Secured Loan with Navy Federal: A Detailed Description of Types and Benefits Are you in need of additional funds but hesitant about accessing expensive credit options? Look no further than Navy Federal's secured loan offerings. Navy Federal Credit Union, a reputable financial institution renowned for its commitment to supporting military personnel and their families, offers a variety of secured loan options to meet your unique financial needs. Read on to discover the benefits of secured loans with Navy Federal and the different types available. Secured loans are a form of credit that require borrowers to pledge collateral, such as a vehicle or savings account, to secure the loan. This collateral serves as a safety net for lenders, minimizing their risk and allowing them to offer more favorable loan terms and rates. Navy Federal's secured loans offer a range of advantages over traditional unsecured loans, including lower interest rates, longer terms, and larger borrowing amounts. By leveraging the collateral, Navy Federal ensures a safer lending experience for its members. Here are the different types of secured loans available through Navy Federal: 1. Share Secured Loans: If you have funds deposited in a Navy Federal savings account, this type of loan allows you to borrow against those funds. Share secured loans provide an excellent opportunity to access credit while preserving your savings and continuing to earn dividends. 2. Certificate Secured Loans: Similar to share secured loans, certificate secured loans utilize your Navy Federal certificate account as collateral. This option enables you to access the funds tied up in your certificates while still reaping the benefits of a secured loan. 3. Auto and Vehicle Loans: Navy Federal offers competitive secured loans for various vehicles, including cars, motorcycles, boats, and RVs. By using the vehicle as collateral, you can take advantage of lower interest rates, flexible repayment terms, and fast approval processes. 4. Home Equity Loans and Lines of Credit: For homeowners, Navy Federal provides secured loans based on the equity they have built in their properties. With a home equity loan or line of credit, you can tap into your home's value to fund home improvements, educational expenses, debt consolidation, or any other significant personal expenses. By choosing a secured loan with Navy Federal, you can benefit from guaranteed approval, even if you have a less-than-perfect credit history. Additionally, Navy Federal offers competitive interest rates, no prepayment penalties, and a personalized approach to lending. The credit union strives to understand your unique situation and help you achieve your financial goals while providing exceptional member service throughout the loan process. To apply for a secured loan with Navy Federal, visit their website or visit one of their many branches nationwide. Be prepared to provide proof of collateral, financial information, and other necessary documents to expedite the application process. In conclusion, Navy Federal's secured loan options provide a reliable and cost-effective way for members to access credit while leveraging their assets. Whether you need to consolidate debt, cover unexpected expenses, or finance a significant purchase, Navy Federal's secured loans offer competitive rates, flexible terms, and a seamless borrowing experience. Explore their various types of secured loans today and take control of your financial future.

Secured Loan With Navy Federal

Description

How to fill out Secured Promissory Note?

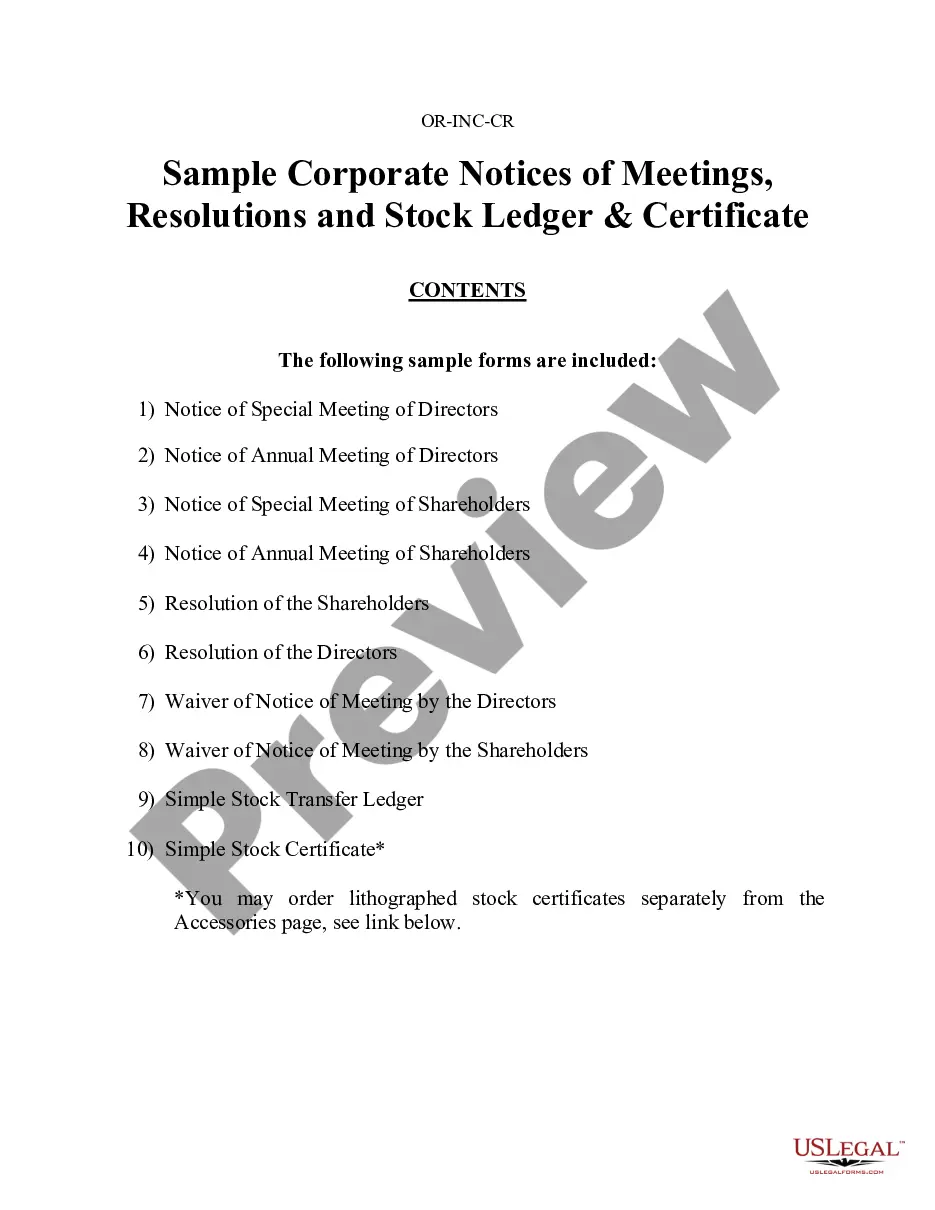

Drafting legal documents from scratch can often be a little overwhelming. Some cases might involve hours of research and hundreds of dollars spent. If you’re searching for an easier and more cost-effective way of creating Secured Loan With Navy Federal or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our virtual collection of more than 85,000 up-to-date legal documents covers almost every element of your financial, legal, and personal matters. With just a few clicks, you can quickly get state- and county-specific forms diligently prepared for you by our legal professionals.

Use our website whenever you need a trusted and reliable services through which you can easily find and download the Secured Loan With Navy Federal. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the form and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes minutes to register it and explore the catalog. But before jumping directly to downloading Secured Loan With Navy Federal, follow these recommendations:

- Review the document preview and descriptions to make sure you have found the form you are searching for.

- Check if template you choose conforms with the regulations and laws of your state and county.

- Pick the best-suited subscription option to get the Secured Loan With Navy Federal.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us now and transform document execution into something easy and streamlined!

Form popularity

FAQ

Fortunately, Navy Federal does not require a minimum credit score for personal loan eligibility, but you must be a member of the NFCU to qualify. The autopay discount is not available to everyone and a late fee of $29 does apply.

A secured loan is a type of debt backed by collateral, such as physical assets like your house or car, or financial assets such as stocks and bonds. Secured loans are commonly used for large purchases.

Navy Federal Credit Union offers both secured and unsecured loans, with secured options including auto loans, mortgages and personal loans, and unsecured options including personal loans and student loans. Secured loans require collateral, such as a car, home, or money in a bank account, while unsecured loans do not.

Shares secured loans are issued with the money in your savings or certificate accounts serving as collateral and normally carry Navy Federal's lowest consumer loan interest rate. To qualify for this type of loan, your savings must equal or exceed the loan Page 4 UNDERSTANDING CREDIT Page 4 of 4 requested.

Secured loans are business or personal loans that require some type of collateral as a condition of borrowing. A bank or lender can request collateral for large loans for which the money is being used to purchase a specific asset or in cases where your credit scores aren't sufficient to qualify for an unsecured loan.