Revocation Trust Notice With The Consent

Description

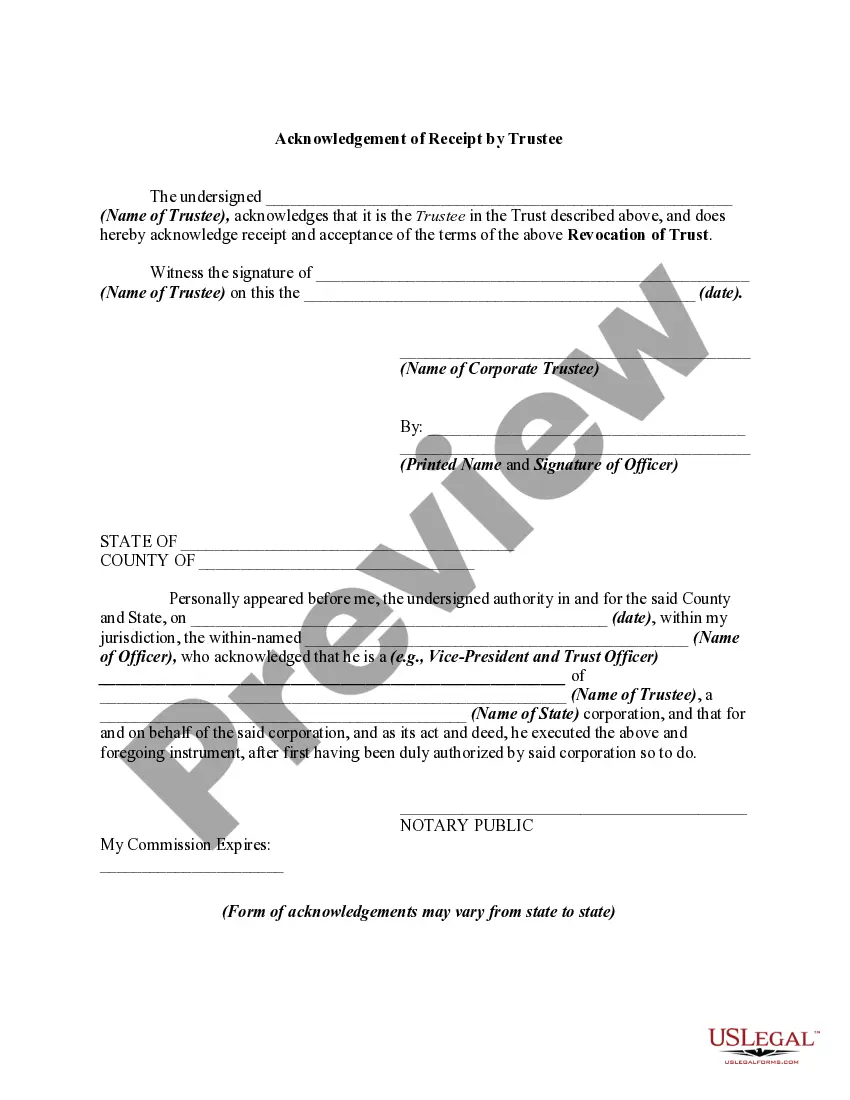

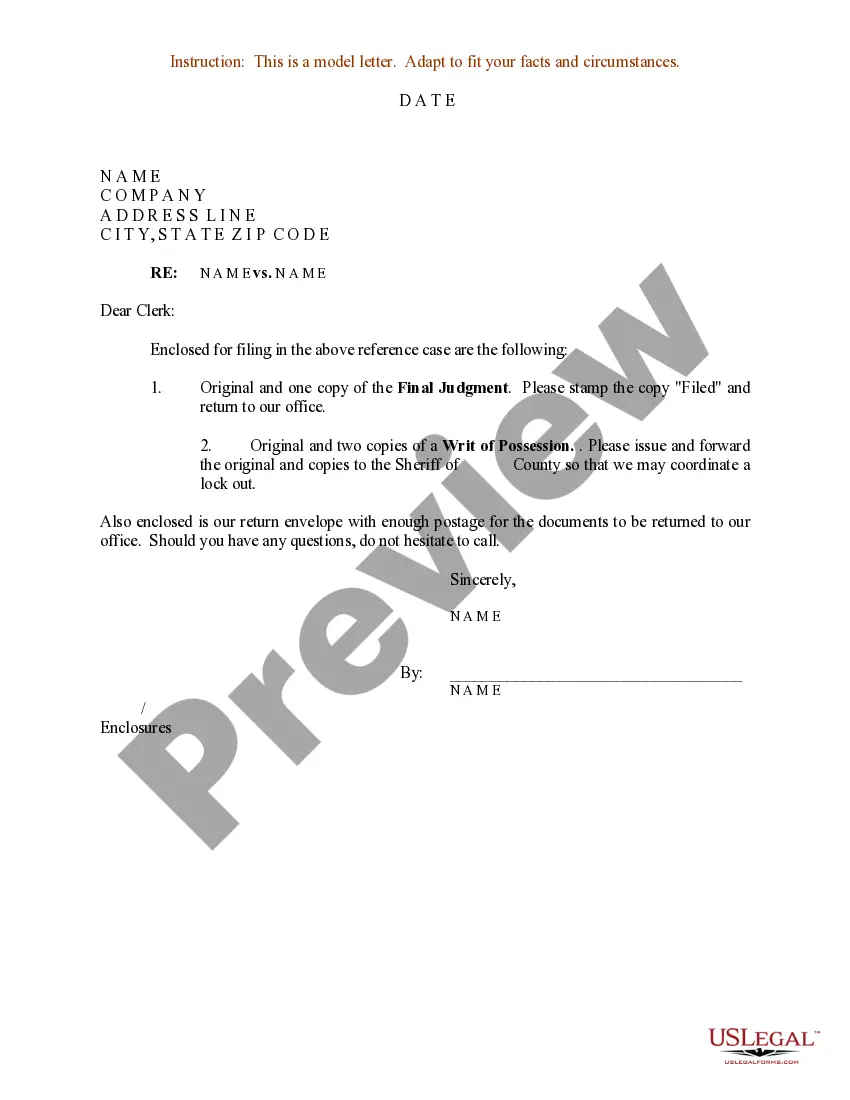

How to fill out Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Revocation By Trustee?

- Log into your US Legal Forms account if you are a returning user. Make sure your subscription is active before downloading your required template.

- If you're a new user, start by exploring the available templates. Verify the form description and ensure it aligns with your state’s legal requirements.

- Utilize the search functionality to find additional templates if necessary. Confirm that your selected document meets your needs before proceeding.

- Select the appropriate subscription plan by clicking on the 'Buy Now' button. Register for an account to access the complete library.

- Complete the payment process using your credit card or PayPal. Ensure the transaction is secure and verify your payment confirmation.

- Download the completed form to your device. You can access it any time from the 'My Forms' section in your profile.

Following this guide will streamline your process in obtaining a revocation trust notice. US Legal Forms offers an extensive library that empowers you with the resources needed to execute your legal documents accurately.

Don't hesitate to explore our platform and take control of your legal documentation today!

Form popularity

FAQ

A revocation clause is a part of the trust document that explicitly states that the trust can be revoked under certain conditions. For example, it might declare that the creator retains the right to revoke or alter the trust at any time with proper documentation, including a revocation trust notice with the consent of all involved parties. Including this clause ensures flexibility and reflects your wishes during your lifetime. It's wise to consult legal resources or professionals when drafting such clauses to ensure compliance with state laws.

Writing up a revocable trust involves several straightforward steps. First, you need to outline your assets and beneficiaries clearly. Next, you draft the trust document, specifying the trust terms, including whom you appoint as trustee. Don’t forget to finalize it with a revocation trust notice with the consent of any involved parties. If you find this process complex, consider using platforms like uslegalforms for guidance and templates that simplify trust creation.

One of the biggest mistakes parents make when setting up a trust fund is failing to communicate their intentions with their heirs. Clear communication helps avoid confusion and ensures that everyone understands how the trust operates and what it entails. Additionally, it's crucial to use a revocation trust notice with the consent of relevant parties if any changes to the trust are needed. Providing this clarity fosters trust among family members and strengthens their understanding of the estate planning process.

A trust revocation occurs when the creator of the trust decides to cancel it. For example, if you established a revocable trust to manage your assets but later changed your mind about how to distribute them, you would issue a revocation trust notice with the consent of any necessary parties. This notice formally ends the trust's authority, allowing you to redirect your assets as you see fit. Employing a clear process ensures that your intentions are met and legally recognized.

Revocation of a trust refers to the formal process of canceling a trust, thus dissolving its terms and transferring assets back to the original owner. This can occur with a revocation trust notice with the consent of involved parties, making the transition smoother. Understanding this process is crucial for anyone managing a trust. Online platforms like UsLegalForms can simplify the necessary documentation and ensure compliance.

A family trust’s main disadvantage lies in its inflexibility after it is established. Once assets are transferred, accessing those assets might require revocation trust notice with the consent, which can be cumbersome. Additionally, you may face ongoing management fees and tax implications that need consideration. Thoroughly researching these aspects will help you determine if a family trust is right for your family.

A nursing home can potentially access the funds in a revocable trust if the assets are not adequately protected. This often occurs if the trust was not established with Medicaid planning in mind. To defend against this, consider understanding how to issue a revocation trust notice with the consent of involved parties to alter your assets accordingly. Consulting legal advice or services like UsLegalForms can be beneficial.

If your parents aim to control their assets and prevent probate, establishing a trust could be advantageous. It can provide clarity and security for their beneficiaries. Engaging in a discussion about their options, including issuing a revocation trust notice with the consent, can facilitate better decision-making. Using platforms like UsLegalForms can simplify the setup process.

The primary downfall of having a trust is the initial effort it takes to create and fund it. This process could require significant legal and administrative work. Additionally, managing a trust may impose ongoing responsibilities like filing taxes or issuing a revocation trust notice with the consent. Understanding these challenges can help you decide if a trust aligns with your financial goals.

In California, notarization is not a strict requirement for a revocation of trust, but it is highly recommended. A notarized document can strengthen the enforceability of the revocation. Therefore, including a revocation trust notice with the consent and getting it notarized can bolster its legal standing.