Construction Contract Agreement Format

Description

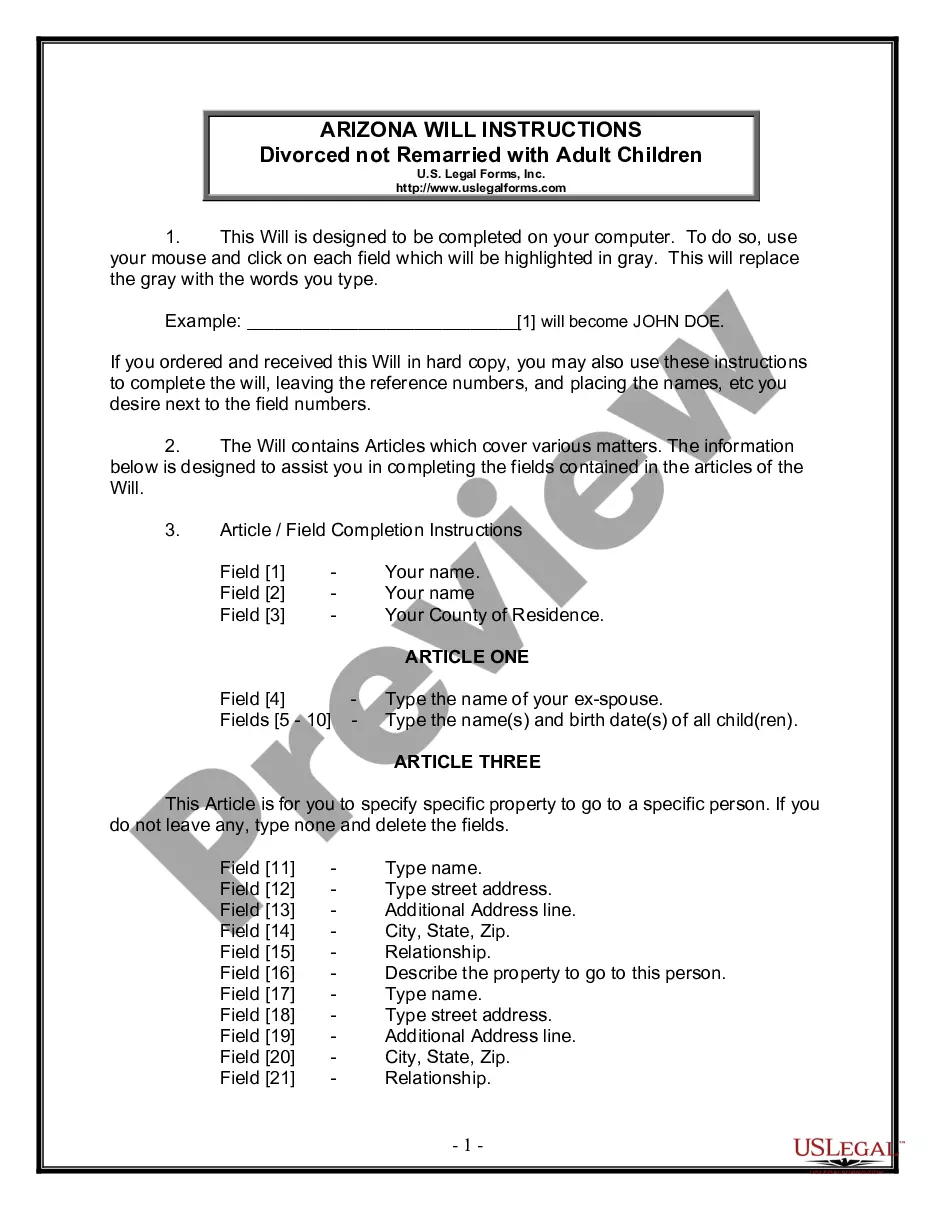

How to fill out Construction Contract For Home - Fixed Fee Or Cost Plus?

Finding a reliable location to obtain the latest and suitable legal templates is half the challenge of navigating bureaucracy.

Selecting the appropriate legal documents necessitates accuracy and careful consideration, which is why it is crucial to gather samples of Construction Contract Agreement Format exclusively from trustworthy sources, like US Legal Forms. An incorrect template can squander your time and delay your situation.

Eliminate the complications associated with your legal documentation. Discover the extensive US Legal Forms library where you can locate legal samples, verify their applicability to your situation, and download them instantly.

- Utilize the library navigation or search feature to find your sample.

- View the form’s description to determine if it corresponds with the requirements of your state and local area.

- Access the form preview, if available, to ensure the template is indeed the one you need.

- Return to the search to find the correct document if the Construction Contract Agreement Format does not align with your needs.

- Once you are certain about the form’s applicability, proceed to download it.

- If you are an authorized customer, click Log in to verify your identity and gain access to your selected forms in My documents.

- If you do not possess an account yet, click Buy now to acquire the form.

- Select the pricing plan that meets your needs.

- Continue to registration to complete your purchase.

- Finalizing your purchase requires selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Construction Contract Agreement Format.

- Once the form is on your device, you can modify it with the editor or print it out and complete it manually.

Form popularity

FAQ

Kentucky Resident Debt Relief. InCharge provides free, nonprofit credit counseling and debt management programs to Kentucky residents. If you live in Kentucky and need help paying off your credit card debt, InCharge can help you.

When drafting a debt settlement agreement, it is essential to include the following: Necessary information about the loan agreement. The contact information of both parties. The date of the agreement. The terms of the agreement. The amount of debt.

Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. You can attempt to settle debts on your own or hire a debt settlement company to assist you. Typical debt settlement offers range from 10% to 50% of the amount you owe.

You can hire a debt settlement company who will negotiate with your creditor for a fee, or you can cut out the middleman and do it yourself. Debt settlement is commonly used when the borrower can no longer afford the high interest on credit card debt, coupled with the amount owed.

What Should Be Included in a Settlement Agreement? Identifying information for all involved parties. A description of the issue you're seeking to settle. An offer of resolutions that both parties agree to. Proof of valid consideration from both parties without coercion or duress. Legal purpose.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay upfront. Also, provide them with a clear description of what you expect in return, such as the removal of missed payments or the account shown as paid in full on your report.

A debt settlement agreement is a contract signed between a creditor and debtor to re-negotiate or compromise on a debt. This is usually in the case when an individual wants to make a final payment for a debt that is owed.