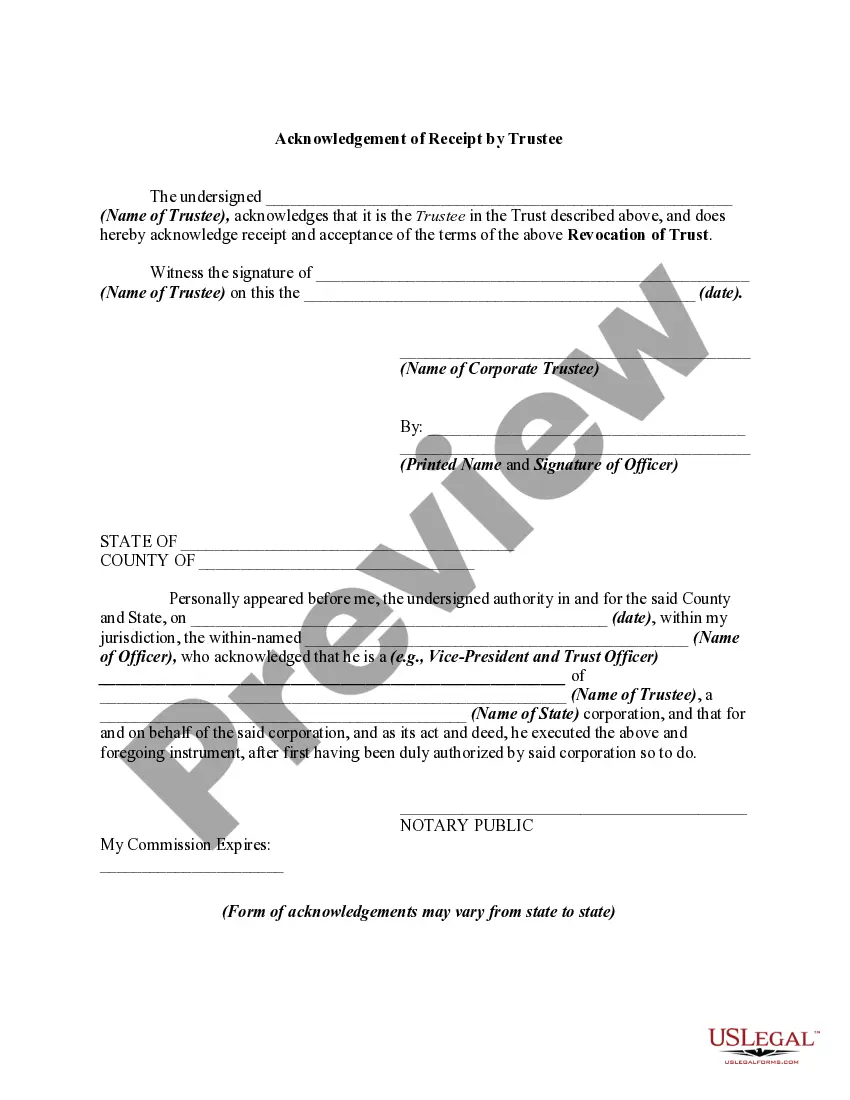

Revocation Acknowledgment Trustee For Charity

Description

How to fill out Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Revocation By Trustee?

- If you have a US Legal Forms account, log in and download your required document by selecting the Download button. Ensure your subscription is active; if not, consider renewing it.

- For first-time users, start by checking the Preview mode and the form description to confirm you've selected the correct form aligned with your local jurisdiction.

- If discrepancies arise, utilize the Search tab above to locate the appropriate document. Proceed only when you find the correct match.

- To buy the document, click on the Buy Now button and choose your desired subscription plan. You will need to create an account for library access.

- Complete your purchase by entering your credit card information or linking your PayPal account for payment.

- Finally, download your form and save it to your device. You can access it anytime in the My Forms menu of your profile.

In summary, obtaining a revocation acknowledgment trustee for charity using US Legal Forms is straightforward and efficient. The platform's robust library of over 85,000 forms ensures that you can find the correct document tailored to your needs.

Take advantage of US Legal Forms today and streamline your legal documentation process with ease!

Form popularity

FAQ

Trustees do not always need to act unanimously unless dictated by the trust document. Some trusts allow majority decisions or independent actions by individual trustees. Understanding these provisions is essential for effective trust management, especially for those engaged with the revocation acknowledgment trustee for charity.

Yes, beneficiaries in Ohio are entitled to a copy of the trust document that governs their interests. This entitlement promotes transparency and aligns with the fiduciary duties of the trustee. When managing a revocation acknowledgment trustee for charity, clear communication about the trust's terms is vital.

In Ohio, trusts are not considered public records unless a court proceedings have occurred. This privacy protects the details of the trust from public scrutiny. However, relevant documentation may be required for the revocation acknowledgment trustee for charity.

Trustees usually need to work collaboratively to fulfill their obligations. Joint action ensures that all decisions are agreed upon, leading to effective trust management. This is particularly important for tasks related to the revocation acknowledgment trustee for charity.

Yes, unfortunately, a trustee can steal from a trust if they misuse their authority. This action is a serious breach of fiduciary duty and can result in legal consequences. When dealing with the revocation acknowledgment trustee for charity, choosing a trustworthy individual as a trustee is crucial.

In Ohio, beneficiaries entitled to trust benefits typically have the right to request a copy of the trust. Trustees must provide this information to ensure transparency and uphold fiduciary responsibilities. This is especially pertinent for those involved with the revocation acknowledgment trustee for charity.

A trust does not have to be registered with the IRS unless it has specific tax obligations. However, the IRS requires certain trusts, such as irrevocable trusts, to obtain a tax identification number. If you're managing a revocation acknowledgment trustee for charity, consider the tax implications of the trust structure.

Although co-trustees generally must act together, some trust documents allow for independent action. It is important to review the trust language to understand any exceptions. This flexibility can be particularly useful when addressing responsibilities related to the revocation acknowledgment trustee for charity.

In Ohio, co-trustees typically need to act jointly unless the trust document specifies otherwise. This requirement ensures that all perspectives are considered when managing the trust. When engaged in actions for the revocation acknowledgment trustee for charity, clear communication among co-trustees is essential.

In Ohio, to terminate a revocable trust, the trustee must follow the instructions in the trust document. If the grantor is still alive, they can revoke the trust by signing a written notice. Understanding these steps is vital for effective management and compliance when considering the revocation acknowledgment trustee for charity.