Letter Of Intent Sample For Internship

Description

How to fill out Letter Of Intent To Sue?

Creating legal documents from the ground up can occasionally be daunting.

Certain circumstances may entail extensive research and considerable expenses.

If you’re seeking a more straightforward and budget-friendly approach to preparing Letter Of Intent Sample For Internship or any other paperwork without unnecessary complications, US Legal Forms is readily available to assist you.

Our online collection of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters.

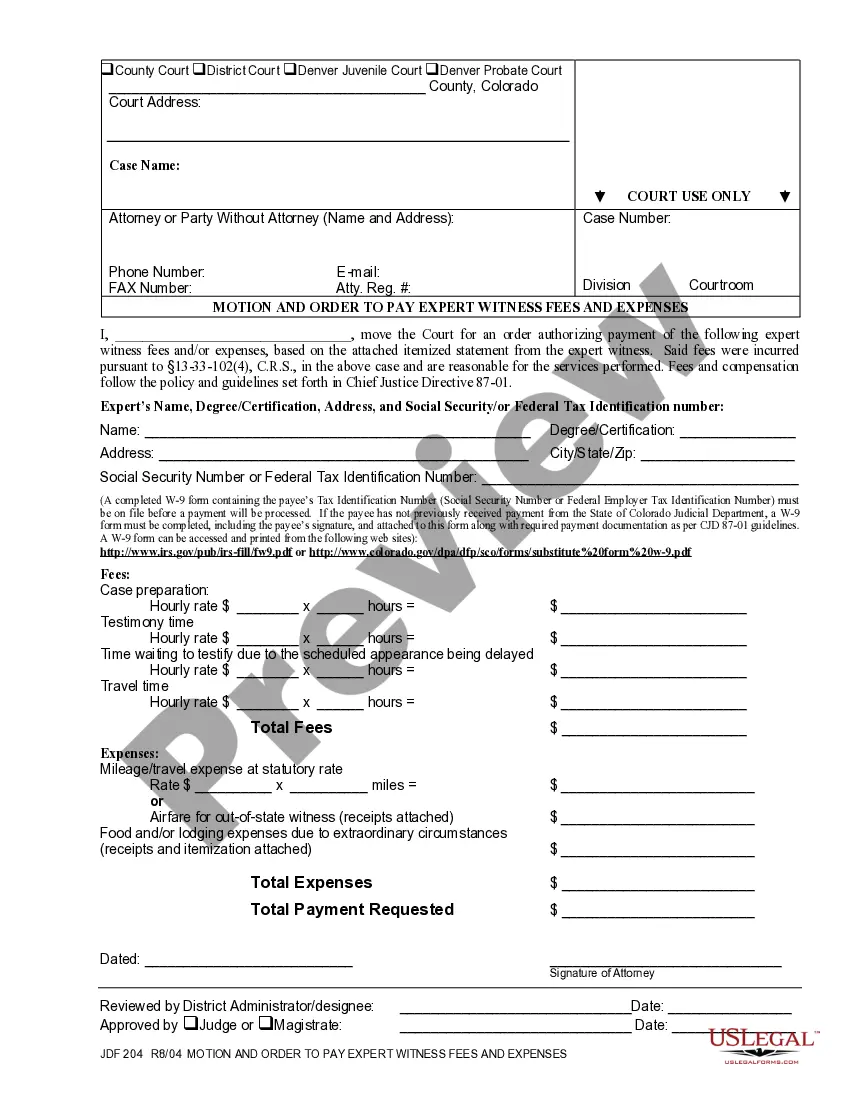

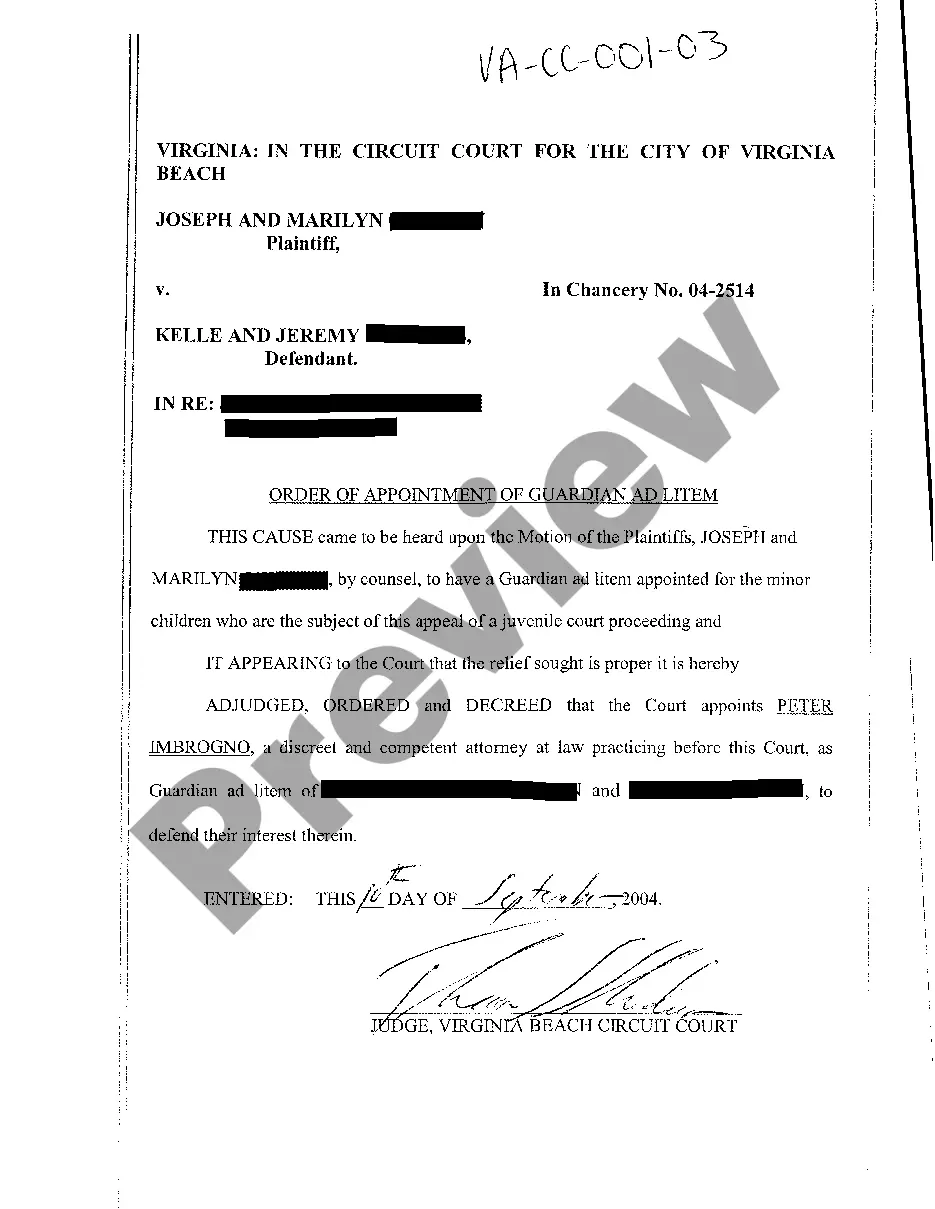

Examine the document preview and descriptions to ensure you have located the correct document.

- With just a few clicks, you can swiftly access state- and county-specific templates meticulously assembled by our legal experts.

- Utilize our platform whenever you require dependable and trustworthy services through which you can conveniently locate and download the Letter Of Intent Sample For Internship.

- If you are already familiar with our services and have set up an account with us before, simply Log In to your account, find the template, and download it or re-download it at any time from the My documents section.

- New to our services? No problem. It only takes minutes to register and browse the catalog.

- Before you proceed to download Letter Of Intent Sample For Internship, consider these recommendations.

Form popularity

FAQ

The Fair Credit Reporting Act (FCRA) mandates that when a business pulls a credit report on someone, they must specify the reason, such as: In conjunction with a loan request. For employment purposes. As part of a credit check by a landlord.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services.

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

A Summary of Your Rights Under the Fair Credit Reporting Act. The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of. information in the files of consumer reporting agencies. There are many types of consumer.

Section 612(f)(1)(A) of the Fair Credit Reporting Act (FCRA) provides that a consumer reporting agency may charge a consumer a reasonable amount for making a disclosure to the consumer pursuant to section 609 of the FCRA.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).