Answer Debt Collector Lawsuit For 2000

Description

How to fill out Answer By Defendant In A Civil Lawsuit Alleging The Affirmative Defense Of Contributory Negligence?

Whether for corporate objectives or personal issues, everyone eventually encounters legal circumstances in their life. Completing legal paperwork necessitates meticulous attention, starting from selecting the right form template.

For instance, if you select an incorrect edition of the Answer Debt Collector Lawsuit For 2000, it will be rejected when you submit it. Thus, it is vital to procure a reliable source of legal forms like US Legal Forms.

- Locate the template you require by utilizing the search bar or browsing the catalog.

- Review the form’s details to ensure it aligns with your case, state, and county.

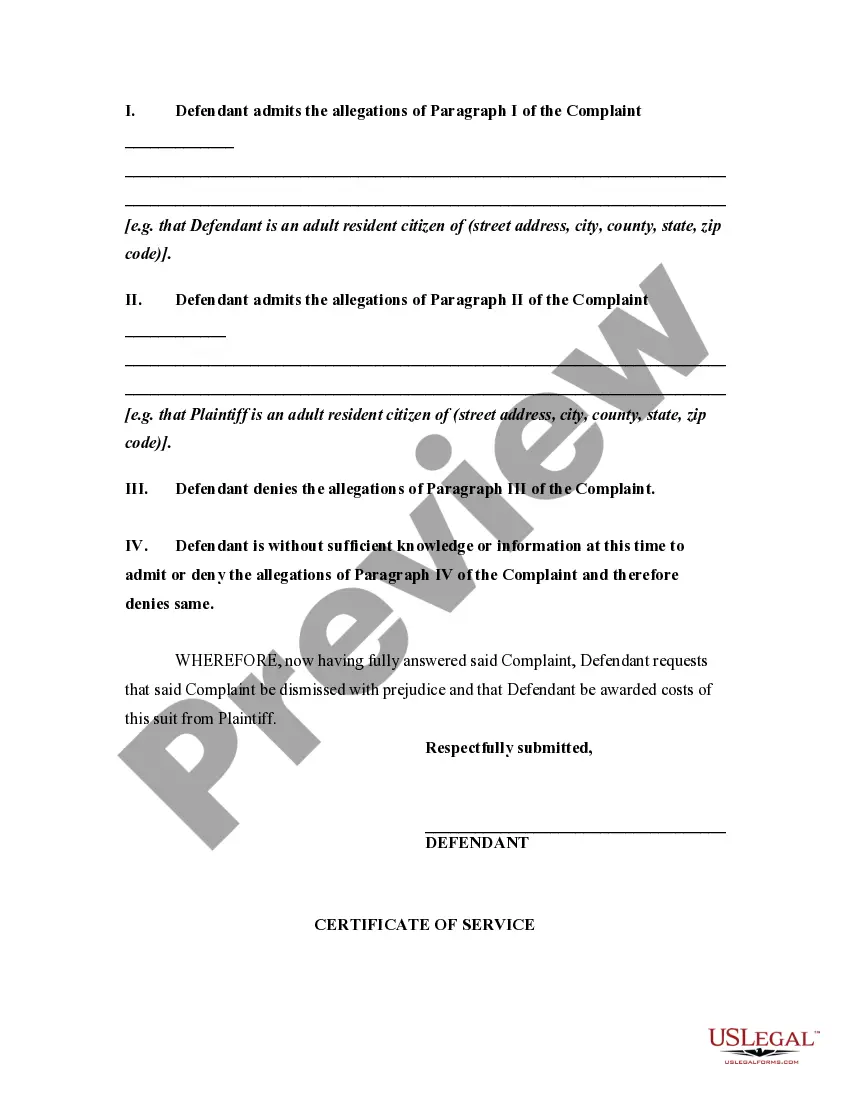

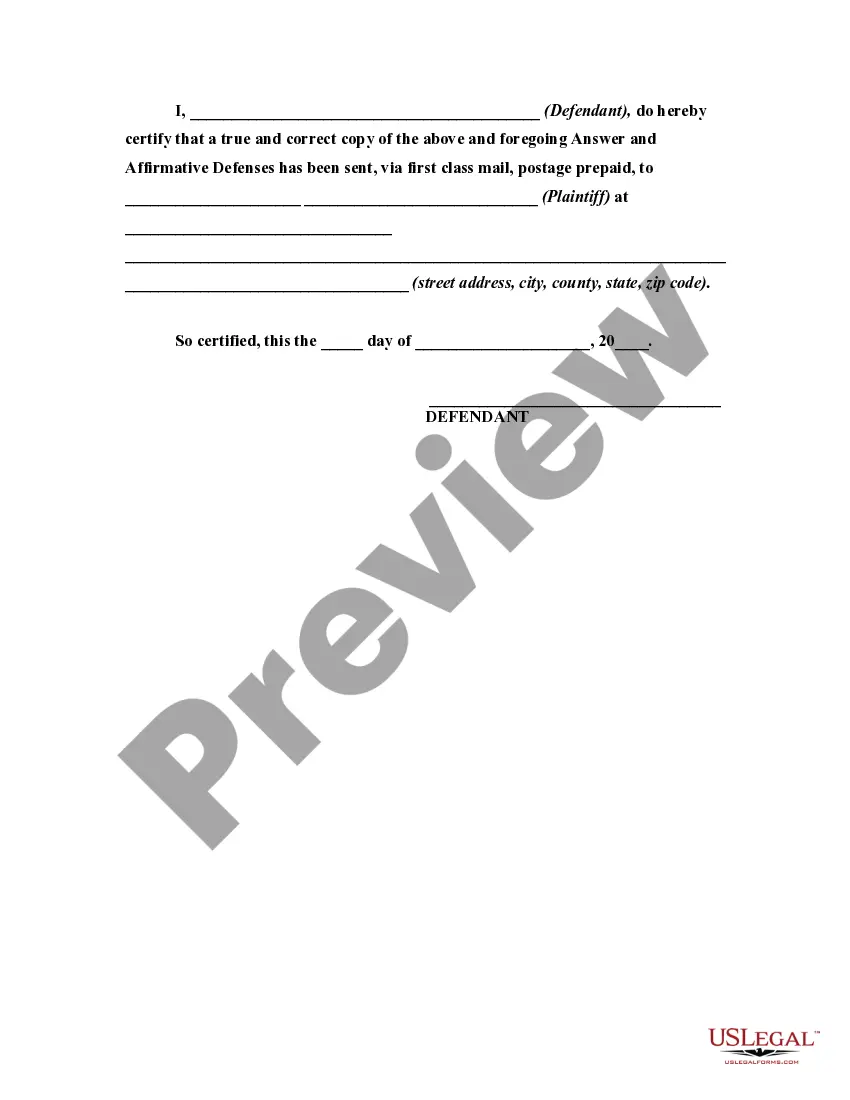

- Select the form’s preview to inspect it.

- If it is the incorrect document, return to the search feature to find the Answer Debt Collector Lawsuit For 2000 template you need.

- Download the file if it meets your specifications.

- If you possess a US Legal Forms account, click Log in to retrieve previously saved documents in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the registration form for the profile.

- Choose your payment method: you can use a credit card or a PayPal account.

- Select the document format you wish and download the Answer Debt Collector Lawsuit For 2000.

- After downloading, you can complete the form using editing software or print it and fill it out manually.

- With an extensive US Legal Forms catalog available, you do not need to waste time searching for the right template online.

- Utilize the library’s straightforward navigation to discover the suitable form for any circumstance.

Form popularity

FAQ

Although the average settlement amounts to 48% of what you originally owed, that number is a bit skewed. If your debts are still with the original creditor, settlement amounts tend to be much higher. You can end up paying up to 80% of what you owe if the debt is still with the original creditor.

Your answer can be a handwritten letter to the court that says you do not agree with the lawsuit. Include your case (cause) number and mailing address and any defenses you may have to the lawsuit; for example, the amount they claim you owe is incorrect, the account isn't yours, or the debt is older than 4 years.

Explain that all debt collection agencies are different, and the amount they will settle for will therefore also differ. Some will only settle for 75-80% of the total amount; others will settle for as a little as 33%.

File the answer with your clerk of courts' office. The summons will have the address and contact information for the clerk of court's office. Mail a copy of your answer on the plaintiff's attorney. You can find name and address for the plaintiff's attorney on the summons.

Dear debt collector: I am responding to your contact about collecting a debt. You contacted me by [phone/mail], on [date] and identified the debt as [any information they gave you about the debt]. You can contact me about this debt, but only in the way I say below.