Charity Download

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active, or renew it if necessary.

- For first-time users, begin by browsing the library. Use the search function to find the charity form that fits your needs and aligns with your local laws.

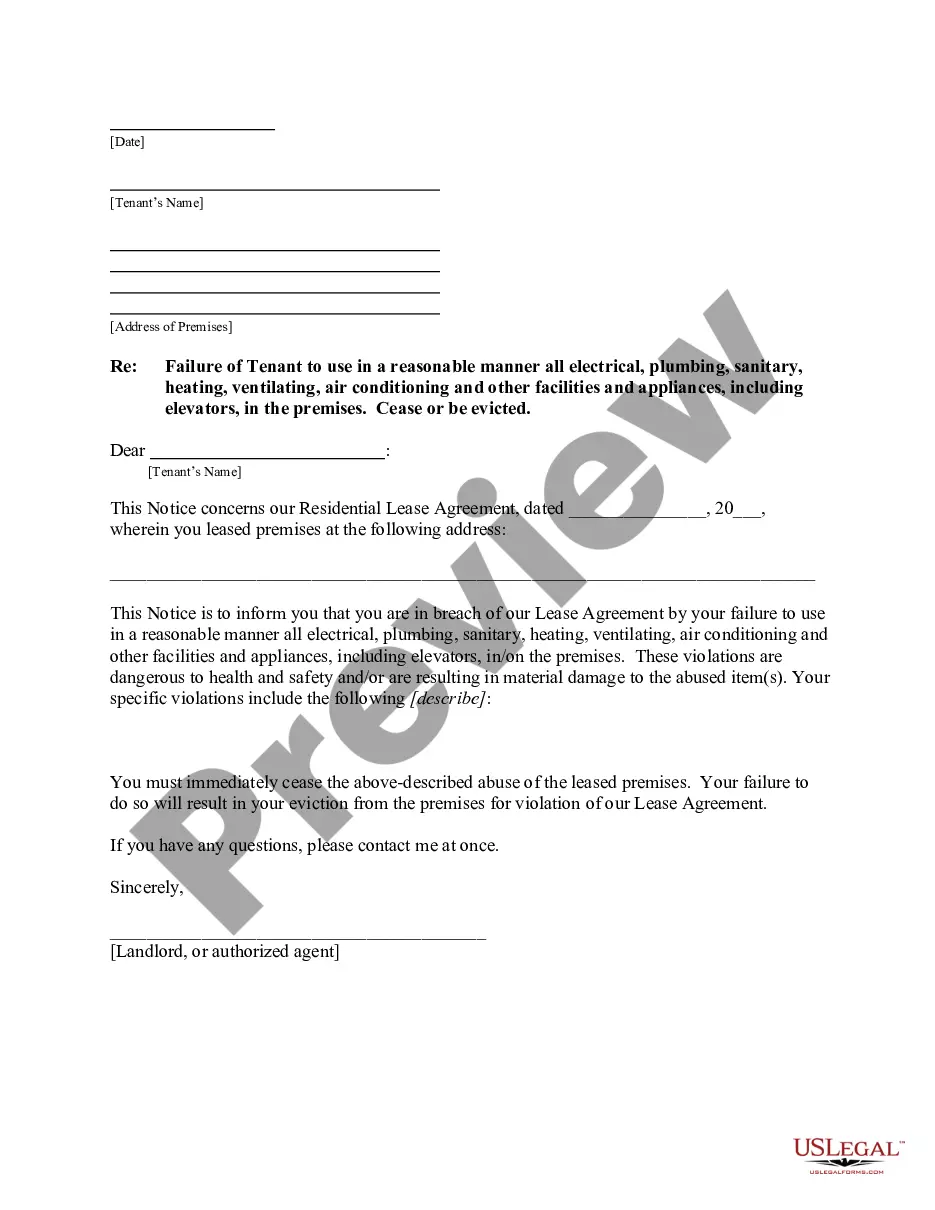

- Review the details and preview mode of the selected form to confirm its suitability.

- If additional forms are needed, utilize the search feature to discover other relevant templates.

- To obtain the document, click the 'Buy Now' button. Choose a suitable subscription plan and create an account to gain library access.

- Finalize your purchase by entering payment information via credit card or PayPal.

- Download the completed form for your records, which can be conveniently accessed anytime from the 'My Forms' section of your profile.

Following these steps guarantees you a robust foundation for executing legal citations with confidence.

Start your journey with US Legal Forms today, and get the most out of your charity download experience!

Form popularity

FAQ

Yes, the IRS requires proof for charitable donations above certain thresholds, typically $250. You need to provide acknowledgment letters, receipts, or bank records as documentation. To keep your records organized, consider using US Legal Forms for templates that help track and justify charitable donations effectively.

If you are required to report income from donations, you may need to use Schedule 1 of Form 1040. This form allows you to disclose any income considered as taxable. To enhance your understanding of donation income reporting, look for resources or charity download options on US Legal Forms, where assistance is readily available.

To claim charity on your taxes, you need to itemize your deductions on Schedule A of Form 1040. Keep accurate records of your donations throughout the year, as this will help maximize your deduction. For a user-friendly charity download experience, visit US Legal Forms to obtain guides and templates that simplify the tax preparation process.

The appropriate form for reporting donations is usually Form 1040, Schedule A for itemized deductions. If your donations exceed certain thresholds, you may also need Form 8283. Utilize US Legal Forms to access the latest forms tailored for charity reporting, ensuring all your submissions are accurate.

You need to provide a written acknowledgment for donations of $250 or more. This acknowledgment should include the date and amount of the donation, as well as a description of any goods or services received in return. For less than $250, a receipt is usually sufficient. Download easy-to-follow templates from US Legal Forms for your charity documentation.

Filling out a W9 as a 501c3 organization is straightforward. Start by providing your organization's name and address in the designated fields. In the tax classification section, select 'Exempt payee' and include your exemption number if applicable. For a comprehensive charity download, you can access templates and guides through US Legal Forms that walk you through the process.

Form 990 must typically be filed electronically for most tax-exempt organizations. The IRS requires electronic filing for certain organizations to improve efficiency and tracking. Our Charity download service simplifies the e-filing process, ensuring you meet all requirements seamlessly. By utilizing trusted platforms, you can ensure compliance while maximizing your organization’s operational effectiveness.

Filing charitable donations involves documenting your contributions and reporting them accurately on your tax returns. You can use our Charity download tool, which provides guidance and forms needed to report these donations. Remember to keep receipts and any required documentation that verifies your donations, as this can support your claims during tax season. Proper filing ensures you receive the potential tax benefits associated with your charitable contributions.

Yes, you can definitely electronically file Form 8283 when you utilize platforms designed for efficiency. Many online services, including our Charity download feature, offer options for electronic submissions. This approach simplifies the process and allows you to expedite your charitable donation reporting. Always confirm that your chosen platform is compliant with IRS regulations.

The approval process for a 501c3 application can vary depending on several factors. Generally, it takes about three to six months after submission to the IRS. However, if you use our Charity download services, you may streamline the application process, which can help reduce delays. Proper preparation and accurate documentation play crucial roles in achieving timely approval.