Note Loan Form For Bank

Description

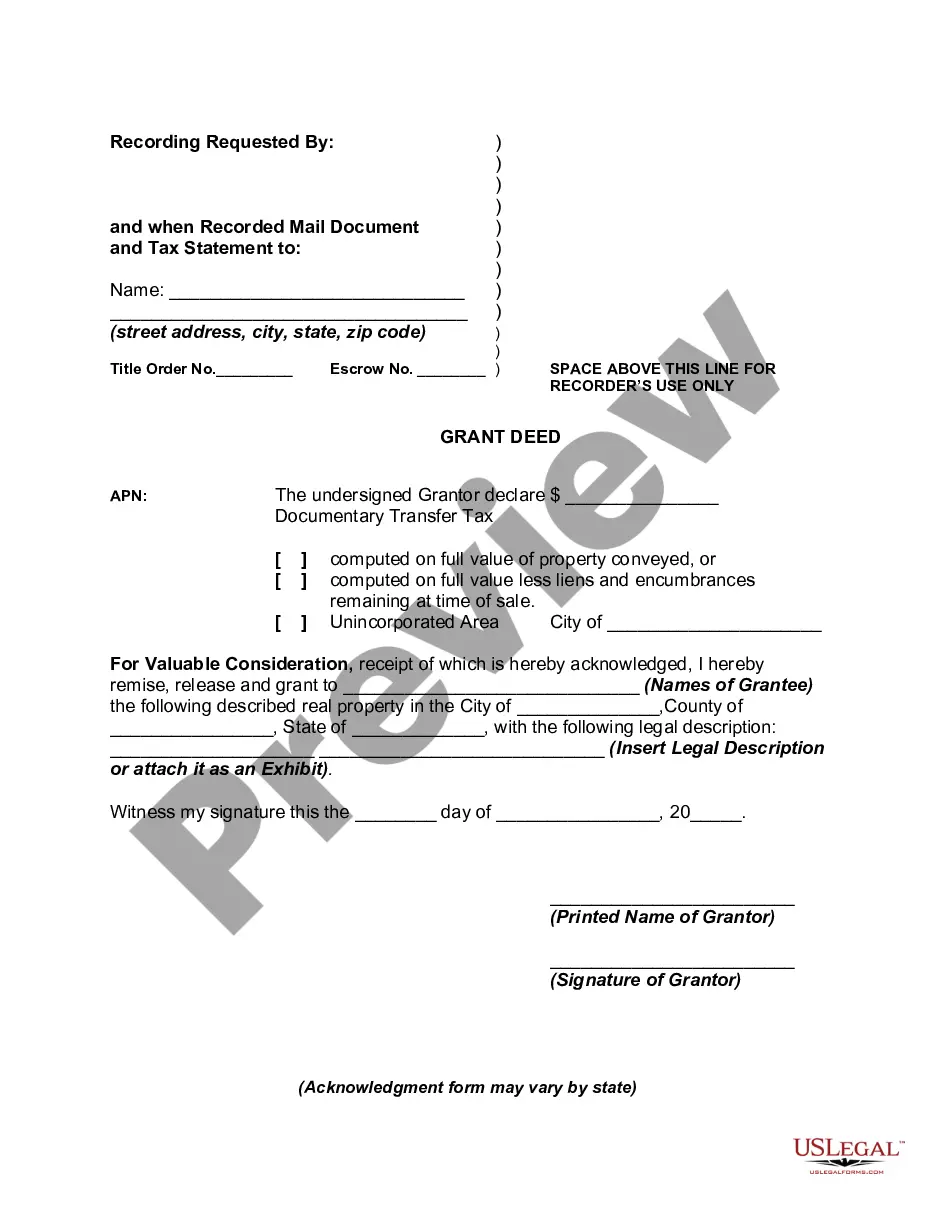

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

The Note Loan Document for Bank you observe on this webpage is a reusable legal framework crafted by expert attorneys in adherence to federal and state regulations.

For over 25 years, US Legal Forms has delivered individuals, businesses, and legal experts with more than 85,000 confirmed, state-specific forms for any corporate and personal situation. It’s the quickest, most uncomplicated, and trustworthy way to acquire the documentation you require, as the service ensures the utmost level of data security and anti-malware safeguard.

Register for US Legal Forms to have verified legal templates for every situation in life at your fingertips.

- Search for the document you need and examine it.

- Browse the example you looked for and preview it or review the form description to ensure it meets your requirements. If it doesn’t, use the search feature to find the correct one. Click Buy Now when you have found the template you require.

- Register and Log In.

- Select the pricing option that fits you and create an account. Utilize PayPal or a credit card to provide a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Acquire the editable template.

- Choose the format you prefer for your Note Loan Document for Bank (PDF, DOCX, RTF) and download the sample to your device.

- Complete and sign the documents.

- Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your form with a legally-binding electronic signature.

- Re-download your documents as needed.

- Use the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously saved forms.

Form popularity

FAQ

Filling out a promissory note requires you to include the loan amount, the interest rate, and repayment terms. Clearly state both parties' names and include signatures to make the document legally binding. Using a note loan form for bank can assist you in correctly formatting your promissory note, ensuring all vital information is included.

To fill out a bank loan form, begin by entering your personal details, including your employment and financial background. Provide accurate information regarding your income and existing debts to ensure the lender can assess your ability to repay the loan. Utilizing a note loan form for bank, available on US Legal Forms, can streamline this process and ensure you include all necessary information.

While requirements can vary by lender, a credit score of 600 or higher is generally considered acceptable for a $5000 loan. A higher credit score may improve your chances of approval and secure lower interest rates. It’s essential to check with your bank about their specific criteria, especially when considering a note loan form for bank.

To fill a bank loan form, start by providing personal information, such as your name, address, and Social Security number. Next, disclose your financial information, including income, expenses, and existing debts. Ensure you carefully read each section; using a note loan form for bank can guide you through the required details.

Writing a note for a loan involves clearly stating the loan amount, interest rate, repayment terms, and due dates. Be sure to include both the borrower's and lender's names, as well as signatures from both parties. You can find templates for a note loan form for bank on platforms like US Legal Forms, which can simplify the process.

Filing a promissory note typically requires submitting it to the appropriate financial institution or recording office, depending on the jurisdiction. It is important to follow the specific filing procedures set by your bank or local authorities. Using a note loan form for bank can simplify this process, ensuring you meet all necessary requirements. Platforms like US Legal Forms offer assistance in understanding these requirements.

Creating a loan note involves outlining the terms of the loan, including the principal amount, interest rate, and repayment schedule. To ensure clarity and legality, it is advisable to use a standardized note loan form for bank. You can find templates and resources on platforms like US Legal Forms, which provide easy-to-follow guidance for drafting your document.

A bank is not legally obligated to accept a promissory note. Each bank has its own policies regarding the acceptance of such notes. Therefore, it is essential to check with your bank to understand their specific requirements. Using a well-drafted note loan form for bank can increase the chances of acceptance.

Yes, you can create your own promissory note, provided you include all necessary terms and conditions. It's essential to ensure that your document complies with local laws to be enforceable. Using a note loan form for bank from a trusted resource like uslegalforms can streamline this process and help you avoid potential legal issues. Always consider having a legal professional review your document for added security.

You can obtain a promissory note form from various sources, including banks, legal websites, and financial institutions. One reliable option is to visit uslegalforms, where you can find a customizable note loan form for bank that meets your specific needs. This platform provides user-friendly templates that are easy to fill out and can save you time. Always ensure that the form you choose complies with state regulations.