Engagement Letter Format For Bank Audit In Wayne

Description

Form popularity

FAQ

Audit team reports frequently adhere to the rule of the “Five C's” of data sharing and communication, and a thorough summary in a report will include each of these elements. The “Five C's” are criteria, condition, cause, consequence, and corrective action.

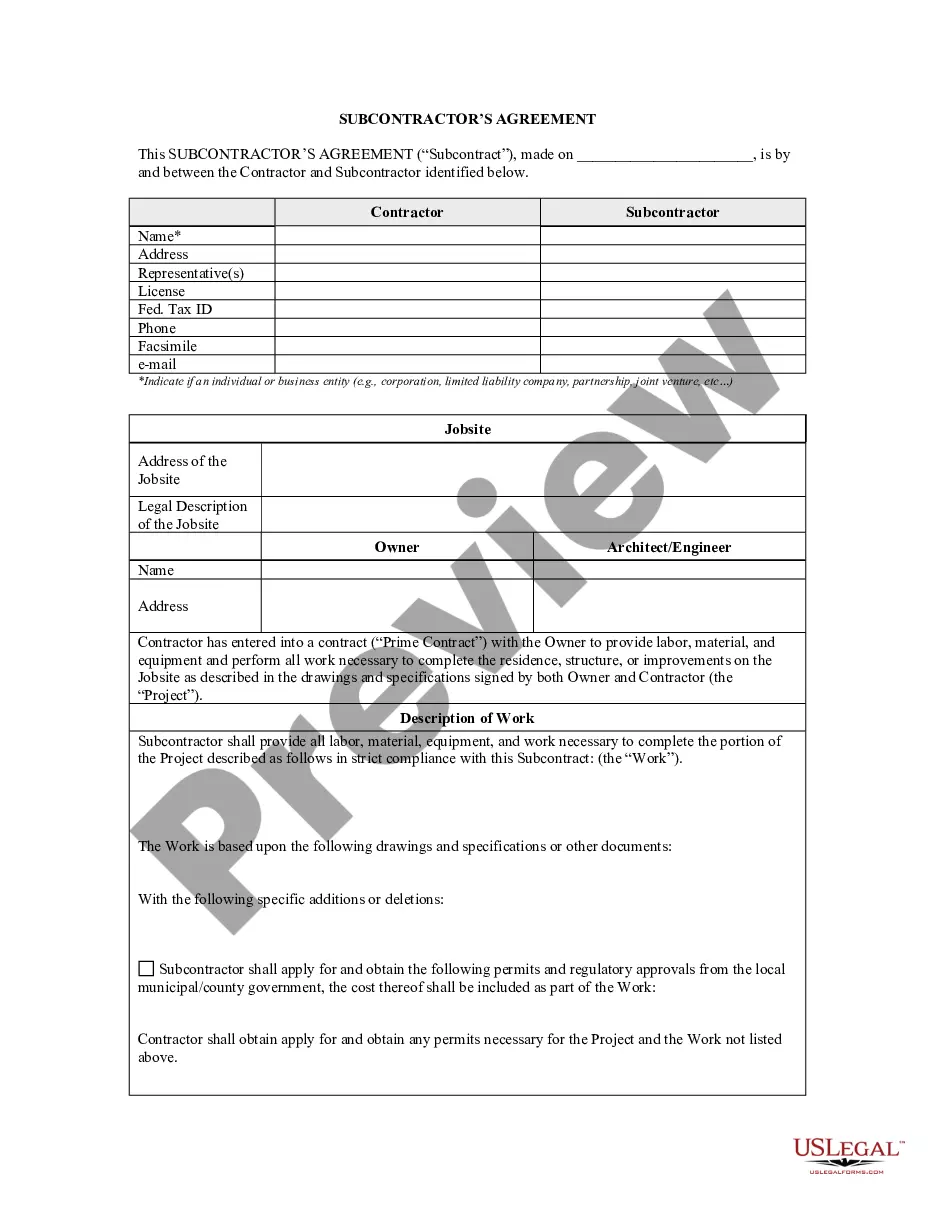

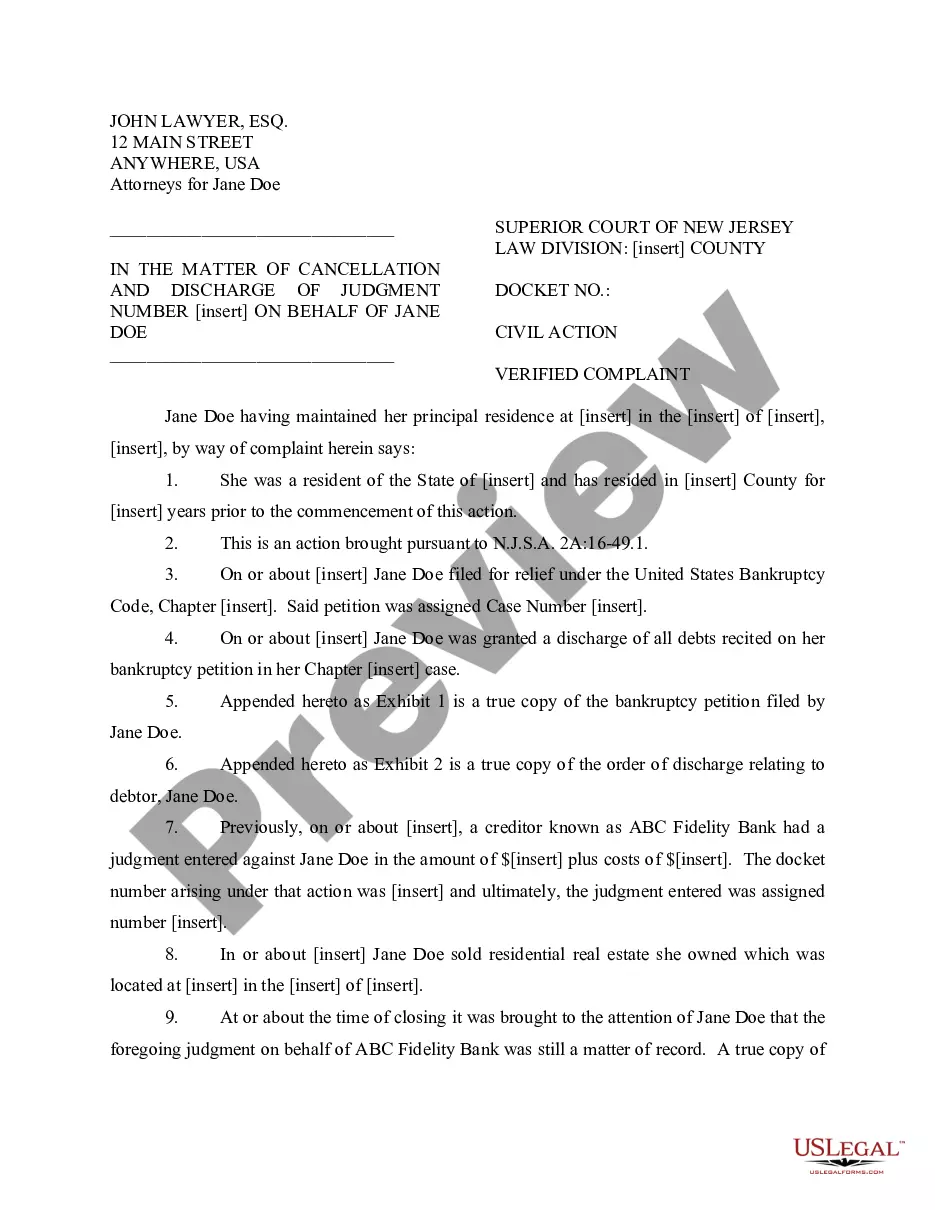

The internal auditor and the auditee should agree on the terms of the engagement before commencement. The agreed terms would need to be recorded in an engagement letter.

Your designated audit firm will prepare the specific terms of engagement using the appropriate AICPA-issued engagement letter template. It should be noted that there are many terms for audit engagements that are deemed required by the AICPA and therefore unable to be negotiated.

Preparation Process The audit engagement letter is typically prepared by the auditor conducting the audit. It serves as a crucial document outlining the terms and responsibilities involved in the audit process.

When should the engagement letter be sent and signed? The audit engagement letter should be sent after verbal confirmation of the appointment of you as the auditor and ideally signed before the start of any audit work.

Steps to an effective data-driven audit Pre-engagement (client onboarding) Audit planning. Data collection and ingestion. Risk assessment. Audit fieldwork & execution. Audit reporting and wrap-up. Audit follow-up.

Engagement letters set the terms of the agreement between two parties and include details such as the scope, fees, and responsibilities, among others. Some of the benefits of engagement letters are that they are legally binding documents, they reduce misunderstandings, and they set clear expectations.

An auditor's engagement letter generally includes matters such as management's responsibility for the entity's compliance with laws and regulations, the factors to be considered in setting preliminary judgments about materiality, and the auditor's responsibility to guarantee accuracy of the financial statements.