Sleeping Partner For A Business

Description

How to fill out Agreement Adding Silent Partner To Existing Partnership?

Regardless of whether for corporate goals or personal issues, everyone must confront legal circumstances at some point in their lives.

Filling out legal paperwork requires meticulous care, starting with choosing the correct template.

Once it is downloaded, you can fill out the form using editing software or print it and complete it by hand. With a vast US Legal Forms library at your disposal, there is no need to waste time searching for the right template online. Utilize the library's simple navigation to find the appropriate template for any circumstance.

- Acquire the template you require by utilizing the search box or catalog browsing.

- Review the form's details to confirm it aligns with your situation, jurisdiction, and region.

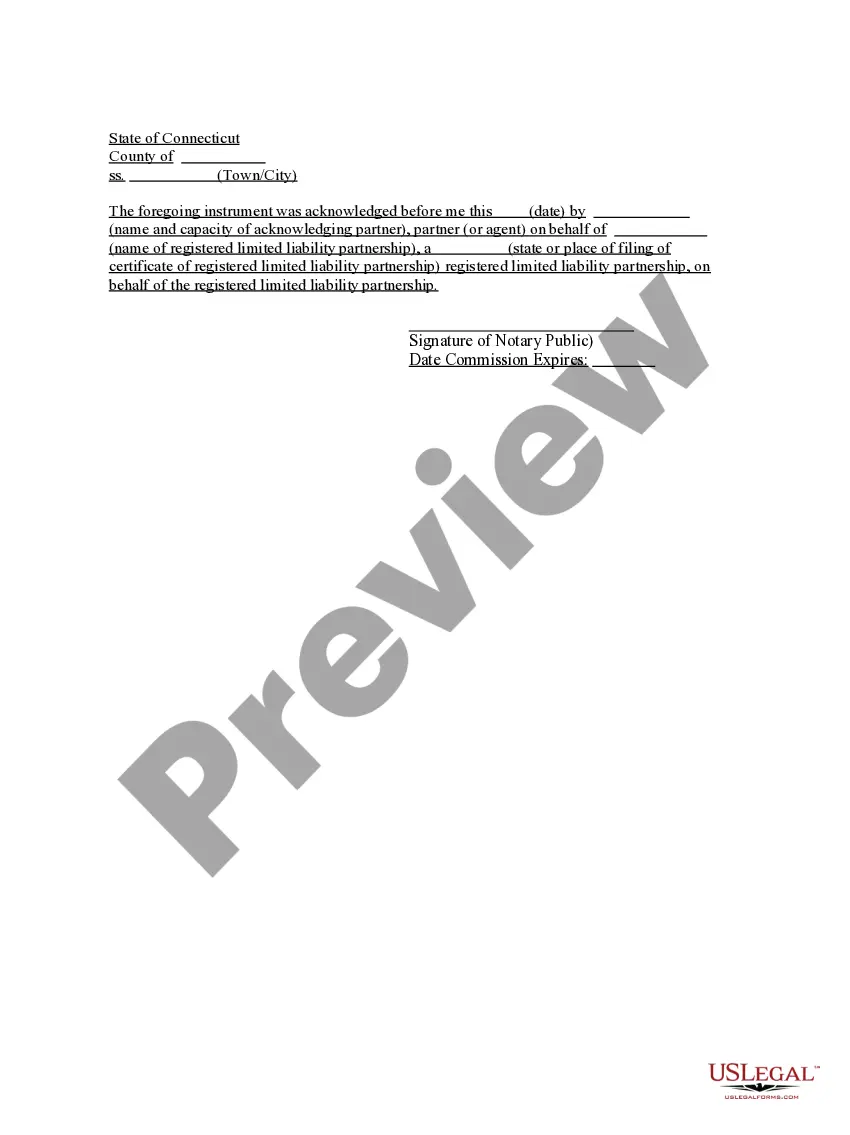

- Select the form's preview to inspect it.

- If it is not the correct form, return to the search option to find the Sleeping Partner For A Business example you need.

- Obtain the document once it fulfills your specifications.

- If you already have a US Legal Forms account, just click Log in to access previously saved templates in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Select the suitable pricing choice.

- Complete the profile registration form.

- Choose your payment method: either a bank card or PayPal account.

- Select the document format you prefer and download the Sleeping Partner For A Business.

Form popularity

FAQ

Yes, a sleeping partner for a business typically contributes capital, which is often the primary reason they become involved. This financial investment allows them to earn a share of the profits without day-to-day responsibilities. Clear terms about capital contribution are vital in the partnership agreement to ensure mutual understanding.

To register your foreign LLC in Wyoming, you need to complete the state's Certificate of Authority application and file it with the Wyoming Secretary of State. Here's the content you'll need to provide: LLC name as registered in home jurisdiction.

Wyoming Statutes § 17-29-110: Though Wyoming does not legally require an operating agreement for an LLC, having one is strongly recommended. This document includes provisions for the regulation of business affairs of the company and its members, as well as managers.

Do I need a physical address for my business in Wyoming? Technically, no. But when you file your business formation documents with the Wyoming Secretary of State, you'll be required to list an address for your registered agent and a business address (known as the ?principal office address? in Wyoming).

Wyoming LLC Fees Starting the company only requires a $100 filing fee payable to the Wyoming Secretary of State. The price is $102 if you file online. There is a $2 convenience fee.

Starting an LLC in Wyoming. ... Decide on a name for your business. ... Assign a registered agent for service of process. ... Get an Employer Identification Number (EIN) from the IRS. ... Create an operating agreement. ... Pay the license tax. ... Familiarize yourself with the LLC's continuing legal obligations, specifically annual reports.

LLC Taxation For Non-Residents Foreigners with a Wyoming LLC are only taxed in the US on income from US sources, which means that income from other countries won't be taxed by the US. But non-US owners of Wyoming LLCs are taxed initially on any US-sourced income at a rate of 30%. This 30% is paid to the IRS.

Starting an LLC in Wyoming. ... Decide on a name for your business. ... Assign a registered agent for service of process. ... Get an Employer Identification Number (EIN) from the IRS. ... Create an operating agreement. ... Pay the license tax. ... Familiarize yourself with the LLC's continuing legal obligations, specifically annual reports.

You can form a Wyoming LLC even if you don't live in Wyoming. Residency in the state, or the USA, is not required to form a company. A majority of LLCs are formed by non-residents. Forming an LLC in Wyoming as a non-resident is the same process as for a resident.