Charitable Agreement Trust For Education

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

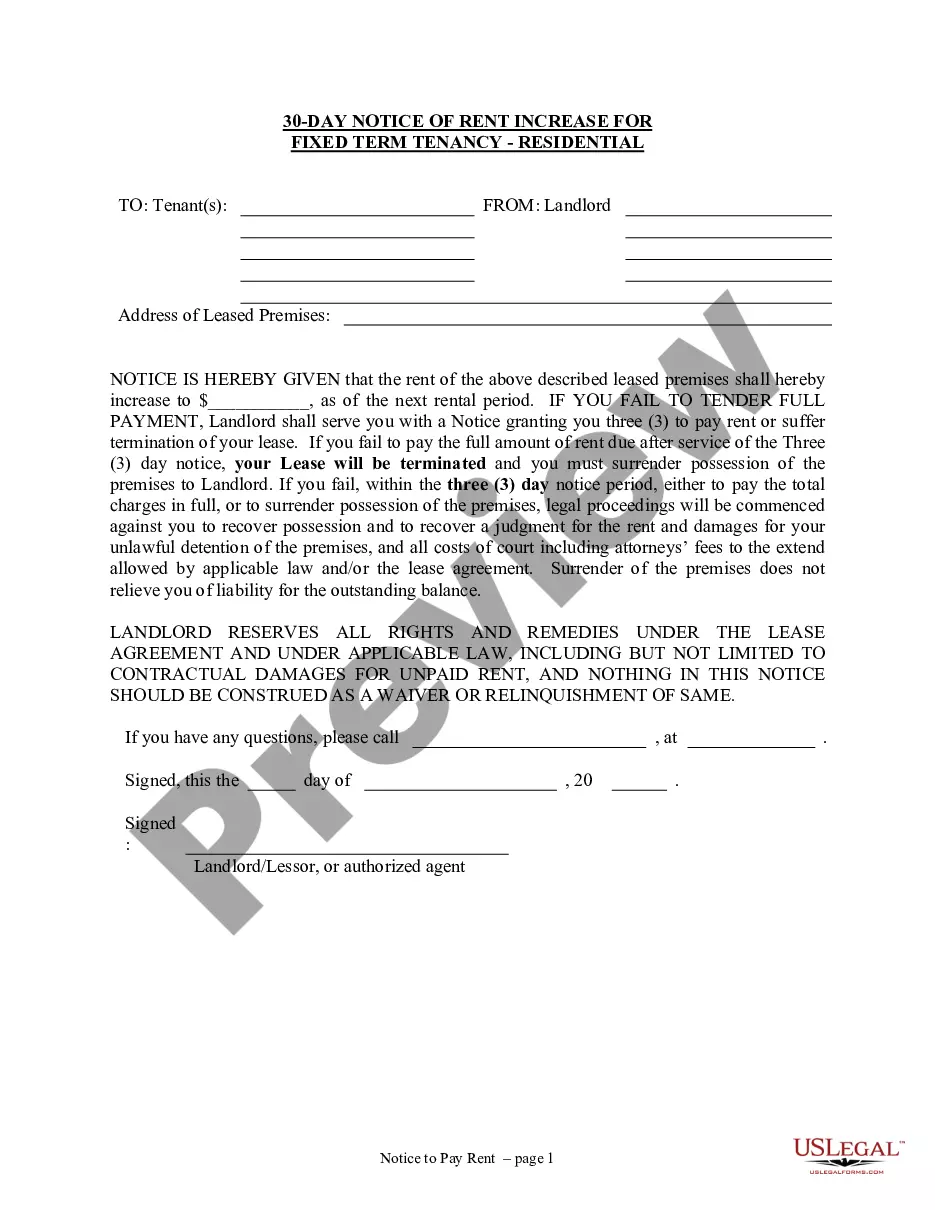

Finding a reliable location to obtain the most recent and suitable legal templates is a significant part of managing bureaucracy.

Securing the appropriate legal documents requires accuracy and meticulousness, making it essential to procure samples of Charitable Agreement Trust For Education solely from trustworthy providers, such as US Legal Forms.

Once you have the document on your device, you can modify it using the editor or print it and fill it out manually. Eliminate the hassle associated with your legal paperwork. Explore the vast collection of US Legal Forms where you can discover legal samples, assess their applicability to your situation, and download them instantly.

- Utilize the directory navigation or search box to find your sample.

- Examine the document’s details to ensure it meets the criteria of your state and county.

- Check the form preview, if available, to confirm this template is indeed what you need.

- Return to the search and find the correct document if the Charitable Agreement Trust For Education does not fulfill your needs.

- If you are confident in the form’s applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected forms in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Choose the pricing option that best fits your requirements.

- Proceed to the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Charitable Agreement Trust For Education.

Form popularity

FAQ

Here's a high-level overview of the process: The donor establishes an irrevocable trust, naming a trustee to manage and invest the assets. ... The donor must fund the trust with appreciated assets like cash, publicly traded stocks, real estate, private business interests, or other property.

Print the T3010 for Signature and Filing You must print, obtain a signature and file the return by mail with the Canada Revenue Agency (CRA). You can, however, file the return online through the CRA's My Business Account (MyBA) service.

A trust can be established by way of a trust deed, whereas a corporation has to be incorporated under the relevant provincial, territorial, or federal legislation. Once an entity is established, the next step is to apply for charitable registration through the Canada Revenue Agency (CRA) .

For example, say that you wanted to leave your house to the local town to use as a community center. You might set up a charitable trust to hold the house and oversee its use and caretaking even after your death.

A charitable trust is a way to hold and protect assets (money, property, etc) for charitable purposes. The trust's assets are managed ing to the purpose set out in a trust deed, or an agreed set of rules.