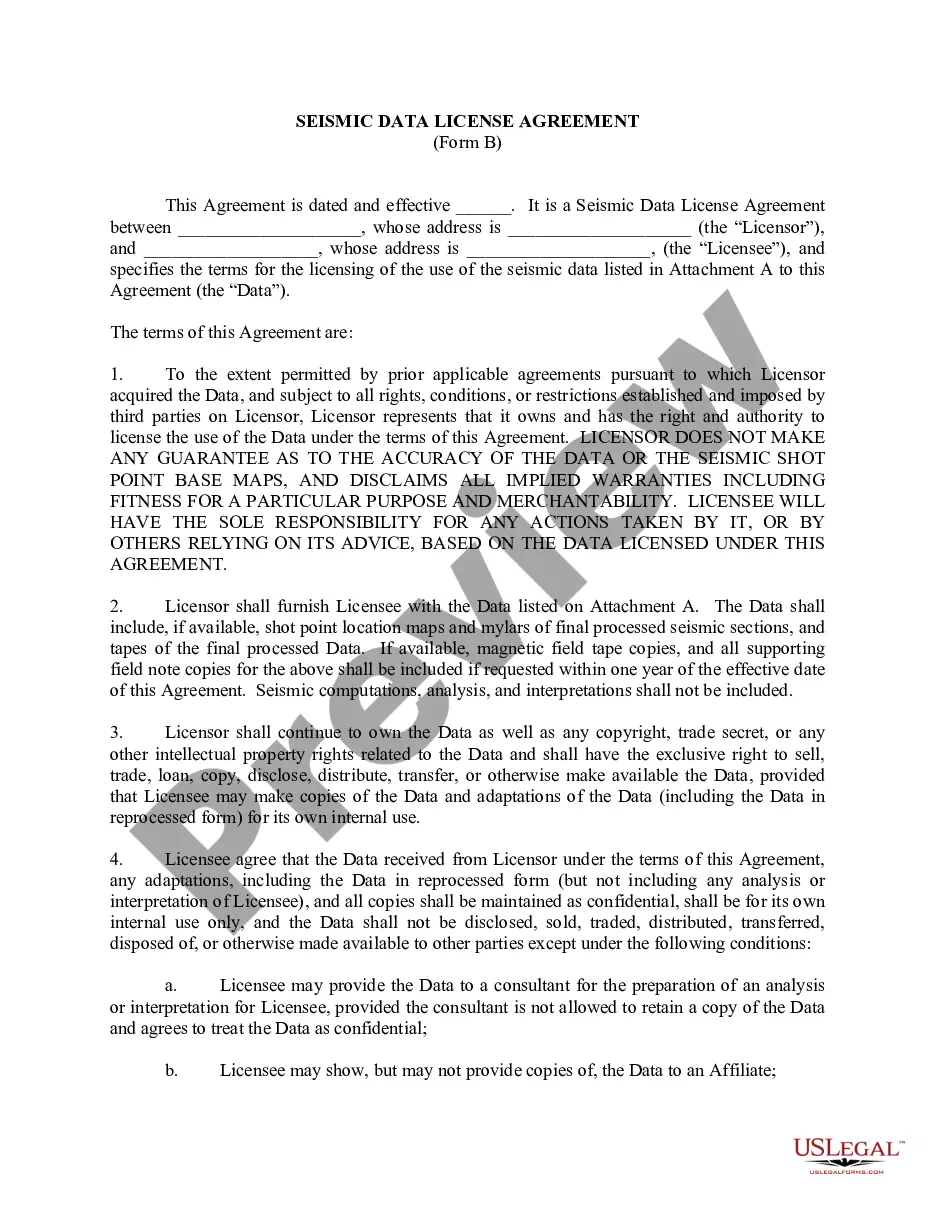

Conserve time and energy sourcing the documents you require, and use US Legal Forms’ enhanced search and Preview feature to find Revocable Trust For Asset Protection and obtain it.

Make sure the template is valid in your state or county, select Buy Now when ready, choose a monthly subscription plan, locate the format you want, and Download, fill it out, sign it, print it, and send your documents. Take advantage of the US Legal Forms online catalogue, supported by 25 years of experience and reliability. Convert your routine document management into a seamless and user-friendly experience today.

- If you possess a subscription, Log In to your US Legal Forms account, locate the form, and download it.

- Visit the My documents section to view documents you have previously acquired and to manage your files as needed.

- If you are a first-time user of US Legal Forms, create a complimentary account and gain unlimited access to all advantages of the library.

- Here are the steps to follow after finding the form you desire.

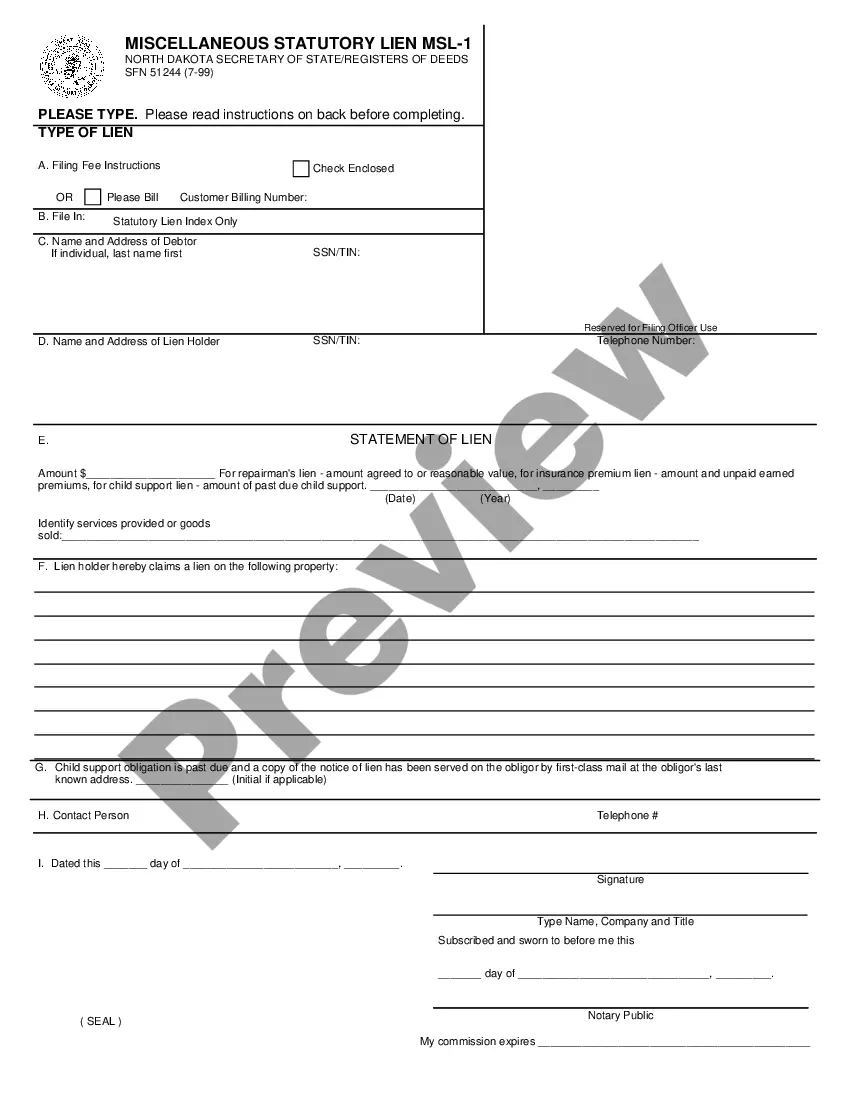

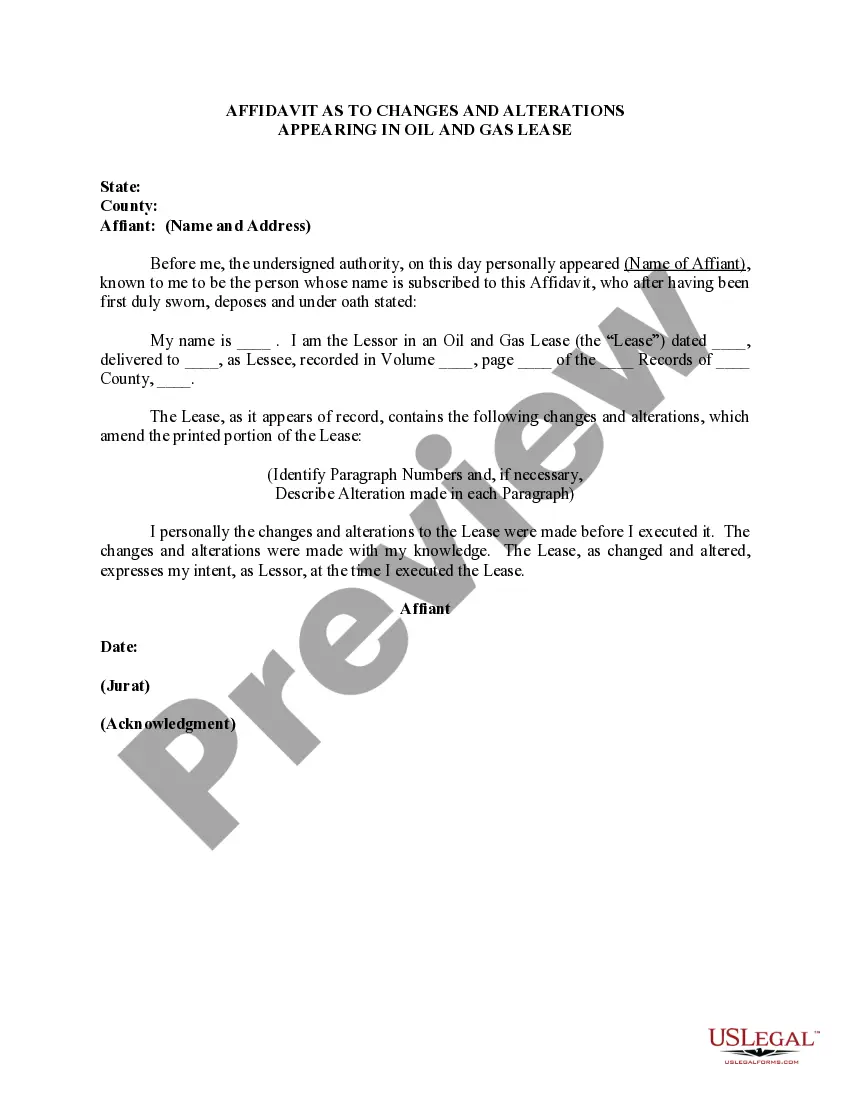

- Confirm that it is the correct document by previewing it and checking its description.

- Access state- or county-specific legal and organizational documents.

- US Legal Forms accommodates all your needs, from personal to corporate paperwork, in one place.

- Utilize sophisticated tools to create and manage your Revocable Trust For Asset Protection.

Form popularity

FAQ

How to set up an asset protection trust Choose a trustee and name the trust beneficiaries. Decide how you want the trustee to manage the assets. Transfer assets into the trust (note that you may need to establish a limited liability company (LLC) before moving over any assets)

The most popular type of trust for asset protection is a self-settled spendthrift trust. This type of trust allows settlors to protect his or her own assets. They may also protect assets which someone will gift to beneficiaries.

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

Irrevocable trusts The assets move out of your estate, and the trust pays its own income tax and files a separate return. This can give you greater protection from creditors and estate taxes.

However, there are other types of trusts that can provide this protection. Put more simply, a revocable living trust is a document that allows individuals to continue to own and control their property while they are alive, then transfer it to whoever they want after they die, all while avoiding probate.