Promissory Note Forgiveness Form

Description

How to fill out Guaranty Of Promissory Note By Corporation - Corporate Borrower?

Well-prepared official documentation serves as a primary safeguard against issues and lawsuits, but obtaining it without assistance from an attorney may require time.

Whether you are in urgent need of a current Promissory Note Forgiveness Form or any other forms related to employment, family, or business matters, US Legal Forms is always available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the desired file. Additionally, you can retrieve the Promissory Note Forgiveness Form anytime, as all documents previously acquired on the platform remain accessible under the My documents section of your profile. Save time and resources on creating formal documents. Experience US Legal Forms today!

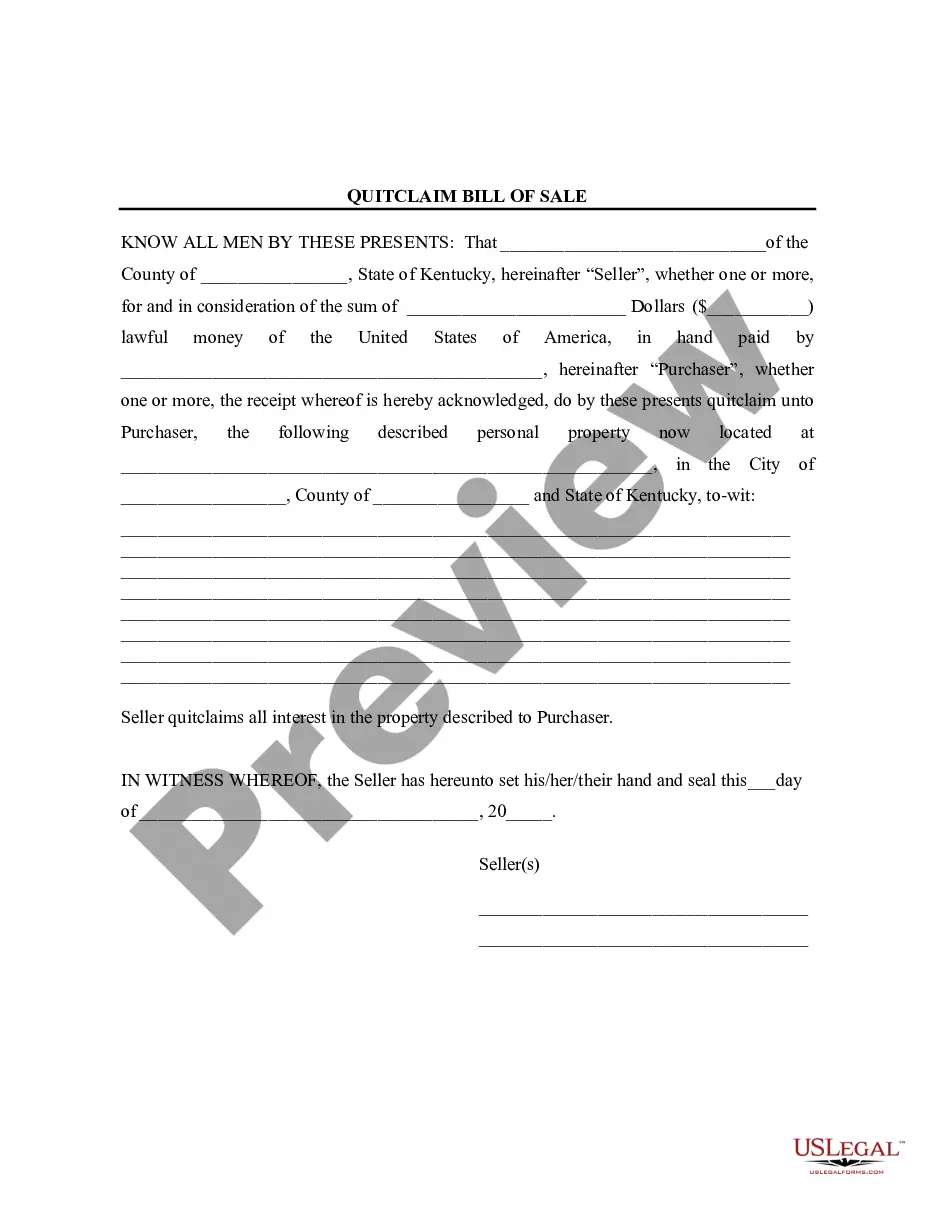

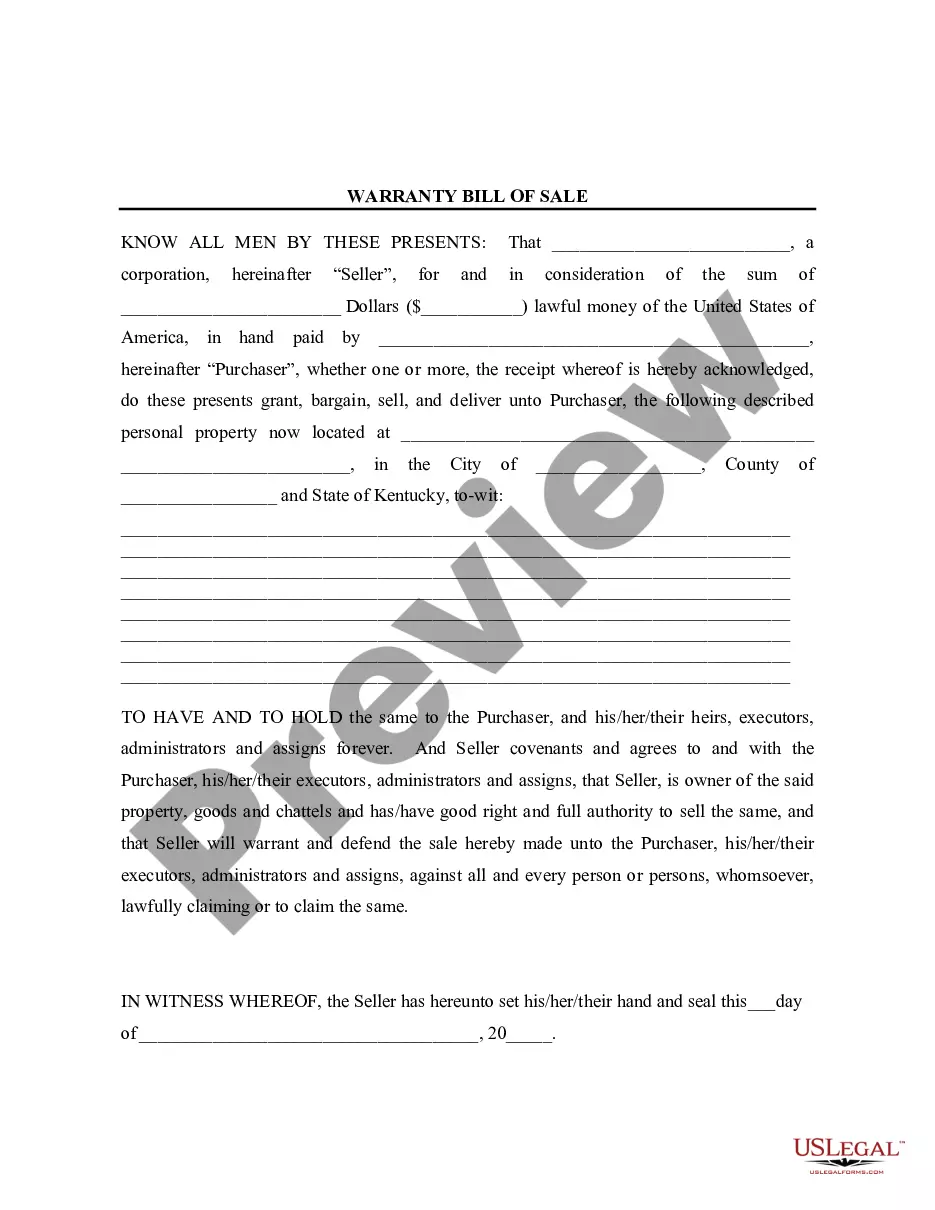

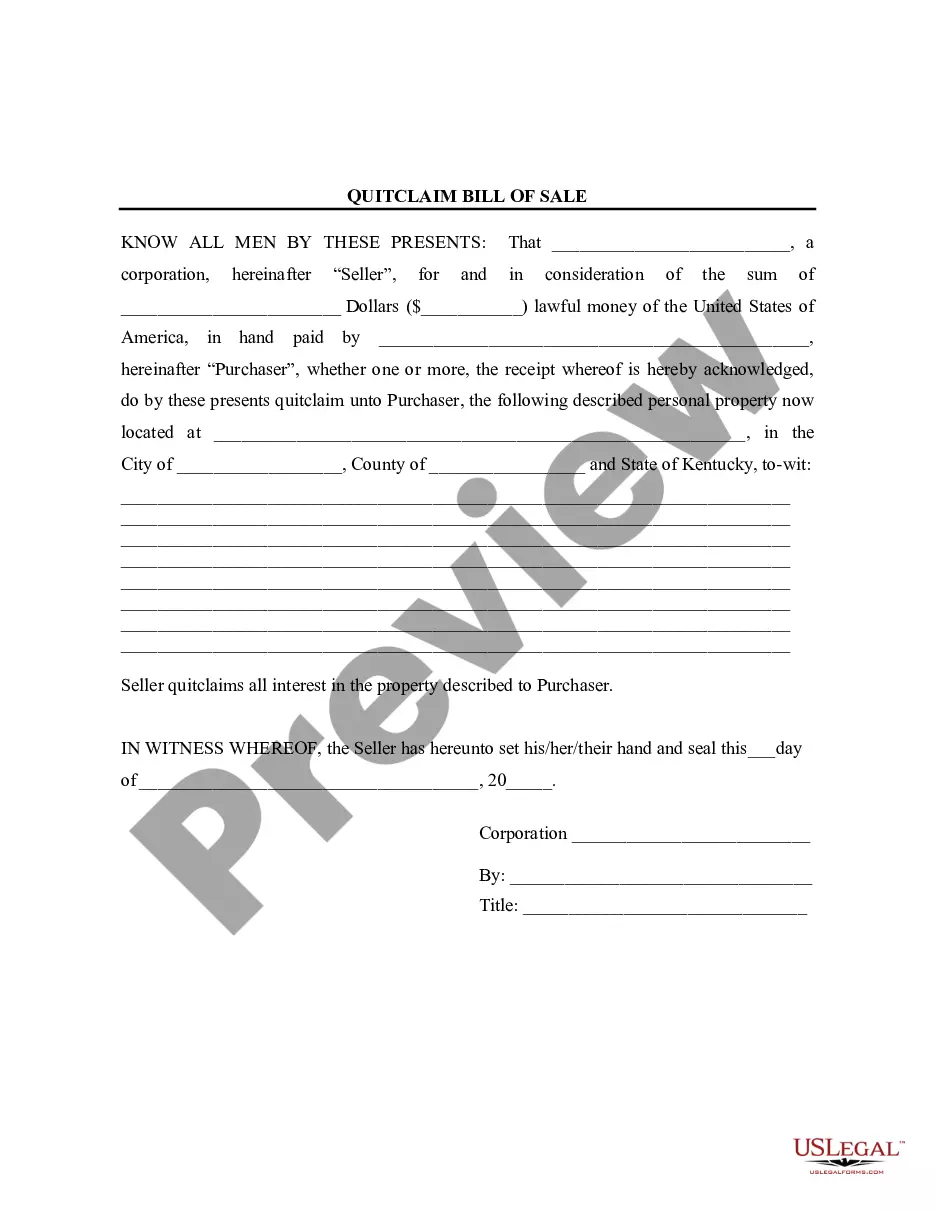

- Verify that the form fits your needs and location by reviewing the description and preview.

- Search for an alternative template (if necessary) using the Search bar in the header of the page.

- Click on Buy Now once you find the correct template.

- Select the pricing plan, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Select PDF or DOCX file format for your Promissory Note Forgiveness Form.

- Click Download, then print the document to fill it out or upload it to an online editor.

Form popularity

FAQ

A signed Master Promissory Note is required: If You had not previously signed an MPN for the current type of loan. If your school requires You to sign a new MPN each academic year (most schools do not require this). If You signed an MPN more than one year ago, but no loan was disbursed.

Follow the steps below to complete the Master Promissory Note:Navigate to the website: "Log In."Enter your FSA ID and Password.Under the "Complete Aid Process" heading, select "Complete Master Promissory Note."Select the appropriate loan type.Enter Your Personal Information.More items...

200b200b200b200b200b200bAn MPN is a legal document that contains the Borrower's Rights and Responsibilities and Terms and Conditions for repayment. Direct PLUS and Direct Subsidized / Unsubsidized loans have different MPNs. An MPN can also be good for up to 10 years if certain enrollment requirements are met.

Do student loans go away after 7 years? Student loans don't go away after seven years. There is no program for loan forgiveness or cancellation after seven years. But if you recently checked your credit report and are wondering, "why did my student loans disappear?" The answer is that you have defaulted student loans.

Complete Master Promissory Note Go to and log in using your FSA ID. Select Complete Loan Agreement (Master Promissory Note). For loan type select MPN for Subsidized/Unsubsidized Loans and then Start. Complete each step of the MPN and click Sign & Submit once you have finished.