Charitable Form Trust Order With Beneficiary

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

- Log into your US Legal Forms account if you're a returning user. Ensure your subscription is active, or renew it as necessary.

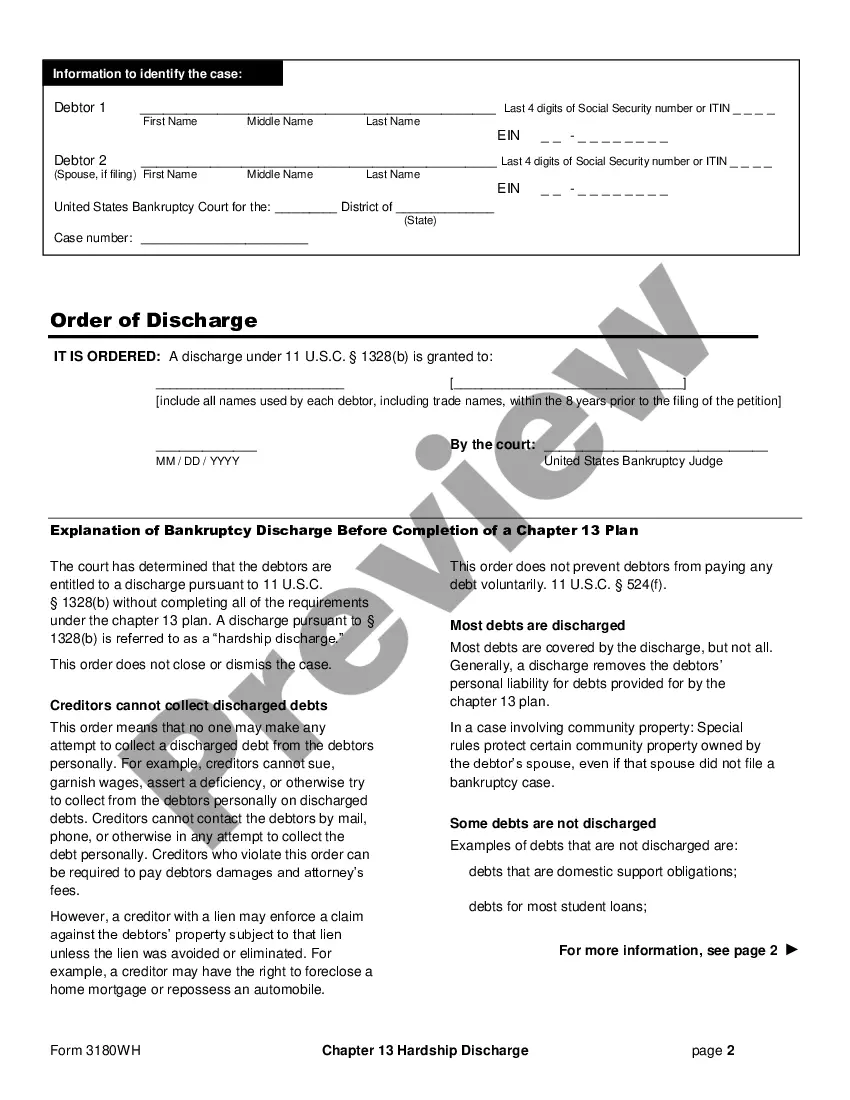

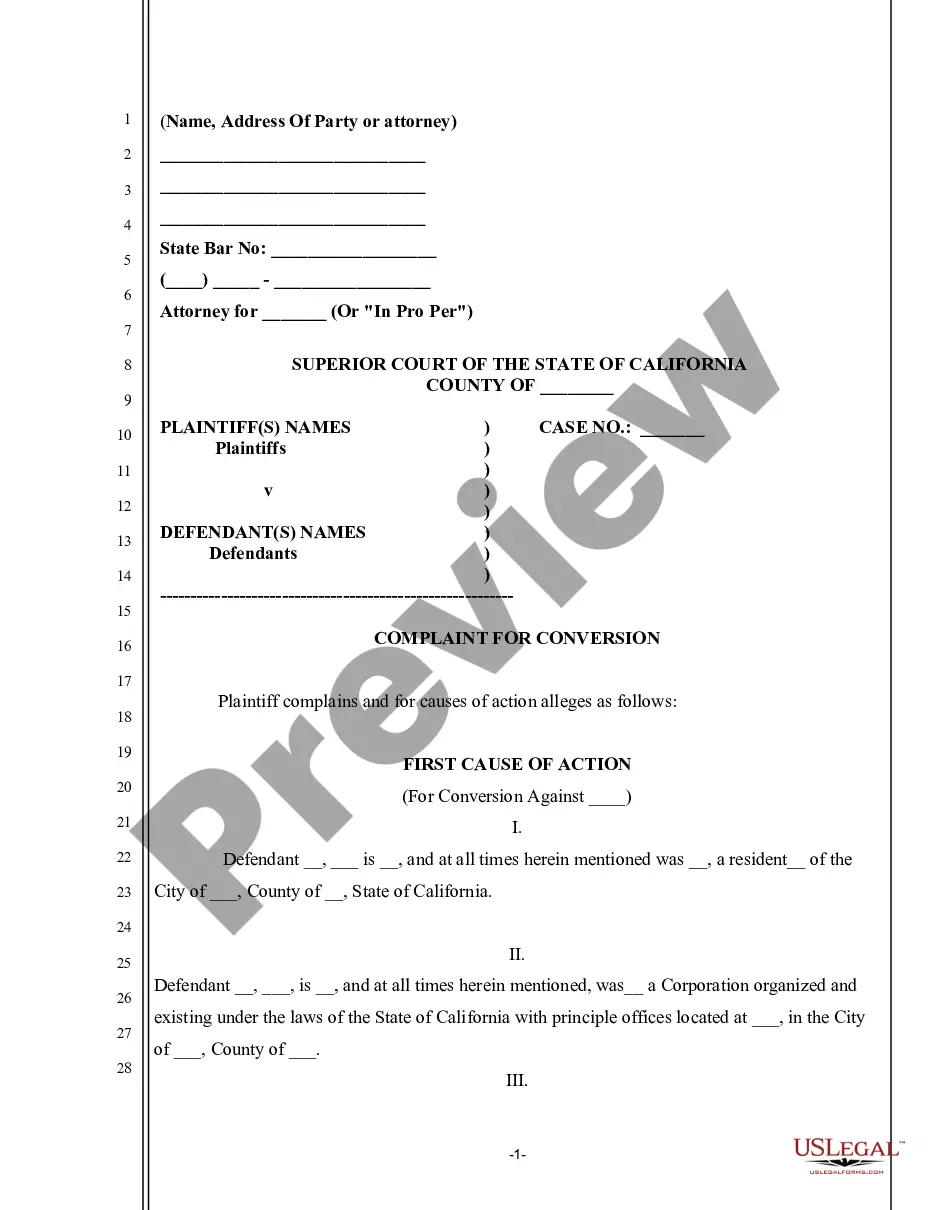

- For first-time users, start by selecting the appropriate form. Review the preview mode and description to ensure it meets your needs and jurisdiction requirements.

- If any discrepancies arise, utilize the Search feature to find alternative templates that better suit your requirements.

- Once you've found the correct document, click on the Buy Now button and choose your desired subscription plan. Creating an account is necessary to access the extensive library.

- Complete your purchase by entering your payment details, either through credit card or PayPal.

- After payment, download the form to your device and access it anytime in the My Forms section of your profile.

By following these straightforward steps, you can efficiently create a charitable form trust order with beneficiary. US Legal Forms not only streamlines the process but also provides a vast library of over 85,000 legal documents to serve various needs.

Take charge of your legal documentation today and explore the robust offerings of US Legal Forms for a hassle-free experience.

Form popularity

FAQ

As a beneficiary of a trust, you may be required to file Form 1041 if the trust generates taxable income. This applies particularly to charitable form trust orders with beneficiaries, where income distributions may be taxable. It’s advisable to consult with a tax advisor to determine your specific filing obligations and understand how distributions may impact your taxes.

Yes, a charitable remainder trust can be e-filed, streamlining your tax reporting process. This is especially advantageous for those dealing with charitable form trust orders with beneficiaries, as it allows for timely handling of tax returns. E-filing enhances accuracy and can improve overall efficiency for trust management.

Certain IRS forms, such as Form 709 for gift tax returns and Form 8832 for entity classification, cannot be electronically filed. These limitations may affect those managing charitable form trust orders with beneficiaries. It is essential to check the latest IRS guidelines or consult with a tax professional to understand which forms require paper filing.

Federal gift tax returns can also be filed electronically, provided you use compatible tax preparation software. This option is particularly useful if you're involved in charitable form trust orders with beneficiaries, allowing you to handle both gift taxes and trust management efficiently. Electronic filing can enhance accuracy while ensuring timely submissions.

Trust tax returns, including those for charitable trusts, can typically be filed electronically. This provides a convenient option for trustees who want to ensure accurate reporting for charitable form trust orders with beneficiaries. When filing electronically, you benefit from built-in checks to minimize errors, speeding up the review process by the IRS.

Yes, a form 5227, which reports charitable trusts, can be filed electronically using the IRS e-file system. This method simplifies the submission process, making it more efficient, especially for those managing charitable form trust orders with beneficiaries. Utilizing electronic filing can reduce processing times and may lead to quicker receipt of tax refunds or confirmations.

Form 1041-A is used to report income received by a revocable trust. This is crucial for anyone managing a charitable form trust order with beneficiary, as it ensures all income is accounted for when filing taxes. Properly utilizing this form keeps your trust in good standing with tax authorities.

The executor or administrator of a trust typically files a 1041-A. This person manages the trust assets, including a charitable form trust order with beneficiary, and is responsible for meeting federal tax filing requirements. Understanding your role in filing can simplify the overall tax process.

To generate form 5227 for a charitable trust, you can utilize online platforms like US Legal Forms. This platform offers intuitive tools to help you create the necessary forms tailored to your charitable form trust order with beneficiary. Accessing accurate forms seamlessly will save you time and ensure compliance.

The 5227 form is used to report information related to certain charitable trusts. If you are managing a charitable form trust order with beneficiary, this form provides essential details regarding distributions and income. Accurate reporting through the 5227 form helps maintain compliance and transparency.