Charitable Trust Online Withdrawal

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

Managing legal documents can be exasperating, even for the most seasoned professionals.

When you are looking for a Charitable Trust Online Withdrawal and lack the time to search for the correct and current version, the process can become overwhelming.

With US Legal Forms, you can.

Access a valuable resource pool of articles, guides, and materials related to your situation and requirements.

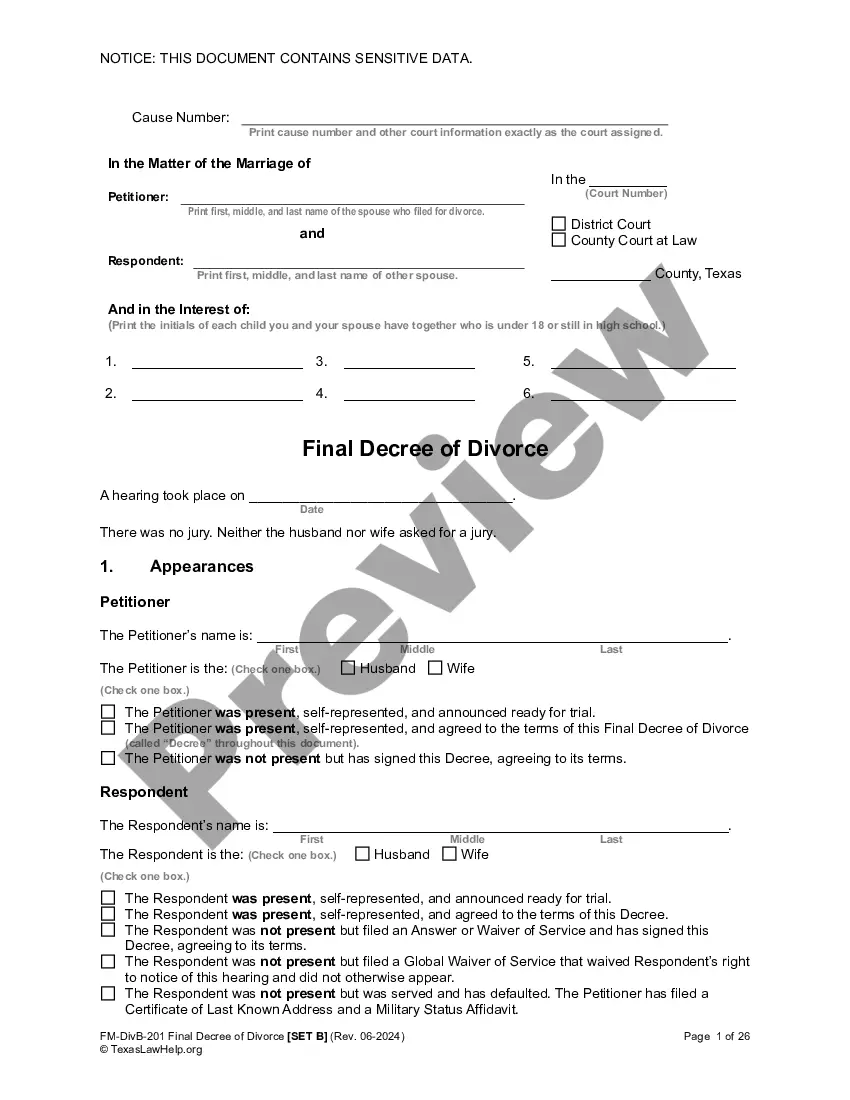

Verify that this is the correct form by previewing it and reviewing its description.

- Save time and effort searching for the documents you need by using US Legal Forms' advanced search and Preview tool to locate and download Charitable Trust Online Withdrawal.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to view the documents you have saved and manage your folders as desired.

- If it’s your first time using US Legal Forms, create an account and gain unlimited access to all the library’s features.

- After downloading your desired form, follow these steps.

- Access a comprehensive online form library that can significantly improve efficiency for anyone dealing with these issues.

- US Legal Forms is a leading provider of online legal documents, offering over 85,000 state-specific forms available at any time.

- Utilize innovative tools to complete and manage your Charitable Trust Online Withdrawal.

Form popularity

FAQ

As of January 1, 2022, all registrants must pay a non-refundable Renewal Fee regardless of total revenue. The Fee Schedule is on the first page of Form RRF-1 & Instructions. It must be paid online using either a checking account (ACH) or credit card at the time of online submission.

Here's a high-level overview of the process: The donor establishes an irrevocable trust, naming a trustee to manage and invest the assets. ... The donor must fund the trust with appreciated assets like cash, publicly traded stocks, real estate, private business interests, or other property.

What Happens if a Charitable Remainder Trust Runs Out of Money? If a Charitable Remainder Trust starts to run out of money during the term when the lead beneficiary is receiving regular payouts, the dollar amount will likely decrease as the principal of the Trust assets shrink.

Every charitable nonprofit corporation, unincorporated association or trustee holding assets for charitable purposes that is required to register with the Attorney General's Office is also required to annually file Form RRF-1, even if the corporation does not file Form 990s annually or is on extended reporting with the ...

Every charitable corporation, unincorporated association, charitable trustee and other legal entities holding property for charitable purposes, must file with the Attorney General an initial registration form and other documents required by law. Initial Registration | State of California - Department of Justice - CA.gov ca.gov ? charities ? initial-reg ca.gov ? charities ? initial-reg