Special Needs Trust Guidelines With The Constitution

Description

How to fill out Trust Agreement - Family Special Needs?

Utilizing legal document examples that comply with federal and state laws is essential, and the web provides numerous choices to select from.

However, what’s the purpose of spending time searching for the suitable Special Needs Trust Guidelines With The Constitution example online if the US Legal Forms online library already assembles such templates in one location.

US Legal Forms is the largest digital legal repository with over 85,000 editable templates crafted by lawyers for any business and personal situation. They are easy to navigate, with all documents categorized by state and intended use. Our specialists keep updated with legal modifications, ensuring your documents are always current and compliant when acquiring a Special Needs Trust Guidelines With The Constitution from our site.

Once you’ve found the correct form, click Buy Now and select a subscription plan. Set up an account or Log In and make a payment using PayPal or a credit card. Choose the best format for your Special Needs Trust Guidelines With The Constitution and download it. All templates you find through US Legal Forms are reusable. To re-download and complete previously acquired forms, access the My documents tab in your profile. Take advantage of the largest and most user-friendly legal documentation service!

- Acquiring a Special Needs Trust Guidelines With The Constitution is straightforward and quick for both existing and new users.

- If you already have an account with an active subscription, Log In and store the document example you need in your desired format.

- If you are unfamiliar with our website, follow the steps below.

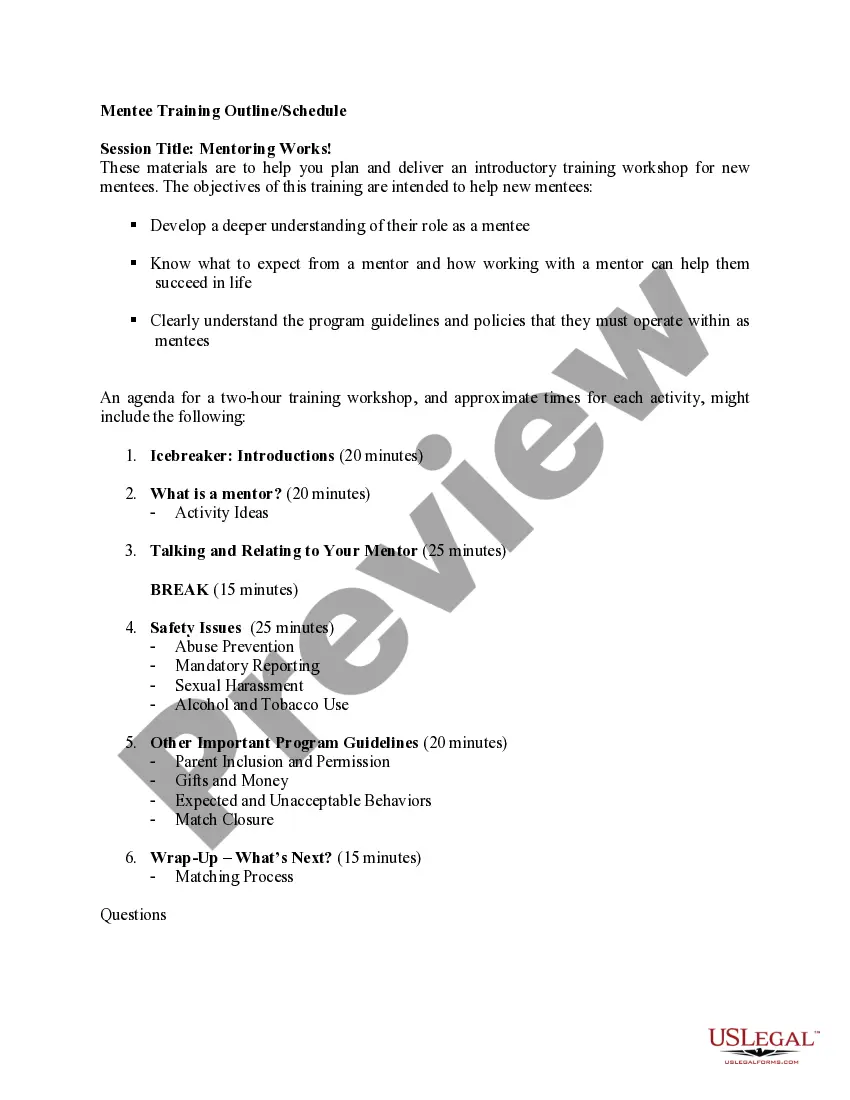

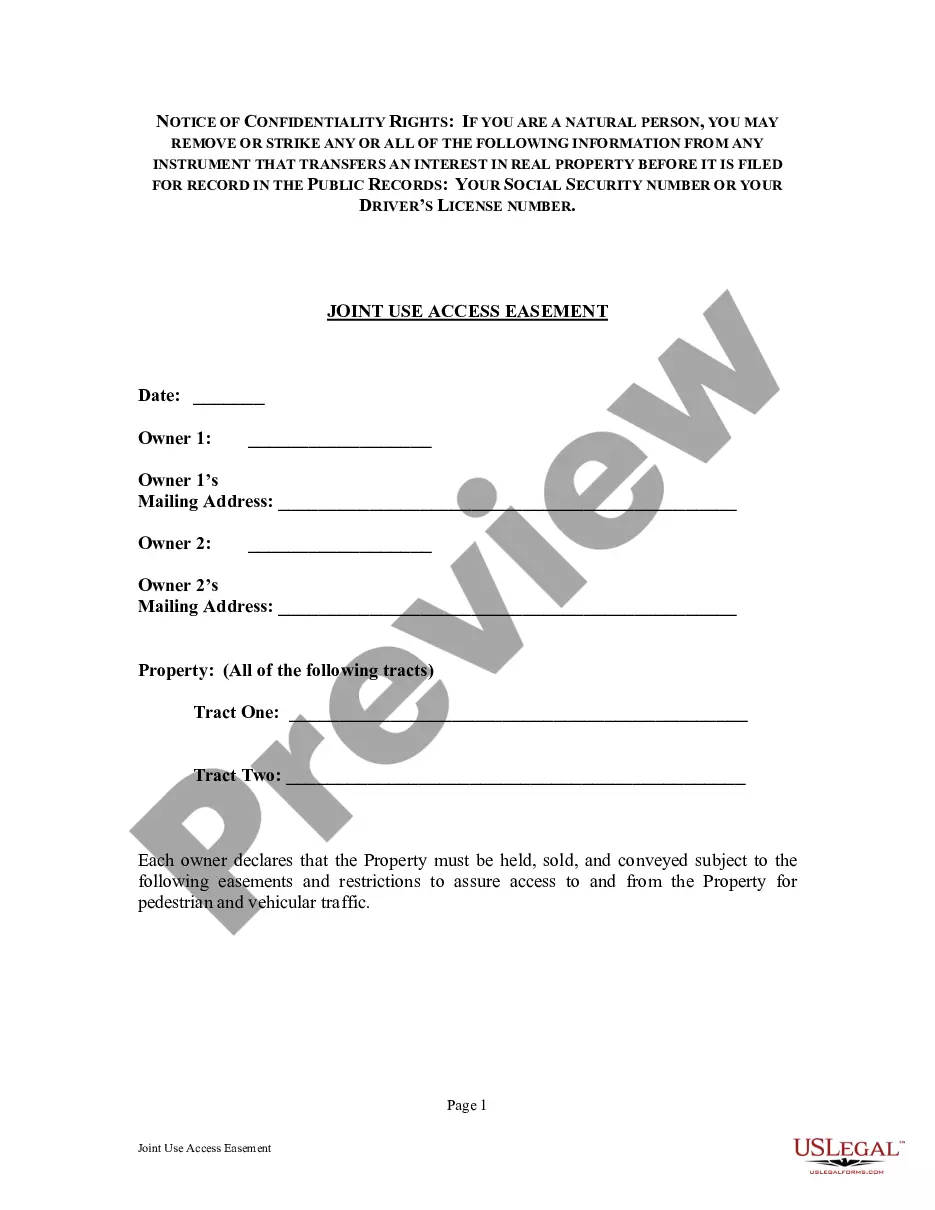

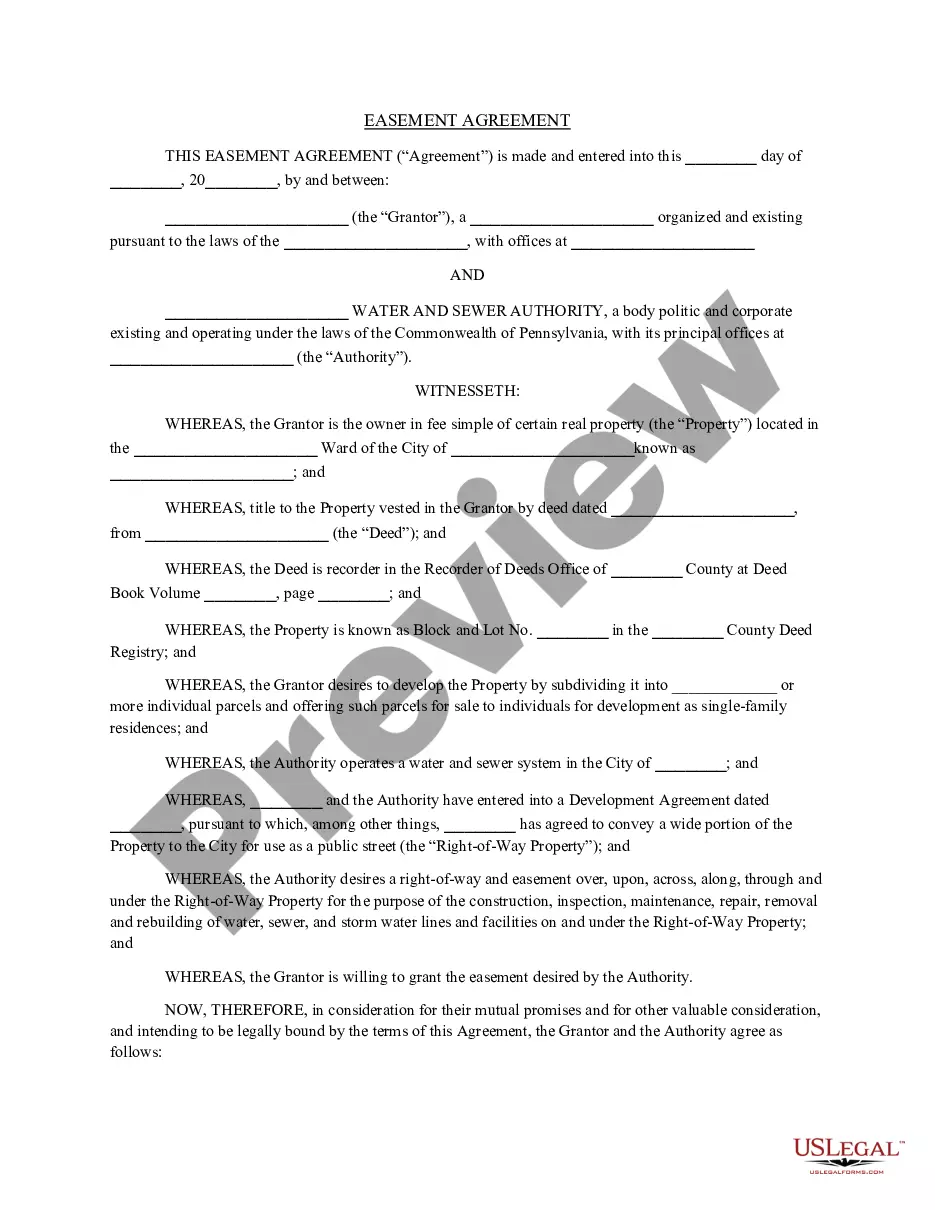

- Review the template using the Preview feature or through the text description to ensure it meets your requirements.

- Search for another example using the search tool at the top of the page if necessary.

Form popularity

FAQ

Creating a special needs trust can be done without legal assistance, but it's highly recommended to seek professional guidance. The special needs trust guidelines with the constitution are intricate, and a misstep can lead to unintended consequences. By working with an expert, you can ensure that the trust is established correctly and serves your loved one’s best interests.

The best trust for a disabled person is often a special needs trust, as it allows for asset management without jeopardizing eligibility for government assistance. This type of trust adheres to special needs trust guidelines with the constitution, ensuring compliance while providing support. It can supplement care and help maintain a better quality of life. Always consult with professionals to determine the most suitable option based on individual circumstances.

To set up a special needs trust, start by gathering essential information about your finances and the needs of the individual with disabilities. Next, consult with a qualified attorney familiar with special needs trust guidelines with the constitution to ensure the trust is correctly established. They will help you draft the trust document and name a trustee who will manage the assets responsibly. This proactive approach ensures that your loved one receives the benefits intended for them.

Setting up a special needs trust typically takes a few weeks, depending on the complexity of your situation. Factors like the details of your assets and your specific needs will influence this timeframe. Working with a qualified attorney can streamline the process, ensuring that your trust meets all special needs trust guidelines with the constitution. Therefore, it is beneficial to start early and discuss your goals thoroughly.

When a beneficiary of a special needs trust turns 65, the trust may still remain in effect, but there may be changes in how funds are distributed and the impact on government benefits. It's crucial to review the trust and local laws to ensure compliance with any new regulations. Knowing the special needs trust guidelines with the constitution can help you make informed decisions that protect the beneficiary's financial future.

The Secure Act 2.0 introduced amendments that further clarify rules regarding retirement plans and trusts, including special needs trusts. This act allows for more flexible strategies in managing inherited accounts tied to beneficiaries with disabilities. By understanding the interplay between the Secure Act 2.0 and special needs trust guidelines with the constitution, you can optimize benefits for your loved ones.

Yes, the Secure Act does apply to certain trusts, including special needs trusts. This law affects how retirement accounts are inherited and distributed, which can impact the financial planning of beneficiaries with disabilities. By staying informed about these special needs trust guidelines with the constitution, you can better navigate the complexities of trust management post-Secure Act.

A special needs trust is designed to protect the assets of a beneficiary without affecting their eligibility for government benefits. However, it imposes restrictions on how funds can be used. For example, the trust cannot provide funds directly for basic needs like food or housing, as this could jeopardize public assistance. Understanding these special needs trust guidelines with the constitution ensures that the trust is set up correctly to maintain benefits.

In a special needs trust, the assets are technically owned by the trust itself, managed by a trustee. The beneficiaries, often individuals with disabilities, receive benefits from the trust without having direct ownership of the assets. This arrangement is crucial as it aligns with the special needs trust guidelines with the constitution, ensuring beneficiaries maintain eligibility for public assistance programs. You can use platforms like uslegalforms to simplify the creation of your special needs trust.

In a unit trust, the legal ownership of assets is held by the trustee on behalf of the beneficiaries. This framework is important because it allows the trustee to manage the assets per the special needs trust guidelines with the constitution. Keep in mind, while beneficiaries benefit from the trust, they do not directly own the assets. This structure helps protect the assets while ensuring they serve their intended purpose.