Unsecured Loan Form With Bank

Description

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

It’s no secret that you can’t become a law professional overnight, nor can you grasp how to quickly draft Unsecured Loan Form With Bank without having a specialized background. Putting together legal documents is a long venture requiring a certain training and skills. So why not leave the creation of the Unsecured Loan Form With Bank to the specialists?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court documents to templates for in-office communication. We know how crucial compliance and adherence to federal and local laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our platform and obtain the form you need in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

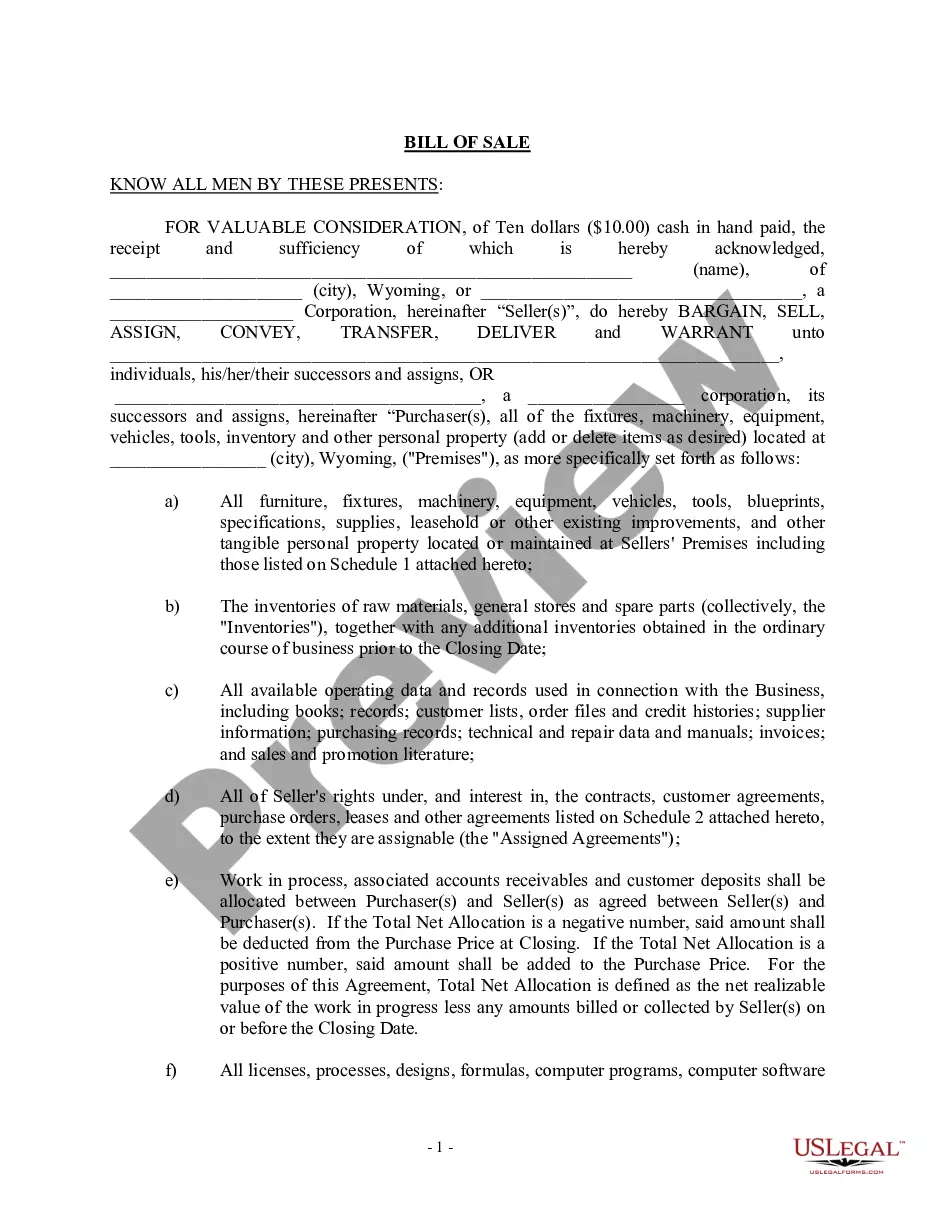

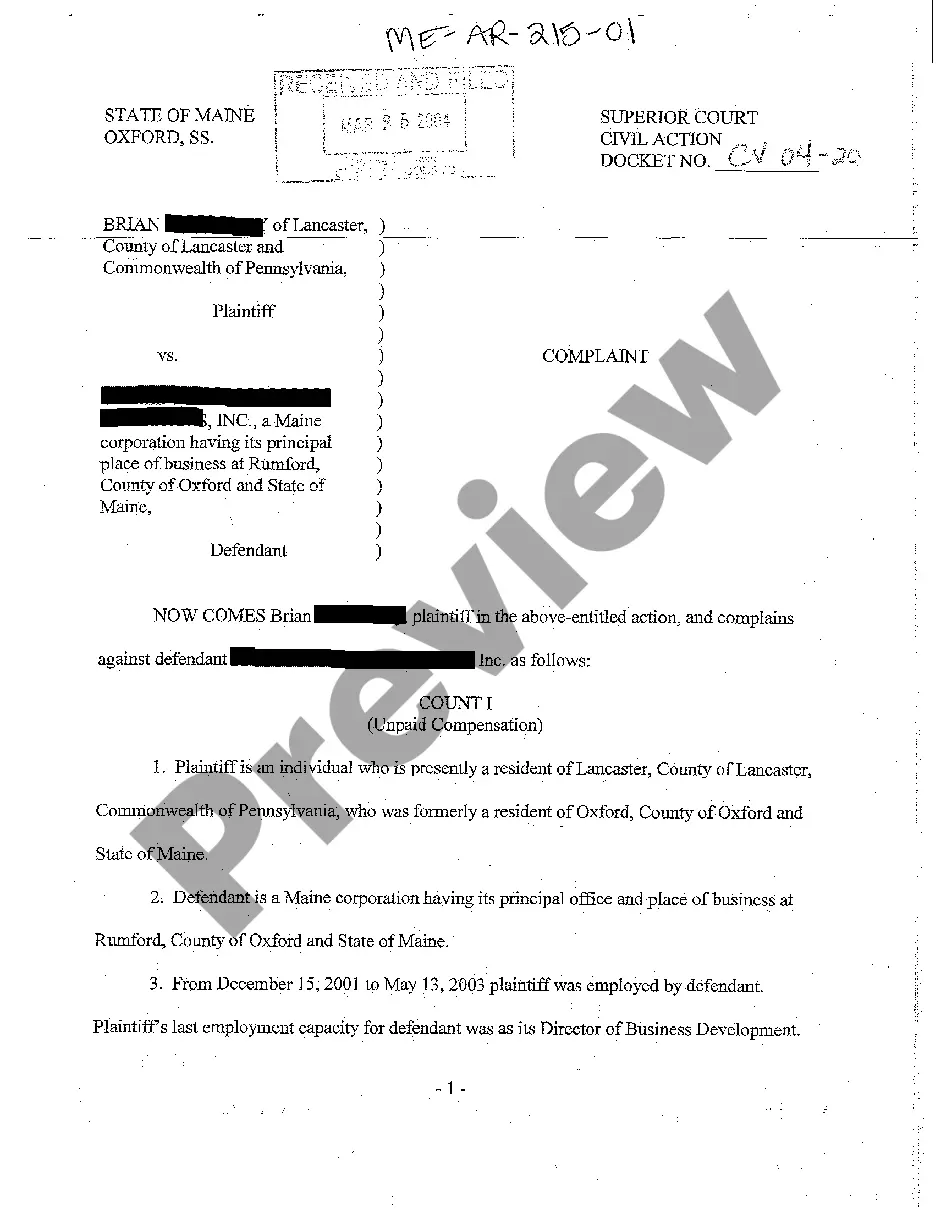

- Preview it (if this option provided) and read the supporting description to determine whether Unsecured Loan Form With Bank is what you’re looking for.

- Start your search over if you need a different template.

- Register for a free account and select a subscription plan to buy the form.

- Choose Buy now. As soon as the transaction is through, you can get the Unsecured Loan Form With Bank, complete it, print it, and send or send it by post to the designated individuals or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your paperwork-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

An unsecured loan is a loan that doesn't require collateral, like a house or car, for approval. Instead, lenders issue this type of personal loan based on information about you, like your credit history, income and outstanding debts.

Qualifications for an unsecured loan Generally, they look for a history of responsible credit use (typically one or more years), on-time payments, low credit card balances and a mix of account types.

You'll fill in how much you pay for housing (rent or mortgage payments) and might have to include information on any other debts you have. You typically need to provide your annual or monthly income as well. Bank statements and tax returns might be required to back up your information.

You can find unsecured loans through national and local banks, credit unions and online lenders. Compare unsecured loan offers. Some lenders offer prequalification so you can see which loans you might qualify for before you apply. Look at each lender's interest rates, fees, loan terms and amounts and special features.

Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan. Some of the documents you'll be asked to provide include, copies of your state- or government-issued ID, copies of paystubs, tax returns or bank statements.