Charitable Remainder Unitrust Living Complete With You

Description

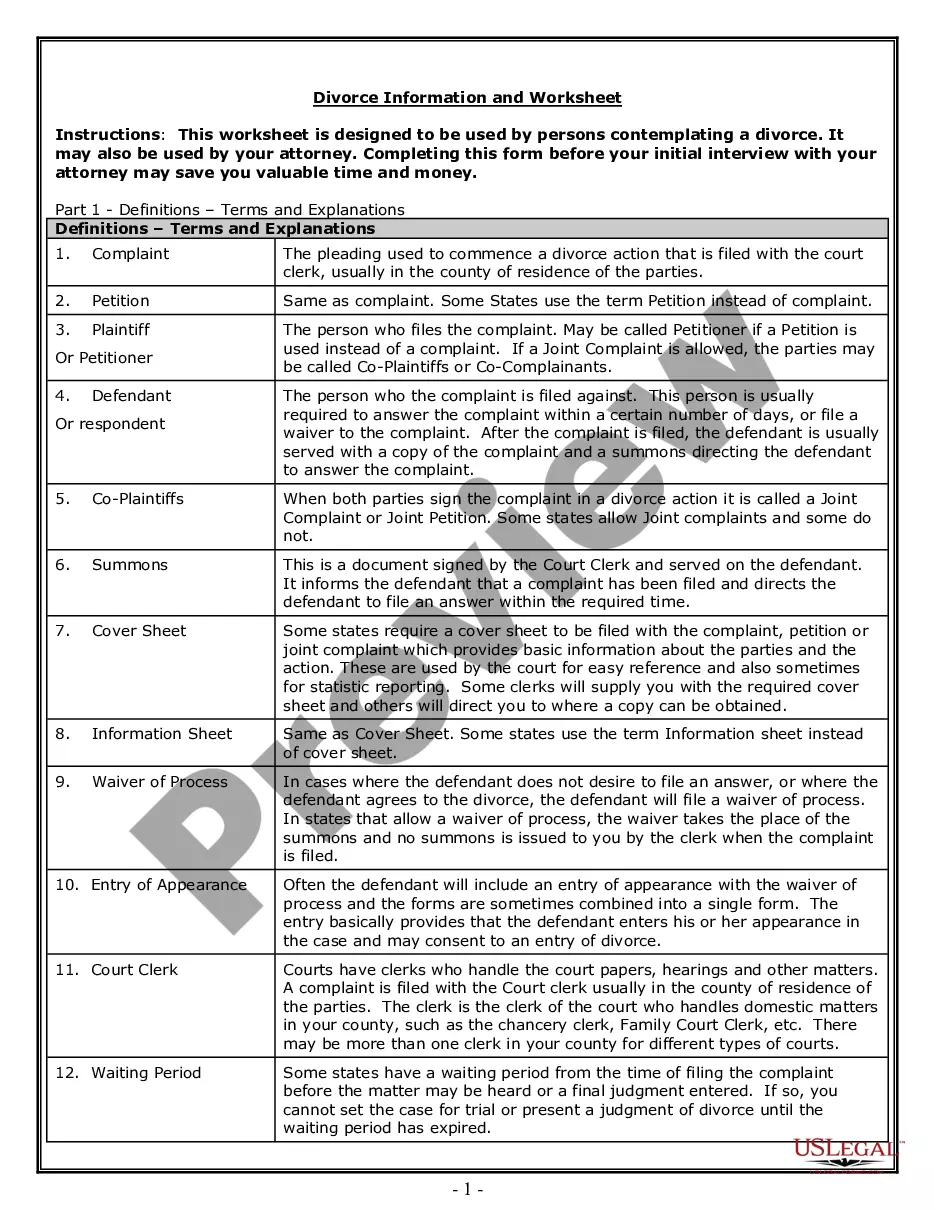

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

- If you’re a returning user, log into your account and check if your subscription is active. Download the required form by selecting the Download button.

- For new users, start by reviewing the Preview mode and form descriptions. Confirm that the form meets your specific needs and aligns with your local jurisdiction.

- If adjustments are necessary, utilize the Search tab to find the correct template. Ensure it meets your criteria before proceeding.

- Purchase the document by selecting the Buy Now button and choosing a subscription plan that fits your requirements. You'll need to create an account.

- Complete your purchase by entering your credit card information or using your PayPal account. This grants you access to our resources.

- Finally, download your form to your device. You can find it anytime in the My Forms section of your profile.

US Legal Forms empowers users to efficiently navigate through legal document processes with its extensive collection of over 85,000 editable forms. Our platform ensures that you have access to the most relevant templates available.

Take control of your legal needs with US Legal Forms today! Start your journey to easily obtain necessary documents.

Form popularity

FAQ

The tax deduction for a charitable remainder trust depends on several factors, including the fair market value of the assets and the income beneficiaries' life expectancy. Generally, you can receive a charitable deduction for the present value of the remainder interest that will go to charity. By utilizing a charitable remainder unitrust living complete with you, you can often maximize your tax benefits while supporting your chosen charitable organization. Consulting with tax professionals or platforms like US Legal Forms can help you navigate this aspect efficiently.

The 5% rule for charitable remainder trusts mandates that the trust must distribute at least 5% of its fair market value to beneficiaries every year. This requirement helps ensure that the trust provides a reasonable income while still fulfilling charitable commitments. Thus, maintaining a charitable remainder unitrust living complete with you not only supports your financial planning but also and encourages gifting to charity. By understanding this rule, you can enhance the trust's effectiveness in meeting your financial and philanthropic goals.

The 5 by 5 rule refers to a provision that allows beneficiaries to withdraw an amount up to the greater of 5% of the trust's value or $5,000 each year from a Crummey trust. This rule is significant because it permits flexibility while still ensuring the trust meets gift tax exclusions. Implementing this rule can help optimize your charitable remainder unitrust living complete with you, allowing your beneficiaries access to funds in a manner that abides by IRS regulations.

You can manage your own charitable remainder trust, but ensure you comply with all regulatory requirements and operational guidelines. While managing it yourself gives you control, it's essential to be well-informed about potential obligations and tax implications. A charitable remainder unitrust living complete with you can be effectively managed through platforms like US Legal Forms, which provide resources and templates for proper management. This ensures that both your trust and charitable intent are respected.

To establish a charitable remainder unitrust, specific requirements must be met, including a minimum charitable benefit of 10% and the must-have a valid trust agreement. The trusts must distribute at least 5% of its assets to the income beneficiaries annually. These requirements ensure that the trust fulfills both charitable intentions and provides income to you or your beneficiaries. A charitable remainder unitrust living complete with you can effectively align financial goals with philanthropic aspirations.

The 5 and 5 rule allows a beneficiary of a charitable remainder unitrust to withdraw up to 5% of the trust’s value each year. However, if the beneficiary does not use this amount in any year, they may carry it over to withdraw an additional 5% the following year. This flexibility can be very beneficial for managing funds while ensuring charitable giving remains intact. Understanding this rule can help you maximize the benefits of a charitable remainder unitrust living complete with you.

In a charitable remainder unitrust living complete with you, the income you can withdraw typically depends on the trust's annual payout rate, which must be at least 5% of the value of the trust assets. This income can provide financial support during your lifetime while simultaneously benefiting charitable organizations. Utilizing a platform like US Legal Forms can help you navigate the complexities and manage your trust effectively.

The 5 rule for charitable remainder trust closely aligns with the 5% requirement, both aiming to standardize the income distribution from the trust. It indicates that the trust must provide a fixed percentage of its assets, enhancing long-term financial planning. Understanding this rule is crucial for maximizing benefits, and professional services like those offered by US Legal Forms can help in compliance.

To set up a charitable remainder unitrust living complete with you, start by defining your charitable intentions and financial goals. Next, you will need to draft a trust document that outlines the terms and conditions of the trust. You may consider working with a legal professional or a service like US Legal Forms to ensure compliance with all regulations and proper execution.

Choosing between a charitable remainder annuity trust (CRAT) and a charitable remainder unitrust (CRUT) depends on your financial goals. A CRAT provides a fixed annual amount to beneficiaries, whereas a CRUT offers variable income based on the trust’s value, which can change annually. If you seek flexibility in income, a CRUT may be more suitable. For tailored advice on which trust aligns with your needs, check out resources from US Legal Forms for charitable remainder unitrust living complete with you.