Assignment Deposit Without Red Flag

Description

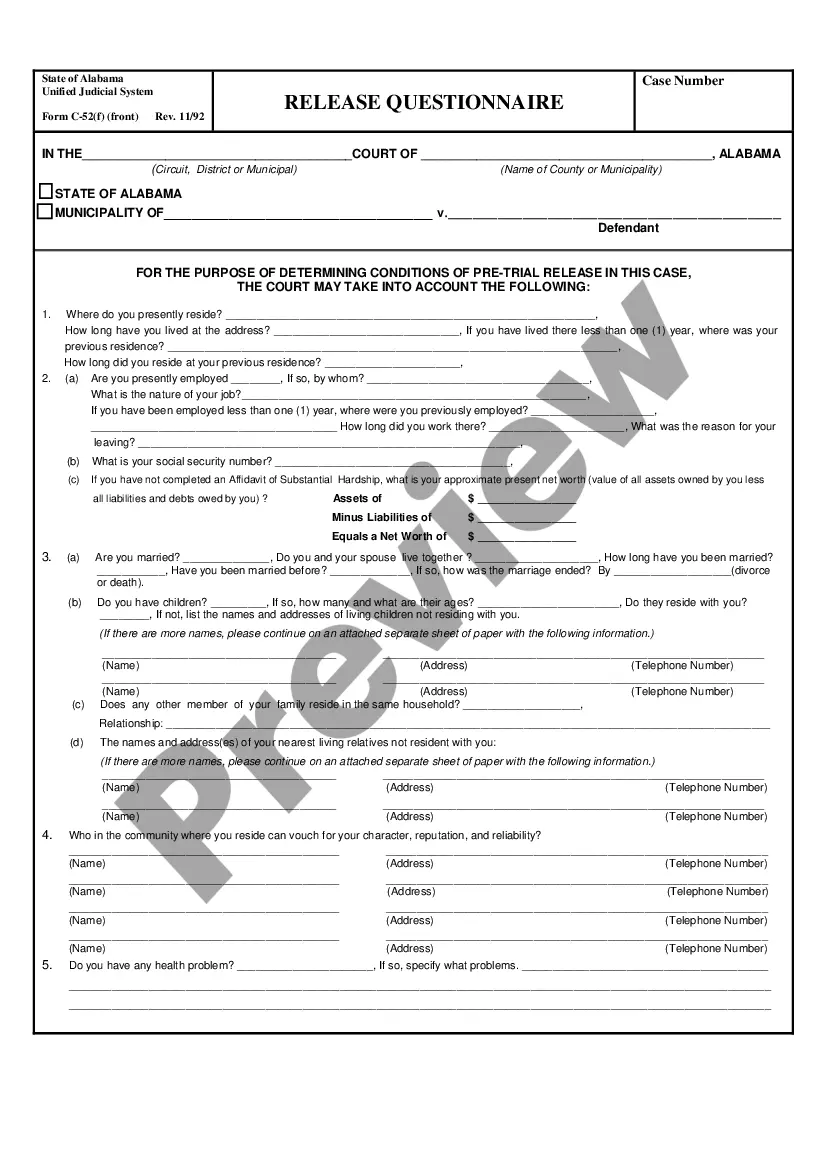

How to fill out Assignment Of Certificate Of Deposit Agreement?

Working with legal papers and procedures might be a time-consuming addition to your day. Assignment Deposit Without Red Flag and forms like it typically need you to search for them and understand how you can complete them correctly. Consequently, regardless if you are taking care of financial, legal, or individual matters, using a comprehensive and hassle-free web catalogue of forms when you need it will significantly help.

US Legal Forms is the number one web platform of legal templates, featuring over 85,000 state-specific forms and a variety of resources to help you complete your papers easily. Explore the catalogue of relevant documents available to you with just a single click.

US Legal Forms provides you with state- and county-specific forms available at any moment for downloading. Protect your papers administration procedures with a top-notch services that allows you to make any form within a few minutes without extra or hidden fees. Just log in to the account, find Assignment Deposit Without Red Flag and download it straight away within the My Forms tab. You may also gain access to formerly saved forms.

Could it be your first time making use of US Legal Forms? Register and set up up an account in a few minutes and you will have access to the form catalogue and Assignment Deposit Without Red Flag. Then, stick to the steps below to complete your form:

- Make sure you have found the right form using the Preview option and reading the form information.

- Choose Buy Now as soon as all set, and select the subscription plan that is right for you.

- Press Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of expertise helping users deal with their legal papers. Find the form you require right now and enhance any operation without having to break a sweat.

Form popularity

FAQ

If you plan to deposit a large amount of cash, it may need to be reported to the government. Banks must report cash deposits totaling more than $10,000. Business owners are also responsible for reporting large cash payments of more than $10,000 to the IRS.

Banks are required to report cash into deposit accounts equal to or in excess of $10,000 within 15 days of acquiring it. The IRS requires banks to do this to prevent illegal activity, like money laundering, and to curtail funds from supporting things like terrorism and drug trafficking.

Financial institutions are required to report cash deposits of $10,000 or more to the Financial Crimes Enforcement Network (FinCEN) in the United States, and also structuring to avoid the $10,000 threshold is also considered suspicious and reportable.

If you plan to deposit a large amount of cash, it may need to be reported to the government. Banks must report cash deposits totaling more than $10,000. Business owners are also responsible for reporting large cash payments of more than $10,000 to the IRS.

Here are some examples of how to explain a cash deposit: Pay stubs or invoices. Report of sale. Copy of marriage license. Signed and dated copy of note for any loan you provided and proof you lent the money. Gift letter signed and dated by the donor and receiver. Letter of explanation from a licensed attorney.