Charitable Remainder Unitrust Form With Two Points

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

It’s obvious that you can’t become a legal professional overnight, nor can you grasp how to quickly draft Charitable Remainder Unitrust Form With Two Points without having a specialized set of skills. Putting together legal forms is a long process requiring a particular education and skills. So why not leave the preparation of the Charitable Remainder Unitrust Form With Two Points to the pros?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court papers to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s start off with our platform and obtain the form you require in mere minutes:

- Discover the document you need with the search bar at the top of the page.

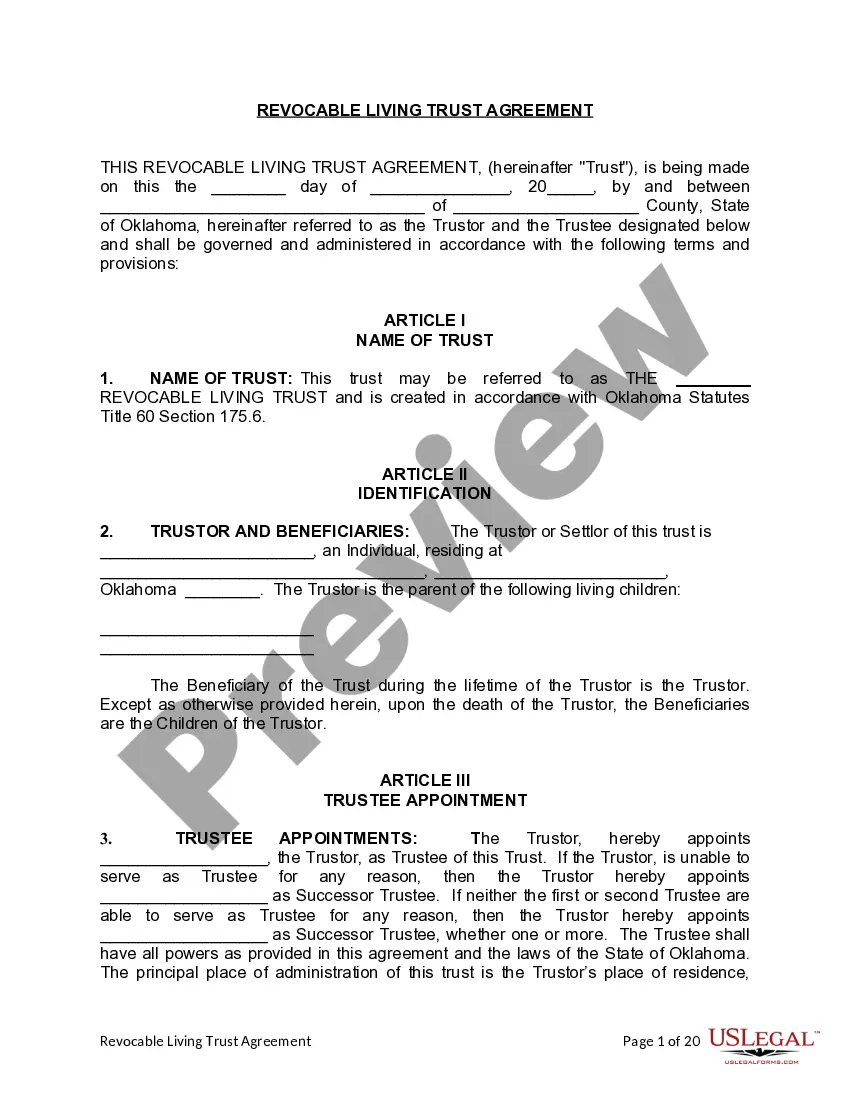

- Preview it (if this option provided) and check the supporting description to figure out whether Charitable Remainder Unitrust Form With Two Points is what you’re looking for.

- Begin your search over if you need a different form.

- Set up a free account and select a subscription option to buy the form.

- Choose Buy now. As soon as the transaction is complete, you can download the Charitable Remainder Unitrust Form With Two Points, fill it out, print it, and send or send it by post to the necessary individuals or entities.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

A charitable remainder unitrust (CRUT) pays a percentage of the value of the trust each year to noncharitable beneficiaries. The payments generally must equal at least 5% and no more than 50% of the fair market value of the assets, valued annually.

Standard unitrusts The unitrust percentage must be at least five percent and is multiplied by the fair market value of the trust assets at the beginning of each year to determine the annual payout to the income beneficiaries.

At the end of the payment term, the remainder of the trust passes to 1 or more qualified U.S. charitable organizations. The remainder donated to charity must be at least 10% of the initial net fair market value of all property placed in the trust.

Namely, that refers to the Charitable Remainder Trust 10 Percent Rule. At the end of the day, this rule makes it so that you must donate at least 10 percent of the fund to the charity of your choice at the end of the trust term (whether that means years or decades down the road).

The deduction is limited to the present value of the charitable organization's remainder interest. This is calculated as the value of the donated property minus the present value of the annuity.